Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

licenses to the insurance company Porto Seguro and<br />

the VoIP provider Sermatel Comercio. Both companies<br />

have teamed up with second-placed operator TIM, which<br />

provides the network infrastructure, and Datora, a<br />

mobile-virtual-network enabler (MVNE). More recently,<br />

Anatel granted the first pure <strong>MVNO</strong> license to the MVNE<br />

Sisteer. Besides TIM, other network operators are looking<br />

with interest at the <strong>MVNO</strong> model, for example, the market<br />

leader Vivo. In March, Vivo announced plans to have at<br />

least two <strong>MVNO</strong> partners by the end <strong>of</strong> 2012. In order<br />

to achieve its objective, the operator created a board<br />

for wholesale and <strong>MVNO</strong> operations and is currently<br />

analyzing proposals from around 30 potential partners.<br />

<strong>The</strong> Latin American <strong>MVNO</strong> market started picking up in<br />

the second half <strong>of</strong> 2011, and the strongest activity was<br />

in Colombia and Chile. In February this year, Chilean<br />

regulator Subtel received 26 license applications from<br />

companies interested in launching <strong>MVNO</strong> operations. In<br />

April, Virgin Mobile Latin America (VMLA) inaugurated<br />

its first <strong>MVNO</strong> in the Andean country, targeting the<br />

youth and “youthful” segments with a simple portfolio <strong>of</strong><br />

prepaid data packages and a small but attractive range<br />

<strong>of</strong> smartphones.<br />

So far, VMLA is the only international group with plans to<br />

launch <strong>MVNO</strong> operations across the region. In addition<br />

to Chile, it plans to launch in Brazil, Colombia, Mexico,<br />

Argentina, Peru, Uruguay and Bolivia. Interestingly,<br />

Colombia is likely to have eight <strong><strong>MVNO</strong>s</strong> and three MNOs<br />

in operation by the end <strong>of</strong> 2012: In addition to the <strong><strong>MVNO</strong>s</strong><br />

already in operation, retailers Exito and Falabella, and<br />

fixed operator Emcali, have also started discussions to<br />

find an MNO partner.<br />

Opportunity for <strong>MVNO</strong>-led<br />

pricing arbitration is low<br />

<strong><strong>MVNO</strong>s</strong> must find ways to <strong>of</strong>fer attractive data<br />

<strong>of</strong>fers – to the right niche and at the right price<br />

In traditional <strong>MVNO</strong> markets, such as Europe, North<br />

America and Asia, <strong><strong>MVNO</strong>s</strong> have historically targeted<br />

the prepaid market with a low-cost proposition and<br />

then tried to attract the more affluent customers.<br />

International experience shows that the wholesale<br />

business can bring MNOs significantly higher EBITDA<br />

margins than retail, by reducing subscriber-acquisition<br />

cost (SAC) while only slightly lowering ARPU. Typically,<br />

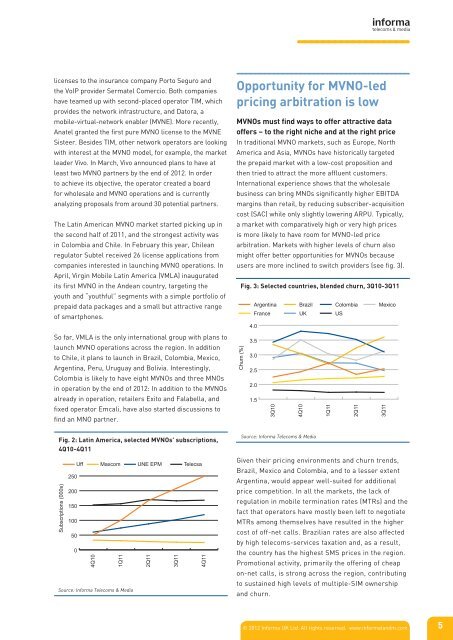

a market with comparatively high or very high prices<br />

is more likely to have room for <strong>MVNO</strong>-led price<br />

arbitration. Markets with higher levels <strong>of</strong> churn also<br />

might <strong>of</strong>fer better opportunities for <strong><strong>MVNO</strong>s</strong> because<br />

users are more inclined to switch providers (see fig. 3).<br />

Churn (%)<br />

Fig. 3: Selected countries, blended churn, 3Q10-3Q11<br />

4.0<br />

3.5<br />

3.0<br />

2.5<br />

2.0<br />

1.5<br />

Argentina Brazil Colombia Mexico<br />

France UK US<br />

3Q10<br />

4Q10<br />

1Q11<br />

2Q11<br />

3Q11<br />

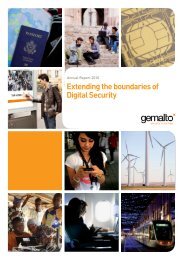

Fig. 2: Latin America, selected <strong><strong>MVNO</strong>s</strong>' subscriptions,<br />

4Q10-4Q11<br />

Source: Informa Telecoms & Media<br />

Uff<br />

250<br />

Maxcom<br />

UNE EPM<br />

Telecsa<br />

Given their pricing environments and churn trends,<br />

Brazil, Mexico and Colombia, and to a lesser extent<br />

Argentina, would appear well-suited for additional<br />

Subscriptions (000s)<br />

200<br />

150<br />

100<br />

50<br />

0<br />

4Q10<br />

1Q11<br />

2Q11<br />

3Q11<br />

4Q11<br />

price competition. In all the markets, the lack <strong>of</strong><br />

regulation in mobile termination rates (MTRs) and the<br />

fact that operators have mostly been left to negotiate<br />

MTRs among themselves have resulted in the higher<br />

cost <strong>of</strong> <strong>of</strong>f-net calls. Brazilian rates are also affected<br />

by high telecoms-services taxation and, as a result,<br />

the country has the highest SMS prices in the region.<br />

Promotional activity, primarily the <strong>of</strong>fering <strong>of</strong> cheap<br />

on-net calls, is strong across the region, contributing<br />

Source: Informa Telecoms & Media<br />

to sustained high levels <strong>of</strong> multiple-SIM ownership<br />

and churn.<br />

© 2012 Informa UK Ltd. All rights reserved. www.informatandm.com 5