Rock Valley College Comprehensive Annual Financial Report ...

Rock Valley College Comprehensive Annual Financial Report ...

Rock Valley College Comprehensive Annual Financial Report ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ROCK VALLEY COLLEGE<br />

ILLINOIS COMMUNITY COLLEGE DISTRICT NUMBER 511<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

Note 1 - <strong>Financial</strong> <strong>Report</strong>ing Entity, Measurement Focus, Basis of Accounting and Significant Accounting<br />

Policies (Continued)<br />

Accounting estimates: The preparation of the financial statements requires management to make estimates and<br />

assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and<br />

liabilities at the date of the financial statements and the reported amounts of revenues and expenses, including<br />

functional allocations during the reporting period. Actual results could differ from those estimates.<br />

Cash equivalents: The <strong>College</strong> considers cash equivalents to be all demand deposits, Illinois Funds Money Market<br />

Fund and Illinois School District Liquid Asset Fund Plus. Investments which have a purchased maturity greater than<br />

90 days are not considered to be cash equivalents.<br />

Investments: The <strong>College</strong>’s investments, with maturities less than one year when purchased and all certificates of<br />

deposit, are reported at cost or amortized cost. Investments, with a maturity greater than one year at the time of<br />

purchase, are recorded at fair value. Fair value is based on published fair values on June 30, 2008 and 2007.<br />

Prepaid Items: Payments for goods and services that benefit future periods are recorded as prepaid items.<br />

Restricted cash and cash equivalents and investments: Restricted cash and cash equivalents and investments are<br />

restricted for the purpose of constructing and purchasing capital assets.<br />

Capital assets: Capital assets include property, plant, equipment and infrastructure assets, such as roads and<br />

sidewalks. Capital assets are defined by the <strong>College</strong> as assets with an initial unit cost of $5,000 or more and an<br />

estimated useful life in excess of two years. Such assets are recorded at historical cost or estimated historical cost if<br />

purchased or constructed. Donated capital assets are recorded at estimated fair market value at the date of<br />

donation. The costs of normal maintenance and repairs that do not add to the value of the asset or materially extend<br />

assets’ lives are not capitalized. Major outlays for capital assets and improvements are capitalized as projects are<br />

constructed.<br />

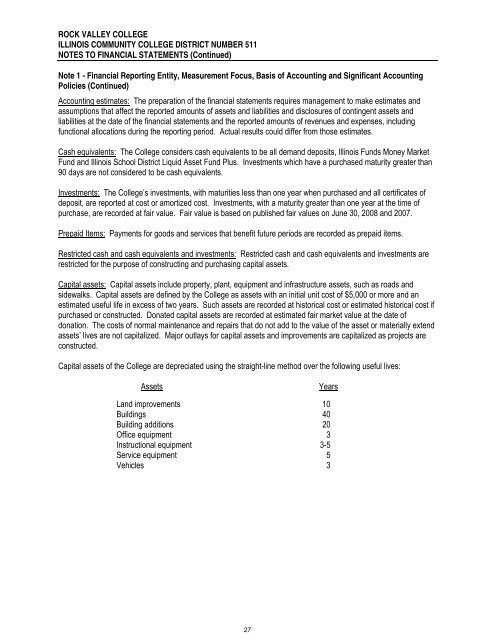

Capital assets of the <strong>College</strong> are depreciated using the straight-line method over the following useful lives:<br />

Assets<br />

Years<br />

Land improvements 10<br />

Buildings 40<br />

Building additions 20<br />

Office equipment 3<br />

Instructional equipment 3-5<br />

Service equipment 5<br />

Vehicles 3<br />

27