Partnership and Corporate Taxation (Acct 217) - Saddleback College

Partnership and Corporate Taxation (Acct 217) - Saddleback College

Partnership and Corporate Taxation (Acct 217) - Saddleback College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

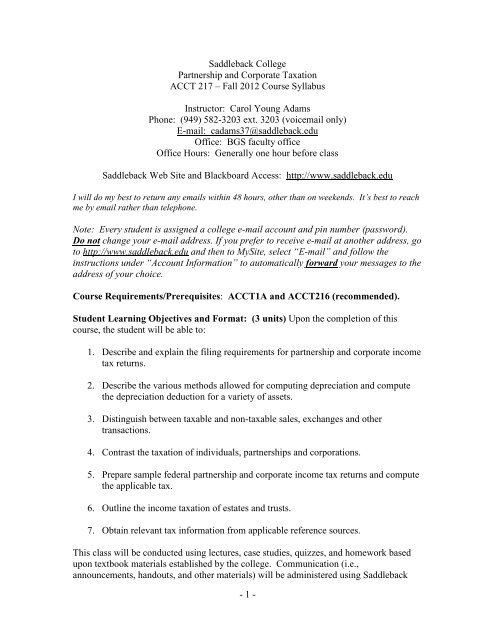

<strong>Saddleback</strong> <strong>College</strong><br />

<strong>Partnership</strong> <strong>and</strong> <strong>Corporate</strong> <strong>Taxation</strong><br />

ACCT <strong>217</strong> – Fall 2012 Course Syllabus<br />

Instructor: Carol Young Adams<br />

Phone: (949) 582-3203 ext. 3203 (voicemail only)<br />

E-mail: cadams37@saddleback.edu<br />

Office: BGS faculty office<br />

Office Hours: Generally one hour before class<br />

<strong>Saddleback</strong> Web Site <strong>and</strong> Blackboard Access: http://www.saddleback.edu<br />

I will do my best to return any emails within 48 hours, other than on weekends. It’s best to reach<br />

me by email rather than telephone.<br />

Note: Every student is assigned a college e-mail account <strong>and</strong> pin number (password).<br />

Do not change your e-mail address. If you prefer to receive e-mail at another address, go<br />

to http://www.saddleback.edu <strong>and</strong> then to MySite, select “E-mail” <strong>and</strong> follow the<br />

instructions under “Account Information” to automatically forward your messages to the<br />

address of your choice.<br />

Course Requirements/Prerequisites: ACCT1A <strong>and</strong> ACCT216 (recommended).<br />

Student Learning Objectives <strong>and</strong> Format: (3 units) Upon the completion of this<br />

course, the student will be able to:<br />

1. Describe <strong>and</strong> explain the filing requirements for partnership <strong>and</strong> corporate income<br />

tax returns.<br />

2. Describe the various methods allowed for computing depreciation <strong>and</strong> compute<br />

the depreciation deduction for a variety of assets.<br />

3. Distinguish between taxable <strong>and</strong> non-taxable sales, exchanges <strong>and</strong> other<br />

transactions.<br />

4. Contrast the taxation of individuals, partnerships <strong>and</strong> corporations.<br />

5. Prepare sample federal partnership <strong>and</strong> corporate income tax returns <strong>and</strong> compute<br />

the applicable tax.<br />

6. Outline the income taxation of estates <strong>and</strong> trusts.<br />

7. Obtain relevant tax information from applicable reference sources.<br />

This class will be conducted using lectures, case studies, quizzes, <strong>and</strong> homework based<br />

upon textbook materials established by the college. Communication (i.e.,<br />

announcements, h<strong>and</strong>outs, <strong>and</strong> other materials) will be administered using <strong>Saddleback</strong><br />

- 1 -