San Antonio Independent School District PURCHASING CARD ...

San Antonio Independent School District PURCHASING CARD ...

San Antonio Independent School District PURCHASING CARD ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SAN ANTONIO INDEPENDENT<br />

SCHOOL DISTRICT<br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

2010 2011

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

BOARD OF TRUSTEES<br />

James Howard................................................................................................................ President<br />

Carlos Villarreal ..................................................................................................... Vice President<br />

Thomas C. Lopez ........................................................................................................... Secretary<br />

Olga M. Hernandez ............................................................................................... Asst. Secretary<br />

Ruben D. Cuero ...............................................................................................................Member<br />

Adela R. Segovia..............................................................................................................Member<br />

Ed Garza..........................................................................................................................Member<br />

SUPERINTENDENT AND CABINET<br />

Dr. Robert J. Durón<br />

Superintendent<br />

Mary “Betty Burks<br />

Deputy Superintendent<br />

Teaching and Learning<br />

Kamal ElHabr<br />

Associate Superintendent<br />

Facilities Services and Construction<br />

Jose H. Moreno<br />

Senior Executive Director<br />

Curriculum & Instruction<br />

Dr. Priscilla Canales<br />

Leadership Executive Director<br />

Mary Esther Macias<br />

Leadership Executive Director<br />

Marcos Zorola<br />

Chief Information Officer<br />

Technology & Mgmt Information Systems<br />

Carmen VázquezGonzález<br />

Executive Director<br />

Governmental & Community Relations<br />

Toni Thompson<br />

Associate Superintendent<br />

Human Resources<br />

Steven J. Bassett, CPA, RTSBA<br />

Associate Superintendent<br />

Financial Services, Business Operations and<br />

Food Services<br />

Cora Johns<br />

Executive Assistant<br />

Superintendent<br />

John Gomez<br />

Leadership Executive Director<br />

Dr. Carol Saxenian<br />

Leadership Executive Director<br />

Leslie Price<br />

Executive Director<br />

Communications & Printing Services<br />

Tiffany Grant<br />

Director<br />

Board & Superintendent Services<br />

i

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

TABLE OF CONTENTS<br />

I. PURPOSE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1<br />

. .<br />

II. PROGRAM ELIGIBILITY. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2<br />

.<br />

III. OBTAINING A SAISD P<strong>CARD</strong> (MASTER<strong>CARD</strong>). . . . . . . . . . . . . 2<br />

IV. GENERAL INFORMATION AND GUIDELINES. . . . . . . . . . . . . . . 3<br />

.<br />

V. APPROVING OFFICIAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5<br />

. .<br />

VI. PROGRAM ADMINISTRATOR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5<br />

.<br />

VII. ACCOUNTING DISTRIBUTION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5<br />

.<br />

VIII. USING THE <strong>CARD</strong>. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5<br />

. .<br />

IX. IMPROPER USES OF THE <strong>CARD</strong> . . . . . . . . . . . . . . . . . . . . . . . . . . . 6<br />

.<br />

X. CAUTIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7<br />

. .<br />

XI. RECORD KEEPING . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7<br />

.<br />

XII. PAYMENT PROCESS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8<br />

.<br />

XIII. RESOLVING ERRORS, DISPUTES, RETURNS AND CREDITS . . 8<br />

XIV. VENDOR/SUPPLIERS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8<br />

.<br />

ii

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

XV. LOST OR STOLEN <strong>CARD</strong>S . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

.<br />

XVI. <strong>CARD</strong> SECURITY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

. .<br />

XVII. <strong>CARD</strong> RENEWAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

. .<br />

XVIII. CANCELING <strong>CARD</strong>S/REVOCATION . . . . . . . . . . . . . . . . . . . . . . . .<br />

.<br />

XIX. ADDITIONAL INFORMATION. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

.<br />

XX. AUDIT OF TRANSACTIONS. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

.<br />

EXHIBITS:<br />

1. <strong>CARD</strong>HOLDER ACCOUNT FORM . . . . . . . . . . . . . . . . . . . . . . . 11<br />

.<br />

2. STATEMENT OF DISPUTED ITEM . . . . . . . . . . . . . . . . . . . . . . . 12<br />

.<br />

3. LOST OR STOLEN <strong>CARD</strong> NOTIFICATION . . . . . . . . . . . . . . . . 13<br />

4. <strong>PURCHASING</strong> <strong>CARD</strong> AGREEMENT . . . . . . . . . . . . . . . . . . . . . . 14<br />

.<br />

5. RECEIPT SAMPLES. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15<br />

.<br />

6. RECEIPT SAMPLES (continued). . . . . . . . . . . . . . . . . . . . . . . . . . . 16<br />

.<br />

9<br />

9<br />

9<br />

9<br />

10<br />

10<br />

iii

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

I. PURPOSE<br />

A. The SAN ANTONIO INDEPENDENT SCHOOL DISTRICT (<strong>District</strong>), offers a<br />

MasterCard Purchasing Card (PCard) through JP Morgan Chase Bank, NA. This<br />

program provides an efficient, costeffective method for the purchase and payment of<br />

goods and services. The PCard can be used at suppliers that can provide itemized<br />

receipts and accept MasterCard as a form of payment.<br />

B. The intention of the PCard is to facilitate the need to acquire low dollar, low value<br />

business transactions necessary for the effective and efficient daytoday operation of<br />

schools and departments throughout the <strong>District</strong>. PCards are to be used specifically for<br />

<strong>District</strong> business purposes only and may not be used for any nonbusiness or personal<br />

purchases. All <strong>District</strong> employees are expected to act in a manner consistent with State<br />

purchasing laws and Board of Education policy at all times. Prudent, good business<br />

judgment must be exercised at all times when making a purchase with a <strong>District</strong> PCard.<br />

Cardholders are expected to be as conscientious with district funds as they would their<br />

own. Before any purchase is made, the cardholder must ask: “How will this transaction<br />

be perceived by the public we serve?” Any purchase or expense perceived as being<br />

excessive, expensive, exorbitant or inconsistent with educational business purposes will<br />

be scrutinized, and if deemed inappropriate, the cardholder will be required to<br />

compensate the <strong>District</strong> for the difference in reasonable and customary costs. The P<br />

Card is NOT intended to avoid or bypass appropriate purchasing or payment<br />

procedures.<br />

C. A number of unique controls have been developed for the PCard that does not exist in<br />

a traditional credit card environment. These controls ensure that the PCard is used<br />

only for specific purchases and within specific dollar limits. Different limits may be set<br />

for each PCard, such as single dollar limit per 30 day cycle. If you exceed your card’s<br />

spending limit, your transaction will be rejected when you attempt to make a purchase.<br />

In addition, each cardholder is required to certify all purchases and have the department<br />

head or manager (Approving Official) verify the charges each month. Several<br />

management reports and independent checks are provided to monitor the PCard<br />

activity and the program effectiveness. However, the success of the program depends<br />

on employee compliance with program requirements.<br />

D. Varying by individual cardholder, certain types of Merchant Category Codes (MCC)<br />

will be prohibited and those suppliers will be blocked for all cardholders. These include<br />

but are not limited to liquor stores, convenience stores, bars, lounges, adult<br />

entertainment facilities, etc. Should you have a question concerning an establishment<br />

you wish to use, contact the PCard Program Administrator.<br />

E. Employees are empowered to perform complete transactions within these guidelines.<br />

While the program places a great deal of trust in <strong>District</strong> employees, it also holds<br />

employees accountable for noncompliance with program requirements.<br />

Page 1<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

F. The PCard is not intended to avoid or bypass appropriate purchasing or payment<br />

procedures. This program complements the existing processes available. The<br />

purchasing card is to be used for school district business only. Personal purchases will<br />

be considered misappropriation of district funds, which constitutes a criminal offense<br />

and must be referred to the SAISD Associate Superintendent of Financial Services,<br />

Business Operations and Food Services.<br />

G. Competitive bidding is not required but you should strive to obtain the best value by<br />

purchasing from awarded vendors through SAISD.<br />

II.<br />

PROGRAM ELIGIBILITY<br />

A. You must be an SAISD employee to participate at any level. Employees on probation<br />

and temporary employees will not be issued a card. Volunteers or students are not<br />

allowed to handle, possess or use the PCard at any time.<br />

B. Employee(s) may not be on administrative probation for failure to follow SAISD<br />

guidelines. If placed on probation for violation of SAISD policy, the employee’s P<br />

Card privileges may be suspended or revoked.<br />

III.<br />

OBTAINING AN SAISD P<strong>CARD</strong> (MASTER<strong>CARD</strong>)<br />

A. All persons applying for an SAISD PCard must first read and become familiar with the<br />

PCard Manual.<br />

B. Complete the Cardholder Account Form, available on the <strong>District</strong> Website, have your<br />

Approving Official approve it, and forward it to the PCard Program Administrator for<br />

disposition.<br />

C. The PCard Program Administrator will establish purchase limits.<br />

D. Upon approval by the Senior Executive Director of Financial Services, the purchasing<br />

card application will be processed with JP Morgan Chase Bank, NA.<br />

E. The PCard will be sent to the Program Administrator who will then schedule a time for<br />

you to receive your PCard and be trained. This will take approximately 30 minutes.<br />

The PCard will only be issued after completion of the training.<br />

F. After completion of the training and signing of the Cardholder Purchasing Card<br />

Agreement, the card will be issued to you. At that time, you may begin to purchase at<br />

suppliers who can provide itemized receipts and accept MasterCard as a form of<br />

payment.<br />

Page 2<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

IV.<br />

GENERAL INFORMATION AND GUIDELINES<br />

A. The PCard is primarily designed for principals and department supervisors who, as part<br />

of their normal duties, routinely purchase goods or outside services for the <strong>District</strong>.<br />

New principals and department supervisors may obtain a PCard by completing the<br />

Cardholder Account Form (Exhibit 1) and obtaining the appropriate approvals.<br />

B. Individual transaction limits vary depending upon cardholder need and levels of<br />

spending authority. Recommended spending/transaction limits are identified in the<br />

Cardholder Account Form. Examples of transaction limits are: number of transactions<br />

per day/month, dollars spent per day/month, and a limit to the types of suppliers that can<br />

be used.<br />

C. The PCard that you receive has both your name and the <strong>District</strong>’s name and logo<br />

embossed on it to distinguish it from your personal credit cards. The PCard should be<br />

secured as you would your personal credit cards. The PCard must not be used for<br />

personal purchases. Departmental cards will not be issued. PCards will only be<br />

issued to individuals.<br />

D. Each single transaction may be comprised of multiple items, but the total cannot exceed<br />

the single transaction dollar limit on your PCard. When purchases exceed the limit(s)<br />

established by the <strong>District</strong>’s policy, normal purchasing procedures must be used.<br />

E. There will be no credit checks on your personal credit history nor will your personal<br />

credit rating be affected.<br />

F. Use of the PCard does not relieve the cardholder from complying with <strong>District</strong><br />

purchasing policies and procedures.<br />

G. Ascertain that the items being purchased are not available in the <strong>District</strong> warehouse.<br />

H. Attempt to make purchases from the <strong>District</strong> Vendor Bid List whenever possible.<br />

I. Gift card purchases are not an authorized purchase and cannot be purchased for<br />

any reason using any funds, including student and campus activity funds. If gift cards<br />

are purchased, the cardholder will be held personally responsible for reimbursing<br />

SAISD.<br />

J. All purchases made on behalf of SAISD are sales tax exempt. The district is exempt<br />

from the State tax portion of Texas hotel taxes but is required to pay all outofstate<br />

hotel (nonsales) taxes. If sales tax is charged, the cardholder will be responsible for<br />

contacting the vendor for a credit or the cardholder is responsible for reimbursing<br />

SAISD. If a receipt includes sales tax, please include a personal check or money order<br />

payable to SAISD with your documentation. A cardholder may personally contact the<br />

vendor who assessed sales tax and ask for a refund as appropriate.<br />

Page 3<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

K. Furniture or equipment shall not be purchased for any reason using the PCard.<br />

Refer to Administrative Procedure C21 Inventory Control of Fixed Assets for further<br />

details on the appropriate procedure for purchasing furniture and equipment.<br />

L. Itemized Receipts are required! A credit card receipt indicating only the amount<br />

charged is NOT acceptable. An itemized purchase receipt must include a list of items<br />

being purchased. Item descriptions on receipts such as “gen mdse,” “misc” or “tax<br />

exempt item” are NOT acceptable. If a receipt is lost it is the cardholder’s<br />

responsibility to request a duplicate copy of the receipt from the vendor.<br />

M. If using fund code 865 (student activity funds), please attach a Payment Authorization<br />

form payable to SAISD Accounting and submit the form with the documentation for the<br />

approver’s signature. Do not send the form to the student activity funds department.<br />

N. When utilizing the PCard to make food purchases the employee is asked to exercise<br />

discretion. A roster must accompany the detailed receipt when food is purchased. This<br />

roster should include the names of the individuals that the food was purchased for and<br />

their business relationship (i.e. parents, student, etc.). Tips may not be charged unless<br />

they are required due to the size of your party (i.e. gratuity for a party of 5 or greater).<br />

The <strong>District</strong> reserves the right to require cardholders to reimburse charges that are<br />

deemed unacceptable or excessive.<br />

O. If you are paying for hotel, flight or registration charges, please include an approved<br />

Trip Authorization Form. However, it is best advised to plan enough in advance to be<br />

able to utilize the <strong>District</strong>’s online purchase requisition system.<br />

P. The Purchasing Card Charges Form must be filled out completely, including a<br />

description/justification for each purchase made and the approval of the cardholder’s<br />

supervisor prior to being sent to the Accounting Department by the requested due<br />

date.<br />

Q. Purchases must not be split to circumvent transaction limitations.<br />

R. Funds must be appropriated and available before any purchases are made using the P<br />

Card.<br />

S. Cardholders are required to sign a Cardholder Agreement (Exhibit 4), indicating that<br />

these procedures have been read and understood.<br />

Page 4<br />

07/22/10

V. APPROVING OFFICIAL<br />

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

A. The Leadership Executive Directors have been designated as the Approving Officials<br />

(AO) for their respective campus’ cardholder. Deputy, Associate Superintendents,<br />

Leadership Executive Directors and Senior Executive Directors have been designated as<br />

the approving officials for their respective departments. The AO will be the cardholder's<br />

immediate supervisor. The AO will review and approve the cardholder statement and<br />

receipts to ensure all purchases meet the requirements of the program. The AO will<br />

also request additional cards as necessary and request modification to existing card<br />

information, if required. The AO will approve each cardholder's Account Form (Exhibit<br />

I).<br />

VI.<br />

PROGRAM ADMINISTRATOR<br />

A. The Senior Executive Director of Financial Services administers the Purchasing Card<br />

program. The Program Administrators (PA’s) are:<br />

Primary Karly Phillips (210) 5548606 kphillips1@saisd.net<br />

Alternate Esther Alvarado (210) 5548590 ealvarado@saisd.net<br />

They can be contacted by telephone or email.<br />

B. The PA also works with the cardholder and the AO to establish hierarchies for account<br />

code editing and reporting, as well as card limits and usage codes. The PA also<br />

performs audit functions and supports the accounting and reporting of the PCard. The<br />

PA should be contacted if there are any questions concerning the use of the PCard.<br />

VII.<br />

ACCOUNTING DISTRIBUTION<br />

A. Budget codes should correspond to the type of purchase made.<br />

VIII. USING THE <strong>CARD</strong><br />

EXAMPLES:<br />

199xx6399xxxxxxxx000 – Supplies<br />

199xx6499xxxxxxxx000 – Misc Operating Expenses (Refreshments)<br />

199xx6411xxxxxxxx000 – Travel<br />

865002133xxxxxx00000 – SAF – Attendance Incentives for Students<br />

A. A cardholder may call, fax, order online, or visit a vendor personally when using the P<br />

Card. The PCard can be used with any supplier or service provider that accepts<br />

MasterCard and provides itemized receipts. Certain types of vendors have been<br />

blocked to prevent use of the PCard. The authorization request will be declined if<br />

you present your PCard to these vendors. If a vendor is declined and you have reason<br />

to think that they should not have been, contact the Program Administrator.<br />

Page 5<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

B. For orders that are delivered or shipped, make sure that complete delivery instructions<br />

are given. Delivery instructions should include:<br />

1. Cardholder name, mailing address, and telephone number.<br />

2. Packing slipdetailing merchandise, taxes, and freight. If item is taxable, then<br />

insure it is itemized on the receipt.<br />

3. Merchant name, address, and identification.<br />

4. To avoid potential duplicate payment, remember to ask that the vendor NOT<br />

send an invoice.<br />

C. Do not give a release number or the blanket purchase order number when ordering with<br />

the PCard. This will prevent the vendor from inadvertently sending an invoice to you<br />

or to the Accounts Payable Department.<br />

D. When reserving a hotel room over the phone, you may use the PCard to HOLD the<br />

room, IF and ONLY IF they confirm that no transaction will occur until the card is<br />

presented in person. Hotels may “pad” (add money to) an authorization placed against<br />

your PCard. This is common practice to protect the hotel against theft, damages,<br />

unpaid contractual gratuity, movies viewed in the room, etc. This will not constitute a<br />

final transaction and will not post to your account until the transaction is finalized. This<br />

authorization (sometimes called a “reserve” or “hold”) will affect the PCard’s available<br />

balance for that cycle until the transaction is posted and you are issued a receipt. If the<br />

transaction is not finalized, those funds will not become available until the new cycle<br />

begins. When you sign your receipt, you are agreeing to the transaction total shown on<br />

the receipt.<br />

E. The cardholder is responsible for ensuring receipt of materials and services. The<br />

cardholder should follow up with the vendor to resolve any delivery problems,<br />

discrepancies such as sales tax charges or claims.<br />

F. Each time you use the PCard, the vendor's credit authorization system will verify the<br />

dollar limit of your transaction and the monthly limit, or any other restrictions placed on<br />

the individual card.<br />

G. The PCard shall not be used to make online purchases through the internet.<br />

IX.<br />

IMPROPER USES OF THE <strong>CARD</strong><br />

A. Personal use items<br />

B. Gift cards<br />

C. Furniture and equipment<br />

D. Inventory items that are on hand in the <strong>District</strong>’s Warehouse at the time of need<br />

Page 6<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

E. Alcoholic beverages<br />

F. Contracted services<br />

G. Cash advances<br />

H. Computer hardware or software<br />

I. Chemicals and hazardous material that require purchase orders for special<br />

environmental reporting<br />

J. Online internet purchases<br />

X. CAUTIONS<br />

A. Pizza Orders: Please note that the transaction must be made the date that the PCard<br />

number was given. Suppliers may not “keep card number on file” and ring transaction<br />

any other time than when the PCard was given in person for that purchase. All pizza<br />

receipts must be itemized (ex: 3 large pepperoni, 2 medium combinations, etc.).<br />

B. $.99/$1.00, Hobby Lobby, Big Lot stores and Bill Miller BBQ may have receipts that<br />

read “Misc Tax Exempt” or “Gen Mdse” for the description of many items. This is not<br />

true itemization and cannot be used as a receipt.<br />

XI.<br />

RECORD KEEPING<br />

A. To facilitate the reconciliation and approval process, the cardholder is responsible for<br />

maintaining all receipts, packing slips and other documentation until the monthly<br />

statement is received.<br />

B. Cardholders will receive their monthly statement from the Program Administrator.<br />

These statements should be reconciled to the receipts and other supporting documents.<br />

Discrepancies between the receipts and statement should be resolved between the<br />

cardholder and supplier (see section XIII). Receipts and related documentation should<br />

be attached to the Purchasing Card Charges form, signed, and then forwarded to the<br />

AO for review and approval.<br />

C. The Cardholder should maintain copies of statements and receipts. All original<br />

documents will be maintained and filed by the Accounting Office.<br />

D. The Cardholder and AO must ensure the approved statement is sent to the Program<br />

Administrator by the due date indicated in the email and on the Purchasing Card<br />

Charges form.<br />

E. The Program Administrator will track and monitor statements received. Reports will be<br />

sent monthly to AO’s indicating when statements have not been received or received<br />

excessively late.<br />

Page 7<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

F. If the Cardholder will not be available to sign the monthly statement because of absence,<br />

all receipts and credits should be forwarded to the AO who will review and submit a<br />

signed statement to the Program Administrator. If the AO is unavailable, the AO's<br />

designee should approve monthly statements.<br />

XII.<br />

PAYMENT PROCESS<br />

A. Individual statements are sent to the Program Administrator from JP Morgan Chase<br />

Bank, NA each month.<br />

B. The statements along with the Purchasing Card Charges form are forwarded via email<br />

each month to the cardholder by the PA in accounting.<br />

C. The cardholder is responsible for ensuring that all documentation associated with<br />

purchases charged to that statement are submitted to the PA by the requested due date.<br />

D. The PA analyzes the documentation and processes payments accordingly. The PA will<br />

make one electronic payment to JP Morgan Chase Bank, NA for the total of all<br />

cardholder purchases.<br />

XIII. RESOLVING ERRORS, DISPUTES, RETURNS, AND CREDITS<br />

A. Acceptance of items is the cardholder's responsibility. All errors or disputes should<br />

be communicated to the PA and JP Morgan Chase Bank, NA within 60 days of the<br />

original transaction, and resolved between the cardholder and vendor. If the cardholder<br />

is unable to reach an agreement with the vendor, a Statement of Disputed Item(s)<br />

(Exhibit 2) with supporting documentation should be sent to JP Morgan Chase Bank,<br />

NA with a duplicate to the PA.<br />

B. Merchandise returns are also handled by the cardholder. Contact the vendor for<br />

instructions. A credit should appear on the next statement. It is the responsibility of<br />

the cardholder to make sure that all returns are credited correctly. Credits will be<br />

approved and edited like other transactions. If a credit does not appear on the<br />

statement within a timely manner, contact the PA for assistance.<br />

XIV. VENDOR/SUPPLIERS<br />

A. If the vendor does not accept the MasterCard purchasing card, contact the PA. The<br />

PA will work with JP Morgan Chase Bank, NA to encourage the vendor to be a part<br />

of the <strong>District</strong>’s Purchasing card program.<br />

B. If a purchase is declined, contact the PA. The PA will contact JP Morgan Chase Bank,<br />

NA and request an override. Please be prepared to provide the PA with the name of the<br />

store, the items being purchased, cost of the items, a justification for the purchase and<br />

the proposed funding that will be used to pay for the items.<br />

Page 8<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

XV.<br />

LOST OR STOLEN <strong>CARD</strong>S<br />

A. The “cardholder” is responsible for purchases made with lost or stolen cards until JP<br />

Morgan Chase Bank, NA is notified. Therefore, it is very important that the PA and<br />

JP Morgan Chase Bank, NA be notified immediately.<br />

For 24 hours / 7days a week customer service call:<br />

JP MORGAN CHASE BANK, NA 18008900669<br />

B. When reporting a lost or stolen card to JP Morgan Chase Bank, NA, the cardholder<br />

should identify the card as a purchasing card. Also, notify the PA and list any purchases<br />

made on the day the card was lost or stolen. A Lost or Stolen Card Notification<br />

(Exhibit 3) will be sent certified mail within two (2) business days. JP Morgan Chase<br />

Bank, NA will reissue a new PCard and new account numbers will be assigned to your<br />

new PCard.<br />

XVI. <strong>CARD</strong> SECURITY<br />

A. The PCard should be kept in an accessible but secure location. The PCard should be<br />

treated as if it was a personal credit card and the account number should be guarded<br />

carefully. The person whose name appears on the PCard is ultimately responsible<br />

for all abuse and misuse.<br />

XVII. <strong>CARD</strong> RENEWAL<br />

A. A renewal PCard is mailed to the cardholder at the address on file upon expiration of<br />

the current card.<br />

XVIII. CANCELING <strong>CARD</strong>S/REVOCATION<br />

A. If a card is to be cancelled, please contact the Program Administrator via email with<br />

details.<br />

B. When an employee leaves the <strong>District</strong> or is transferred to a new campus or department,<br />

the PCard will be canceled. To cancel the PCard, simply cut it in half and return it to<br />

the PA who will forward it to JP Morgan Chase Bank, NA. A final statement will<br />

follow to show the account closed.<br />

C. A card may be revoked and not reissued if the card is used for non eligible purchases or<br />

for failure to submit backup documentation in a timely manner.<br />

Page 9<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

XIX.<br />

ADDITIONAL INFORMATION<br />

A. Each cardholder is required to sign the <strong>District</strong>’s Purchasing Card Agreement (Exhibit<br />

4). Under NO circumstances is the PCard to be used for personal use.<br />

Inappropriate use will result in cancellation of the PCard and disciplinary action up to<br />

and including termination of employment.<br />

B. Changes to a cardholder's profile should be reported IN WRITING to the PA. The<br />

request should be initialed by the AO. If necessary, the PA will request JP Morgan<br />

Chase Bank, NA to issue a new PCard.<br />

XX.<br />

AUDIT OF TRANSACTIONS<br />

A. The <strong>District</strong> reserves the right to perform periodic audits of cardholder's transactions to<br />

ensure compliance with this policy. Records are subject to audit by state and federal<br />

auditors, funding agencies, grantors, and other governmental agencies with funding<br />

jurisdiction. The PA shall make records and supporting documentation available to<br />

authorized requestors. Violations of this policy will be subject to disciplinary action up<br />

to and including loss of PCard benefits and termination of employment.<br />

Page 10<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

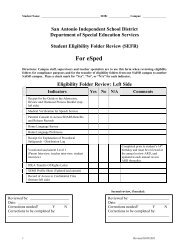

Exhibit 1<br />

______ Add<br />

______ Change<br />

______ Delete<br />

Cardholder Account Form<br />

Second Embossed Lined (Optional):<br />

Account Number (For Change or Delete):<br />

Approving Official Title or Description:<br />

Cardholder Name:<br />

Mailing Address – Line 1:<br />

Mailing Address – Line 2 (optional):<br />

City, State, Zip Code:<br />

Work Phone:<br />

Cell Phone:<br />

Email Address:<br />

Social Security Number (Last 4 digits):<br />

Monthly Statement (Hard Copy or EMail)<br />

Area Number:<br />

Campus Number:<br />

Send Card to the attention of:<br />

Hard Copy<br />

Senior Executive Director<br />

Financial Services<br />

141 Lavaca St.<br />

<strong>San</strong> <strong>Antonio</strong>, TX 78210<br />

Cardholders Purchase Limits Recommended Changes<br />

Spending Limit Per Day: $ 750.00<br />

Spending Limit Per Month: $ 750.00<br />

Merchant Category Codes to Block: All Travel & Entertainment<br />

Single Purchase Limit: $ 500.00<br />

Number of Transactions Allowed Per day: 5<br />

Number of Transactions Allowed Per Month: 20<br />

Employee/Cardholder Signature:<br />

Date:<br />

Approving Official Name:<br />

Approving Official Signature:<br />

Date:<br />

Page 11<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

Exhibit 2<br />

STATEMENT OF DISPUTED ITEM (S)<br />

RETURN ADDRESS:<br />

ACCOUNT NO:<br />

MERCHANT NAME:<br />

AMOUNT:<br />

TRANSACTION DATE:<br />

REFERENCE #:<br />

To assist our investigation, please mark the box below indicating the reason for your dispute.<br />

¨<br />

I did not make nor authorize the above transaction. Please indicate the whereabouts of the credit card.<br />

¨<br />

There is a difference in the amount I authorized and the amount I was billed. A copy of the charge must be attached.<br />

¨<br />

I only transacted one charge and I was previously billed for this sales draft. Date of previous charge:<br />

¨<br />

The above transaction is mine but I am disputing the transaction. Please state the reasons why in detail.<br />

¨<br />

¨<br />

Please send me a copy of the sales draft. There is a $3.00 charge for each copy.<br />

I have received a credit voucher for the above transaction, but it has not yet appeared on my account. A copy of the credit<br />

voucher must be attached.<br />

¨ My account has been charged for the above transaction, but I have not received this merchandise. The details of<br />

my attempts to resolve the dispute with the merchant and the merchant's response are indicated below.<br />

¨<br />

¨<br />

My account has been charged for the above transaction, but the merchandise has since been returned.<br />

Other:<br />

Signature:<br />

Date:<br />

Page 12<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

Exhibit 3<br />

LOST OR STOLEN <strong>CARD</strong> NOTIFICATION<br />

CALL JP MORGAN CHASE BANK, NA IMMEDIATELY at 18008900669<br />

TO REPORT A LOST OR STOLEN <strong>CARD</strong>.<br />

<strong>CARD</strong> WAS:<br />

Lost<br />

Stolen<br />

Other (Describe)<br />

<strong>CARD</strong>HOLDER NAME:<br />

CREDIT <strong>CARD</strong> NUMBER:<br />

DATE & TIME BANK ONE WAS CALLED:<br />

FAX COMPLETED FORM TO PROGRAM ADMINISTRATOR<br />

(DO NOT WRITE BELOW THIS LINE, FOR ACCOUNTING PURPOSES ONLY)<br />

*****************************************************************<br />

APPROVED BY:<br />

DATE:<br />

PRINT NAME:<br />

Page 13<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

Exhibit 4<br />

<strong>CARD</strong>HOLDER <strong>PURCHASING</strong> <strong>CARD</strong> AGREEMENT<br />

The <strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> is pleased to issue you this Purchasing Card. It<br />

represents trust in you and your empowerment as a responsible agent to safeguard and protect<br />

company assets.<br />

I «Cardholder Name», hereby acknowledge receipt of a <strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

MasterCard Purchasing Card, No. «Acct». As a cardholder, I agree to comply with the terms and<br />

conditions of this Agreement and the Purchasing Card Guidelines.<br />

I acknowledge receipt of this Agreement and confirm that I have read and understand the<br />

Agreement’s terms and conditions and the Purchasing Card Guidelines. I understand that I am<br />

liable to the <strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong>, JP Morgan Chase Bank, NA and<br />

MasterCard for all unauthorized charges.<br />

I agree to use this card for <strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> approved purchases only and<br />

agree not to charge personal purchases or alcoholic beverages. I understand that the <strong>San</strong> <strong>Antonio</strong><br />

<strong>Independent</strong> <strong>School</strong> <strong>District</strong> reserves the right to audit the use of this card and report any<br />

discrepancies.<br />

I further understand that improper use of this card may result in disciplinary action, up to and<br />

including termination of employment. Should I fail to use this card properly, I authorize the <strong>San</strong><br />

<strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> to take from my salary as a payroll deduction the amount<br />

equal to the total of the discrepancy. I also agree to immediately repay to <strong>San</strong> <strong>Antonio</strong><br />

<strong>Independent</strong> <strong>School</strong> <strong>District</strong> all amounts owed by me for unauthorized charges even if the <strong>San</strong><br />

<strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> no longer employs me.<br />

I understand that the <strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong> may terminate my right to use this<br />

card at any time for any reason. I agree to return the card to the <strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong><br />

<strong>District</strong> immediately upon request or upon termination of employment.<br />

Cardholder:<br />

Signature:<br />

Print Name:«LastName»<br />

Date:<br />

Location:«Location»<br />

Approving Officer:<br />

Signature:<br />

Title:<br />

Date:<br />

Phone:<br />

Page 14<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

Exhibit 5<br />

RECEIPT SAMPLES<br />

Page 15<br />

07/22/10

<strong>San</strong> <strong>Antonio</strong> <strong>Independent</strong> <strong>School</strong> <strong>District</strong><br />

<strong>PURCHASING</strong> <strong>CARD</strong> GUIDELINES<br />

Page 16<br />

07/22/10