to Form 990 - The Pew Charitable Trusts

to Form 990 - The Pew Charitable Trusts

to Form 990 - The Pew Charitable Trusts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

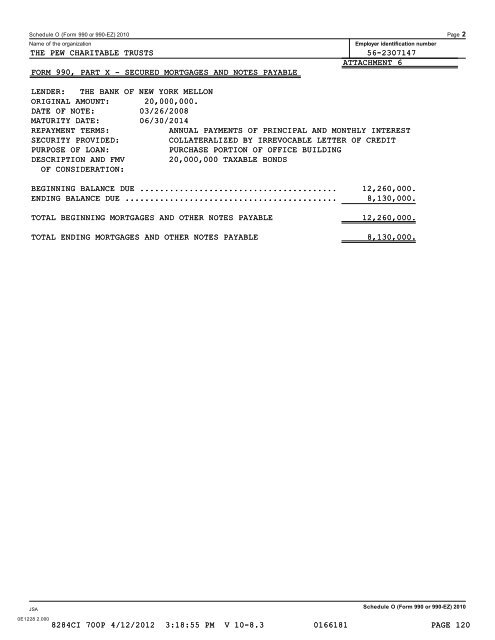

Schedule O (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>EZ) 2010 Page 2<br />

Name of the organization<br />

THE PEW CHARITABLE TRUSTS<br />

FORM <strong>990</strong>, PART X SECURED MORTGAGES AND NOTES PAYABLE<br />

Employer identification number<br />

562307147<br />

ATTACHMENT 6<br />

LENDER:<br />

THE BANK OF NEW YORK MELLON<br />

ORIGINAL AMOUNT: 20,000,000.<br />

DATE OF NOTE: 03/26/2008<br />

MATURITY DATE: 06/30/2014<br />

REPAYMENT TERMS:<br />

ANNUAL PAYMENTS OF PRINCIPAL AND MONTHLY INTEREST<br />

SECURITY PROVIDED:<br />

COLLATERALIZED BY IRREVOCABLE LETTER OF CREDIT<br />

PURPOSE OF LOAN:<br />

PURCHASE PORTION OF OFFICE BUILDING<br />

DESCRIPTION AND FMV<br />

20,000,000 TAXABLE BONDS<br />

OF CONSIDERATION:<br />

BEGINNING BALANCE DUE ........................................ 12,260,000.<br />

ENDING BALANCE DUE ........................................... 8,130,000.<br />

TOTAL BEGINNING MORTGAGES AND OTHER NOTES PAYABLE 12,260,000.<br />

TOTAL ENDING MORTGAGES AND OTHER NOTES PAYABLE 8,130,000.<br />

JSA<br />

Schedule O (<strong>Form</strong> <strong>990</strong> or <strong>990</strong>BEZ) 2010<br />

0E1228 2.000<br />

8284CI 700P 4/12/2012 3:18:55 PM V 108.3 0166181 PAGE 120