download pdf - Port of Antwerp

download pdf - Port of Antwerp

download pdf - Port of Antwerp

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

7<br />

Annual Accounts<br />

notes to<br />

the annual accounts<br />

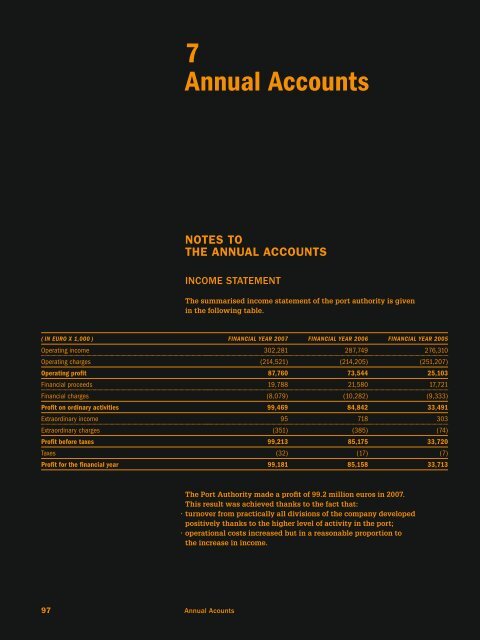

income statement<br />

The summarised income statement <strong>of</strong> the port authority is given<br />

in the following table.<br />

( in euro x 1,000 ) financial year 2007 financial year 2006 financial year 2005<br />

Operating income 302,281 287,749 276,310<br />

Operating charges (214,521) (214,205) (251,207)<br />

Operating pr<strong>of</strong>it 87,760 73,544 25,103<br />

Financial proceeds 19,788 21,580 17,721<br />

Financial charges (8,079) (10,282) (9,333)<br />

Pr<strong>of</strong>it on ordinary activities 99,469 84,842 33,491<br />

Extraordinary income 95 718 303<br />

Extraordinary charges (351) (385) (74)<br />

Pr<strong>of</strong>it before taxes 99,213 85,175 33,720<br />

Taxes (32) (17) (7)<br />

Pr<strong>of</strong>it for the financial year 99,181 85,158 33,713<br />

The <strong>Port</strong> Authority made a pr<strong>of</strong>it <strong>of</strong> 99.2 million euros in 2007.<br />

This result was achieved thanks to the fact that:<br />

∙ turnover from practically all divisions <strong>of</strong> the company developed<br />

positively thanks to the higher level <strong>of</strong> activity in the port;<br />

∙ operational costs increased but in a reasonable proportion to<br />

the increase in income.<br />

97 Annual Acounts

Operating income<br />

The various turnover categories are classified as follows:<br />

Electricity 4.3 % Miscellaneous 0.5 %<br />

Dock cranes 2.5 %<br />

Floating cranes 0.8 %<br />

Concessions and port charges 40.0 %<br />

Shipping dues 33.8 %<br />

Barge dues 3.2 %<br />

Tugging 15.3 %<br />

The variation in the different income categories over the past three years<br />

is as follows:<br />

The tugging department saw a rise in the level <strong>of</strong> its activity. The number<br />

<strong>of</strong> tugging tasks increased by 7.3%, and the number <strong>of</strong> slings rose<br />

further. Since fuel costs continued to rise in 2007 as in 2006, the bunker<br />

surcharge also increased, leading to a further expansion in turnover.<br />

The turnover for electricity remained almost the same, with only a very<br />

slight decrease from 11.1 million to 10.9 million euros<br />

After several years <strong>of</strong> strong growth, the turnover from mobile cranes<br />

stabilised. As regards dock cranes, the turnover from mobile cranes<br />

continued to grow and the share <strong>of</strong> rail cranes diminished further.<br />

Turnover from floating cranes increased strongly in 2007 by 117% after<br />

several years <strong>of</strong> decline, mostly because it was possible to conclude a<br />

major new contract.<br />

The other operating income amounted to 48.0 million euros in 2007,<br />

compared with 46.9 million in 2006. This operating income consists<br />

to a large extent <strong>of</strong> operational subsidies from the Flemish Region<br />

(24.2 million euros in 2007 and 24.4 million in 2006). The subsidies are a<br />

contribution towards the costs that the <strong>Port</strong> Authority incurs in carrying<br />

out tasks that are actually incumbent upon the Flemish Region under<br />

the terms <strong>of</strong> the <strong>Port</strong> Decree.<br />

As in 2006, the other operating income in 2006 included the amounts<br />

passed on for withholding tax on income from real estate and water<br />

supplies, totalling 15.7 million euros.<br />

Operating costs<br />

The following chart shows a comparison <strong>of</strong> the various sub-categories.<br />

The income from concessions is up by around 6%, due to a combination<br />

<strong>of</strong> tariff increases and the sites in the Deurganck dock coming into<br />

operation.<br />

In the case <strong>of</strong> ship dues, the increased volume <strong>of</strong> activity led to an additional<br />

3.5% in turnover. The income from barge dues also rose as a result<br />

<strong>of</strong> the average size <strong>of</strong> barges increasing, both for internal movements and<br />

for transit movements.<br />

98 Annual Report 2007 99 Annual Acounts

Purchases <strong>of</strong> services and miscellaneous goods are up by<br />

2.3 million euros, mainly for the following reasons:<br />

∙ increased costs for dredging out commercial berths in tidal areas,<br />

∙ increased costs for waste collection and treatment.<br />

The personnel costs amounted to 97.6 million euros, compared with<br />

95.1 million euros in 2006.<br />

The wage costs rose by 3%, although the number <strong>of</strong> personnel remained<br />

practically the same. The main reasons for the increase are as follows:<br />

∙ the full impact in 2007 <strong>of</strong> the last index-linking in October 2006,<br />

∙ the smaller effect <strong>of</strong> a higher average wage bracket.<br />

The Pension Fund is still being wound up, and the <strong>Port</strong> Authority will<br />

have to meet any deficit, or if there is a surplus it will benefit from a<br />

liquidation bonus. Based on the current prospects for the liquidation,<br />

however, no significant positive or negative consequences for the <strong>Port</strong><br />

Authority are expected.<br />

The reserves have increased on balance by 13.7 million euros.<br />

This balance is mainly determined by the need to build up further<br />

environmental provisions.<br />

The main components <strong>of</strong> the other operating charges are the withholding<br />

tax on income from real estate and the tax on water supply points.<br />

Assets<br />

The amount <strong>of</strong> tangible and intangible assets has risen by 16.3 million<br />

euros. The balance is made up as follows:<br />

million euros<br />

Investments + 55.5<br />

Depreciation - 38.8<br />

Decommissioning/revaluation - 0.3<br />

The investments are made up mainly <strong>of</strong> the following components:<br />

∙ investments in various docks (22.6 million euros)<br />

∙ buildings (7.6 million euros)<br />

∙ purchase <strong>of</strong> land (6.2 million euros)<br />

∙ Roads (7.6 million euros).<br />

Amounts receivable have risen by 11.4 million euros, since the “Other<br />

amounts receivable” still include significant claims for collection <strong>of</strong><br />

operating subsidies for the Harbourmaster’s Office, under the terms<br />

<strong>of</strong> the <strong>Port</strong> Decree. These amounts were received in 2008.<br />

Thanks to the positive result overall and the positive cashflow for the<br />

financial year, the short-term investments have risen from 72 million<br />

to 89.7 million euros.<br />

Financial result<br />

The financial results has fallen due to lower amortisation <strong>of</strong> investment<br />

grants. This is directly connected to the changes in depreciation<br />

mentioned above.<br />

Balance Sheet<br />

The Balance Sheet is summarised in the table below.<br />

(in EURO x 1,000) 31/12/2007 31/12/2006 31/12/2007 31/12/2006<br />

Assets<br />

Liabilities<br />

I/III. Intangible/tangible assets 973,341 957,024 I. Capital 307,110 307,110<br />

IV. Financial assets 617 787 III. Revaluation surplus 14,721 15,855<br />

V. Receivables > 1 year 0 1,325 IV. Reserves 211,606 124,178<br />

VI. Stocks 2,289 2,300 VI. Investment grants 286,525 297,859<br />

VII. Receivables < 1 year 52,568 41,137 VII. Provisions 112,494 98,783<br />

VIII. Investments 89,755 72,022 VIII. Amts payable > 1 year 69,499 128,445<br />

IX. Liquid assets 5,978 6,373 IX. Amts payable < 1 year 95,407 84,075<br />

X. Deferred charges and accrued income 3,393 6,092 X. Accrued charges and deferred income 30,579 30,755<br />

Total 1,127,941 1,087,060 1,127,941 1,087,060<br />

Liabilities<br />

The capital and reserves have risen because out <strong>of</strong> the total net result <strong>of</strong><br />

99.2 million euros, 86.4 million was appropriated to capital and reserves<br />

and 12.8 million was appropriated as pr<strong>of</strong>it to be paid out.<br />

The increase in reserves is mainly due to further new reserves being set<br />

aside for disputes and environmental obligations.<br />

Because <strong>of</strong> the development in the <strong>Port</strong> Authority’s cash position<br />

(see next page under Cashflow statement), long-term loans were repaid<br />

where possible and financially advantageous, so that the long-term<br />

loans have fallen from 128.4 million to 69.5 million euros.<br />

The amounts payable within one year have risen, mainly due to an increase<br />

in the current portion <strong>of</strong> debts together with a rise in the amounts<br />

payable to suppliers. Like last year, the pr<strong>of</strong>it <strong>of</strong> 12.8 million euros to be<br />

paid out has been included under the heading “Other debts.”<br />

100 Annual Report 2007 101 Annual Acounts

Cashflow Statement<br />

The cashflow is summarised in the table below. Note that for the first<br />

time in several years, the income from operating cashflow is significantly<br />

higher than the expenditure for investments and financing costs.<br />

The auditors Deloitte Bedrijfsrevisoren, Mr. G. Lauwers and<br />

Mrs. A. Coolsaet have approved the annual accounts without<br />

qualification.<br />

<strong>Antwerp</strong>, 13 May 2008<br />

2007 2006 2005<br />

Short-term investments and liquid assets at start <strong>of</strong> year 78,395 17,641 16,611<br />

Cashflow generated from operating activities 134,900 111,996 136,545<br />

Cashflow devoted to investment activities (52,341) (33,569) (47,457)<br />

Cashflow devoted to financing activities/pensions (65,221) (17,673) (88,058)<br />

Short-term investments and liquid assets at year end 95,733 78,395 17,641<br />

For the Board <strong>of</strong> Directors<br />

Eddy Bruyninckx<br />

Managing Director<br />

Marc Van Peel<br />

Chairman <strong>of</strong> the Board<br />

<strong>of</strong> Directors<br />

The cashflow from operational activities has increased due to the negative<br />

impact on working capital at the end <strong>of</strong> 2006, which in turn was due<br />

to a decrease in short-term debts as a result <strong>of</strong> lower pension obligations.<br />

The cashflow devoted to investment activities has risen due to large<br />

investments in docks, buildings and roads.<br />

The cashflow devoted to financial activities has risen, as a result <strong>of</strong><br />

debts being repaid where possible and financially advantageous.<br />

Other required information<br />

Apart from the information mentioned in the annual accounts, there<br />

were no significant events after the closing date <strong>of</strong> the Balance Sheet.<br />

The points regarding R&D and the existence <strong>of</strong> branch <strong>of</strong>fices are not<br />

applicable. No procedures were carried out under application <strong>of</strong><br />

art. 523 <strong>of</strong> the Companies Act. No use is made <strong>of</strong> financial instruments<br />

<strong>of</strong> any significance in judging the assets, liabilities, financial position<br />

and result.<br />

As regards the risks and uncertainties facing the <strong>Port</strong> Authorities,<br />

these are mainly in the following areas:<br />

∙ developments in legislation as a result <strong>of</strong> the <strong>Port</strong> Decree and its<br />

implementation;<br />

∙ developments in legislation in the field <strong>of</strong> town and country planning<br />

and delimitation <strong>of</strong> the port area;<br />

∙ developments in environmental legislation.<br />

The attractiveness <strong>of</strong> ports in general is determined by factors such as<br />

the accessibility <strong>of</strong> the port, the efficiency <strong>of</strong> activities within the port<br />

itself, and the quality <strong>of</strong> the hinterland connections.<br />

102 Annual Report 2007 103 Annual Acounts

Balance sheet (in euro)<br />

liabilities<br />

codes period preceding period<br />

assets<br />

codes period preceding period<br />

fixed assets 20/28 973,957,195.66 957,810,420.56<br />

Formation expenses (Toel. 1) 20<br />

Intangible assets (Toel. 2) 21 954,688.97 77,692.16<br />

Tangible assets (Toel. 3) 22/27 972,385,567.83 956,945,634.43<br />

Land and buildings 22 839,011,977.58 848,358,501.21<br />

Plant, machinery and equipment 23 55,850,541.54 56,359,062.46<br />

Furniture and vehicles 24 27,920,237.58 30,730,909.83<br />

Leasing and other similar rights 25 545,462.46 572,288.49<br />

Other tangible assets 26 59,905.62 59,905.62<br />

Assets under construction and advance payments 27 48,997,443.05 20,864,966.82<br />

Financial assets (Toel. 4 & 5.1) 28 616,938.86 787,093.97<br />

Affiliated enterprises (Toel. 4.1 & 14) 280/1 27,888.02 27,888.02<br />

Participating interests 280 27,888.02 27,888.02<br />

Amounts receivable 281<br />

Other enterprises linked by<br />

participating interests (Toel. 4.2 & 14) 282/3 581,000.45 581,000.45<br />

Participating interests 282 581,000.45 581,000.45<br />

Amounts receivable 283<br />

Other financial assets 284/8 8,050.39 178,205.50<br />

Shares 284 8,050.39 8,050.39<br />

Amounts receivable and cash guarantees 285/8 170,155.11<br />

current assets 29/58 153,983,413.88 129,249,286.50<br />

Amounts receivable after more than one year 29 1,325,278.35<br />

Trade debtors 290 1,325,278.35<br />

Other amounts receivable 291<br />

Stocks and contracts in progress 3 2,289,070.23 2,300,092.99<br />

Stocks 30/36 2,289,070.23 2,300,092.99<br />

Raw materials and consumables 30/31 2,289,070.23 2,300,092.99<br />

Work in progress 32<br />

Finished goods 33<br />

Goods purchased for resale 34<br />

Immovable property acquired or constructed for resale 35<br />

Advance payments 36<br />

Contracts in progress 37<br />

Amounts receivable within one year 40/41 52,568,254.38 41,137,219.98<br />

Trade debtors 40 23,871,869.29 20,347,458.03<br />

Other amounts receivable 41 28,696,385.09 20,789,761.95<br />

Investments (Toel. 6) 50/53 89,755,305.53 72,021,711.15<br />

Own shares 50<br />

Other investments and deposits 51/53 89,755,305.53 72,021,711.15<br />

Cash at bank and in hand 54/58 5,977,436.37 6,373,160.49<br />

Deferred charges and accrued income (Toel. 6) 490/1 3,393,347.37 6,091,823.54<br />

total assets 20/58 1,127,940,609.54 1,087,059,707.06<br />

capital and reserves 10/15 819,962,360.49 745,002,940.83<br />

Capital (Toel. 7) 10 307,109,691.74 307,109,691.74<br />

Issued capital 100 307,109,691.74 307,109,691.74<br />

Uncalled capital 101<br />

Share premium account 11<br />

Revaluation surplus 12 14,721,191.75 15,855,389.71<br />

Reserves 13 211,606,162.30 124,178,667.29<br />

Legal reserve 130 24,015,907.40 14,097,797.12<br />

Reserves not available for distribution 131 18,414,048.06 17,367,655.90<br />

In respect <strong>of</strong> own shares held 1310<br />

Other 1311 18,414,048.06 17,367,655.90<br />

Untaxed reserves 132<br />

Reserves available for distribution 133 169,176,206.84 92,713,214.27<br />

Pr<strong>of</strong>it (loss) carried forward (+) (–) 14<br />

Investments grants 15 286,525,314.70 297,859,192.09<br />

Advance payment to partners<br />

on distribution <strong>of</strong> net assets 19<br />

provisions and deferred taxation 16 112,493,891.90 98,783,080.22<br />

Provisions for liabilities and charges 160/5 112,493,891.90 98,783,080.22<br />

Pensions and similar obligations 160<br />

Taxation 161<br />

Major repairs and maintenance 162 34,128,421.95 33,610,673.71<br />

Other liabilities and charges (Toel. 8) 163/5 78,365,469.95 65,172,406.51<br />

Deferred taxation 168<br />

creditors 17/49 195,484,357.15 243,273,686.01<br />

Amounts payable after more than one year (Toel. 9) 17 69,498,882.13 128,445,197.56<br />

Financial debts 170/4 69,498,882.13 128,445,197.56<br />

Subordinated loans 170<br />

Unsubordinated debentures 171<br />

Leasing and other similar obligations 172 149,773.43 219,962.63<br />

Credit institutions 173 69,349,108.70 128,225,234.93<br />

Other loans 174<br />

Trade debts 175<br />

Suppliers 1750<br />

Bills <strong>of</strong> exchange payable 1751<br />

Advances received on contracts in progress 176<br />

Other amounts payable 178/9<br />

Amounts payable within one year 42/48 95,406,739.69 84,073,767.20<br />

Current portion <strong>of</strong> amounts payable after<br />

more than one year (Toel. 9) 42 16.164.620.09 9.639.378.83<br />

Financial debts 43<br />

Credit institutions 430/8<br />

Other loans 439<br />

Trade debts 44 39,834,744.07 34,947,863.82<br />

Suppliers 440/4 39,834,744.07 34,947,863.82<br />

Bills <strong>of</strong> exchange payable 441<br />

Advances received on contracts in progress 46 1,386,000.00 1,386,000.00<br />

Taxes, remuneration and social security (Toel. 9) 45 22,293,454.29 22,302,432.78<br />

Taxes 450/3 1,609,823.76 1,604,701.49<br />

Remuneration and social security 454/9 20,683,630.53 20,697,731.29<br />

Other amounts payable 47/48 15,727,921.24 15,798,091.77<br />

Accrued charges (Toel. 9) 492/3 30,578,735.33 30,754,721.25<br />

total liabilities 10/49 1,127,940,609.54 1,087,059,707.06<br />

104 Annual Report 2007 105 Annual Acounts

income statement (in euro)<br />

codes period preceding period<br />

Operating income 70/74 302,280,576.15 287,749,425.99<br />

Turnover 70 252,608,572.05 238,678,742.15<br />

Increase (decrease) in stocks <strong>of</strong><br />

finished goods, work and contracts<br />

in progress (+)(–) 71<br />

Produced fixed assets 72 1,673,809.40 2,093,046.39<br />

Other operating income (Toel. 10) 74 47,998,194.70 46,977,637.45<br />

Operating charges 60/64 214,520,849.99 214,205,001.14<br />

Raw materials, consumables and goods for resale 60 4,105,174.61 3,584,034.87<br />

Purchases 600/8 4,084,614.22 3,649,077.71<br />

Decrease (increase) in stocks (+)(–) 609 20,560.39 -65,042.84<br />

Services and other goods 61 45,616,985.89 43,227,319.90<br />

Remuneration, social security costs and pensions (+)(–)<br />

(Toel. 10) 62 97,651,787.81 95,108,538.69<br />

Depreciation <strong>of</strong> and to other amounts written <strong>of</strong>f<br />

formation expenses, intangible and tangible<br />

fixed assets 630 38,806,081.51 45,883,632.81<br />

Increase (decrease) in amounts written <strong>of</strong>f<br />

stocks, contracts in progress and trade debtors (+)(–) 631/4 -1,407,253.76 161,364.89<br />

Increase (decrease) in provisions for<br />

liabilities and charges (Toel. 10) (+)(–) 635/7 13,710,811.68 10,452,019.44<br />

Other operating charges (Toel. 10) 640/8 16,037,262.25 15,788,090.54<br />

Operating charges capitalised as<br />

reorganisation costs (–) 649<br />

Operating pr<strong>of</strong>it (loss) (+)(–) 9901 87,759,726.16 73,544,424.85<br />

Financial income 75 19,788,422.21 21,580,262.23<br />

Income from financial fixed assets 750 472,708.82 479,772.44<br />

Income from current assets 751 311,109.86 640,232.73<br />

Other financial income (Toel. 11) 752/9 19,004,603.53 20,460,257.06<br />

Financial charges 65 8,079,056.75 10,282,307.10<br />

Interest and other debt charges 650 8,021,070.12 10,251,437.53<br />

Write-downs <strong>of</strong> current assets other than stocks,<br />

orders in progress and trade receivables –<br />

new write-downs (write-backs) (+)(–) 651<br />

Other financial charges 652/9 57,986.63 30,869.57<br />

Pr<strong>of</strong>it (loss) on ordinary activities<br />

before taxes (+)(–) 9902 99,469,091.62 84,842,379.98<br />

codes period preceding period<br />

Extraordinary income 76 95,314.46 718,452.09<br />

Adjustments to depreciation <strong>of</strong> and<br />

to other amounts written <strong>of</strong>f intangible and<br />

tangible fixed assets 760<br />

Adjustments to amounts written <strong>of</strong>f<br />

financial fixed assets 761<br />

Adjustments to provisions for extraordinary<br />

liabilities and charges 762<br />

Gain on disposal <strong>of</strong> fixed assets 763 95,314.46 718,452.09<br />

Other extraordinary income 764/9<br />

Extraordinary charges 66 351,019.30 385,643.19<br />

Extraordinary depreciation <strong>of</strong> and extraordinary<br />

amounts written <strong>of</strong>f formation expenses,<br />

intangible and tangible fixed assets 660<br />

Amounts written <strong>of</strong>f financial fixed assets 661<br />

Provisions for extraordinary liabilities<br />

and charges - Increase (decrease) (+)(–) 662<br />

Loss on disposal <strong>of</strong> fixed assets 663 351,019.30 385,643.19<br />

Other extraordinary charges 664/8<br />

Extraordinary charges capitalised<br />

as reorganisation costs (–) 669<br />

Pr<strong>of</strong>its (Loss) for the period before taxes (+)(–) 9903 99,213,386.78 85,175,188.88<br />

Transfer from deferred taxation 780<br />

Transfer to deferred taxation 680<br />

Income taxes (Toel. 12) (+)(–) 67/77 32,283.93 16,886.53<br />

Income taxes 670/3 32,283.93 16,886.53<br />

Adjustment <strong>of</strong> income taxes and write-back<br />

<strong>of</strong> tax provisions 77<br />

Pr<strong>of</strong>it (Loss) for the period (+)(–) 9904 99,181,102.85 85,158,302.35<br />

Transfer from untaxed reserve 789<br />

Transfer to untaxed reserve 689<br />

Pr<strong>of</strong>it (Loss) for the period<br />

available for appropriation (+)(–) 9905 99,181,102.85 85,158,302.35<br />

106 Annual Report 2007 107 Annual Acounts

appropriation account<br />

notes<br />

codes period preceding period<br />

Pr<strong>of</strong>it (Loss) to be appropriated (+)(–) 9906 99,181,102.85 85,158,302.35<br />

Pr<strong>of</strong>it (Loss) for the period<br />

available for appropriation (+)(–) (9905) 99,181,102.85 85,158,302.35<br />

Pr<strong>of</strong>it (Loss) brought forward (+)(–) 14P<br />

Transfers from capital and reserves 791/2<br />

From capital and share premium account 791<br />

From reserves 792<br />

Transfers to capital and reserves 691/2 86,381,102.85 72,358,302.35<br />

From capital and share premium account 691<br />

To legal reserve 6920 9,918,110.28 8,515,830.24<br />

To other reserves 6921 76,462,992.57 63,842,472.11<br />

Pr<strong>of</strong>it (Loss) to be carried forward (+)(–) (14)<br />

Shareholders’ contribution in respect <strong>of</strong> losses 794<br />

Distribution <strong>of</strong> pr<strong>of</strong>it 694/6 12,800,000.00 12,800,000.00<br />

Dividends 694<br />

Directors’ emoluments 695<br />

Other allocations 696 12,800,000.00 12,800,000.00<br />

2. statement OF INTANGIBLE ASSETS<br />

2.2 concessions, patents, licences, know-how,<br />

brand names and similar rights<br />

codes period preceding period<br />

Acquisition value at the end <strong>of</strong> the preceding period 8052P xxxxxxxxxxxx 704,505.05<br />

Movements during the period<br />

Acquisitions, including production <strong>of</strong> assets 8022 255,816.93<br />

Disposals and retirals 8032<br />

Transfers from one heading to another (+)(–) 8042 718,100.86<br />

Acquisition value at the end <strong>of</strong> the period 8052 1,678,422.84<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the preceding period 8122P xxxxxxxxxxxx 626,812.89<br />

Movements during the period<br />

Recorded 8072 96,920.98<br />

Written back as excessive 8082<br />

Acquisitions from third parties 8092<br />

Written down as disposals and retirals 8102<br />

Transfers from one heading to another (+)(–) 8112<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the period 8122 723,733.87<br />

Net book value at the end <strong>of</strong> the period 211 954,688.97<br />

108 Annual Report 2007 109 Annual Acounts

3. statement OF TANGIBLE FIXED ASSETS<br />

3.1 land and buildings<br />

codes period preceding period<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8191P xxxxxxxxxxxx 1,150,378,976.08<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8161 7,030,672.32<br />

Disposals and retirals 8171 5,809,820.52<br />

Transfers from one heading to another (+)(–) 8181 15,896,127.38<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8191 1,167,495,955.26<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8251P xxxxxxxxxxxx 24,027,526.72<br />

Movements during the period<br />

Recorded 8211<br />

Acquisitions from third parties 8221<br />

Reversals 8231 90,229.17<br />

Transfers from one heading to another (+)(–) 8241<br />

Revaluation surpluses at the end <strong>of</strong> the period 8251 23,937,297.55<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the preceding period 8321P xxxxxxxxxxxx 326,048,001.59<br />

Movements during the period<br />

Recorded 8271 27,442,872.77<br />

Written back as excessive 8281<br />

Acquisitions from third parties 8291<br />

Written down after disposals and retirals 8301 1,069,599,13<br />

Transfers from one heading to another (+)(–) 8311<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the period 8321 352,421,275.23<br />

Net book value at the end <strong>of</strong> the period (22) 839,011,977.58<br />

3.2 plant, machinery and equipment<br />

codes period preceding period<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8192P xxxxxxxxxxxx 194,047,972.48<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8162 8,267,458.98<br />

Disposals and retirals 8172 5,026,617.08<br />

Transfers from one heading to another (+)(–) 8182 352,108.20<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8192 197,640,922.58<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8252P xxxxxxxxxxxx 5,857,953.59<br />

Movements during the period<br />

Recorded 8212<br />

Acquisitions from third parties 8222<br />

Reversals 8232 288,269.17<br />

Transfers from one heading to another (+)(–) 8242<br />

Revaluation surpluses at the end <strong>of</strong> the period 8252 5,569,684.42<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the preceding period 8322P xxxxxxxxxxxx 143,546,863.61<br />

Movements during the period<br />

Recorded 8272 7,559,548.89<br />

Written back as excessive 8282<br />

Acquisitions from third parties 8292<br />

Written down after disposals and retirals 8302 3,746,347.04<br />

Transfers from one heading to another (+)(–) 8312<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the period 8322 147,360,065.46<br />

Net book value at the end <strong>of</strong> the period (23) 55,850,541.54<br />

110 Annual Report 2007 111 Annual Acounts

3.3 Furniture and vehicles<br />

codes period preceding period<br />

3.4 leasing and other similar rights<br />

codes period preceding period<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8193P xxxxxxxxxxxx 71,783,481.32<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8163 879,420.89<br />

Disposals and retirals 8173 796,672.65<br />

Transfers from one heading to another (+)(–) 8183<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8193 71,866,229.56<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8253P xxxxxxxxxxxx 3,200,075.16<br />

Movements during the period<br />

Recorded 8213<br />

Acquisitions from third parties 8223<br />

Reversals 8233 25,801.21<br />

Transfers from one heading to another (+)(–) 8243<br />

Revaluation surpluses at the end <strong>of</strong> the period 8253 3,174,273.95<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the preceding period 8323P xxxxxxxxxxxx 44,252,646.65<br />

Movements during the period<br />

Recorded 8273 3,679,912.84<br />

Written back as excessive 8283<br />

Acquisitions from third parties 8293<br />

Written down after disposals and retirals 8303 812,293.56<br />

Transfers from one heading to another (+)(–) 8313<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the period 8323 47,120,265.93<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8194P xxxxxxxxxxxx 813,382.95<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8164<br />

Disposals and retirals 8174<br />

Transfers from one heading to another (+)(–) 8184<br />

Acquisition cost at the end <strong>of</strong> the period 8194 813,382.95<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8254P xxxxxxxxxxxx 80,817.81<br />

Movements during the period<br />

Recorded 8214<br />

Acquisitions from third parties 8224<br />

Reversals 8234<br />

Transfers from one heading to another (+)(–) 8244<br />

Revaluation surpluses at the end <strong>of</strong> the period 8254 80,817.81<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the preceding period 8324P xxxxxxxxxxxx 321,912.27<br />

Movements during the period<br />

Recorded 8274 26,826.03<br />

Written back as excessive 8284<br />

Acquisitions from third parties 8294<br />

Written down after disposals and retirals 8304<br />

Transfers from one heading to another (+)(–) 8314<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the period 8324 348,738.30<br />

Net book value at the end <strong>of</strong> the period (24) 27,920,237.58<br />

Net book value at the end <strong>of</strong> the period (25) 545,462.46<br />

<strong>of</strong> which<br />

Land and buildings 250 545,462.46<br />

Plant, machinery and equipment 251<br />

Furniture and vehicles 252<br />

112 Annual Report 2007 113 Annual Acounts

3.5 other tangible fixed assets<br />

codes period preceding period<br />

3.6 assets under construction and prepayments<br />

codes period preceding period<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8195P xxxxxxxxxxxx 59,905.62<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8165<br />

Disposals and retirals 8175<br />

Transfers from one heading to another (+)(–) 8185<br />

Acquisition cost at the end <strong>of</strong> the period 8195 59,905.62<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8255P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8215<br />

Acquisitions from third parties 8225<br />

Reversals 8235<br />

Transfers from one heading to another (+)(–) 8245<br />

Revaluation surpluses at the end <strong>of</strong> the period 8255<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the preceding period 8325P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8275<br />

Written back as excessive 8285<br />

Acquisitions from third parties 8295<br />

Written down after disposals and retirals 8305<br />

Transfers from one heading to another (+)(–) 8315<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the period 8325<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8196P xxxxxxxxxxxx 20,864,966.82<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8166 45,682,904.83<br />

Disposals and retirals 8176<br />

Transfers from one heading to another (+)(–) 8186 -17,550,428.60<br />

Acquisition cost at the end <strong>of</strong> the period 8196 48,997,443.05<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8256P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8216<br />

Acquisitions from third parties 8226<br />

Reversals 8236<br />

Transfers from one heading to another (+)(–) 8246<br />

Revaluation surpluses at the end <strong>of</strong> the period 8256<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the preceding period 8326P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8276<br />

Written back as excessive 8286<br />

Acquisitions from third parties 8296<br />

Written down after disposals and retirals 8306<br />

Transfers from one heading to another (+)(–) 8316<br />

Depreciation and amounts written down<br />

at the end <strong>of</strong> the period 8326<br />

Net book value at the end <strong>of</strong> the period (26) 59,905.62<br />

Net book value at the end <strong>of</strong> the period (27) 48,997,443.05<br />

114 Annual Report 2007 115 Annual Acounts

4. statement OF FINANCIAL FIXED ASSETS<br />

4.1 affiliated enterprises – participating interests and shares<br />

codes period preceding period<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8391P xxxxxxxxxxxx 55,776.04<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8361<br />

Disposals and retirals 8371<br />

Transfers from one heading to another (+)(–) 8381<br />

Acquisition cost at the end <strong>of</strong> the period 8391 55,776.04<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8451P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8411<br />

Acquisitions from third parties 8421<br />

Reversals 8431<br />

Transfers from one heading to another (+)(–) 8441<br />

Depreciation at the end <strong>of</strong> the preceding period 8521P xxxxxxxxxxxx 27,888.02<br />

Movements during the period<br />

Recorded 8471<br />

Written back as excessive 8481<br />

Acquisitions from third parties 8491<br />

Written down after disposals and retirals 8501<br />

Transfers from one heading to another (+)(–) 8511<br />

Depreciation at the end <strong>of</strong> the period 8521 27,888.02<br />

Uncalled amounts at the end <strong>of</strong> the preceding period 8551P xxxxxxxxxxxx<br />

Movements during the period (+)(–) 8541<br />

Uncalled amounts at the end <strong>of</strong> the period 8551<br />

net book value at the end <strong>of</strong> the period (280) 27,888.02<br />

associated companies -<br />

amounts receivable<br />

net book value at the end <strong>of</strong> the prec. period 281P xxxxxxxxxxxx<br />

Movements during the period<br />

Additions 8581<br />

Reimbursements 8591<br />

Value adjustment entries 8601<br />

Reversed value adjustments 8611<br />

Exchange differences (+)(–) 8621<br />

Other movements (+)(–) 8631<br />

net book value at the end <strong>of</strong> the prec. period (281)<br />

accumulated amounts written <strong>of</strong>f on amounts<br />

receivable at the end <strong>of</strong> the period 8651<br />

4.2 enterprises with participation – participating interests and shares<br />

codes period preceding period<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8392P xxxxxxxxxxxx 2,338,812.45<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8362<br />

Disposals and retirals 8372<br />

Transfers from one heading to another (+)(–) 8382<br />

Acquisition cost at the end <strong>of</strong> the period 8392 2,338,812.45<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8452P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8412<br />

Acquisitions from third parties 8422<br />

Reversals 8432<br />

Transfers from one heading to another (+)(–) 8442<br />

Revaluation surpluses at the end <strong>of</strong> the period 8452<br />

Depreciation at the end <strong>of</strong> the preceding period 8522P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8472<br />

Written back as excessive 8482<br />

Acquisitions from third parties 8492<br />

Written down after disposals and retirals 8502<br />

Transfers from one heading to another (+)(–) 8512<br />

Depreciation at the end <strong>of</strong> the period 8522<br />

Uncalled amounts at the end <strong>of</strong> the preceding period 8552P xxxxxxxxxxxx 1,757,812.00<br />

Movements during the period (+)(–) 8542<br />

Uncalled amounts at the end <strong>of</strong> the period 8552 1,757,812.00<br />

Net book value at the end <strong>of</strong> the period (282) 581,000.45<br />

enterprises linked by participation -<br />

amounts receivable<br />

net book value at the end <strong>of</strong> the prec. period 283P xxxxxxxxxxxx<br />

Movements during the period<br />

Additions 8582<br />

Reimbursements 8592<br />

Value adjustment entries 8602<br />

Reversed value adjustments 8612<br />

Exchange differences (+)(–) 8622<br />

Other movements (+)(–) 8632<br />

net book value at the end <strong>of</strong> the prec. period (283)<br />

accumulated amounts written <strong>of</strong>f on amounts<br />

receivable at the end <strong>of</strong> the period 8652<br />

116 Annual Report 2007 117 Annual Acounts

4.3 other enterprises – participating interests and shares<br />

codes period preceding period<br />

Acquisition cost at the end <strong>of</strong> the preceding period 8393P xxxxxxxxxxxx 13,609.55<br />

Movements during the period<br />

Acquisitions, including produced fixed assets 8363<br />

Disposals and retirals 8373<br />

Transfers from one heading to another (+)(–) 8383<br />

Acquisition cost at the end <strong>of</strong> the period 8393 13,609.55<br />

Revaluation surpluses at the end<br />

<strong>of</strong> the preceding period 8453P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8413<br />

Acquisitions from third parties 8423<br />

Reversals 8433<br />

Transfers from one heading to another (+)(–) 8443<br />

Revaluation surpluses at the end <strong>of</strong> the period 8453<br />

Depreciation at the end <strong>of</strong> the preceding period 8523P xxxxxxxxxxxx<br />

Movements during the period<br />

Recorded 8473<br />

Written back as excessive 8483<br />

Acquisitions from third parties 8493<br />

Written down after disposals and retirals 8503<br />

Transfers from one heading to another (+)(–) 8513<br />

5. information about the participations<br />

5.1 participatinG INTERESTS AND OTHER RIGHTS<br />

in OTHER ENTERPRISES<br />

List <strong>of</strong> both enterprises in which the enterprise holds a participating interest (recorded in the headings 280 and 282 <strong>of</strong> the assets),<br />

and other enterprises in which the enterprise holds rights (recorded in the headings 284 and 51/53 <strong>of</strong> the assets) in the amount<br />

<strong>of</strong> at least 10% <strong>of</strong> the capital issued.<br />

rights held by the enterprise<br />

information from the most recent period<br />

Name, full address directly subsidiaries CAPITAL and net<br />

<strong>of</strong> the registered <strong>of</strong>fice number % % annual cur- reserves result<br />

and v.a.t. number accounts rency (+) oR (–)<br />

(in units)<br />

Maatschappij voor het Grond- 31/12/2006 EUR 126,843,210 5,512,462<br />

en Industrialisatiebeleid van het<br />

Linkerscheldeoevergebied CVBA<br />

Sluisgebouw<br />

9120 Beveren-Waas<br />

België<br />

0223.944.690<br />

1,875 37.50 0.00<br />

<strong>Antwerp</strong> <strong>Port</strong> Consultancy NV 31/12/2006 EUR 27,306 -53,768<br />

Entrepotkaai 1<br />

2000 <strong>Antwerp</strong>en<br />

België<br />

0466.583.658<br />

9 90.00 0.00<br />

Depreciation at the end <strong>of</strong> the period 8523<br />

Uncalled amounts at the end <strong>of</strong> the preceding period 8553P xxxxxxxxxxxx 5,559.16<br />

Movements during the period (+)(–) 8543<br />

Uncalled amounts at the end <strong>of</strong> the period 8553 5,559.16<br />

Net book value at the end <strong>of</strong> the period (284) 8,050.39<br />

other enterprises - accounts receivable<br />

Net book value at the end <strong>of</strong> the prec. period 285/8P xxxxxxxxxxxx 170,155.11<br />

Movements during the year<br />

Additions 8583<br />

Additions (–) 8593 170,155.11<br />

Write-downs 8603<br />

Write-back <strong>of</strong> write-downs 8613<br />

Exchange rate differences (+)(–) 8623<br />

Other (+)(–) 8633<br />

Net book value at the end <strong>of</strong> the period (285/8)<br />

Cumulative write-down <strong>of</strong> accounts<br />

receivable at the end <strong>of</strong> the period 8653<br />

118 Annual Report 2007 119 Annual Acounts

6. other cash INVESTMENTS, DEFERRED CHARGES AND ACCRUED INCOME<br />

other cash INVESTMENTS<br />

codes period preceding period<br />

Shares 51 67,620,305.53 64,657,711.15<br />

book value increased with the<br />

uncalled amount 8681 67,620,305.53 64,657,711.15<br />

Uncalled amount 8682<br />

7. statement OF CAPITAL and the shareholder structure<br />

statement OF CAPITAL<br />

codes period preceding period<br />

Capital<br />

Issued capital at the end <strong>of</strong> the preceding period 100P xxxxxxxxxxxx 307,109,691.74<br />

Issued capital at the end <strong>of</strong> the period (100) 307,109,691.74<br />

Fixed income securities 52<br />

Fixed income securities<br />

issued by credit institutions 8684<br />

Term deposits with credit institutions 53 22,135,000.00 7,364,000.00<br />

Falling due<br />

less or equal to one month 8686<br />

between one month and one year 8687 22,135,000.00 7,364,000.00<br />

more than one year 8688<br />

Other investments not included in the above 8689<br />

Movements during the period<br />

codes amounts number <strong>of</strong> shares<br />

Structure <strong>of</strong> the capital<br />

Different categories <strong>of</strong> shares<br />

no shares issued considering legal structure<br />

Registered 8702 xxxxxxxxxxxx<br />

To bearer 8703 xxxxxxxxxxxx<br />

deFERRED CHARGES AND ACCRUED INCOME<br />

period<br />

uncalled<br />

called, but<br />

codes amount unpaid amount<br />

Analysis <strong>of</strong> heading 490/1 <strong>of</strong> assets<br />

if the amount is significant<br />

Wages January 2008 2,414,449.14<br />

Other revenue to be received 614,136.00<br />

Other 364,762.23<br />

Uncalled capital<br />

Uncalled capital (101) xxxxxxxxxxxx<br />

Called, but unpaid capital 8712 xxxxxxxxxxxx<br />

Shareholders having yet to pay up in full<br />

TOTAL deferred charges and accrued inCOME 3,393,347.37<br />

8. provisions FOR OTHER LIABILITIES AND CHARGES<br />

analysis <strong>of</strong> heading 163/5 <strong>of</strong> liabilities<br />

if the amount is significant<br />

period<br />

Pending litigations and risks 11,734,994.61<br />

Environment 58,934,579.60<br />

Social plans for personnel 2,395,756.56<br />

Other 5,300,139.18<br />

total provisions for other<br />

liabilities and charges 78,365,469.95<br />

120 Annual Report 2007 121 Annual Acounts

9. statement OF AMOUNTS PAYABLE<br />

analysis by current portions <strong>of</strong> amounts initially payable<br />

after more than one year according to their remaining period<br />

codes<br />

period<br />

Amounts payable not more than one year<br />

Financial debts 8801 16,164,620.09<br />

Subordinated loans 8811<br />

Unsubordinated debentures 8821<br />

Leasing and other similar obligations 8831 70,189.20<br />

Credit institutions 8841 16,094,430.89<br />

Other loans 8851<br />

Trade debts 8861<br />

Suppliers 8871<br />

Bills <strong>of</strong> exchange payable 8881<br />

Advances received on contracts in progress 8891<br />

Other amounts payable 8901<br />

total amounts payable within one year (42) 16,164,620.09<br />

Amounts payable between one and five years<br />

Financial debts 8802 41,665,003.79<br />

Subordinated loans 8812<br />

Unsubordinated debentures 8822<br />

Leasing and other similar obligations 8832 149,773.43<br />

Credit institutions 8842 41,515,230.36<br />

Other loans 8852<br />

Trade debts 8862<br />

Suppliers 8872<br />

Bills <strong>of</strong> exchange payable 8882<br />

Advances received on contracts in progress 8892<br />

Other amounts payable 8902<br />

amounts payable for taxes, remuneration<br />

and social security<br />

codes<br />

period<br />

Taxes (heading 450/3 <strong>of</strong> liabilities)<br />

Expired taxes payable 9072<br />

non expired taxes payable 9073 1,609,823.76<br />

Estimated taxes payable 450<br />

Remuneration and social security (heading 454/9 <strong>of</strong> liabilities)<br />

Amounts due to National Office <strong>of</strong> Social Security 9076<br />

Other amounts payable relating to remuneration and social security 9077 20,683,630.53<br />

accrued charges<br />

period<br />

Analysis <strong>of</strong> heading 492/3 <strong>of</strong> liabilities<br />

if the amount is significant<br />

Deferred income long-term contract 3,534,548.54<br />

Invoicing concessions 1st quarter 2008 25,146,224.95<br />

Other 1,897,961.84<br />

TOTAL accrued charges 30,578,735.33<br />

TOTAL amounts payable between one and five yEARS 8912 41,665,003.79<br />

Amounts payable over five years<br />

Financial debts 8803 27,833,878.34<br />

Subordinated loans 8813<br />

Unsubordinated debentures 8823<br />

Leasing and other similar obligations 8833<br />

Credit institutions 8843 27,833,878.34<br />

Other loans 8853<br />

Trade debts 8863<br />

Suppliers 8873<br />

Bills <strong>of</strong> exchange payable 8883<br />

Advances received on contracts in progress 8893<br />

Other amounts payable 8903<br />

TOTAL amounts payable over five years 8913 27,833,878.34<br />

122 Annual Report 2007 123 Annual Acounts

10. operating results<br />

operating income<br />

codes period preceding period<br />

11. Financial and exceptional results<br />

Financial result<br />

codes period preceding period<br />

net turnover<br />

breakdown according to type <strong>of</strong> company<br />

breakdown according to geographical market<br />

Other operating income<br />

The total amount <strong>of</strong> subsidies and compensatory<br />

amounts obtained from public authorities 740 26,178,116.00 24,779,593.06<br />

Other financial income<br />

Amount <strong>of</strong> subsidies granted by public authorities,<br />

credited to income for the period<br />

Capital subsidies 9125 14,288,392.38 16,744,615.31<br />

Interest subsidies 9126<br />

Detail <strong>of</strong> other financial income classified<br />

under this heading, if material<br />

Surplus to current assets 2,397,952.74 368,847.94<br />

Interest swap 2,313,669.41 3,341,007.35<br />

operating costs<br />

codes period preceding period<br />

full breakdown <strong>of</strong> other<br />

financial income 4,711,622.15 3,709,855.29<br />

Employees recorded in the personnel register<br />

Total number at the closing date 9086 1,637 1,647<br />

Average number <strong>of</strong> employees<br />

in full-time equivalents 9087 1,640.0 1,646.5<br />

number <strong>of</strong> actual working hours 9088 2,274,786 3,149,751<br />

Personnel charges<br />

Remuneration and direct social benefits 620 68,337,140.17 67,354,560.44<br />

Employers’ contribution for social security 621 23,462,546.74 22,384,152.57<br />

Employers’ premium for extra statutory insurance 622 906,014.37 727,326.33<br />

Other personnel charges 623 4,946,086.53 4,675,348.35<br />

Pensions 624 -32,849.00<br />

Provision for pensions<br />

new provision (utilisation and write-backs) (+)(–) 635<br />

Amounts written <strong>of</strong>f<br />

Stocks and contracts in progress<br />

Recorded 9110 496,486.32<br />

Written back 9111 9,537.63<br />

Trade debtors<br />

Recorded 9112<br />

Written back 9113 1,397,716.13 335,121.43<br />

Provisions for liabilities and charges<br />

Increases 9115 23,179,280.34 15,736,516.92<br />

Decreases 9116 9,468,468.66 5,284,497.48<br />

Other operating charges<br />

Taxes related to operations 640 10,575,776.54 10,447,646.80<br />

Other charges 641/8 5,461,485.71 5,340,443.74<br />

Temporary personnel and persons placed<br />

at the disposal <strong>of</strong> the enterprise<br />

Total number at the closing date 9096 2 2<br />

Average number <strong>of</strong> employees<br />

in full-time equivalents 9097 1.5 4.0<br />

number <strong>of</strong> actual working hours 9098 2,922 7,970<br />

Charges to the enterprise 617 90,171.93 233,102.93<br />

12. taxes and duties<br />

income taxes<br />

codes<br />

period<br />

Income taxes <strong>of</strong> the current period 9134 32,283.93<br />

Taxes and withholding taxes due or paid 9135 32,283.93<br />

Excess <strong>of</strong> income tax prepayments and<br />

withholding taxes capitalised 9136<br />

Estimated additional charges for income taxes 9137<br />

Taxes on the results <strong>of</strong> previous financial years 9138<br />

Supplementary taxes owed or paid 9139<br />

Estimated supplementary taxes or taxes for which<br />

provisions have been made 9140<br />

Main reasons for differences between pr<strong>of</strong>it before tax<br />

and the estimated taxable pr<strong>of</strong>it<br />

The <strong>Antwerp</strong> <strong>Port</strong> Authority is not subject to corporate<br />

taxation but to legal entity taxation<br />

value added tax and<br />

taXES BORNE BY THIRD parties<br />

codes period preceding period<br />

The total amount <strong>of</strong> value added tax, turnover taxes<br />

and special taxes charged during the period<br />

To the enterprise (deductible) 9145 25,701,764.00 17,093,309.81<br />

by the enterprise 9146 32,170,902.86 14,884,662.87<br />

Amounts retained on behalf <strong>of</strong> third parties for<br />

Payroll withholding taxes 9147 20,222,588.13 20,132,190.12<br />

Withholding taxes on investment income 9148<br />

124 Annual Report 2007 125 Annual Acounts

13. materials and securities held by third parties in their own name,<br />

but for the benefit and at the risk <strong>of</strong> the company,<br />

to the extent that these are not included in the balance sheet<br />

codes<br />

period<br />

Instructions given for purchase <strong>of</strong> fixed assets 54,532,528.00<br />

important pending litigation and other significant obligations<br />

14. relationships WITH AFFILIATED ENTERPRISES<br />

and ENTERPRISES LINKED BY PARTICIPATING INTERESTS<br />

codes period preceding period<br />

Financial fixed assets (280/1) 27,888.02 27,888.02<br />

Shares (280) 27,888.02 27,888.02<br />

Subordinated claims 9271<br />

Other claims 9281<br />

Amounts receivable 9291 121,723.69<br />

After one year 9301<br />

Within one year 9311 121,723.69<br />

During the 2000 financial year, third parties<br />

instituted proceedings to suspend the construction<br />

permit issued by the Flemish Region<br />

on 23 June 2000 for the Deurganck Dock. The<br />

Council <strong>of</strong> State effectively suspended the<br />

construction permit on 7 March 2001 so that<br />

the works were shut down. Third parties filed<br />

legal challenges against the permits granted<br />

by the authorities on which basis the works<br />

had restarted. The competent courts have<br />

until now dismissed these challenges but not<br />

all the proceedings that were instituted have<br />

been completed yet. The concession-holders<br />

in the Deurganck Dock have also placed the<br />

<strong>Port</strong> Authority <strong>of</strong> <strong>Antwerp</strong> in default and reserved<br />

the right to claim damages. The <strong>Port</strong><br />

Authority intends to reject these claims for<br />

damages.<br />

The firm Seaport Terminals NV instituted a<br />

claim in 2003 against the <strong>Port</strong> Authority for<br />

damages to the sum <strong>of</strong> 86,762,734 euros.<br />

This concerns damages for alleged complicity<br />

in breach <strong>of</strong> contract by the Cast shipping<br />

company in connection with the Flanders<br />

Container Terminal. The Board <strong>of</strong> Directors<br />

considers on the basis <strong>of</strong> a legal analysis<br />

<strong>of</strong> the available data that insufficient arguments<br />

have been formulated against the <strong>Port</strong><br />

Authority <strong>of</strong> <strong>Antwerp</strong> in connection with this<br />

claim that would justify including a provision<br />

for this in the accounts.<br />

The firm Aspiravi NV, which did not win the<br />

tender, has already started various proceedings<br />

against the <strong>Port</strong> Authority in connection<br />

with the award <strong>of</strong> the wind farm contract in<br />

the <strong>Port</strong> <strong>of</strong> <strong>Antwerp</strong> by the <strong>Port</strong> Authority. The<br />

judgments <strong>of</strong> various courts <strong>of</strong> law have up<br />

until now been favourable to the <strong>Port</strong> Authority.<br />

On 20 February 2004, Aspiravi NV summoned<br />

the <strong>Port</strong> Authority to appear before<br />

the Court <strong>of</strong> First Instance in connection<br />

with the tender award claiming damages <strong>of</strong><br />

117,309,425 euros. No provision has been<br />

made in the accounts given that previous proceedings,<br />

where the same arguments were<br />

adduced, led to the courts finding in favour <strong>of</strong><br />

the <strong>Port</strong> Authority.<br />

companies in which there is a participatory interest<br />

codes period preceding period<br />

Financial fixed assets (282/3) 581,000.45 581,000.45<br />

Shares (282) 581,000.45 581,000.45<br />

Subordinated claims 9272<br />

Other claims 9282<br />

15. Financial relations with the auditor(s)<br />

and persons connected with them<br />

codes<br />

period<br />

where applicable, a brief description <strong>of</strong> the arrangements for<br />

supplementary retirement or survival pensions for management<br />

personnel or other members <strong>of</strong> personnel, stating the measures<br />

that have been taken and the resulting costs to be covered<br />

The <strong>Port</strong> Authority has taken out a non-statutory pension insurance policy in favour <strong>of</strong> contractual members <strong>of</strong> personnel, <strong>of</strong> the fixed contribution type.<br />

These contributions are paid monthly, and are taken into account under the heading “Employer’s premiums for non-statutory insurance policies.”<br />

Auditors’ fees 9505 23,760.00<br />

Payment for exceptional or special activities<br />

carried out within the company by persons<br />

connected with the auditor(s)<br />

Other auditing tasks 95081 4,040.00<br />

Tax consulting 95082<br />

Other tasks outside the normal scope<br />

<strong>of</strong> the auditor’s duties 95083 8,910.00<br />

126 Annual Report 2007 127 Annual Acounts

Social report<br />

Numbers <strong>of</strong> the parity committees that apply to the company: 100<br />

statement <strong>of</strong> the persons employed<br />

Employees recorded in the personnel register<br />

full-time part-time total (T) or total (T) or<br />

During the period and total in full-time total in full-time<br />

the preceding period equivalents (fTE) equivalents (fTE)<br />

codes (period) (period) (period) (preceding period)<br />

Average number <strong>of</strong> employees 100 1,635.0 10.0 1,640.0 (VTE) 1,646.5 (VTE)<br />

number <strong>of</strong> actual<br />

working hours 101 2,265,445 9,341 2,274,786 (T) 3,149,751 (T)<br />

Personnel charges 102 97,302,332.58 349,455.23 97,651,787.81 (T) 95,141,387.69 (T)<br />

Amount <strong>of</strong> the benefits<br />

in addition to wages 103 xxxxxxxxxx xxxxxxxxxxx (T) (T)<br />

As at the closing date <strong>of</strong> the period<br />

CODES<br />

full-time part-time total<br />

in full-time<br />

Equivalents<br />

Number <strong>of</strong> employees recorded<br />

in the personnel register 105 1,627 10 1,632.0<br />

By nature <strong>of</strong> the employment contract<br />

Contract <strong>of</strong> unlimited duration 110 1,617 7 1,620.5<br />

Contract <strong>of</strong> limited duration 111 5 1 5.5<br />

Contract regarding a specific work 112<br />

Contract regarding substitution 113 5 2 6.0<br />

By sex<br />

Male 120 1,401 4 1,403.0<br />

Female 121 226 6 229.0<br />

By pr<strong>of</strong>essional category<br />

Management personnel 130 9 9.0<br />

Employees 134 852 8 856.0<br />

Workers 132 766 2 767.0<br />

Other 133<br />

Temporary personnel and persons placed at the disposal <strong>of</strong> the enterprise<br />

temporary personnel placed<br />

During the period personnel at the disposal<br />

codes<br />

<strong>of</strong> the enterprise<br />

Average number <strong>of</strong> personnel employed 150 1.5<br />

number <strong>of</strong> actual working hours 151 2,922<br />

Charges to the enterprise 152 90,171.93<br />

LIST OF PERSONNEL MOVEMENTS DURING THE FINANCIAL period<br />

Entrants<br />

full-time part-time total in full-time<br />

CODES<br />

Equivalents<br />

Number <strong>of</strong> employed persons recorded in<br />

the personnel register during the period 205 91 1 91,5<br />

By nature <strong>of</strong> the employment contract<br />

Contract <strong>of</strong> unlimited duration 210 83 83,0<br />

Contract <strong>of</strong> limited duration 211 3 3,0<br />

Contract regarding a specific work 212<br />

Contract regarding substitution 213 5 1 5,5<br />

By sex and level <strong>of</strong> education<br />

Male:<br />

Primary education 220 44 44,0<br />

Secondary education 221 19 19,0<br />

higher non-university education 222 3 3,0<br />

University education 223 6 6,0<br />

Female:<br />

Primary education 230 7 7,0<br />

Secondary education 231 5 1 5,5<br />

higher non-university education 232 1 1,0<br />

University education 233 6 6,0<br />

Leavers<br />

full-time part-time total in full-time<br />

CODES<br />

Equivalents<br />

Number <strong>of</strong> employed persons <strong>of</strong> which the date <strong>of</strong><br />

termination <strong>of</strong> the contracts has been recorded in<br />

the personnel register during the period 305 100 2 101.0<br />

By nature <strong>of</strong> the employment contract<br />

Contract <strong>of</strong> unlimited duration 310 93 2 94.0<br />

Contract <strong>of</strong> limited duration 311 3 3.0<br />

Contract regarding a specific work 312<br />

Contract regarding substitution 313 4 4.0<br />

By sex and level <strong>of</strong> education<br />

Male:<br />

Primary education 320 11 11.0<br />

Secondary education 321 58 58.0<br />

higher non-university education 322 4 4.0<br />

University education 323 7 1 7.5<br />

Female:<br />

Primary education 330 2 1 2.5<br />

Secondary education 331 15 15.0<br />

higher non-university education 332 1 1.0<br />

University education 333 2 2.0<br />

By reason <strong>of</strong> termination <strong>of</strong> contract<br />

Pension 340 47 47.0<br />

Prepension 341<br />

Dismissal 342 9 9.0<br />

Other reason 343 44 2 45.0<br />

Of which: number <strong>of</strong> former employees who continued<br />

rendering services to the enterprise at least on a<br />

part-time basis in the capacity <strong>of</strong> self-employed person 350<br />

128 Annual Report 2007 129 Annual Acounts

STATEMENT OF USE MADE OF MEASURES TO PROMOTE<br />

EMPLOYMENT DURING THE period<br />

Measures to promote employment<br />

N o nO. <strong>of</strong> employees concernED AMOUnt <strong>of</strong><br />

in full-tiME<br />

Financial<br />

CODES number equivalenTS BEnefit<br />

Measures with financial benefit*<br />

Special career plan (to encourage hiring<br />

<strong>of</strong> job seekers belonging to risk groups) 414 15 14.5 26,174.98<br />

Conventional half-time bridge pensions 411<br />

Full career break 412<br />

Reduction in working hours<br />

(partial career break) 413<br />

Social Maribel 415<br />

Structural reduction in social security 416<br />

Throughput programmes 417<br />

Service jobs 418<br />

On-the-job training contract 503<br />

Apprenticeship contract 504<br />

Initial employment contract 419<br />

Other measures<br />

young person’s training course 502<br />

Successive contracts <strong>of</strong> employment<br />

for a certain time 505<br />

Conventional bridge pensions 506<br />

Reduction in social security contributions<br />

for low-wage employees 507<br />

No. <strong>of</strong> employees involved in one or more<br />

measures for promoting employment<br />

Total for the period 550 15 14.5<br />

Total for the preceding period 550P 11 11.0<br />

INFORMATION ON VOCATIONAL TRAINING FOR EMPLOYED PERSONS DURING THE PERIOD<br />

Total <strong>of</strong> training initiatives<br />

at the expense <strong>of</strong> the employer codes men codes women<br />

Number <strong>of</strong> employees 5801 442 5811 105<br />

number <strong>of</strong> training hours 5802 4,565 5812 1,185<br />

Charges to enterprise 5803 169,170.00 5813 70,278.00<br />

* Financial benefit for the employer in respect <strong>of</strong> the jobholder or the latter’s.<br />

accounting principles<br />

Under the terms <strong>of</strong> art. 34 <strong>of</strong> its Articles <strong>of</strong> Association, <strong>Antwerp</strong> <strong>Port</strong><br />

Authority is subject to the Act <strong>of</strong> 17 July 1975 concerning the accounting<br />

and annual accounts <strong>of</strong> companies, which specifies that the accounts<br />

must be kept in accordance with the Royal Decree <strong>of</strong> 30 January 2001<br />

concerning the annual accounts <strong>of</strong> companies. Drawing up the annual<br />

accounts falls under the responsibility <strong>of</strong> the Board <strong>of</strong> Directors.<br />

Describing the accounting principles as accurately as possible<br />

forms an integral part <strong>of</strong> this.<br />

general Accounting principles<br />

The annual accounts <strong>of</strong> <strong>Antwerp</strong> <strong>Port</strong> Authority are drawn up in accordance<br />

with the legislation governing annual accounts. As laid down by<br />

art. 24 <strong>of</strong> the Royal Decree <strong>of</strong> 30 January 2001 the accounting principles<br />

are drawn up in compliance with the requirement to give a true picture<br />

<strong>of</strong> the situation, taking into account the specific characteristics <strong>of</strong> the<br />

company. In those matters where it is necessary to supplement the law<br />

and in cases where a choice is left to the company, the Board <strong>of</strong> Directors<br />

has laid down the following accounting principles.<br />

Specific accounting principles<br />

Tangible fixed assets<br />

General principle<br />

By tangible fixed assets is meant long-lasting, tangible operating<br />

resources with a lifetime <strong>of</strong> more than one financial year and with an<br />

initial purchase value greater than or equal to 1250.00 euros posted to the<br />

assets. The valuation is made at the acquisition cost or production cost,<br />

as laid down in arts. 36 and 37 <strong>of</strong> the Royal Decree; any additional costs<br />

can be posted in full to the Income Statement in the course <strong>of</strong> the year.<br />

Revaluations<br />

The non-subsidised part <strong>of</strong> the tangible fixed assets that can be depreciated<br />

was revalued up to an including 31/12/2002, in accordance with<br />

the circular letter sent to regional and local authorities. The revaluation<br />

surplus is posted to the “Revaluation surpluses” account <strong>of</strong> the liabilities,<br />

individualised (in accordance with the circular <strong>of</strong> 19 <strong>of</strong> July 1986) and<br />

transferred to a non-available reserve pro rata the depreciation rate <strong>of</strong><br />

the underlying asset.<br />

Depreciation<br />

Depreciation is calculated by the straight line method and applied for<br />

a full year, on the basis revalued acquisition value <strong>of</strong> the investments,<br />

according to the following depreciation percentages:<br />

130 Annual Report 2007 131 Annual Acounts

S<strong>of</strong>tware 33.33 %<br />

Land and premises<br />

Land 0 %<br />

Service buildings and warehouses 3 %<br />

Warehouses 5 %<br />

Waterways 3 %<br />

Rights <strong>of</strong> use on major capital works 3 %<br />

Hydraulic engineering works 3 %<br />

Shelters, sheds, hangars etc. 5 %<br />

Roads 5 %<br />

Installations, machinery and equipment<br />

Hoisting apparatus 5 %<br />

Vessels 5 %<br />

a.o. Dredging rigs, Sounding vessels, Mooring pontoons, Inspection vessels<br />

Electrical installations 5 %<br />

a.o. Public lighting, Cable network,<br />

Crane cable net, Traffic signalling<br />

Underwater cells 16.67 %<br />

Machines and general equipment 10 %<br />

a.o. Tools and appliances<br />

Lifebuoy installations<br />

Tackle and chains<br />

Compressor units<br />

Excavator combines<br />

Heating and cooling installations 10 %<br />

Lifts 10 %<br />

Alarm installations 10 %<br />

Telecommunications 20 %<br />

a.o. Telephone installations, Radio communication<br />

Cameras and tannoys at locks<br />

<strong>Port</strong> radar 20 %<br />

Technical hardware 20 %<br />

a.o. Apics including cable network<br />

Geographic information system (GIS)<br />

Data processing unit for hydrographic measuring<br />

Furnishings and rolling stock<br />

Furnishings 10 %<br />

Office machinery 20 %<br />

Hardware administration 20 %<br />

Rolling stock<br />

a.o. Tug boats 5 %<br />

Drainage pumps 20 %<br />

Private cars 20 %<br />

Trucks 20 %<br />

Forklifts 20 %<br />

Salting vehicles 20 %<br />

Mobile cranes 6.67 %<br />

Leasing<br />

The charges for use <strong>of</strong> tangible fixed assets held by the company under<br />

leasing or similar agreements are posted to this heading after deduction<br />

<strong>of</strong> the cumulated depreciations or reductions in value, as regards the<br />

part <strong>of</strong> the periods payable under the agreement for reconstitution <strong>of</strong><br />

the capital value. The rate <strong>of</strong> depreciation is according to the percentages<br />

mentioned under “Depreciation.”<br />

Other depreciations and reductions in value<br />

In the case <strong>of</strong> tangible fixed assets with a limited lifetime, an additional<br />

depreciation is applied if their book value is higher than their useful<br />

value as a result <strong>of</strong> technical obsolescence or changes in the economic<br />

or technical circumstances. In case <strong>of</strong> a lasting reduction in the value<br />

<strong>of</strong> tangible fixed assets, an extraordinary reduction in value is posted.<br />

Such depreciations and extraordinary write-downs are submitted to<br />

the Board <strong>of</strong> Directors by the Management Committee.<br />

Contributions by third parties<br />

Contributions by third parties towards investments posted to assets<br />

(other than investment grants) are booked under debts, at face value.<br />

The portion <strong>of</strong> the fixed assets for which these contributions have been<br />

received is not revalued and is fully depreciated when the asset is taken<br />

into use. At that moment the contribution itself is shown as another item<br />

<strong>of</strong> operating income.<br />

Land and sites<br />

Land and sites contributed on 1 January 1997 were revalued in their entirety<br />

on the basis <strong>of</strong> an estimate made in 1986; these have been further<br />

supplemented by purchases made between 1988 and the end <strong>of</strong> 1996.<br />

The individual values <strong>of</strong> the land and sites are obtained by calculating<br />

the fraction represented by the area <strong>of</strong> the land or site and applying it<br />

to this total value. Land and sites purchased or acquired after 1 January<br />

1997 are booked at their acquisition value.<br />

Usufruct<br />

The usufruct <strong>of</strong> among others the Europa terminal is valued on the basis<br />

<strong>of</strong> the contribution made by the municipally-owned company (the predecessor<br />

<strong>of</strong> the <strong>Port</strong> Authority) to the financing <strong>of</strong> the assets on which the<br />

usufruct is granted. The usufruct is depreciated on the basis <strong>of</strong> the economic<br />

lifetime <strong>of</strong> the underlying asset. The rate <strong>of</strong> depreciation is according<br />

to the percentages mentioned under “Depreciation.”<br />

Assets under construction<br />

Large projects and those extending over a longer period are first posted<br />

to the assets under “Tangible fixed assets under construction.” The<br />

amount posted to the assets is the acquisition price (as invoiced by thirdparty<br />

suppliers). At the moment there are no rules for internal costs and<br />

interim interest to be posted to the assets: these are currently posted<br />

directly to the result. Assets under construction are transferred to their<br />

respective headings under tangible fixed assets on the date <strong>of</strong> provisional<br />

handover <strong>of</strong> the work; the notification <strong>of</strong> provisional handover is passed<br />

to the Accounting department by the Technical department. No depreciation<br />

is applied to assets under construction (except in exceptional cases,<br />

if there is a lasting reduction in value); these assets are not revalued,<br />

neither are the investment grants relating to them included in the result.<br />

132 Annual Report 2007 133 Annual Acounts

Projects by the Electrical Facilities department<br />

In the case <strong>of</strong> assets with similar characteristics (lamp standards, cable<br />

networks, low voltage cabinets etc.) a system <strong>of</strong> standard values is used.<br />

The value <strong>of</strong> these assets is reviewed annually by comparing them with<br />

market prices. The value comprises the average purchase price plus the<br />

direct labour costs. Larger projects such as construction <strong>of</strong> high voltage<br />

substations are valued on an individual basis, according to the rule laid<br />

down for “Tangible fixed assets under construction.”<br />

Financial fixed assets<br />

Shares and pr<strong>of</strong>it-sharing certificates held by the company are posted to<br />

the assets at their acquisition value. The amounts receivable under this<br />

heading are included at their face value. The financial fixed assets are reviewed<br />

annually, and a write-down is applied if there is a lasting reduction<br />

in value or devaluation <strong>of</strong> all or part <strong>of</strong> them, or if there is uncertainty<br />

regarding their repayment. The amount <strong>of</strong> the write-down is proposed by<br />

the Management Committee and submitted to the Board <strong>of</strong> Directors for<br />

its approval.<br />

Stocks<br />

Articles held in stock are valued at the latest acquisition value, which<br />

in practice represents a simplified replacement value. This means that<br />

for older articles the historical acquisition value is replaced by the most<br />

recent acquisition value. A reduction in value is applied to obsolescent<br />

items or those with a slow rate <strong>of</strong> rotation. Under this system a writedown<br />

by a fixed percentage is applied on the basis <strong>of</strong> the latest movement.<br />

The following percentages are applied:<br />

Number <strong>of</strong> years without movement<br />

Percentage write-down<br />

1 year 25 %<br />

2 years 50 %<br />

3 years 75 %<br />

4 years and older 100 %<br />

Arrears > 6 months 20 %<br />

Arrears > 12 months 80 %<br />

Arrears > 18 months 100 %<br />

If it appears that the claim is uncollectable or dubious and the corresponding<br />

write-down would be greater than the amounts mentioned above,<br />