Rock Valley College Comprehensive Annual Financial Report ...

Rock Valley College Comprehensive Annual Financial Report ...

Rock Valley College Comprehensive Annual Financial Report ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ROCK VALLEY COLLEGE<br />

ILLINOIS COMMUNITY COLLEGE DISTRICT NUMBER 511<br />

NOTES TO FINANCIAL STATEMENTS (Continued)<br />

Note 2 - Cash, Cash Equivalents and Investments (Continued)<br />

Custodial risk for investments is the risk that, in the event of a failure of the counterparty, the <strong>College</strong> will not be able<br />

to recover the value of investments that are in the possession of an outside party. The <strong>College</strong>’s investment policy<br />

requires all investments to be purchased on a delivery versus payment (DVP) basis with the underlying investment<br />

held by an independent third party, acting as an agent of the <strong>College</strong>, in the <strong>College</strong>’s name. At June 30, 2007, the<br />

repurchase agreements were exposed to custodial credit risk as the securities underlying the repurchase agreement<br />

were held in safekeeping by the counterparty.<br />

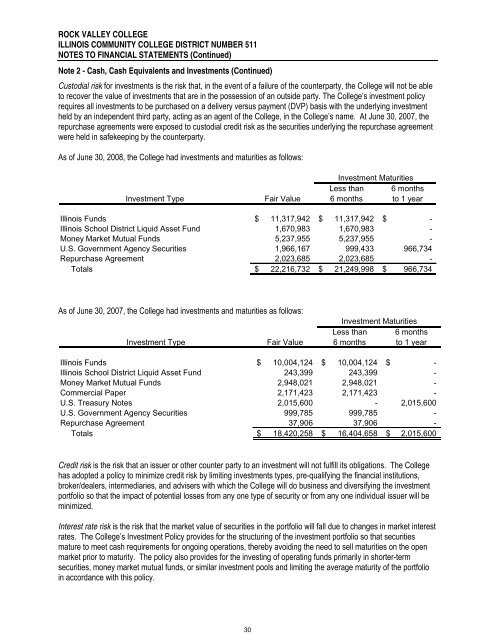

As of June 30, 2008, the <strong>College</strong> had investments and maturities as follows:<br />

Investment Maturities<br />

Less than 6 months<br />

Investment Type Fair Value 6 months to 1 year<br />

Illinois Funds $ 11,317,942 $ 11,317,942 $<br />

-<br />

Illinois School District Liquid Asset Fund 1,670,983 1,670,983 -<br />

Money Market Mutual Funds 5,237,955 5,237,955 -<br />

U.S. Government Agency Securities 1,966,167 999,433 966,734<br />

Repurchase Agreement 2,023,685 2,023,685 -<br />

Totals $ 22,216,732 $ 21,249,998 $ 966,734<br />

As of June 30, 2007, the <strong>College</strong> had investments and maturities as follows:<br />

Investment Maturities<br />

Less than 6 months<br />

Investment Type Fair Value 6 months to 1 year<br />

Illinois Funds $ 10,004,124 $ 10,004,124 $<br />

-<br />

Illinois School District Liquid Asset Fund 243,399 243,399 -<br />

Money Market Mutual Funds 2,948,021 2,948,021 -<br />

Commercial Paper 2,171,423 2,171,423 -<br />

U.S. Treasury Notes 2,015,600 - 2,015,600<br />

U.S. Government Agency Securities 999,785 999,785 -<br />

Repurchase Agreement 37,906 37,906 -<br />

Totals $ 18,420,258 $ 16,404,658 $ 2,015,600<br />

Credit risk is the risk that an issuer or other counter party to an investment will not fulfill its obligations. The <strong>College</strong><br />

has adopted a policy to minimize credit risk by limiting investments types, pre-qualifying the financial institutions,<br />

broker/dealers, intermediaries, and advisers with which the <strong>College</strong> will do business and diversifying the investment<br />

portfolio so that the impact of potential losses from any one type of security or from any one individual issuer will be<br />

minimized.<br />

Interest rate risk is the risk that the market value of securities in the portfolio will fall due to changes in market interest<br />

rates. The <strong>College</strong>’s Investment Policy provides for the structuring of the investment portfolio so that securities<br />

mature to meet cash requirements for ongoing operations, thereby avoiding the need to sell maturities on the open<br />

market prior to maturity. The policy also provides for the investing of operating funds primarily in shorter-term<br />

securities, money market mutual funds, or similar investment pools and limiting the average maturity of the portfolio<br />

in accordance with this policy.<br />

30