RQIA Annual Report & Accounts 2011-12 - Regulation and Quality ...

RQIA Annual Report & Accounts 2011-12 - Regulation and Quality ...

RQIA Annual Report & Accounts 2011-12 - Regulation and Quality ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The unchanged position illustrates the pay freeze experienced by both <strong>RQIA</strong>‟s<br />

highest paid Director <strong>and</strong> <strong>RQIA</strong>‟s median paid staff. <strong>RQIA</strong> reorganised its<br />

Directorate structures <strong>and</strong> responsibilities during <strong>2011</strong>-<strong>12</strong>, however the skill mix of<br />

staff remained largely unchanged.<br />

In <strong>2011</strong>-<strong>12</strong> <strong>and</strong> 2010-11 no employees received remuneration in excess of the<br />

highest paid director. Remuneration ranged from £0K – £5K to £145K - £150K.<br />

The calculation on total remuneration includes salary, non-consolidated<br />

performance-related pay, benefits-in-kind as well as severance payments. The<br />

calculation does not include employer pension contributions <strong>and</strong> the cash<br />

equivalent transfer value of pensions. In <strong>2011</strong>-<strong>12</strong> <strong>RQIA</strong> did not make any<br />

severance or non-consolidated performance related pay payments or provide any<br />

benefits-in-kind.<br />

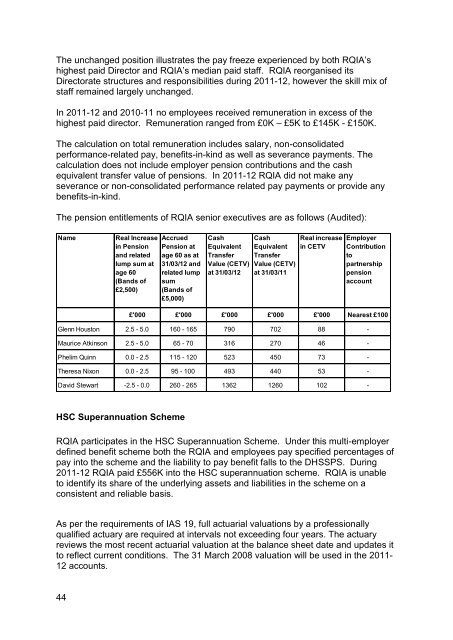

The pension entitlements of <strong>RQIA</strong> senior executives are as follows (Audited):<br />

Name<br />

Real Increase<br />

in Pension<br />

<strong>and</strong> related<br />

lump sum at<br />

age 60<br />

(B<strong>and</strong>s of<br />

£2,500)<br />

Accrued<br />

Pension at<br />

age 60 as at<br />

31/03/<strong>12</strong> <strong>and</strong><br />

related lump<br />

sum<br />

(B<strong>and</strong>s of<br />

£5,000)<br />

Cash<br />

Equivalent<br />

Transfer<br />

Value (CETV)<br />

at 31/03/<strong>12</strong><br />

Cash<br />

Equivalent<br />

Transfer<br />

Value (CETV)<br />

at 31/03/11<br />

Real increase<br />

in CETV<br />

Employer<br />

Contribution<br />

to<br />

partnership<br />

pension<br />

account<br />

£'000 £'000 £'000 £'000 £'000 Nearest £100<br />

Glenn Houston 2.5 - 5.0 160 - 165 790 702 88 -<br />

Maurice Atkinson 2.5 - 5.0 65 - 70 316 270 46 -<br />

Phelim Quinn 0.0 - 2.5 115 - <strong>12</strong>0 523 450 73 -<br />

Theresa Nixon 0.0 - 2.5 95 - 100 493 440 53 -<br />

David Stewart -2.5 - 0.0 260 - 265 1362 <strong>12</strong>60 102 -<br />

HSC Superannuation Scheme<br />

<strong>RQIA</strong> participates in the HSC Superannuation Scheme. Under this multi-employer<br />

defined benefit scheme both the <strong>RQIA</strong> <strong>and</strong> employees pay specified percentages of<br />

pay into the scheme <strong>and</strong> the liability to pay benefit falls to the DHSSPS. During<br />

<strong>2011</strong>-<strong>12</strong> <strong>RQIA</strong> paid £556K into the HSC superannuation scheme. <strong>RQIA</strong> is unable<br />

to identify its share of the underlying assets <strong>and</strong> liabilities in the scheme on a<br />

consistent <strong>and</strong> reliable basis.<br />

As per the requirements of IAS 19, full actuarial valuations by a professionally<br />

qualified actuary are required at intervals not exceeding four years. The actuary<br />

reviews the most recent actuarial valuation at the balance sheet date <strong>and</strong> updates it<br />

to reflect current conditions. The 31 March 2008 valuation will be used in the <strong>2011</strong>-<br />

<strong>12</strong> accounts.<br />

44