Chinese Consumer Report 2012 - Luxury - Roland Berger

Chinese Consumer Report 2012 - Luxury - Roland Berger

Chinese Consumer Report 2012 - Luxury - Roland Berger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

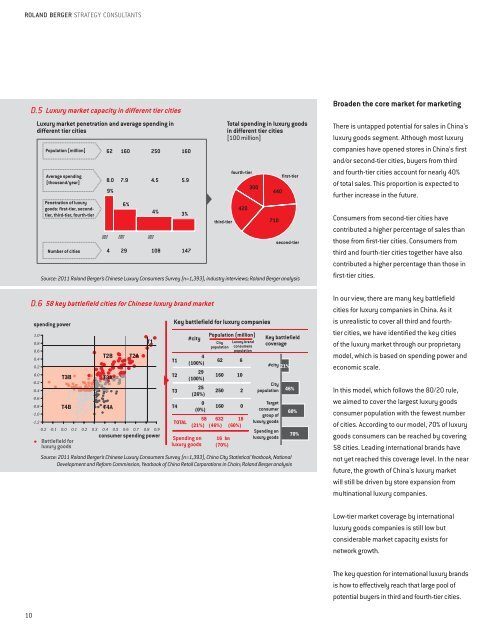

<strong>Luxury</strong> market capacity in different tier cities<br />

<strong>Luxury</strong> market penetration and average spending in<br />

different tier cities<br />

Population [million]<br />

Average spending<br />

[thousand/year]<br />

Penetration of luxury<br />

goods: first-tier, secondtier,<br />

third-tier, fourth-tier<br />

Number of cities<br />

Source: 2011 <strong>Roland</strong> <strong>Berger</strong>’s <strong>Chinese</strong> <strong>Luxury</strong> <strong>Consumer</strong>s Survey (n=1,393), industry interviews; <strong>Roland</strong> <strong>Berger</strong> analysis<br />

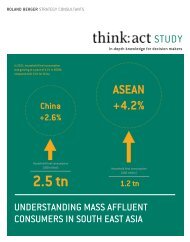

58 key battlefield cities for <strong>Chinese</strong> luxury brand market<br />

spending power<br />

Battlefield for<br />

luxury goods<br />

consumer spending power<br />

third-tier<br />

Total spending in luxury goods<br />

in different tier cities<br />

[100 million]<br />

fourth-tier<br />

Key battlefield for luxury companies<br />

first-tier<br />

second-tier<br />

Source: 2011 <strong>Roland</strong> <strong>Berger</strong>’s <strong>Chinese</strong> <strong>Luxury</strong> <strong>Consumer</strong>s Survey (n=1,393), China City Statistical Yearbook, National<br />

Development and Reform Commission, Yearbook of China Retail Corporations in Chain; <strong>Roland</strong> <strong>Berger</strong> analysis<br />

#city<br />

Spending on<br />

luxury goods<br />

Population (million)<br />

City <strong>Luxury</strong> brand<br />

population consumers<br />

population<br />

Key battlefield<br />

coverage<br />

#city<br />

City<br />

population<br />

Target<br />

consumer<br />

group of<br />

luxury goods<br />

Spending on<br />

luxury goods<br />

Broaden the core market for marketing<br />

There is untapped potential for sales in China's<br />

luxury goods segment. Although most luxury<br />

companies have opened stores in China's first<br />

and/or second-tier cities, buyers from third<br />

and fourth-tier cities account for nearly 40%<br />

of total sales. This proportion is expected to<br />

further increase in the future.<br />

<strong>Consumer</strong>s from second-tier cities have<br />

contributed a higher percentage of sales than<br />

those from first-tier cities. <strong>Consumer</strong>s from<br />

third and fourth-tier cities together have also<br />

contributed a higher percentage than those in<br />

first-tier cities.<br />

In our view, there are many key battlefield<br />

cities for luxury companies in China. As it<br />

is unrealistic to cover all third and fourthtier<br />

cities, we have identified the key cities<br />

of the luxury market through our proprietary<br />

model, which is based on spending power and<br />

economic scale.<br />

In this model, which follows the 80/20 rule,<br />

we aimed to cover the largest luxury goods<br />

consumer population with the fewest number<br />

of cities. According to our model, 70% of luxury<br />

goods consumers can be reached by covering<br />

58 cities. Leading international brands have<br />

not yet reached this coverage level. In the near<br />

future, the growth of China's luxury market<br />

will still be driven by store expansion from<br />

multinational luxury companies.<br />

Low-tier market coverage by international<br />

luxury goods companies is still low but<br />

considerable market capacity exists for<br />

network growth.<br />

The key question for international luxury brands<br />

is how to effectively reach that large pool of<br />

potential buyers in third and fourth-tier cities.<br />

10