AMLAC & Fraud - IIR

AMLAC & Fraud - IIR

AMLAC & Fraud - IIR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

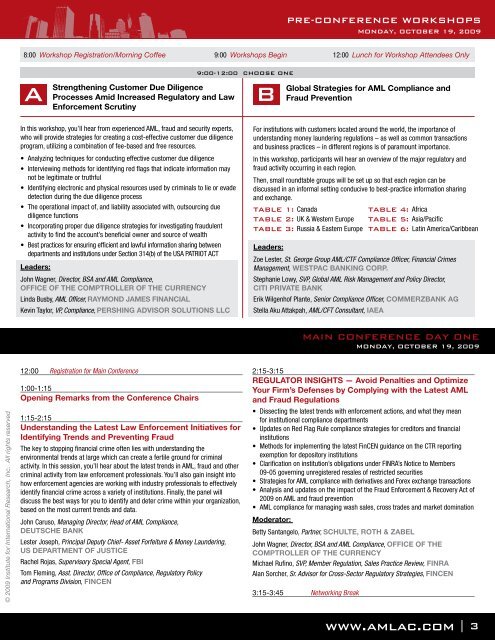

PRE-CONFERENCE WORKSHOPS<br />

MONDAY, OCTOBER 19, 2009<br />

8:00 Workshop Registration/Morning Coffee 9:00 Workshops Begin 12:00 Lunch for Workshop Attendees Only<br />

A<br />

Strengthening Customer Due Diligence<br />

Processes Amid Increased Regulatory and Law<br />

Enforcement Scrutiny<br />

9:00-12:00 Choose one<br />

B<br />

Global Strategies for AML Compliance and<br />

<strong>Fraud</strong> Prevention<br />

In this workshop, you’ll hear from experienced AML, fraud and security experts,<br />

who will provide strategies for creating a cost-effective customer due diligence<br />

program, utilizing a combination of fee-based and free resources.<br />

• Analyzing techniques for conducting effective customer due diligence<br />

• Interviewing methods for identifying red flags that indicate information may<br />

not be legitimate or truthful<br />

• Identifying electronic and physical resources used by criminals to lie or evade<br />

detection during the due diligence process<br />

• The operational impact of, and liability associated with, outsourcing due<br />

diligence functions<br />

• Incorporating proper due diligence strategies for investigating fraudulent<br />

activity to find the account’s beneficial owner and source of wealth<br />

• Best practices for ensuring efficient and lawful information sharing between<br />

departments and institutions under Section 314(b) of the USA PATRIOT ACT<br />

Leaders:<br />

John Wagner, Director, BSA and AML Compliance,<br />

OFFICE OF THE COMPTROLLER OF THE CURRENCY<br />

Linda Busby, AML Officer, RAYMOND JAMES FINANCIAL<br />

Kevin Taylor, VP, Compliance, PERSHING ADVISOR SOLUTIONS LLC<br />

For institutions with customers located around the world, the importance of<br />

understanding money laundering regulations – as well as common transactions<br />

and business practices – in different regions is of paramount importance.<br />

In this workshop, participants will hear an overview of the major regulatory and<br />

fraud activity occurring in each region.<br />

Then, small roundtable groups will be set up so that each region can be<br />

discussed in an informal setting conducive to best-practice information sharing<br />

and exchange.<br />

Table 1: Canada<br />

Table 2: UK & Western Europe<br />

Table 3: Russia & Eastern Europe<br />

Table 4: Africa<br />

Table 5: Asia/Pacific<br />

Table 6: Latin America/Caribbean<br />

Leaders:<br />

Zoe Lester, St. George Group AML/CTF Compliance Officer, Financial Crimes<br />

Management, WESTPAC BANKING CORP.<br />

Stephanie Lowy, SVP, Global AML Risk Management and Policy Director,<br />

CITI PRIVATE BANK<br />

Erik Wilgenhof Plante, Senior Compliance Officer, COMMERZBANK AG<br />

Stella Aku Attakpah, AML/CFT Consultant, IAEA<br />

MAIN CONFERENCE DAY ONE<br />

MONDAY, OCTOBER 19, 2009<br />

© 2009 Institute for International Research, Inc. All rights reserved<br />

12:00 Registration for Main Conference<br />

1:00-1:15<br />

Opening Remarks from the Conference Chairs<br />

1:15-2:15<br />

Understanding the Latest Law Enforcement Initiatives for<br />

Identifying Trends and Preventing <strong>Fraud</strong><br />

The key to stopping financial crime often lies with understanding the<br />

environmental trends at large which can create a fertile ground for criminal<br />

activity. In this session, you’ll hear about the latest trends in AML, fraud and other<br />

criminal activity from law enforcement professionals. You’ll also gain insight into<br />

how enforcement agencies are working with industry professionals to effectively<br />

identify financial crime across a variety of institutions. Finally, the panel will<br />

discuss the best ways for you to identify and deter crime within your organization,<br />

based on the most current trends and data.<br />

John Caruso, Managing Director, Head of AML Compliance,<br />

DEUTSCHE BANK<br />

Lester Joseph, Principal Deputy Chief- Asset Forfeiture & Money Laundering,<br />

US DEPARTMENT OF JUSTICE<br />

Rachel Rojas, Supervisory Special Agent, FBI<br />

Tom Fleming, Asst. Director, Office of Compliance, Regulatory Policy<br />

and Programs Division, FINCEN<br />

2:15-3:15<br />

REGULATOR INSIGHTS — Avoid Penalties and Optimize<br />

Your Firm’s Defenses by Complying with the Latest AML<br />

and <strong>Fraud</strong> Regulations<br />

• Dissecting the latest trends with enforcement actions, and what they mean<br />

for institutional compliance departments<br />

• Updates on Red Flag Rule compliance strategies for creditors and financial<br />

institutions<br />

• Methods for implementing the latest FinCEN guidance on the CTR reporting<br />

exemption for depository institutions<br />

• Clarification on institution’s obligations under FINRA’s Notice to Members<br />

09-05 governing unregistered resales of restricted securities<br />

• Strategies for AML compliance with derivatives and Forex exchange transactions<br />

• Analysis and updates on the impact of the <strong>Fraud</strong> Enforcement & Recovery Act of<br />

2009 on AML and fraud prevention<br />

• AML compliance for managing wash sales, cross trades and market domination<br />

Moderator:<br />

Betty Santangelo, Partner, SCHULTE, ROTH & ZABEL<br />

John Wagner, Director, BSA and AML Compliance, OFFICE OF THE<br />

COMPTROLLER OF THE CURRENCY<br />

Michael Rufino, SVP, Member Regulation, Sales Practice Review, FINRA<br />

Alan Sorcher, Sr. Advisor for Cross-Sector Regulatory Strategies, FINCEN<br />

3:15-3:45 Networking Break<br />

www.amlac.com<br />

| 3