AMLAC & Fraud - IIR

AMLAC & Fraud - IIR

AMLAC & Fraud - IIR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

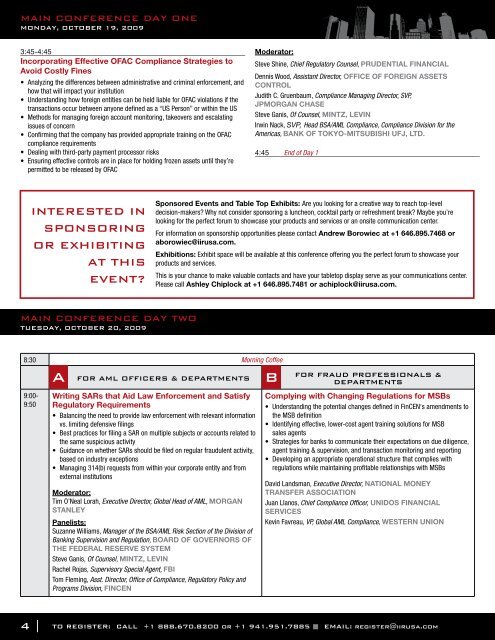

MAIN CONFERENCE DAY ONE<br />

MONDAY, OCTOBER 19, 2009<br />

3:45-4:45<br />

Incorporating Effective OFAC Compliance Strategies to<br />

Avoid Costly Fines<br />

• Analyzing the differences between administrative and criminal enforcement, and<br />

how that will impact your institution<br />

• Understanding how foreign entities can be held liable for OFAC violations if the<br />

transactions occur between anyone defined as a “US Person” or within the US<br />

• Methods for managing foreign account monitoring, takeovers and escalating<br />

issues of concern<br />

• Confirming that the company has provided appropriate training on the OFAC<br />

compliance requirements<br />

• Dealing with third-party payment processor risks<br />

• Ensuring effective controls are in place for holding frozen assets until they’re<br />

permitted to be released by OFAC<br />

Moderator:<br />

Steve Shine, Chief Regulatory Counsel, PRUDENTIAL FINANCIAL<br />

Dennis Wood, Assistant Director, OFFICE OF FOREIGN ASSETS<br />

CONTROL<br />

Judith C. Gruenbaum, Compliance Managing Director, SVP,<br />

JPMORGAN CHASE<br />

Steve Ganis, Of Counsel, MINTZ, LEVIN<br />

Irwin Nack, SVP, Head BSA/AML Compliance, Compliance Division for the<br />

Americas, BANK OF TOKYO-MITSUBISHI UFJ, LTD.<br />

4:45 End of Day 1<br />

Interested in<br />

Sponsoring<br />

or Exhibiting<br />

at this<br />

event?<br />

Sponsored Events and Table Top Exhibits: Are you looking for a creative way to reach top-level<br />

decision-makers? Why not consider sponsoring a luncheon, cocktail party or refreshment break? Maybe you’re<br />

looking for the perfect forum to showcase your products and services or an onsite communication center.<br />

For information on sponsorship opportunities please contact Andrew Borowiec at +1 646.895.7468 or<br />

aborowiec@iirusa.com.<br />

Exhibitions: Exhibit space will be available at this conference offering you the perfect forum to showcase your<br />

products and services.<br />

This is your chance to make valuable contacts and have your tabletop display serve as your communications center.<br />

Please call Ashley Chiplock at +1 646.895.7481 or achiplock@iirusa.com.<br />

MAIN CONFERENCE DAY Two<br />

TuesDAY, OCTOBER 20, 2009<br />

8:30 Morning Coffee<br />

9:00-<br />

9:50<br />

A<br />

For AML Officers & Departments<br />

Writing SARs that Aid Law Enforcement and Satisfy<br />

Regulatory Requirements<br />

• Balancing the need to provide law enforcement with relevant information<br />

vs. limiting defensive filings<br />

• Best practices for filing a SAR on multiple subjects or accounts related to<br />

the same suspicious activity<br />

• Guidance on whether SARs should be filed on regular fraudulent activity,<br />

based on industry exceptions<br />

• Managing 314(b) requests from within your corporate entity and from<br />

external institutions<br />

Moderator:<br />

Tim O’Neal Lorah, Executive Director, Global Head of AML, MORGAN<br />

STANLEY<br />

Panelists:<br />

Suzanne Williams, Manager of the BSA/AML Risk Section of the Division of<br />

Banking Supervision and Regulation, BOARD OF GOVERNORS OF<br />

THE FEDERAL RESERVE SYSTEM<br />

Steve Ganis, Of Counsel, MINTZ, LEVIN<br />

Rachel Rojas, Supervisory Special Agent, FBI<br />

Tom Fleming, Asst. Director, Office of Compliance, Regulatory Policy and<br />

Programs Division, FINCEN<br />

B<br />

For <strong>Fraud</strong> Professionals &<br />

Departments<br />

Complying with Changing Regulations for MSBs<br />

• Understanding the potential changes defined in FinCEN‘s amendments to<br />

the MSB definition<br />

• Identifying effective, lower-cost agent training solutions for MSB<br />

sales agents<br />

• Strategies for banks to communicate their expectations on due diligence,<br />

agent training & supervision, and transaction monitoring and reporting<br />

• Developing an appropriate operational structure that complies with<br />

regulations while maintaining profitable relationships with MSBs<br />

David Landsman, Executive Director, NATIONAL MONEY<br />

TRANSFER ASSOCIATION<br />

Juan Llanos, Chief Compliance Officer, UNIDOS FINANCIAL<br />

SERVICES<br />

Kevin Favreau, VP, Global AML Compliance, WESTERN UNION<br />

4 |<br />

TO REGISTER: Call +1 888.670.8200 or +1 941.951.7885 ■ Email: register@iirusa.com