Chinese Consumer Report 2012 - Luxury - Roland Berger

Chinese Consumer Report 2012 - Luxury - Roland Berger

Chinese Consumer Report 2012 - Luxury - Roland Berger

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Defining <strong>Chinese</strong> luxury brand consumers<br />

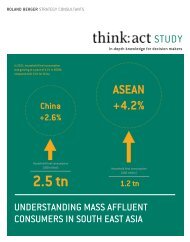

The capacity and increasing speed of the global luxury market<br />

[One billion euros]<br />

Other countries<br />

Other Asia-Pacific<br />

countries<br />

Japan<br />

<strong>Chinese</strong> mainland<br />

America<br />

Europe<br />

Who are <strong>Chinese</strong> luxury brand consumers?<br />

CAGR<br />

New market<br />

capacity<br />

New market<br />

proportion<br />

Source: <strong>Roland</strong> <strong>Berger</strong> Analysis<br />

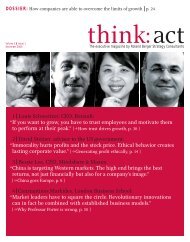

Gender distribution Age distribution Household income distribution<br />

<strong>Chinese</strong> consumers are displaying a newfound<br />

and growing interest in luxury goods. The<br />

wealthy and elite are eagerly embracing the<br />

culture of the luxury market and wish to own<br />

the same brands that are popular in developed<br />

economies. This has not escaped the notice of<br />

mainstream luxury brand producers. In recent<br />

years they have seen their products become<br />

a feature of daily life in China to a moderate<br />

but steadily increasing degree. If luxury goods<br />

makers are to capitalize on this trend they<br />

should move quickly to acquire and develop<br />

a deeper understanding of <strong>Chinese</strong> luxury<br />

consumers. As <strong>Chinese</strong> luxury consumers are<br />

expected to account for 40% of the new luxury<br />

market globally between 2010- 2015, it is an<br />

opportunity that few can afford to miss.<br />

Male<br />

Female<br />

China<br />

Source: 2011 <strong>Roland</strong> <strong>Berger</strong>’s <strong>Chinese</strong> <strong>Luxury</strong> <strong>Consumer</strong>s Survey (n=1,393), Germany 2010 Survey; <strong>Roland</strong> <strong>Berger</strong> analysis<br />

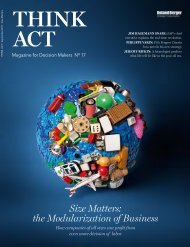

Archetypes of <strong>Chinese</strong> luxury consumers<br />

Archetypes:<br />

Western<br />

European<br />

<strong>Consumer</strong>s<br />

Era leader<br />

Wealthy second<br />

generation<br />

Western<br />

European<br />

<strong>Consumer</strong>s<br />

China<br />

highest<br />

20%<br />

medium<br />

30%<br />

lowest<br />

50%<br />

Ambitious elites Savvy investors<br />

Western<br />

European<br />

<strong>Consumer</strong>s<br />

Stylish whitecollars<br />

China<br />

Gift buyers<br />

Buyers of luxury goods in China are younger<br />

than buyers in mature markets. This can<br />

be attributed to a large degree to China's<br />

demography. China has a relatively young<br />

age population and wealth creation has been<br />

mostly concentrated in the young generation<br />

since the country's social and economic<br />

reform. A further differentiating factor,<br />

however, is that <strong>Chinese</strong> luxury consumers are<br />

often found in the top social status group as<br />

opposed to the more general across-the-board<br />

distribution that occurs in mature markets.<br />

Archetypes<br />

% Share ~25% ~30% ~10% ~5% ~10% ~20%<br />

Social profile<br />

Psychological<br />

traits<br />

Behavioral<br />

traits<br />

> private business<br />

owners, corporate<br />

executives<br />

(foreign, stateowned,<br />

private)<br />

> 25 to 40 years<br />

old<br />

Pursue<br />

>worship<br />

>wisdom<br />

>self-cultivation<br />

>follow others<br />

> recognize top<br />

brands<br />

> young people<br />

from the second<br />

generation of<br />

the wealthy<br />

and officials,<br />

including “rich<br />

men’s wives”<br />

> 20 to 35 years<br />

old<br />

Pursue<br />

>innovation<br />

>self-confidence<br />

>passion<br />

> are independent<br />

> have strong selfawareness<br />

> middle managers<br />

of multinational<br />

or state-owned<br />

companies,<br />

professionals,<br />

entrepreneurs<br />

> 25 to 35 years<br />

old<br />

Pursue<br />

>enterprise<br />

>passion<br />

>challenge<br />

> have strong selfawareness<br />

> have a good<br />

understanding of<br />

luxury goods<br />

> real estate<br />

speculators,<br />

stock traders,<br />

freelancers, the<br />

unemployed<br />

> 25 to 40 years<br />

old<br />

Pursue<br />

>trendiness<br />

>individuality<br />

>luxury<br />

> have fluctuating<br />

consumption<br />

capacity<br />

> focus on<br />

popularity<br />

> fresh to the<br />

workforce, have<br />

stable income<br />

higher than their<br />

peers<br />

> 20 to 30 years<br />

old<br />

Pursue<br />

>beauty<br />

>luxury<br />

>fashion<br />

> have strong selfawareness<br />

> have a good<br />

understanding of<br />

luxury goods<br />

> lack of distinctive<br />

features<br />

Pursue<br />

>worship<br />

>respect<br />

> have a low<br />

purchasing<br />

frequency<br />

> focus on<br />

popularity<br />

<strong>Roland</strong> <strong>Berger</strong> experts segmented <strong>Chinese</strong><br />

luxury consumers into six archetypes<br />

based on their physical, psychological and<br />

behavioral characteristics. The six archetypes<br />

are Era Leaders, Wealthy Second Generation,<br />

Ambitious Elites, Savvy Investors, Stylish<br />

White Collars and Gift Buyers. An in-depth<br />

appreciation of the uniqueness of these six<br />

groups can assist producers of luxury brands<br />

to devise more precise brand development<br />

strategies for the <strong>Chinese</strong> market.<br />

Source: 2011 <strong>Roland</strong> <strong>Berger</strong>’s <strong>Chinese</strong> <strong>Luxury</strong> <strong>Consumer</strong>s Survey (n=1,393), industry interviews; <strong>Roland</strong> <strong>Berger</strong> analysis<br />

4