Automotive inSIGHTS 1/2007 - Roland Berger

Automotive inSIGHTS 1/2007 - Roland Berger

Automotive inSIGHTS 1/2007 - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6 | <strong>Automotive</strong> Insights | Low Cost Cars<br />

ferences are two of the most important success factors.<br />

Market selection involves evaluating the regulatory environment,<br />

economic situation and consumer behaviors,<br />

as well as the activities of other OEMs. Further success<br />

factors include adapting vehicles for local markets,<br />

operating platform strategies, extensively standardizing<br />

components and production processes, choosing low cost<br />

locations. To determine which country presents the highest<br />

potential and is most favorable for low cost car production,<br />

it is important to examine each individual market.<br />

In the US, the low cost car segment is expected to grow<br />

to 0.7 million vehicles by 2012<br />

The fi rst low cost car ever made in the USA was Henry<br />

Ford‘s Model T. In its last year of production, the Model T<br />

costed USD 380 – the equivalent of USD 4,200 at today‘s<br />

prices. But cars have become less afford able over time.<br />

Between 1980 and 2003, the average vehicle selling<br />

price rose by 2.2 percent per annum, growing faster than<br />

all but the top 5 percent of US family incomes. At the<br />

same time, high fuel prices are driving down demand for<br />

large SUVs while boosting sales of small cars.<br />

Through 2012, the entry level car segment in Western<br />

Europe will grow by only 0.3 million vehicles<br />

Despite Western Europe‘s prosperity, car prices have outgrown<br />

the wages. As a result, many consumers are becoming<br />

more and more willing to compromise on comfort,<br />

basing car purchase decisions mainly on price instead.<br />

One vivid illustration of this phenomenon is the unexpected<br />

success of Renault‘s Dacia Logan. New models in the<br />

low cost, entry-level segment have considerable potential<br />

if they are fuel-effi cient and inexpensive to run.<br />

Domestic entry-level sales in the Japanese automotive<br />

market are expected to grow from 2.5 million vehicles<br />

in 2006 to 2.6 million vehicles in 2012<br />

Entry-level vehicles in Japan fall into two categories:<br />

Compact cars with engine displacement between 1,000<br />

cc and 1,300 cc and "Kei" or sub-compact cars with<br />

engine displacement of less than 660 cc. The entry-level<br />

vehicle segment, including sub-compact cars, accounted<br />

for 43 percent of the passenger car market in 2005, a<br />

slight increase from the 41 percent market share in 2001.<br />

Japan presents an interesting contrast to other vehicle<br />

markets in that the trend seems to be moving from larger<br />

to smaller vehicles. Foreign OEMs who aim to take advantage<br />

of this trend are nevertheless likely to face numerous<br />

challenges, given the strength of domestic OEMs.<br />

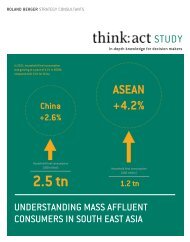

We expect China to be the strongest growth market, with<br />

a volume of 2.6 million entry-level cars by 2012<br />

Currently, the cheapest cars in the world are produced<br />

and sold in China, with MSRPs for many models starting<br />

below EUR 3,000. In China, the upper starting price limit<br />

for A segment cars is around EUR 4,000.<br />

> China‘s entry-level segment is growing rapidly and<br />

represents one third of the market<br />

> The quality of Chinese production is improving and<br />

the market still has plenty excess capacity<br />

> Local Chinese OEMs are gearing up for exports to<br />

developed markets<br />

Global sales forecast of A/B-segment vehicles ('000 units)<br />

4.2%<br />

455 582<br />

Mexico<br />

2006<br />

8,7%<br />

428 705<br />

USA<br />

3.9%<br />

1,204 1,513<br />

Brazil<br />

0,8%<br />

5,471 5,756<br />

Western Europe<br />

4.1%<br />

17,685<br />

13,935<br />

7.8%<br />

726 1,138<br />

Eastern Europe<br />

8.7%<br />

226 441<br />

Russia 1)<br />

7.6%<br />

980 1,519<br />

India<br />

13.4% 133 216<br />

1,243 2,640<br />

China<br />

16.3%<br />

42 104<br />

Thailand<br />

8.4%<br />

South Korea<br />

6.4%<br />

265 385<br />

Malaysia<br />

0.6%<br />

2,508 2,599<br />

Japan<br />

2012<br />

A/B Worldwide<br />

1) For Russia comparison of 2006 vs. 2014 CAGR 2006-2012 Source: J.D. Power; <strong>Roland</strong> <strong>Berger</strong> market model