2011 REPORT ANNUAL - Racing NSW

2011 REPORT ANNUAL - Racing NSW

2011 REPORT ANNUAL - Racing NSW

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

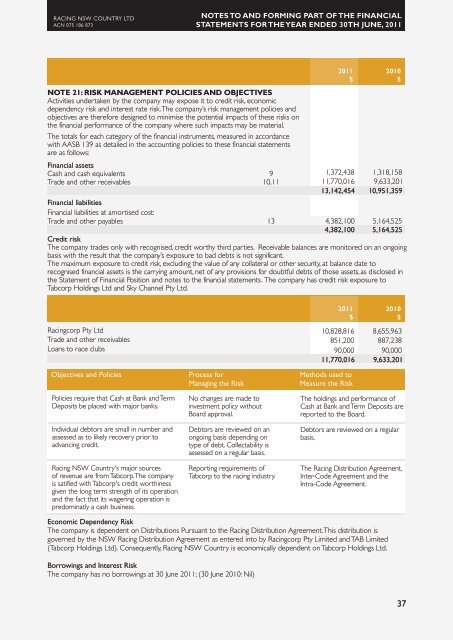

RACING <strong>NSW</strong> COUNTRY LTD<br />

ACN 075 186 873<br />

NOTES TO AND FORMING PART OF THE FINANCIAL<br />

STATEMENTS FOR THE YEAR ENDED 30TH JUNE, <strong>2011</strong><br />

<strong>2011</strong><br />

$<br />

2010<br />

$<br />

NOTE 21: RISK MANAGEMENT POLICIES AND OBJECTIVES<br />

Activities undertaken by the company may expose it to credit risk, economic<br />

dependency risk and interest rate risk. The company’s risk management policies and<br />

objectives are therefore designed to minimise the potential impacts of these risks on<br />

the financial performance of the company where such impacts may be material.<br />

The totals for each category of the financial instruments, measured in accordance<br />

with AASB 139 as detailed in the accounting policies to these financial statements<br />

are as follows:<br />

Financial assets<br />

Cash and cash equivalents 9 1,372,438 1,318,158<br />

Trade and other receivables 10,11 11,770,016 9,633,201<br />

13,142,454 10,951,359<br />

Financial liabilities<br />

Financial liabilities at amortised cost:<br />

Trade and other payables 13 4,382,100 5,164,525<br />

4,382,100 5,164,525<br />

Credit risk<br />

The company trades only with recognised, credit worthy third parties. Receivable balances are monitored on an ongoing<br />

basis with the result that the company’s exposure to bad debts is not significant.<br />

The maximum exposure to credit risk, excluding the value of any collateral or other security, at balance date to<br />

recognised financial assets is the carrying amount, net of any provisions for doubtful debts of those assets, as disclosed in<br />

the Statement of Financial Position and notes to the financial statements. The company has credit risk exposure to<br />

Tabcorp Holdings Ltd and Sky Channel Pty Ltd.<br />

<strong>2011</strong><br />

$<br />

2010<br />

$<br />

<strong>Racing</strong>corp Pty Ltd 10,828,816 8,655,963<br />

Trade and other receivables 851,200 887,238<br />

Loans to race clubs 90,000 90,000<br />

11,770,016 9,633,201<br />

Objectives and Policies<br />

Policies require that Cash at Bank and Term<br />

Deposits be placed with major banks.<br />

Individual debtors are small in number and<br />

assessed as to likely recovery prior to<br />

advancing credit.<br />

<strong>Racing</strong> <strong>NSW</strong> Country's major sources<br />

of revenue are from Tabcorp. The company<br />

is satified with Tabcorp's credit worthiness<br />

given the long term strength of its operation<br />

and the fact that its wagering operation is<br />

predominatly a cash business.<br />

Process for<br />

Managing the Risk<br />

No changes are made to<br />

investment policy without<br />

Board approval.<br />

Debtors are reviewed on an<br />

ongoing basis depending on<br />

type of debt. Collectability is<br />

assessed on a regular basis.<br />

Reporting requirements of<br />

Tabcorp to the racing industry.<br />

Methods used to<br />

Measure the Risk<br />

The holdings and performance of<br />

Cash at Bank and Term Deposits are<br />

reported to the Board.<br />

Debtors are reviewed on a regular<br />

basis.<br />

The <strong>Racing</strong> Distribution Agreement,<br />

Inter-Code Agreement and the<br />

Intra-Code Agreement.<br />

Economic Dependency Risk<br />

The company is dependent on Distributions Pursuant to the <strong>Racing</strong> Distribution Agreement. This distribution is<br />

governed by the <strong>NSW</strong> <strong>Racing</strong> Distribution Agreement as entered into by <strong>Racing</strong>corp Pty Limited and TAB Limited<br />

(Tabcorp Holdings Ltd). Consequently, <strong>Racing</strong> <strong>NSW</strong> Country is economically dependent on Tabcorp Holdings Ltd.<br />

Borrowings and Interest Risk<br />

The company has no borrowings at 30 June <strong>2011</strong>; (30 June 2010: Nil)<br />

37