Automotive inSIGHTS 1/2007 - Roland Berger

Automotive inSIGHTS 1/2007 - Roland Berger

Automotive inSIGHTS 1/2007 - Roland Berger

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10 | <strong>Automotive</strong> Insights | Suppliers<br />

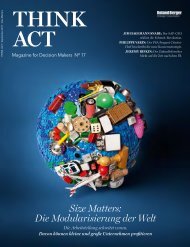

Top perfomers grew more than 5 times faster than low performers and were more than 2 times more profitable<br />

Financial performance by supplier 2000-2005<br />

Revenue growth 1) [CAGR %]<br />

ROCE Avg. 2000-2005 1) [%]<br />

16.3<br />

ROCE 2005 [%]<br />

17.3<br />

10.3<br />

10.4<br />

2.9x<br />

11.3<br />

3.1x<br />

7.0<br />

3.4x<br />

3.0<br />

5.7<br />

5.5<br />

Top<br />

performer<br />

Industry<br />

Low<br />

performer<br />

Top<br />

performer<br />

Industry<br />

Low<br />

performer<br />

Top<br />

performer<br />

Industry<br />

Low<br />

performer<br />

1) If 2000 or 2005 fi gures are not available, 2001 and 2004 fi gures are used respectively Basis: Median of performance-rated suppliers<br />

markets such as India and Russia. Carmakers will also<br />

continue to pay premium prices for product features that<br />

help them differentiate themselves from other brands.<br />

In addition, many of the suppliers still have room to cut<br />

costs and boost profi tability, by offshoring production<br />

and engineering tasks to low-wage countries, optimizing<br />

their general expenses and improving their balance sheet<br />

structure.<br />

To exploit the outlined potential, suppliers should bear<br />

in mind the 12 levers that were identifi ed in the study.<br />

The key success factor for supplier executives to achieve<br />

or maintain the competitiveness of their companies will lie<br />

in deriving specifi c conclusions on how to deploy those<br />

levers. This could mean focusing more exactly on their<br />

product portfolio, making the customer base more international,<br />

or reengineering the fi nancing structure.<br />

The study, "Strategies for profitable growth in the<br />

global automotive supply industry", conducted by<br />

<strong>Roland</strong> <strong>Berger</strong> Strategy Consultants and the investment<br />

bank Rothschild draws on the analysis of<br />

fi nancial and business fi gures from more than 350<br />

globally operating automotive suppliers from the<br />

years 2000 to 2005.<br />

If you are interested<br />

in receiving a<br />

copy of the study,<br />

please complete<br />

the order form<br />

you can fi nd on<br />

the <strong>Roland</strong> <strong>Berger</strong><br />

website:<br />

www.rolandberger.com/expertise/publications<br />

For further information, please contact<br />

Dana Rehfuß, tel. +49 69 29924 6301, or<br />

dana_rehfuss@de.rolandberger.com<br />

THE TAKE-AWAY<br />

> <strong>Automotive</strong> suppliers have become more profi table<br />

in the past fi ve years – the gap between top and low<br />

performers is widening<br />

> Profi tability varies greatly by region, company size,<br />

and product segment<br />

> Successful suppliers applied – on average – different<br />

strategies than their low performing peers<br />

Marcus Berret<br />

Partner at <strong>Roland</strong> <strong>Berger</strong><br />

Strategy Consultants, Stuttgart<br />

marcus_berret@de.rolandberger.com