Automotive inSIGHTS 1/2007 - Roland Berger

Automotive inSIGHTS 1/2007 - Roland Berger

Automotive inSIGHTS 1/2007 - Roland Berger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AUTOMOTIVE<br />

<strong>Automotive</strong> Competence Center customer magazine No. 01_<strong>2007</strong><br />

> Low cost cars: Who will make the most of the growing market?<br />

> Suppliers: On average more profitable than OEMs<br />

China‘s market for<br />

low cost cars is booming

Editorial<br />

Contents<br />

"INSIGHTS":<br />

<strong>Automotive</strong> Insights,<br />

model year <strong>2007</strong><br />

Dear Reader,<br />

New model year, new features. What is<br />

good for the automotive industry is good<br />

for <strong>Automotive</strong> Insights as well: We have<br />

relaunched our magazine to make room<br />

for more true insights into the latest<br />

trends and developments in our industry.<br />

From now on we will start every issue<br />

with a look around the world: <strong>Roland</strong><br />

<strong>Berger</strong> Consultants will report on the<br />

newest topics in their markets. This time<br />

we take a look at Russia, the US and<br />

Japan. News and interesting publications,<br />

a story on a famous car and two factpacked<br />

reports on new studies follow.<br />

In this issue we offer insights into the<br />

development of the markets for low cost<br />

cars and research why suppliers on average<br />

work more profi tably than the OEMs.<br />

We hope you will enjoy reading our new<br />

<strong>Automotive</strong> Insights.<br />

Sincerely,<br />

Ralf Kalmbach<br />

2 News<br />

2 „Insights“: A look<br />

around the world<br />

2 USA North American<br />

suppliers: the good, the<br />

bad and the ugly<br />

3 Russia Dilemma for<br />

western suppliers<br />

3 Japan Never walk alone:<br />

Entering the Japanese<br />

market<br />

4 Teaming up to exploit<br />

potential OEMs and<br />

dealers can achieve<br />

more working together<br />

4 Famous cars<br />

The Aston Martin DB 5<br />

4 Books & Studies<br />

5 Studies<br />

5 Low cost cars<br />

A <strong>Roland</strong> <strong>Berger</strong> study<br />

shows: Production<br />

will grow by 4 million<br />

units by 2012<br />

8 <strong>Automotive</strong> suppliers<br />

drive away with the<br />

profit A survey of<br />

<strong>Roland</strong> <strong>Berger</strong> Strategy<br />

Consultants and investment<br />

bank Rothschild<br />

Published by: <strong>Roland</strong> <strong>Berger</strong><br />

Strategy Consultants GmbH,<br />

Mies-van-der-Rohe-Straße 6,<br />

80307 München<br />

Responsible: Ralf Kalmbach<br />

and Ralf Landmann<br />

Editors: Susanne Tebartz,<br />

Dr. Heidi Sylvester<br />

Photographs: Renault, VW, GM,<br />

Chery, Picture Alliance, Magna<br />

Steyr AG, <strong>Roland</strong> <strong>Berger</strong>, Rothschild<br />

GmbH<br />

Layout: Jens Kaiser<br />

Printed by: Girodruck, Hamburg<br />

Circulation: 3,500. Published<br />

three times a year, no reprints<br />

without prior permission of the<br />

publisher<br />

USA<br />

Growing pains in Russia,<br />

new rules in the US,<br />

chances for European<br />

suppliers in Japan – a<br />

look around the world<br />

North American Suppliers:<br />

the good, the bad and the ugly<br />

The performance of the North American<br />

automotive supplier industry is becoming<br />

increas ingly polarized. True, the industry<br />

as a whole has suffered, as median<br />

Return on Assets (ROA) among 33 large,<br />

public suppliers has fallen from 5 percent<br />

in 2000 to 1 percent in 2005.<br />

However, many suppliers are performing<br />

well. In 2005, more than half of these<br />

suppliers enjoyed Return on Equity (ROE)<br />

above 10 percent, while the bottom<br />

quartile showed negative ROE. The top<br />

quartile had ROA of 8 and EBITDA margins<br />

of 18 percent, compared to the<br />

bottom quartile‘s -14 percent ROA and<br />

EBITDA margins of -2 percent. The<br />

volume reductions at GM, Ford, and<br />

Chrysler, increasing price pressure, and<br />

rising raw material prices create a perfect<br />

storm in the industry. Bankruptcies<br />

became common among US suppliers.<br />

In this challenging environment, there is<br />

strong interest from private equity fi rms<br />

and hedge funds to invest in suppliers.<br />

They will bring in capital and turn around<br />

skills, and will drive industry consolidation.<br />

Mega-suppliers are on the horizon,<br />

as weaker players either consolidate or<br />

drop out of the business. Indeed, some<br />

mega-suppliers may move further up the<br />

value chain and begin assembling their<br />

own complete vehicles.

News | <strong>Automotive</strong> Insights | 3<br />

What's going on around the globe<br />

RUSSIA<br />

Dilemma for western suppliers<br />

The Russian car market grew by 20<br />

percent in 2006. Profi teering from the<br />

growth are mostly foreign carmakers.<br />

To secure their share in the booming<br />

market many foreign car companies are<br />

investing in production sites in Russia.<br />

But since they regard it as a high risk<br />

investment, most OEMs are building only<br />

relatively small factories with a capacity<br />

of 50,000 to 70,000 vehicles per year.<br />

Suppliers have to follow the OEMs<br />

Since local Russian suppliers are still<br />

trying to catch up with technological<br />

developments, OEMs have asked their<br />

sup pliers from home to follow them into<br />

Russia and build up capacities as well.<br />

But these suppliers face a di lemma by<br />

entering Russia: The capacity of the OEMs<br />

Russian factories is so low that they can't<br />

keep the suppliers production plant busy,<br />

and they don't reach the critical mass.<br />

Joint ventures with local suppliers<br />

Since OEMs expect them to follow into<br />

Model of new Volkswagen plant in Kaluga: Siemens is coming, too<br />

Russia, many western suppliers are exploring<br />

the opportunities for joint ventures<br />

with local companies. Westerners would<br />

deliver the technology and manage the<br />

joint project, the local supplier the capacity<br />

and manpower.<br />

There is a downside<br />

Siemens has set up such a joint venture<br />

with local Auto electronica in Kaluga,<br />

where Volkswagen is building its Russian<br />

factory. Many other western suppliers<br />

are expected to follow the example of<br />

Siemens. The joint ventures have, however,<br />

a downside: With the injection of<br />

state-of-the-art technology and modern<br />

management techniques the western<br />

suppliers are teaching their Russian<br />

counterparts. It may not take too long<br />

until joint venture partners will become<br />

competitors.<br />

JAPAN<br />

Never walk alone: Entering the<br />

Japanese market<br />

Local production by Japanese OEMs has<br />

nearly doubled since 1999. But European<br />

suppliers trying to participate in the booming<br />

market meet diffi culties. There are several<br />

ways to Japan: First of all, they have to meet<br />

the expectations of Japanese OEMs. Functionality<br />

of product, high quality standards,<br />

local contact for customers, price competitiveness<br />

and a manufacturing location in<br />

Japan are required. To meet these demands<br />

most foreign suppliers form a business alliance<br />

with a local supplier as a fi rst step.<br />

Edscha from Germany for example teamed<br />

up with Oi Seisakujo, a major Japanese<br />

supplier in door hinges for Nissan, in 2001.<br />

Edscha established a joint venture with Oi<br />

Seisakujo in 2003, transferring its Japanese<br />

business to the new company.<br />

Mahle, world market leader in fi lter systems,<br />

took a different path into the market. In<br />

2001, it acquired Tenex, Nissan‘s major<br />

supplier in fi lters. By now Mahle supplies<br />

fi lters to several Japanese OEMs.<br />

Bosch's journey into the Japanese market<br />

has been long. It entered in the 1970s by<br />

supplying licenses to local companies. In<br />

the following years, Bosch founded joint<br />

ventures and acquired shares in local companies.<br />

Step by step it obtained control<br />

of production, development and sales in<br />

Japan. Since 2002, Bosch has integrated<br />

three acquired companies to expand the<br />

brand image, and to increase awareness<br />

among Japanese OEMs.<br />

The reasons why successful suppliers don't<br />

enter the Japanese market alone:<br />

Insider status – the ties between OEMs<br />

and their preferred suppliers are very tight.<br />

Difficulty understanding specifications –<br />

OEMs will only give specifi cations with low<br />

detail level. Without assistance, western<br />

suppliers will fi nd it tricky.<br />

Geographical barriers – time difference<br />

and logistics hinder effective business.

4 | <strong>Automotive</strong> Insights | News<br />

Teaming up to exploit potential<br />

<strong>Automotive</strong> OEMs and dealers can achieve more if they work together<br />

Carmakers are dissatisfi ed with the performance<br />

of their sales organizations, dealers<br />

complain of dwindling sales and pressure on<br />

margins. So how can the two sides collaborate<br />

to deliver sales numbers that are acceptable<br />

to both? <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

has identifi ed three potent strategies.<br />

1. Lay a firm foundation for success<br />

To do so, both sides must be prepared to give<br />

each other insight into how things work "on<br />

the inside". Successful OEMs make top sales<br />

executives spend several days a year experiencing<br />

everyday working life at one of their<br />

dealers. Conversely, the managers of car dealers<br />

should also gain hands-on experience of<br />

manufacturers' sales planning and network<br />

development activities.<br />

The second step toward superior collaboration<br />

is to establish a sales planning process<br />

based on partnership. For OEMs, this means<br />

planning annual sales for individual market<br />

areas in line with realistic potential, and working<br />

with dealers to clarify how targets are<br />

to be met. Together they implement binding<br />

development plans.<br />

2. Live brand messages<br />

While automakers manufacture vehicles, customers<br />

buy brands. The actual vehicle and its<br />

fi ttings and features is merely one way of injecting<br />

life into the brand, of making the brand<br />

tangible. Advertising and communication are<br />

another way to achieve the same goal. The<br />

most important thing, however, is that all staff<br />

who interface with customers must live out<br />

the defi ned brand values day in, day out.<br />

3. Improve processes at the point of sale<br />

In eight out of ten cases, poor performance<br />

by dealers is what prevents cars from being<br />

sold. Professional dealer behavior is therefore<br />

the key lever to signifi cantly boost sales –<br />

apart from launching new models and expensive<br />

marketing campaigns. OEMs should there -<br />

fore help their dealers to concentrate on the<br />

most important processes. Sales promotion<br />

campaigns, for example, can be made more<br />

effective merely by planning, communicating<br />

and implementing them jointly. A new study<br />

("<strong>Automotive</strong> Sales Champions", see right)<br />

will identify the levers for more successful<br />

cooperation between dealers and OEMs.<br />

Books & Studies<br />

Mastering <strong>Automotive</strong><br />

Challenges<br />

The automotive<br />

industry<br />

is currently<br />

experiencing<br />

a period of<br />

wide-spread<br />

changes: the<br />

disappearance<br />

of traditional markets and<br />

customers, intensifying competition,<br />

increasing innovation and<br />

product complexity, and structural<br />

changes in the automotive<br />

value chain – to name just a few.<br />

Mastering <strong>Automotive</strong> Challenges<br />

provides comprehensive and<br />

practical guidance for managers,<br />

showing them how to tackle<br />

necessary action, benefi cial<br />

for day to day management.<br />

The key issues facing managers<br />

are laid out, followed by case<br />

studies which show how these<br />

challenges can be successfully<br />

overcome. Mastering <strong>Automotive</strong><br />

Challenges is a must-read for<br />

any manager within the industry.<br />

<strong>Automotive</strong> Sales<br />

Champions<br />

Famous cars: 007‘s Aston Martin DB 5<br />

They were sold by millions: The Aston Martin<br />

DB 5, gunmetal gray, fi tted with machine<br />

guns and ejection seat was a big success in<br />

Corgi Toys 1965 range of model cars. The<br />

driver made all the difference: Q gave the<br />

original car to 007 to help in his fi ght with<br />

"Goldfi nger". Since then, boys around the<br />

world think of the Astons as the ultimate in<br />

cool. In recent years Aston Martin launched<br />

an astonishing offensive of new models. The<br />

V8 Vantage, the V12 Vanquish S and the DB<br />

9, heir of Sean Connery‘s car. This spring<br />

the fans of the British brand are eagerly<br />

expecting the new Vantage roadster. And<br />

again Aston Martin became the company<br />

car at MI 6 – the latest 007 is driving Aston<br />

Martin DBS, a thoroughbred sportscar, in<br />

"Casino Royale".<br />

Ultimately cool: 007 with DB5<br />

The Automo tive Compe tence<br />

Center of <strong>Roland</strong> <strong>Berger</strong> Strategy<br />

Consultants together with IBM<br />

is conducting a study on excellence<br />

in sales. Questions looked<br />

at: How to improve operating<br />

effi ciency, how to exceed the<br />

expectations of customers and<br />

dealers, how to turn excellence<br />

into market share gains. Results<br />

are due out in May <strong>2007</strong>.<br />

Interested in the book?<br />

Mail to dana_rehfuss@<br />

de.rolandberger.com

Low Cost Cars | <strong>Automotive</strong> Insights | 5<br />

Low cost cars: The early<br />

bird catches the worm<br />

A market study by <strong>Roland</strong> <strong>Berger</strong> Strategy<br />

Consultants found that production of entry-level<br />

cars will grow by four million units by 2012.<br />

Yes, you can do it! Renault's Dacia Logan was the fi rst<br />

model to show Western Europeans that it really is<br />

possible for them to build cars at a profi t in the low cost<br />

car segment. It defi nitely makes economic sense to take<br />

a closer look at this segment. A recent market study by<br />

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants found that annual<br />

production of entry level cars (A/B segments) will grow<br />

by four million units between now and 2012. Fresh<br />

demand is springing up not only in emerging markets<br />

such as China and India, but also in the richer western<br />

nations, where the cost of buying and running a car has<br />

signifi cantly outstripped income growth. Carmakers that<br />

res pond swiftly to this trend can look forward to signifi -<br />

cant market opportunities. Low cost cars are defi ned as<br />

automobiles that sell for under EUR 10,000 (or under USD<br />

10,000 in the USA).<br />

The auto industry is currently witnessing developments<br />

that have already been experienced by the aviation, hotel<br />

and textile sectors. With the mid-range price segment<br />

shrinking, companies can only earn money on ex pensive<br />

premium offerings or in the low cost segment.<br />

Incumbent OEMs can rise to the challenge at the low<br />

end of the market by basing their strategies on three key<br />

strengths that we refer to as car, care and core.<br />

Car: Vehicles themselves must, of course, be adapted to<br />

market conditions. They must be based on shared global<br />

platforms and modules used in other models, must also<br />

have low cost features and be built at low cost locations.<br />

Care: Finance, insurance, repairs and maintenance,<br />

warranty fulfi llment and mobility guarantees – these and<br />

other services that are especially important for low cost<br />

vehicles allow established manufacturers to score over<br />

their rivals from emerging markets.<br />

Core: This term refers to the brands that OEMs have cultivated<br />

over decades – the core values that encompass the<br />

product itself (car) and the related services (care). Another<br />

advantage is the broad customer base that reinforces the<br />

brands of traditional OEMs, whereas automakers that<br />

originate from emerging markets are only now beginning<br />

to develop their brands and nurture customer loyalty.<br />

Making an acceptable profi t with vehicles in the low cost<br />

car segment requires a new and different approach and<br />

mindset for most incumbent OEMs. Our research shows<br />

six paradigms to make this strategy work:<br />

> Ensure independence from complex and costly<br />

corporate structures<br />

> Limit dependency on brands<br />

> Stick to basic functionality and don‘t overdo the<br />

features: "value for money" is the key<br />

> Operate a global low cost strategy in development,<br />

sourcing and production<br />

> Target markets such as China, India, Russia and Brazil,<br />

where market conditions and the "rules of the game" vary<br />

> Establish potential partnerships to cover all the core<br />

competencies required for a low cost car strategy,<br />

including leveraging shared (low cost) components<br />

and infrastructure. This is vital to keep a cap on costs<br />

Selecting the right target market and gaining an in-depth<br />

understanding of changing consumer behaviors and pre-<br />

Car costs vs. real wage index in Germany<br />

(%, base year 1999 = 100)<br />

125<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

Car costs<br />

Note: Price index based on operating/purchase costs of passenger cars<br />

Source: German offi ce of statistics; Global Insight<br />

Wages<br />

1999 2000 2001 2002 2003 2004 2005<br />

Dacia Logan:<br />

Proves that<br />

European<br />

OEMs can<br />

build low cost<br />

cars, too

6 | <strong>Automotive</strong> Insights | Low Cost Cars<br />

ferences are two of the most important success factors.<br />

Market selection involves evaluating the regulatory environment,<br />

economic situation and consumer behaviors,<br />

as well as the activities of other OEMs. Further success<br />

factors include adapting vehicles for local markets,<br />

operating platform strategies, extensively standardizing<br />

components and production processes, choosing low cost<br />

locations. To determine which country presents the highest<br />

potential and is most favorable for low cost car production,<br />

it is important to examine each individual market.<br />

In the US, the low cost car segment is expected to grow<br />

to 0.7 million vehicles by 2012<br />

The fi rst low cost car ever made in the USA was Henry<br />

Ford‘s Model T. In its last year of production, the Model T<br />

costed USD 380 – the equivalent of USD 4,200 at today‘s<br />

prices. But cars have become less afford able over time.<br />

Between 1980 and 2003, the average vehicle selling<br />

price rose by 2.2 percent per annum, growing faster than<br />

all but the top 5 percent of US family incomes. At the<br />

same time, high fuel prices are driving down demand for<br />

large SUVs while boosting sales of small cars.<br />

Through 2012, the entry level car segment in Western<br />

Europe will grow by only 0.3 million vehicles<br />

Despite Western Europe‘s prosperity, car prices have outgrown<br />

the wages. As a result, many consumers are becoming<br />

more and more willing to compromise on comfort,<br />

basing car purchase decisions mainly on price instead.<br />

One vivid illustration of this phenomenon is the unexpected<br />

success of Renault‘s Dacia Logan. New models in the<br />

low cost, entry-level segment have considerable potential<br />

if they are fuel-effi cient and inexpensive to run.<br />

Domestic entry-level sales in the Japanese automotive<br />

market are expected to grow from 2.5 million vehicles<br />

in 2006 to 2.6 million vehicles in 2012<br />

Entry-level vehicles in Japan fall into two categories:<br />

Compact cars with engine displacement between 1,000<br />

cc and 1,300 cc and "Kei" or sub-compact cars with<br />

engine displacement of less than 660 cc. The entry-level<br />

vehicle segment, including sub-compact cars, accounted<br />

for 43 percent of the passenger car market in 2005, a<br />

slight increase from the 41 percent market share in 2001.<br />

Japan presents an interesting contrast to other vehicle<br />

markets in that the trend seems to be moving from larger<br />

to smaller vehicles. Foreign OEMs who aim to take advantage<br />

of this trend are nevertheless likely to face numerous<br />

challenges, given the strength of domestic OEMs.<br />

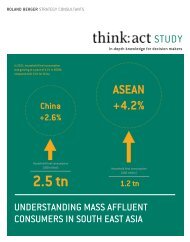

We expect China to be the strongest growth market, with<br />

a volume of 2.6 million entry-level cars by 2012<br />

Currently, the cheapest cars in the world are produced<br />

and sold in China, with MSRPs for many models starting<br />

below EUR 3,000. In China, the upper starting price limit<br />

for A segment cars is around EUR 4,000.<br />

> China‘s entry-level segment is growing rapidly and<br />

represents one third of the market<br />

> The quality of Chinese production is improving and<br />

the market still has plenty excess capacity<br />

> Local Chinese OEMs are gearing up for exports to<br />

developed markets<br />

Global sales forecast of A/B-segment vehicles ('000 units)<br />

4.2%<br />

455 582<br />

Mexico<br />

2006<br />

8,7%<br />

428 705<br />

USA<br />

3.9%<br />

1,204 1,513<br />

Brazil<br />

0,8%<br />

5,471 5,756<br />

Western Europe<br />

4.1%<br />

17,685<br />

13,935<br />

7.8%<br />

726 1,138<br />

Eastern Europe<br />

8.7%<br />

226 441<br />

Russia 1)<br />

7.6%<br />

980 1,519<br />

India<br />

13.4% 133 216<br />

1,243 2,640<br />

China<br />

16.3%<br />

42 104<br />

Thailand<br />

8.4%<br />

South Korea<br />

6.4%<br />

265 385<br />

Malaysia<br />

0.6%<br />

2,508 2,599<br />

Japan<br />

2012<br />

A/B Worldwide<br />

1) For Russia comparison of 2006 vs. 2014 CAGR 2006-2012 Source: J.D. Power; <strong>Roland</strong> <strong>Berger</strong> market model

Low Cost Cars | <strong>Automotive</strong> Insights | 7<br />

India‘s entry-level car segment will grow to 1.5 million<br />

units by 2012<br />

Market analysts set starting prices at EUR 3,900 for the<br />

Indian A segment and at EUR 6,100 for the B segment.<br />

India‘s passenger car market, with a sales volume of<br />

1.1 million units in 2005, is expected to grow by 9.0<br />

percent per annum through 2009. After that, growth<br />

is projected to accelerate to 13.2 percent per annum<br />

through 2012. As consumer purchasing power continues<br />

to increase, we estimate that, every year through 2012,<br />

as many as 1.6 million motorcycle owners will become<br />

fi rst-time car buyers, mainly entering the A or B segments.<br />

The Brazilian entry-level segment will increase from<br />

1.2 million to 1.5 million vehicles by 2012<br />

The entry-level segment represents more than 80 percent<br />

of the Brazilian car market. In many ways, Brazil can be<br />

considered a classic low cost car market. However, the<br />

cars in this segment are hardly comparable to those in<br />

India or China. As European OEMs dominate the market,<br />

there are very few cars that sell for less than EUR 8,000.<br />

In Central and Eastern Europe, sales of entry-level<br />

cars will grow from 0.7 to 1.1 million in 2012<br />

The CEE car market has a large proportion of low cost<br />

cars, some of which are also acceptable to developed<br />

markets. CEE costs trail those in Western Europe and<br />

car ownership is low, positioning the region both as a<br />

target market and a production base for European<br />

automotive operations. Generally, even though consumer<br />

prices and labor costs are increasing relatively quickly,<br />

total costs are still extremely low in absolute terms<br />

compared to Western Europe.<br />

The Russian entry-level segment will grow from 0.2<br />

million units in 2006 to 0.4 million units in 2014<br />

More than 1.6 million units have been sold in 2006 on<br />

the Russian passenger car market, which is expec ted to<br />

expand at an annual rate of 3.8 percent over the next<br />

years. Global OEMs are increasing production and sales in<br />

Russia. C segment cars at low prices dominate the market.<br />

THE TAKE-AWAY<br />

> Annual production of entry-level cars will grow by<br />

4 million units until 2012<br />

> With the mid-range price segment shrinking,<br />

companies can only earn money on premium<br />

offerings or in the low cost segment<br />

> Car, care and core are three key strengths carmakers<br />

need to focus on to compete in the low cost segment<br />

Erkut Uludag<br />

Partner at <strong>Roland</strong> <strong>Berger</strong><br />

Strategy Consultants, Detroit<br />

erkut_uludag@us.rolandberger.com<br />

Low cost car cost structure and price range (USD)<br />

5,400 100<br />

90<br />

4,000<br />

900<br />

630<br />

500<br />

250<br />

516<br />

416<br />

600<br />

450<br />

921<br />

628<br />

1,000<br />

0<br />

300<br />

200<br />

10,237<br />

6,664<br />

614<br />

400<br />

10,851<br />

7,064<br />

Base price<br />

of Chinese<br />

produced<br />

car 1)<br />

Import<br />

tariffs 2)<br />

(2.5%)<br />

Logistics<br />

costs<br />

Litigation<br />

costs<br />

Conversion<br />

costs<br />

Warranty<br />

costs<br />

Marketing/<br />

promotional<br />

cost 3)<br />

Manufacturer<br />

profi t<br />

Dealership<br />

profi t<br />

Expected<br />

MSRP<br />

price<br />

6%<br />

sales<br />

tax<br />

Total<br />

cost<br />

Lower end price point Higher end price point<br />

1) Subtracting profi t 2) For countries with NTR – Normal Trade Relation status 3) 2004 measured US new vehicle and spending per vehicle<br />

Source: Global Auto Insider, Autobuyology.com, FMVSS, Internationalecon.com, China Daily, Business Week, TNS Media Intelligence, <strong>Automotive</strong> News Data Center, <strong>Roland</strong> <strong>Berger</strong>

8 | <strong>Automotive</strong> Insights | Suppliers<br />

<strong>Automotive</strong> suppliers drive<br />

away with the profits<br />

<strong>Automotive</strong> suppliers have increased their profi ts – and in many<br />

cases they have outperformed OEMs: A survey by <strong>Roland</strong> <strong>Berger</strong><br />

Strategy Consultants and investment bank Rothschild<br />

Over the past years, automotive suppliers have faced<br />

signifi cant competitive challenges. They were put under<br />

pressure from two angles: On their own supply side,<br />

prices of raw materials have risen sharply. For steel,<br />

aluminum or resin, for example, suppliers currently have<br />

to pay 40 to 60 percent more than in the beginning of<br />

2003. At the same time, automotive manufacturers have<br />

become ever more demanding. In an attempt to further<br />

reduce their sourcing costs, carmakers are pushing<br />

suppliers for even larger price reductions, while volumes<br />

have become in creasingly volatile.<br />

Not all suppliers have been able to respond appropriately<br />

to this increase in pressure. The automotive supplier industry<br />

is thus being assessed increasingly pessimistically<br />

by the fi nancial markets. In Moody‘s automotive supplier<br />

global public rating, the number of companies outside<br />

the investment grades has risen from below 60 percent<br />

to almost 70 percent since 2004. This assessment is<br />

shared by many supplier executives. In an adjacent survey<br />

of <strong>Roland</strong> <strong>Berger</strong> with SupplierBusiness.com, 70 percent<br />

of the interviewed CEOs and CFOs of leading suppliers<br />

expect supplier bankruptcies to increase.<br />

<strong>Automotive</strong> suppliers are performing much better than<br />

expected<br />

In spite of the diffi cult environment, automotive suppliers<br />

have clearly improved their return on capital employed<br />

(ROCE) over the past fi ve years, and even outperformed the<br />

profi tability development of manufacturers. Suppliers'<br />

ROCE rose from 8.6 percent in 2001 to 11.3 percent in<br />

2005. Today, only three manu facturers – Porsche, Audi, and<br />

Nissan – achieve a higher return on capital employed than<br />

the supplier average.<br />

However, overall supplier profi tability has developed very<br />

differently depending on products, company size and<br />

the regional focus of business. While Western European<br />

suppliers achieved consistently high ROCE (12.6 percent<br />

in 2005), their North American counterparts have been<br />

struggling with constantly falling profi tability (9.3 per -<br />

cent in 2005). There were major improvements among<br />

Japanese and South Korean suppliers.<br />

Looking at company size, mid-sized and large suppliers<br />

(sales of EUR 500 million to EUR 10 billion) turned out<br />

to be most profi table. In 2005, they achieved ROCE of<br />

12.4 to 15.5 percent. Small suppliers (sales of less than<br />

EUR 250 million) as well as very large ones (sales of over<br />

EUR 10 billion) are less profi table; their ROCE hovers<br />

between 8.2 and 10.1 percent. In terms of products,<br />

suppliers focusing on infotainment, interiors, chassis<br />

and tires did best, achieving ROCE of 11.4 to 13.0<br />

percent in 2005.<br />

Top performers have a clear recipe for success<br />

Individual companies experienced the overall positive<br />

de velopment within the industry to different extents. To<br />

identify the top performing companies among the sup pliers<br />

analyzed, we looked at three criteria: Revenue growth,<br />

average return on capital employed over the period studied,<br />

and ROCE level in 2005. Suppliers achieving above-average<br />

results in all three criteria qualifi ed as top performers.<br />

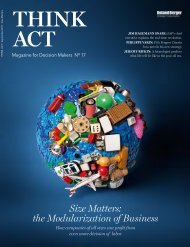

On average, suppliers outperformed OEMs<br />

Profi tability of automotive suppliers vs. OEMs<br />

2000-2005<br />

ROCE [%]<br />

10.1<br />

8.4<br />

9.3<br />

8.6 8.9<br />

10.6 10.4<br />

9.1<br />

11.6 11.3<br />

8.6<br />

2000 2001 2002 2003 2004 2005<br />

Basis: Median of performance-rated suppliers; fi nancial performance of the<br />

13 biggest OEMs<br />

Suppliers<br />

OEMs<br />

7.9

Suppliers | <strong>Automotive</strong> Insights | 9<br />

Heavy stamping of large body parts at Magna Steyr:<br />

Outperforming OEMs<br />

Accordingly, low performers showed below-average results<br />

in all three criteria.<br />

In the period studied, the top performers grew roughly<br />

three times as fast as the low performers, with annual<br />

revenue growth of 10.3 percent and 3.0 percent respectively.<br />

The top performers were also three times as<br />

profi table (with average ROCE of 16.3 percent versus<br />

5.7 percent). The gap between top and low performers<br />

has continued to widen over the past fi ve years.<br />

Top performers include well-known companies from Europe<br />

– for example Autoliv, Beru, Elring Klinger, Leoni – and<br />

North America – BorgWarner, Harmann International,<br />

Johnson Controls, Magna. Various Korean suppliers also<br />

qualifi ed as top performers over the last years. Among<br />

the low performers, we found several large-scale North<br />

American automotive suppliers like Dana, Delphi, Federal-<br />

Mogul, Metaldyne, and Visteon, but also many Japanese<br />

companies and the European heavyweight Faurecia. The<br />

differences between the two groups comes down to a<br />

question of strategy. As evidenced in the study, 12<br />

identifi ed levers made up the top performers‘ recipe for<br />

success in the areas of revenue structure, operating<br />

cost, balance sheet structure and management quality.<br />

In terms of revenues, top performers possess a more<br />

strongly focused product portfolio, as well as a broader<br />

and more globally aligned customer base. In particular,<br />

their share of revenues with the Big Three North American<br />

manufacturers – General Motors, Ford and Chrysler – tends<br />

to be lower than average.<br />

Top performers are more consistent in offshoring pro duction<br />

capacity to low-wage locations. They also make more<br />

selective investments in research and development and<br />

invest more in their plants and equipment. On the fi nancing<br />

side, top performers differentiate themselves through<br />

excellent working capital management and highly fl exible<br />

fi nancing structures gained from an over-proportional<br />

use of equity.<br />

Finally, stable management structures and lean customerfocused<br />

organizational structures, accompanied by effective<br />

controlling and fi nancial reporting systems, support the<br />

superior development of top performers.<br />

Outlook: <strong>Automotive</strong> supply remains an attractive but<br />

demanding industry segment<br />

Over the next years, the automotive supplier business<br />

will remain an attractive segment with very interesting<br />

investment opportunities for both suppliers and external<br />

investors, despite an undoubtedly challenging industry<br />

environment.<br />

Vehicle production is likely to increase further in key<br />

markets, with extraordinary growth rates in emerging<br />

Suppliers with a business focus on powertrain, chassis or infotainment reached above-average profitability<br />

Profi tability of automotive suppliers by product segment, 2005 [ROCE %]<br />

Powertrain<br />

Chassis Exterior Interior Infotainmt. Electrics Tires<br />

Change<br />

’05 vs. ’00<br />

-0.2 +2.7 -1.9 +2.7 +2.9 -2.9 +3.9<br />

ø ® ø ® ¢ ø ¢<br />

Average<br />

11.3<br />

11.7 12.0<br />

9.4<br />

12.8 13.0<br />

9.8<br />

11.4<br />

Basis: Median of performance-rated suppliers

10 | <strong>Automotive</strong> Insights | Suppliers<br />

Top perfomers grew more than 5 times faster than low performers and were more than 2 times more profitable<br />

Financial performance by supplier 2000-2005<br />

Revenue growth 1) [CAGR %]<br />

ROCE Avg. 2000-2005 1) [%]<br />

16.3<br />

ROCE 2005 [%]<br />

17.3<br />

10.3<br />

10.4<br />

2.9x<br />

11.3<br />

3.1x<br />

7.0<br />

3.4x<br />

3.0<br />

5.7<br />

5.5<br />

Top<br />

performer<br />

Industry<br />

Low<br />

performer<br />

Top<br />

performer<br />

Industry<br />

Low<br />

performer<br />

Top<br />

performer<br />

Industry<br />

Low<br />

performer<br />

1) If 2000 or 2005 fi gures are not available, 2001 and 2004 fi gures are used respectively Basis: Median of performance-rated suppliers<br />

markets such as India and Russia. Carmakers will also<br />

continue to pay premium prices for product features that<br />

help them differentiate themselves from other brands.<br />

In addition, many of the suppliers still have room to cut<br />

costs and boost profi tability, by offshoring production<br />

and engineering tasks to low-wage countries, optimizing<br />

their general expenses and improving their balance sheet<br />

structure.<br />

To exploit the outlined potential, suppliers should bear<br />

in mind the 12 levers that were identifi ed in the study.<br />

The key success factor for supplier executives to achieve<br />

or maintain the competitiveness of their companies will lie<br />

in deriving specifi c conclusions on how to deploy those<br />

levers. This could mean focusing more exactly on their<br />

product portfolio, making the customer base more international,<br />

or reengineering the fi nancing structure.<br />

The study, "Strategies for profitable growth in the<br />

global automotive supply industry", conducted by<br />

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants and the investment<br />

bank Rothschild draws on the analysis of<br />

fi nancial and business fi gures from more than 350<br />

globally operating automotive suppliers from the<br />

years 2000 to 2005.<br />

If you are interested<br />

in receiving a<br />

copy of the study,<br />

please complete<br />

the order form<br />

you can fi nd on<br />

the <strong>Roland</strong> <strong>Berger</strong><br />

website:<br />

www.rolandberger.com/expertise/publications<br />

For further information, please contact<br />

Dana Rehfuß, tel. +49 69 29924 6301, or<br />

dana_rehfuss@de.rolandberger.com<br />

THE TAKE-AWAY<br />

> <strong>Automotive</strong> suppliers have become more profi table<br />

in the past fi ve years – the gap between top and low<br />

performers is widening<br />

> Profi tability varies greatly by region, company size,<br />

and product segment<br />

> Successful suppliers applied – on average – different<br />

strategies than their low performing peers<br />

Marcus Berret<br />

Partner at <strong>Roland</strong> <strong>Berger</strong><br />

Strategy Consultants, Stuttgart<br />

marcus_berret@de.rolandberger.com

Interview | <strong>Automotive</strong> Insights | 11<br />

"Strong pressure to<br />

reduce prices"<br />

Interview: Thomas Kästele of investment bank Rothschild sees<br />

challenges for automotive suppliers, private equity and IPOs<br />

From the perspective of an investment<br />

banker, what are the key challenges the<br />

automotive supplier industry in Western<br />

Europe is currently facing?<br />

Obviously the continued strong pressure to<br />

reduce prices together with weak production<br />

volumes in Western Europe are the two most<br />

important challenges. This is particularly<br />

im portant for those suppliers that are signifi<br />

cantly exposed to the North American<br />

market, which has been really suffering. We<br />

have also seen that many European suppliers<br />

have been struggling to diversify their<br />

customer base to wards successful Asian,<br />

e.g. Ja pa nese and Korean, OEMs in order<br />

to achieve risk diversi fi cation and open new,<br />

profi table growth opportunities. The study,<br />

which Rothschild and <strong>Roland</strong> <strong>Berger</strong> have<br />

published recently, clearly shows that the<br />

more successful players, we called them<br />

top performers, had one of their advantages<br />

in this area.<br />

What recommendations would you give to<br />

automotive suppliers in Western Europe,<br />

and in particular in Germany, with regard<br />

to their capital structure?<br />

In our work as corporate fi nance advisors,<br />

we have seen that balance sheet fl exibility<br />

has become increasingly important, as<br />

the fi nancial structure of a supplier must<br />

be adaptable to an ever faster changing<br />

market environment. Therefore we saw the<br />

increasing use of fl exible fi nancing instruments,<br />

for example asset-backed securities<br />

and factoring, in the supplier industry in<br />

Germany. Also sale-and-lease-back structures<br />

have become increasingly important which<br />

refl ects the capital intensive nature of the<br />

sector. But it is not only the most suitable<br />

instruments at the lowest possible costs<br />

which are required, suppliers are also paying<br />

more attention to the terms and conditions<br />

of their fi nancing arrangements such as<br />

covenants, bas kets and transferability of<br />

loans. In particular with reference to the<br />

last point, a careful selection of the banking<br />

syndicate with a strong agency function is<br />

key. In this area, Rothschild’s Debt Advisory<br />

Team has been working with more and more<br />

suppliers to optimize their capital structure<br />

in a number of ways.<br />

In light of an increasing number of companies<br />

stumbling, do you expect that<br />

private equity investors will maintain or<br />

even further increase their activities in<br />

the German supplier industry?<br />

Some private equity investors have been<br />

struggling with their investments in the automotive<br />

supply industry, in particular in the<br />

German market. This has raised the level of<br />

concern within the private equity community<br />

and the fi nancing banks, which have made<br />

many of the deals in the past possible with<br />

aggressively leveraged transactions. I would<br />

expect that we will continue to see buy-outs<br />

in the German supplier industry but that<br />

investors will become more cautious in terms<br />

of the value creation potential and the<br />

question of how to exit again.<br />

Bearing in mind the rather negative<br />

public opinion regarding private equity<br />

investors, what is the value-added that<br />

those investors can bring to the table for<br />

privately-held automotive suppliers?<br />

Private equity investors typically take a broad<br />

approach in looking at the whole value chain<br />

Thomas Kästele<br />

Director at Rothschild GmbH,<br />

Frankfurt<br />

thomas.kaestele@rothschild.de<br />

of an automotive supplier. They try to implement<br />

improvements in all aspects of a<br />

company’s activities, but in our experience<br />

with acquisitions most attention was paid<br />

to areas such as clear profi table growth<br />

strategy, capital expenditures and working<br />

capital discipline and optimizing management<br />

and customer-oriented organizational<br />

structures. In addition, creating value<br />

through buy and build strategies is also<br />

being considered in an industry, where we<br />

expect further consolidation on a global<br />

scale in many segments.<br />

How do you evaluate the IPO conditions<br />

for medium-sized suppliers, given that the<br />

last German public offering, Grammer AG,<br />

was undertaken almost two years ago?<br />

We believe that the equity market in general<br />

has no aversion towards automotive suppliers<br />

with a convincing equity story. The reasons<br />

for their absence in our view were the availability<br />

of cheaper funding from other sources<br />

of capital, in particular from the debt markets,<br />

and the concern of a potentially negative<br />

impact of detailed fi nancial disclosure requirements<br />

for those companies with attractive<br />

profi tability. However, the currently favorable<br />

equity market environment has convinced<br />

some IPO candidates that are market leaders<br />

in attractive niche areas such as infotainment,<br />

powertrain or fuel effi ciency to<br />

potentially consider a listing. We may see<br />

some of them come to the market in <strong>2007</strong>.

Amsterdam<br />

Bahrain<br />

Barcelona<br />

Beijing<br />

Berlin<br />

Brussels<br />

Bucharest<br />

Budapest<br />

Detroit<br />

Düsseldorf<br />

Frankfurt<br />

Hamburg<br />

Kiev<br />

Lisbon<br />

London<br />

Madrid<br />

Milan<br />

Moscow<br />

Munich<br />

New York<br />

Paris<br />

Prague<br />

Riga<br />

Rome<br />

São Paulo<br />

Shanghai<br />

Stuttgart<br />

Tokyo<br />

Vienna<br />

Warsaw<br />

Zagreb<br />

Zurich<br />

© <strong>Roland</strong> <strong>Berger</strong> Strategy Consultants<br />

All rights reserved<br />

www.rolandberger.com