2011 REPORT ANNUAL - Racing NSW

2011 REPORT ANNUAL - Racing NSW

2011 REPORT ANNUAL - Racing NSW

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

RACING <strong>NSW</strong> COUNTRY LTD<br />

ACN 075 186 873<br />

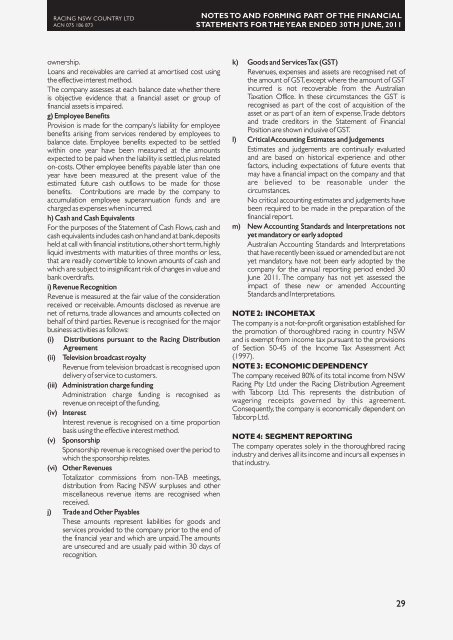

NOTES TO AND FORMING PART OF THE FINANCIAL<br />

STATEMENTS FOR THE YEAR ENDED 30TH JUNE, <strong>2011</strong><br />

ownership. k) Goods and Services Tax (GST)<br />

Loans and receivables are carried at amortised cost using Revenues, expenses and assets are recognised net of<br />

the effective interest method.<br />

the amount of GST, except where the amount of GST<br />

The company assesses at each balance date whether there incurred is not recoverable from the Australian<br />

is objective evidence that a financial asset or group of Taxation Office. In these circumstances the GST is<br />

financial assets is impaired.<br />

recognised as part of the cost of acquisition of the<br />

g) Employee Benefits<br />

asset or as part of an item of expense. Trade debtors<br />

and trade creditors in the Statement of Financial<br />

Provision is made for the company’s liability for employee<br />

Position are shown inclusive of GST.<br />

benefits arising from services rendered by employees to<br />

balance date. Employee benefits expected to be settled l) Critical Accounting Estimates and Judgements<br />

within one year have been measured at the amounts Estimates and judgements are continually evaluated<br />

expected to be paid when the liability is settled, plus related and are based on historical experience and other<br />

on-costs. Other employee benefits payable later than one factors, including expectations of future events that<br />

year have been measured at the present value of the may have a financial impact on the company and that<br />

estimated future cash outflows to be made for those are believed to be reasonable under the<br />

benefits. Contributions are made by the company to circumstances.<br />

accumulation employee superannuation funds and are No critical accounting estimates and judgements have<br />

charged as expenses when incurred.<br />

been required to be made in the preparation of the<br />

h) Cash and Cash Equivalents<br />

financial report.<br />

For the purposes of the Statement of Cash Flows, cash and m) New Accounting Standards and Interpretations not<br />

cash equivalents includes cash on hand and at bank, deposits yet mandatory or early adopted<br />

held at call with financial institutions, other short term, highly Australian Accounting Standards and Interpretations<br />

liquid investments with maturities of three months or less, that have recently been issued or amended but are not<br />

that are readily convertible to known amounts of cash and yet mandatory, have not been early adopted by the<br />

which are subject to insignificant risk of changes in value and company for the annual reporting period ended 30<br />

bank overdrafts.<br />

June <strong>2011</strong>. The company has not yet assessed the<br />

i) Revenue Recognition<br />

impact of these new or amended Accounting<br />

Revenue is measured at the fair value of the consideration Standards and Interpretations.<br />

received or receivable. Amounts disclosed as revenue are<br />

net of returns, trade allowances and amounts collected on NOTE 2: INCOME TAX<br />

behalf of third parties. Revenue is recognised for the major The company is a not-for-profit organisation established for<br />

business activities as follows:<br />

the promotion of thoroughbred racing in country <strong>NSW</strong><br />

(i) Distributions pursuant to the <strong>Racing</strong> Distribution and is exempt from income tax pursuant to the provisions<br />

Agreement<br />

of Section 50-45 of the Income Tax Assessment Act<br />

(ii) Television broadcast royalty<br />

(1997).<br />

Revenue from television broadcast is recognised upon NOTE 3: ECONOMIC DEPENDENCY<br />

delivery of service to customers.<br />

The company received 80% of its total income from <strong>NSW</strong><br />

(iii) Administration charge funding<br />

<strong>Racing</strong> Pty Ltd under the <strong>Racing</strong> Distribution Agreement<br />

Administration charge funding is recognised as with Tabcorp Ltd. This represents the distribution of<br />

revenue on receipt of the funding.<br />

wagering receipts governed by this agreement.<br />

Consequently, the company is economically dependent on<br />

(iv) Interest<br />

Tabcorp Ltd.<br />

Interest revenue is recognised on a time proportion<br />

basis using the effective interest method.<br />

(v) Sponsorship<br />

NOTE 4: SEGMENT <strong>REPORT</strong>ING<br />

Sponsorship revenue is recognised over the period to<br />

The company operates solely in the thoroughbred racing<br />

which the sponsorship relates.<br />

industry and derives all its income and incurs all expenses in<br />

that industry.<br />

(vi) Other Revenues<br />

Totalizator commissions from non-TAB meetings,<br />

distribution from <strong>Racing</strong> <strong>NSW</strong> surpluses and other<br />

miscellaneous revenue items are recognised when<br />

received.<br />

j) Trade and Other Payables<br />

These amounts represent liabilities for goods and<br />

services provided to the company prior to the end of<br />

the financial year and which are unpaid. The amounts<br />

are unsecured and are usually paid within 30 days of<br />

recognition.<br />

29