Thin capitalisation: eroding asset values and increasing debt ... - PwC

Thin capitalisation: eroding asset values and increasing debt ... - PwC

Thin capitalisation: eroding asset values and increasing debt ... - PwC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

TaxTalk – Electronic Bulletin of Australian Tax Developments<br />

• Parking space levy – from 1 July<br />

2009, the parking space levy will<br />

increase from $950 to $2,000 a<br />

year per off-street, non-residential<br />

parking space in the Sydney, North<br />

Sydney <strong>and</strong> Milsons Point business<br />

districts; <strong>and</strong> from $470 to $710<br />

a year in the business areas of St<br />

Leonards, Chatswood, Parramatta<br />

<strong>and</strong> Bondi Junction.<br />

• Mineral royalties – increased<br />

mineral royalty rates will apply<br />

from 1 January 2009.<br />

For further information, please contact your<br />

usual PricewaterhouseCoopers adviser, or:<br />

Mono Ray, Partner<br />

(02) 8266 9171<br />

mono.ray@au.pwc.com<br />

Angela Melick, Partner<br />

(02) 8266 7234<br />

angela.melick@au.pwc.com<br />

Western Australia:<br />

l<strong>and</strong> tax reductions<br />

On 21 October 2008, the West Australian<br />

Treasurer announced an immediate cut<br />

in rates applying to l<strong>and</strong> tax <strong>and</strong> the<br />

Metropolitan Region Improvement Tax<br />

(MRIT). The Treasurer said that the “cuts<br />

would apply to assessable properties<br />

across the board <strong>and</strong> would average<br />

around seven per cent”. The Treasurer<br />

further added that assessments based<br />

on calculations in the May 2008 Budget<br />

had been due to go out on 24 September<br />

2008, the new Government’s first<br />

working day in office, but had been held<br />

back pending legislation to enable the<br />

immediate adjustment.<br />

Under the changes, l<strong>and</strong> tax on<br />

l<strong>and</strong> valued at $500,000 will drop<br />

by $20 to $180. For l<strong>and</strong> valued at<br />

$1million, the reduction will be $70,<br />

from $700 to $630. If the property is<br />

located in the metropolitan region, the<br />

MRIT savings will be a further $20 in<br />

the case of the l<strong>and</strong> valued at $500,000<br />

<strong>and</strong> a further $70 in the case of the l<strong>and</strong><br />

valued at $1million.<br />

The proposed new tax scales are<br />

as follows.<br />

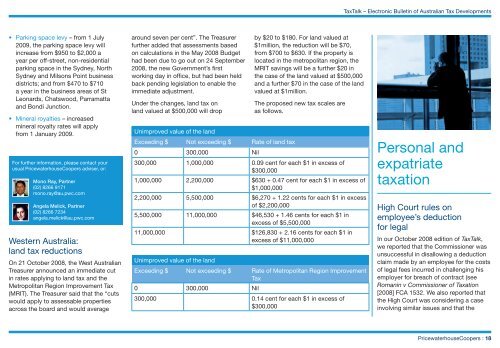

Unimproved value of the l<strong>and</strong><br />

Exceeding $ Not exceeding $ Rate of l<strong>and</strong> tax<br />

0 300,000 Nil<br />

300,000 1,000,000 0.09 cent for each $1 in excess of<br />

$300,000<br />

1,000,000 2,200,000 $630 + 0.47 cent for each $1 in excess of<br />

$1,000,000<br />

2,200,000 5,500,000 $6,270 + 1.22 cents for each $1 in excess<br />

of $2,200,000<br />

5,500,000 11,000,000 $46,530 + 1.46 cents for each $1 in<br />

excess of $5,500,000<br />

11,000,000 $126,830 + 2.16 cents for each $1 in<br />

excess of $11,000,000<br />

Unimproved value of the l<strong>and</strong><br />

Exceeding $ Not exceeding $ Rate of Metropolitan Region Improvement<br />

Tax<br />

0 300,000 Nil<br />

300,000 0.14 cent for each $1 in excess of<br />

$300,000<br />

Personal <strong>and</strong><br />

expatriate<br />

taxation<br />

High Court rules on<br />

employee’s deduction<br />

for legal<br />

In our October 2008 edition of TaxTalk,<br />

we reported that the Commissioner was<br />

unsuccessful in disallowing a deduction<br />

claim made by an employee for the costs<br />

of legal fees incurred in challenging his<br />

employer for breach of contract (see<br />

Romanin v Commissioner of Taxation<br />

[2008] FCA 1532. We also reported that<br />

the High Court was considering a case<br />

involving similar issues <strong>and</strong> that the<br />

PricewaterhouseCoopers : 18