You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

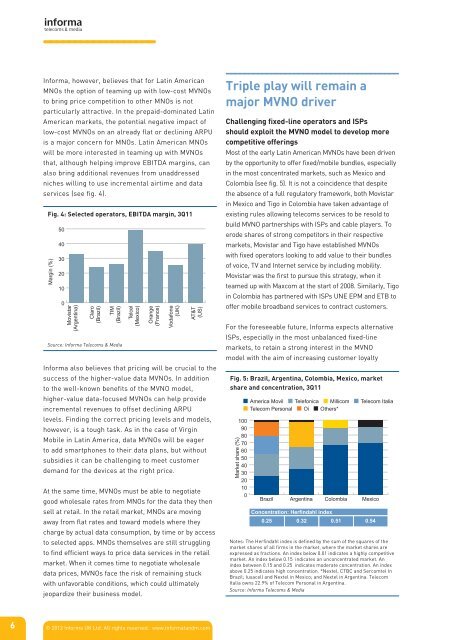

Informa, however, believes that for Latin American<br />

MNOs the option <strong>of</strong> teaming up with low-cost <strong><strong>MVNO</strong>s</strong><br />

to bring price competition to other MNOs is not<br />

particularly attractive. In the prepaid-dominated Latin<br />

American markets, the potential negative impact <strong>of</strong><br />

low-cost <strong><strong>MVNO</strong>s</strong> on an already flat or declining ARPU<br />

is a major concern for MNOs. Latin American MNOs<br />

will be more interested in teaming up with <strong><strong>MVNO</strong>s</strong><br />

that, although helping improve EBITDA margins, can<br />

also bring additional revenues from unaddressed<br />

niches willing to use incremental airtime and data<br />

services (see fig. 4).<br />

Fig. 4: Selected operators, EBITDA margin, 3Q11<br />

Margin (%)<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Movistar<br />

(Argentina)<br />

Claro<br />

(Brazil)<br />

TIM<br />

(Brazil)<br />

Source: Informa Telecoms & Media<br />

Telcel<br />

(Mexico)<br />

Informa also believes that pricing will be crucial to the<br />

success <strong>of</strong> the higher-value data <strong><strong>MVNO</strong>s</strong>. In addition<br />

to the well-known benefits <strong>of</strong> the <strong>MVNO</strong> model,<br />

higher-value data-focused <strong><strong>MVNO</strong>s</strong> can help provide<br />

incremental revenues to <strong>of</strong>fset declining ARPU<br />

levels. Finding the correct pricing levels and models,<br />

however, is a tough task. As in the case <strong>of</strong> Virgin<br />

Mobile in Latin America, data <strong><strong>MVNO</strong>s</strong> will be eager<br />

to add smartphones to their data plans, but without<br />

subsidies it can be challenging to meet customer<br />

demand for the devices at the right price.<br />

At the same time, <strong><strong>MVNO</strong>s</strong> must be able to negotiate<br />

good wholesale rates from MNOs for the data they then<br />

sell at retail. In the retail market, MNOs are moving<br />

away from flat rates and toward models where they<br />

charge by actual data consumption, by time or by access<br />

to selected apps. MNOs themselves are still struggling<br />

to find efficient ways to price data services in the retail<br />

market. When it comes time to negotiate wholesale<br />

data prices, <strong><strong>MVNO</strong>s</strong> face the risk <strong>of</strong> remaining stuck<br />

with unfavorable conditions, which could ultimately<br />

jeopardize their business model.<br />

Orange<br />

(France)<br />

Vodafone<br />

(UK)<br />

AT&T<br />

(US)<br />

Triple play will remain a<br />

major <strong>MVNO</strong> driver<br />

Challenging fixed-line operators and ISPs<br />

should exploit the <strong>MVNO</strong> model to develop more<br />

competitive <strong>of</strong>ferings<br />

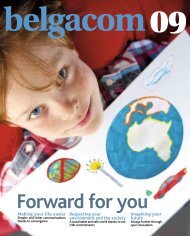

Most <strong>of</strong> the early Latin American <strong><strong>MVNO</strong>s</strong> have been driven<br />

by the opportunity to <strong>of</strong>fer fixed/mobile bundles, especially<br />

in the most concentrated markets, such as Mexico and<br />

Colombia (see fig. 5). It is not a coincidence that despite<br />

the absence <strong>of</strong> a full regulatory framework, both Movistar<br />

in Mexico and Tigo in Colombia have taken advantage <strong>of</strong><br />

existing rules allowing telecoms services to be resold to<br />

build <strong>MVNO</strong> partnerships with ISPs and cable players. To<br />

erode shares <strong>of</strong> strong competitors in their respective<br />

markets, Movistar and Tigo have established <strong><strong>MVNO</strong>s</strong><br />

with fixed operators looking to add value to their bundles<br />

<strong>of</strong> voice, TV and Internet service by including mobility.<br />

Movistar was the first to pursue this strategy, when it<br />

teamed up with Maxcom at the start <strong>of</strong> 2008. Similarly, Tigo<br />

in Colombia has partnered with ISPs UNE EPM and ETB to<br />

<strong>of</strong>fer mobile broadband services to contract customers.<br />

For the foreseeable future, Informa expects alternative<br />

ISPs, especially in the most unbalanced fixed-line<br />

markets, to retain a strong interest in the <strong>MVNO</strong><br />

model with the aim <strong>of</strong> increasing customer loyalty<br />

Fig. 5: Brazil, Argentina, Colombia, Mexico, market<br />

share and concentration, 3Q11<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Market share (%)<br />

America Movil Telefonica Millicom Telecom Italia<br />

Telecom Personal Oi Others*<br />

Brazil<br />

Argentina<br />

Concentration: Herfindahl index<br />

Colombia<br />

Mexico<br />

0.25 0.32 0.51 0.54<br />

Notes: <strong>The</strong> Herfindahl index is defined by the sum <strong>of</strong> the squares <strong>of</strong> the<br />

market shares <strong>of</strong> all firms in the market, where the market shares are<br />

expressed as fractions. An index below 0.01 indicates a highly competitive<br />

market. An index below 0.15 indicates an unconcentrated market. An<br />

index between 0.15 and 0.25 indicates moderate concentration. An index<br />

above 0.25 indicates high concentration. *Nextel, CTBC and Sercomtel In<br />

Brazil; Iusacell and Nextel in Mexico; and Nextel in Argentina. Telecom<br />

Italia owns 22.9% <strong>of</strong> Telecom Personal in Argentina.<br />

Source: Informa Telecoms & Media<br />

6<br />

© 2012 Informa UK Ltd. All rights reserved. www.informatandm.com