Annual Report 2006 - Rheinland Pfalz Bank

Annual Report 2006 - Rheinland Pfalz Bank

Annual Report 2006 - Rheinland Pfalz Bank

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

40 LRP Landesbank <strong>Rheinland</strong>-<strong>Pfalz</strong> – Group –<br />

Segment <strong>Report</strong>ing<br />

The purpose of segment reporting is to provide information<br />

that makes it possible to characterize the profit<br />

and risk situation of individual business and geographic<br />

segments. The relevant disaggregated performance<br />

and portfolio figures used for this purpose are taken<br />

from internal profit center accounting, external accounting<br />

and LRP’s reporting system. The segments<br />

are identified on the basis of the Group’s internal organizational<br />

structure (mainly relating to customer and<br />

product groups), taking the respective individual opportunity<br />

and risk profiles into account.<br />

In the column “Other/Consolidation” the interlocking<br />

relationships of the Group are eliminated, and this column<br />

presents a reconciliation of internal financial control<br />

data to external reporting data.<br />

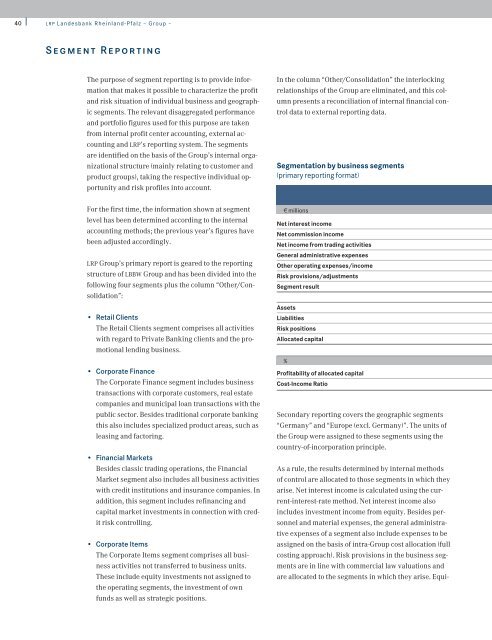

Segmentation by business segments<br />

(primary reporting format)<br />

For the first time, the information shown at segment<br />

level has been determined according to the internal<br />

accounting methods; the previous year’s figures have<br />

been adjusted accordingly.<br />

LRP Group’s primary report is geared to the reporting<br />

structure of LBBW Group and has been divided into the<br />

following four segments plus the column “Other/Consolidation”:<br />

• Retail Clients<br />

The Retail Clients segment comprises all activities<br />

with regard to Private <strong>Bank</strong>ing clients and the promotional<br />

lending business.<br />

• Corporate Finance<br />

The Corporate Finance segment includes business<br />

transactions with corporate customers, real estate<br />

companies and municipal loan transactions with the<br />

public sector. Besides traditional corporate banking<br />

this also includes specialized product areas, such as<br />

leasing and factoring.<br />

• Financial Markets<br />

Besides classic trading operations, the Financial<br />

Market segment also includes all business activities<br />

with credit institutions and insurance companies. In<br />

addition, this segment includes refinancing and<br />

capital market investments in connection with credit<br />

risk controlling.<br />

• Corporate Items<br />

The Corporate Items segment comprises all business<br />

activities not transferred to business units.<br />

These include equity investments not assigned to<br />

the operating segments, the investment of own<br />

funds as well as strategic positions.<br />

1 millions<br />

Net interest income<br />

Net commission income<br />

Net income from trading activities<br />

General administrative expenses<br />

Other operating expenses/income<br />

Risk provisions/adjustments<br />

Segment result<br />

Assets<br />

Liabilities<br />

Risk positions<br />

Allocated capital<br />

%<br />

Profitability of allocated capital<br />

Cost-Income Ratio<br />

Secondary reporting covers the geographic segments<br />

“Germany” and “Europe (excl. Germany)”. The units of<br />

the Group were assigned to these segments using the<br />

country-of-incorporation principle.<br />

As a rule, the results determined by internal methods<br />

of control are allocated to those segments in which they<br />

arise. Net interest income is calculated using the current-interest-rate<br />

method. Net interest income also<br />

includes investment income from equity. Besides personnel<br />

and material expenses, the general administrative<br />

expenses of a segment also include expenses to be<br />

assigned on the basis of intra-Group cost allocation (full<br />

costing approach). Risk provisions in the business segments<br />

are in line with commercial law valuations and<br />

are allocated to the segments in which they arise. Equi-