board of directors governance policy manual - SAE International

board of directors governance policy manual - SAE International

board of directors governance policy manual - SAE International

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

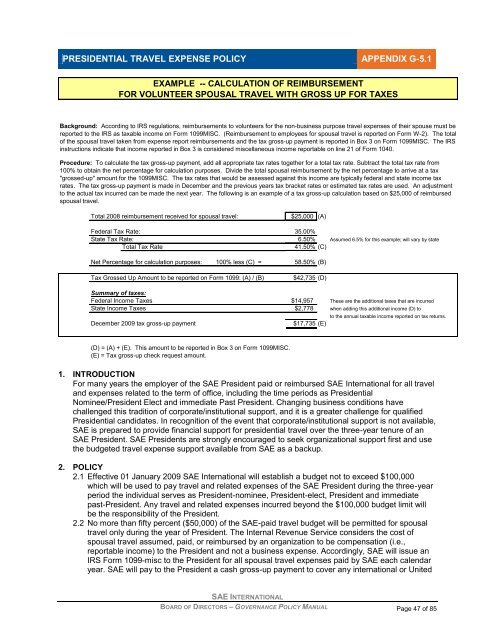

PRESIDENTIAL TRAVEL EXPENSE POLICY<br />

APPENDIX G-5.1<br />

EXAMPLE -- CALCULATION OF REIMBURSEMENT<br />

FOR VOLUNTEER SPOUSAL TRAVEL WITH GROSS UP FOR TAXES<br />

Background: According to IRS regulations, reimbursements to volunteers for the non-business purpose travel expenses <strong>of</strong> their spouse must be<br />

reported to the IRS as taxable income on Form 1099MISC. (Reimbursement to employees for spousal travel is reported on Form W-2). The total<br />

<strong>of</strong> the spousal travel taken from expense report reimbursements and the tax gross-up payment is reported in Box 3 on Form 1099MISC. The IRS<br />

instructions indicate that income reported in Box 3 is considered miscellaneous income reportable on line 21 <strong>of</strong> Form 1040.<br />

Procedure: To calculate the tax gross-up payment, add all appropriate tax rates together for a total tax rate. Subtract the total tax rate from<br />

100% to obtain the net percentage for calculation purposes. Divide the total spousal reimbursement by the net percentage to arrive at a tax<br />

"grossed-up" amount for the 1099MISC. The tax rates that would be assessed against this income are typically federal and state income tax<br />

rates. The tax gross-up payment is made in December and the previous years tax bracket rates or estimated tax rates are used. An adjustment<br />

to the actual tax incurred can be made the next year. The following is an example <strong>of</strong> a tax gross-up calculation based on $25,000 <strong>of</strong> reimbursed<br />

spousal travel.<br />

Total 2008 reimbursement received for spousal travel:<br />

$25,000 (A)<br />

Federal Tax Rate: 35.00%<br />

State Tax Rate: 6.50% Assumed 6.5% for this example; will vary by state<br />

Total Tax Rate<br />

41.50% (C)<br />

Net Percentage for calculation purposes: 100% less (C) = 58.50% (B)<br />

Tax Grossed Up Amount to be reported on Form 1099: (A) / (B)<br />

$42,735 (D)<br />

Summary <strong>of</strong> taxes:<br />

Federal Income Taxes $14,957 These are the additional taxes that are incurred<br />

State Income Taxes $2,778 when adding this additional income (D) to<br />

December 2009 tax gross-up payment<br />

$17,735 (E)<br />

to the annual taxable income reported on tax returns.<br />

(D) = (A) + (E). This amount to be reported in Box 3 on Form 1099MISC.<br />

(E) = Tax gross-up check request amount.<br />

1. INTRODUCTION<br />

For many years the employer <strong>of</strong> the <strong>SAE</strong> President paid or reimbursed <strong>SAE</strong> <strong>International</strong> for all travel<br />

and expenses related to the term <strong>of</strong> <strong>of</strong>fice, including the time periods as Presidential<br />

Nominee/President Elect and immediate Past President. Changing business conditions have<br />

challenged this tradition <strong>of</strong> corporate/institutional support, and it is a greater challenge for qualified<br />

Presidential candidates. In recognition <strong>of</strong> the event that corporate/institutional support is not available,<br />

<strong>SAE</strong> is prepared to provide financial support for presidential travel over the three-year tenure <strong>of</strong> an<br />

<strong>SAE</strong> President. <strong>SAE</strong> Presidents are strongly encouraged to seek organizational support first and use<br />

the budgeted travel expense support available from <strong>SAE</strong> as a backup.<br />

2. POLICY<br />

2.1 Effective 01 January 2009 <strong>SAE</strong> <strong>International</strong> will establish a budget not to exceed $100,000<br />

which will be used to pay travel and related expenses <strong>of</strong> the <strong>SAE</strong> President during the three-year<br />

period the individual serves as President-nominee, President-elect, President and immediate<br />

past-President. Any travel and related expenses incurred beyond the $100,000 budget limit will<br />

be the responsibility <strong>of</strong> the President.<br />

2.2 No more than fifty percent ($50,000) <strong>of</strong> the <strong>SAE</strong>-paid travel budget will be permitted for spousal<br />

travel only during the year <strong>of</strong> President. The Internal Revenue Service considers the cost <strong>of</strong><br />

spousal travel assumed, paid, or reimbursed by an organization to be compensation (i.e.,<br />

reportable income) to the President and not a business expense. Accordingly, <strong>SAE</strong> will issue an<br />

IRS Form 1099-misc to the President for all spousal travel expenses paid by <strong>SAE</strong> each calendar<br />

year. <strong>SAE</strong> will pay to the President a cash gross-up payment to cover any international or United<br />

<strong>SAE</strong> INTERNATIONAL<br />

BOARD OF DIRECTORS – GOVERNANCE POLICY MANUAL<br />

Page 47 <strong>of</strong> 85