Partnership and Corporate Taxation (Acct 217) - Saddleback College

Partnership and Corporate Taxation (Acct 217) - Saddleback College

Partnership and Corporate Taxation (Acct 217) - Saddleback College

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

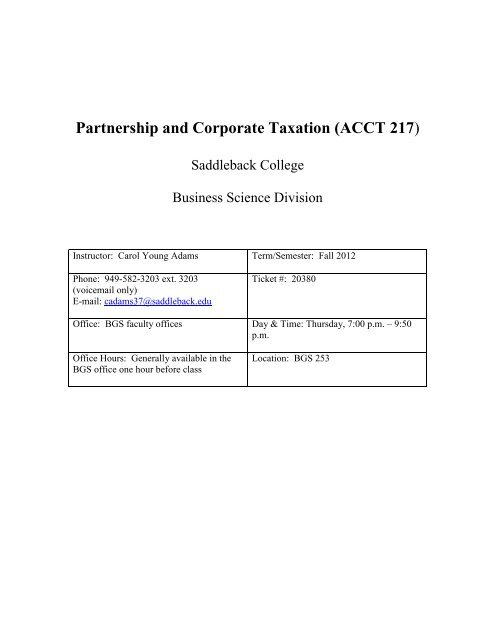

<strong>Partnership</strong> <strong>and</strong> <strong>Corporate</strong> <strong>Taxation</strong> (ACCT <strong>217</strong>)<br />

<strong>Saddleback</strong> <strong>College</strong><br />

Business Science Division<br />

Instructor: Carol Young Adams Term/Semester: Fall 2012<br />

Phone: 949-582-3203 ext. 3203<br />

(voicemail only)<br />

E-mail: cadams37@saddleback.edu<br />

Ticket #: 20380<br />

Office: BGS faculty offices Day & Time: Thursday, 7:00 p.m. – 9:50<br />

p.m.<br />

Office Hours: Generally available in the<br />

BGS office one hour before class<br />

Location: BGS 253

<strong>Saddleback</strong> <strong>College</strong><br />

<strong>Partnership</strong> <strong>and</strong> <strong>Corporate</strong> <strong>Taxation</strong><br />

ACCT <strong>217</strong> – Fall 2012 Course Syllabus<br />

Instructor: Carol Young Adams<br />

Phone: (949) 582-3203 ext. 3203 (voicemail only)<br />

E-mail: cadams37@saddleback.edu<br />

Office: BGS faculty office<br />

Office Hours: Generally one hour before class<br />

<strong>Saddleback</strong> Web Site <strong>and</strong> Blackboard Access: http://www.saddleback.edu<br />

I will do my best to return any emails within 48 hours, other than on weekends. It’s best to reach<br />

me by email rather than telephone.<br />

Note: Every student is assigned a college e-mail account <strong>and</strong> pin number (password).<br />

Do not change your e-mail address. If you prefer to receive e-mail at another address, go<br />

to http://www.saddleback.edu <strong>and</strong> then to MySite, select “E-mail” <strong>and</strong> follow the<br />

instructions under “Account Information” to automatically forward your messages to the<br />

address of your choice.<br />

Course Requirements/Prerequisites: ACCT1A <strong>and</strong> ACCT216 (recommended).<br />

Student Learning Objectives <strong>and</strong> Format: (3 units) Upon the completion of this<br />

course, the student will be able to:<br />

1. Describe <strong>and</strong> explain the filing requirements for partnership <strong>and</strong> corporate income<br />

tax returns.<br />

2. Describe the various methods allowed for computing depreciation <strong>and</strong> compute<br />

the depreciation deduction for a variety of assets.<br />

3. Distinguish between taxable <strong>and</strong> non-taxable sales, exchanges <strong>and</strong> other<br />

transactions.<br />

4. Contrast the taxation of individuals, partnerships <strong>and</strong> corporations.<br />

5. Prepare sample federal partnership <strong>and</strong> corporate income tax returns <strong>and</strong> compute<br />

the applicable tax.<br />

6. Outline the income taxation of estates <strong>and</strong> trusts.<br />

7. Obtain relevant tax information from applicable reference sources.<br />

This class will be conducted using lectures, case studies, quizzes, <strong>and</strong> homework based<br />

upon textbook materials established by the college. Communication (i.e.,<br />

announcements, h<strong>and</strong>outs, <strong>and</strong> other materials) will be administered using <strong>Saddleback</strong><br />

- 1 -

<strong>College</strong>’s Blackboard Learning System. Supplemental “lectures” will be presented<br />

through the use of technology tools such as iPod audio <strong>and</strong> other on-line media.<br />

Homework will be administered through the textbook publisher’s Connect homework<br />

management system.<br />

Text:<br />

Required: “<strong>Taxation</strong> of Business Entities 2012 Edition,” Spilker, Brian, Ayers, Ben, et<br />

al., McGraw-Hill/Irwin Publishing Company, 2011. (Bundled with Connect) ISBN<br />

0077434137.<br />

To register with McGraw-Hill-use the following address:<br />

http://connect.mcgraw-hill.com/class/c_adams_acct_<strong>217</strong>-partnership__corp_tax<br />

Note: The textbook package includes everything you need for this class <strong>and</strong> is specially<br />

bundled for you by the publisher. It is only available through the <strong>Saddleback</strong> bookstore<br />

or on-line with the publisher. If you purchase the text from any other source, you will be<br />

responsible for any resource that is in this package.<br />

Exams/Grading Policy:<br />

Exams will consist of multiple choice questions, short answer questions, essays <strong>and</strong> short<br />

problems. There will be NO MAKE UP EXAMS given for any reason. If for an<br />

EMERGENCY reason you must miss an exam, the instructor must be notified BEFORE<br />

the scheduled exam or a grade of zero will be assigned. Late work will not be accepted.<br />

Your grade will be determined on the basis of the number of cumulative points scored on<br />

quizzes, exams, projects, <strong>and</strong> class participation. The points will be weighted as follows:<br />

Exam (4@ 100pts)<br />

Homework<br />

Project <strong>and</strong> or quizzes<br />

400 points<br />

240 points<br />

60 points<br />

Note: Homework will be administered via Connect (see below). There is no extra<br />

credit.<br />

---------------<br />

TOTAL 700 POINTS<br />

Grades are determined as follows:<br />

Grade Index: Points % Letter Grade<br />

(630-700) 90-100 A<br />

(560-629) 80- 89 B<br />

(490-559) 70- 79 C<br />

(420-489) 60- 69 D<br />

(0 - 419) below 60 F<br />

- 2 -

Access to Blackboard (<strong>Saddleback</strong>’s Online Portal)<br />

Go online to http://socccd.blackboard.com, click on “Logon.” Complete instructions are<br />

available to the left of the “Username” <strong>and</strong> “Password” boxes. If, after following the<br />

instructions, you are unable to access BLACKBOARD, please advise me <strong>and</strong> I will<br />

advise you whom you may e-mail for assistance. Include your name, student ID, your<br />

four-digit PIN <strong>and</strong> your Course ID.<br />

Access to Connect<br />

Homework, quizzes, <strong>and</strong> exams are administered through Connect. You may access the<br />

application either through Blackboard/External Links or directly through the URL<br />

provided to you by the instructor. (http://connect.mcgrawhill.com/class/c_adams_acct_<strong>217</strong>-partnership__corp_tax)<br />

You must register as a student<br />

with the access code provided to you in the text package (see TEXT above). Work<br />

MUST be submitted into Connect only <strong>and</strong> will not be accepted in any other form.<br />

To create a student account, follow these directions:<br />

1. Click on the “Register for this class” link on the student menu found on your<br />

course homepage.<br />

2. Enter the 20 digit code in the boxes on the Student Registration page, <strong>and</strong> click<br />

the next button (note: the code is case-sensitive; please enter the code in upper<br />

case letters).<br />

3. Fill out the registration form that appears <strong>and</strong> click the “OK” button.<br />

4. Click the “YES” button to confirm your account.<br />

Connect Tips<br />

<br />

<br />

<br />

<br />

<br />

You can only do one thing at a time. You cannot view past results while you are<br />

in the process of taking an assignment. You cannot take two graded assignments<br />

at the same time.<br />

When trying to print an assignment use the browser’s Print Preview <strong>and</strong> Page<br />

Setup options to get the best output possible. You should switch from portrait to<br />

l<strong>and</strong>scape, <strong>and</strong> should extend the margins as far as possible.<br />

Use the “Next,” “Back,” “Jump to,” <strong>and</strong> “Save my Work” buttons periodically to<br />

save <strong>and</strong> avoid timing out. If there is no activity within 60 minutes, Homework<br />

Manager will automatically log out your session.<br />

Click “Quit <strong>and</strong> Save” if you wish to work on your assignment at a later time<br />

without grading. Remember, you can only work on one open, un-graded<br />

assignment at a time.<br />

Don’t copy <strong>and</strong> paste, this might enter illegal characters in your homework <strong>and</strong><br />

prevent you from getting a grade.<br />

- 3 -

McGraw-Hill Faculty <strong>and</strong> student tech support:<br />

Telephone Tech support: 1-800-331-5094<br />

Email tech support: www.mhhe.com/support<br />

Normal Hours (Pacific St<strong>and</strong>ard Time), open 76 hours per week:<br />

Sunday:<br />

4 p.m. – 9 p.m.<br />

Monday – Thursday: 6 a.m. – 9 p.m.<br />

Friday:<br />

6 a.m. – 4 p.m.<br />

Note: Technical Support for Homework Manager, eBook, <strong>and</strong> other course content<br />

should be addressed with McGraw-Hill Technical Support.<br />

CHEATING<br />

THE FIELD OF ACCOUNTING REQUIRES A HIGH DEGREE OF ETHICAL<br />

RESPONSIBILITY IN ORDER TO INSTILL A LEVEL OF CONFIDENCE IN THE<br />

QUALITY OF THE INFORMATION PRODUCED. AN ACADEMIC<br />

ENVIRONMENT IS NO DIFFERENT. CHEATING OF ANY KIND ON ANY<br />

PROJECT OR TEST WILL NOT BE TOLERATED IN THIS CLASS. A STUDENT<br />

WHO IS SUSPECTED OF CHEATING WILL BE SUBJECT TO THE APPROPRIATE<br />

PROCEDURES DESCRIBED IN THE SADDLEBACK COLLEGE STUDENT CODE<br />

OF CONDUCT.<br />

THESE PROCEDURES PROVIDE GUIDANCE REGARDING CHEATING OR<br />

PLAGIARISM AND MAY RESULT IN AN ASSIGNED GRADE OF "F" FOR THE<br />

COURSE. THE PROCEDURES PROVIDE THE INSTRUCTOR WITH<br />

THE RIGHT TO ADJUST INDIVIDUAL GRADES DUE TO CIRCUMSTANCES<br />

THAT MAY AFFECT A PARTICULAR STUDENT DURING THE SEMESTER. IN<br />

SHORT -- DON'T CHEAT. IT GIVES ONE A NEGATIVE REPUTATION AND<br />

DOES NOT ALLOW YOU TO BUILD THE CONFIDENCE THAT YOU NEED TO<br />

SUCCEED IN THE REAL WORLD. CHEATING IS DEFINED AS TURNING IN<br />

WORK AS ONE'S OWN WHICH IS ACTUALLY THE WORK OF SOMEONE ELSE.<br />

THIS APPLIES TO ALL WORK IN THIS CLASS, INCLUDING TEST ANSWERS.<br />

"PEEKING" AT ONE'S NOTES DURING AN EXAM WILL ALSO NOT BE<br />

TOLERATED. "QUESTIONING" OTHER STUDENTS IN MY CLASS AS TO<br />

"WHAT THE EXAM COVERED" WILL ALSO CONSTITUTE CHEATING. ANY<br />

INSTANCES OF THIS TYPE WILL BE PUNISHED BY THE ASSIGNMENT OF AN<br />

AUTOMATIC "F." IT WILL BE DISALLOWED IN MY CLASS - PERIOD.<br />

WITHDRAWALS DURING THE TERM<br />

See <strong>Saddleback</strong> <strong>College</strong> web site at www.saddleback.edu<br />

Do not assume that the instructor will automatically drop you from the course. If you<br />

feel you must drop, take the initiative <strong>and</strong> do it yourself.<br />

- 4 -

Course Policies, Procedures <strong>and</strong> Assignments<br />

The instructor assumes you have the requisite computer skills to successfully<br />

complete this course. This includes (at least) proficiency with Microsoft Office<br />

<strong>and</strong> access to the Internet.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Each chapter will have a series of exercises <strong>and</strong> problem, which will be performed<br />

through Connect. Exercises are worth 20 points per chapter.<br />

There will be four exams administered throughout the semester.<br />

There will be an additional 60 points that will consist of a project (or projects) <strong>and</strong><br />

or in class quizzes.<br />

Since you are being provided with due dates well in advance, there will be no<br />

extensions for due dates for Connect. Reasons such as “Blackboard or Connect<br />

was down” will not be accepted.<br />

You are expected to read the chapter materials, review the author’s support<br />

materials, complete assigned homework, quizzes, <strong>and</strong> exams prior to the assigned<br />

due date. You are responsible for any material provided by the textbook publisher<br />

in the textbook <strong>and</strong>/or their online learning web site.<br />

ALL cell phones, pagers, palm pilots, iPods, <strong>and</strong> other wireless devices must be<br />

OFF during class <strong>and</strong> during exams.<br />

Tape recorders, calculators <strong>and</strong> laptop computers are permitted in class. You are<br />

highly recommended to bring a calculator for exams. Cell phones <strong>and</strong> PDAs are<br />

NOT allowed for exams. If you have any questions, please ask the instructor<br />

before the exam.<br />

This course will cover the entire textbook except chapters 12 <strong>and</strong> 13.<br />

<br />

<br />

Every student is required to attend all class sessions <strong>and</strong> complete all assignments.<br />

There will be no make-up lectures on an individual basis. Poor attendance will be<br />

sufficient grounds for being DROPPED from the course; however, do not assume<br />

that the instructor will drop you from the course. Once the semester reaches the<br />

drop deadline, you will receive a grade.<br />

You are expected to read the chapter materials prior to class lecture. The author’s<br />

PowerPoint presentations are used as a lecture outline but we will discuss much<br />

more than what is on the file. You are responsible for any material presented in<br />

the textbook, resource material, or class discussion.<br />

- 5 -

ACCOUNTING <strong>217</strong><br />

PARTNERSHIP AND CORPORATE TAXATION (FALL 2012)<br />

Note: Dates are approximates <strong>and</strong> are subject to change; Exam dates are approximate<br />

<strong>and</strong> will be officially announced in class.<br />

Administration of each week’s chapter multiple-choice questions will be through<br />

Connect. You must register online with Connect.<br />

Connect is an interactive, Internet-based product designed to help you complete all<br />

exercises <strong>and</strong> problems. You will receive instant feedback <strong>and</strong> the ability to correct any<br />

errors. All work must be fully completed <strong>and</strong> turned in by its due date. You are<br />

responsible for the due dates listed in Connect or as provided in class.<br />

Calendar:<br />

Week<br />

Week<br />

Beginning<br />

Chapter<br />

Assignment<br />

1. 8/23 Over-view <strong>and</strong> Introduction<br />

2. 8/30 Chapter 1 – Business Income,<br />

Deductions, <strong>and</strong> Accounting<br />

Methods<br />

3. 9/6 Chapter 2 – Property Acquisition<br />

<strong>and</strong> Cost Recovery<br />

Connect problems Ch 1-due @<br />

midnight on 9/7<br />

Connect problems Ch 2 due @<br />

midnight on 9/14<br />

4. 9/13 Chapter 3 – Property Dispositions Connect probems Ch 3 due @<br />

midnight on 9/21<br />

5. 9/20 Chapters 4 – Entities Overview<br />

(included on Exam 2) & review for<br />

Connect problems Ch 4 due @<br />

midnight on 9/28<br />

exam 1<br />

6. 9/27 Exam 1 (Chapters 1–3)<br />

Connect problems Ch 5 due @<br />

Chapter 5 – <strong>Corporate</strong> Operations<br />

7. 10/4 Chapter 6 – Accounting for Income<br />

Taxes<br />

(Review for Exam 2-Ch 4,5,6)<br />

8. 10/11 Exam 2 (Chapters 4-6)<br />

Begin Chapter 7-<strong>Corporate</strong><br />

<strong>Taxation</strong>: Nonliquidating<br />

Distributions<br />

9. 10/18 Finish Chapter 7 & begin Chapter 8<br />

– <strong>Corporate</strong> <strong>Taxation</strong>: Formation,<br />

Reorganization, <strong>and</strong> Liquidation<br />

midnight on 10/5<br />

Connect problems Ch 6 due @<br />

midnight on 10/12<br />

Connect problems Ch 7 due @<br />

midnight on 10/26<br />

Connect problems Ch 8 due @<br />

midnight on 11/2<br />

- 6 -

Week<br />

Week<br />

Beginning<br />

Chapter<br />

Assignment<br />

10. 10/25 Finsh Chapter 8 – <strong>Corporate</strong><br />

<strong>Taxation</strong>: Formation,<br />

Reorganization, <strong>and</strong> Liquidation<br />

Begin Ch 9-Forming <strong>and</strong> Operating<br />

<strong>Partnership</strong>s<br />

11. 11/1 Finish Chap. 9 Forming <strong>and</strong><br />

Operating <strong>Partnership</strong>s<br />

Review for Exam 3 (Ch 7, 8, 9)<br />

12. 11/8 Exam 3 (Ch 7, 8, 9)<br />

Begin Chapter 10 – Dispositions of<br />

<strong>Partnership</strong> Interests <strong>and</strong><br />

<strong>Partnership</strong> Distributions<br />

13. 11/15 Finish Ch 10 & Begin Chapter 11 –<br />

14. 11/22<br />

(Thanksgiving<br />

Week)<br />

S Corporations<br />

No Class<br />

15. 11/29 Finish Chapter 11 – S Corporations<br />

Begin Chapter 14 Transfer Taxes<br />

<strong>and</strong> Wealth Planning<br />

16. 12/6 Chapter 14 Transfer Taxes <strong>and</strong><br />

Wealth Planning & review for<br />

exam<br />

17. 12/13 Exam 4 (Chapters 10, 11, 14)<br />

Connect problems Ch 9 due @<br />

midnight on 11/8<br />

No additional homework see above<br />

Connect problems Ch 10 due @<br />

midnight on 11/22<br />

Connect problems Ch 11 due @<br />

midnight on 12/7<br />

Connect problems Ch 14 due @<br />

midnight on 12/7<br />

No additional homework see above<br />

- 7 -