Practicing With Professionalism - South Carolina Bar Association

Practicing With Professionalism - South Carolina Bar Association

Practicing With Professionalism - South Carolina Bar Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

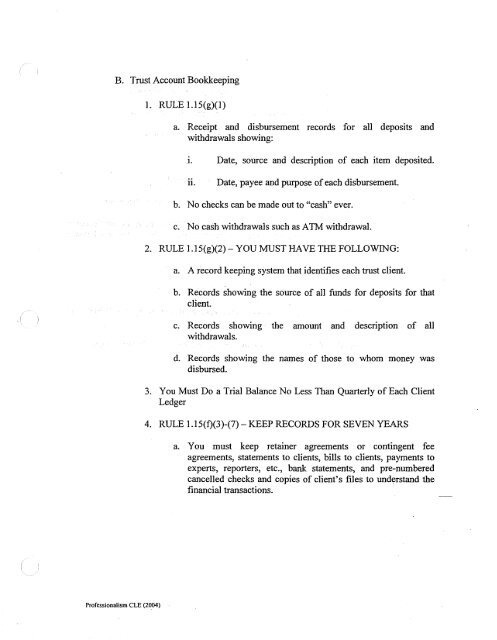

B. Trust Account Bookkeeping<br />

1. RULE 1.15(g)(1)<br />

a. Receipt and disbursement records for all deposits and<br />

withdrawals showing:<br />

1. Date, source and description of each item deposited.<br />

ll.<br />

Date,payee and purpose ofeach disbursement.<br />

b. No checks can be made out to "cash" ever.<br />

c. No cash withdrawals such as ATM withdrawal.<br />

2. RULE 1.15(g)(2) - YOU MUST HAVE THE FOLLOWING:<br />

a. A record keeping system that identifies each trust client.<br />

b. Records showing the source of all funds for deposits for that<br />

client.<br />

c. Records showing the amount and description of all<br />

withdrawals.<br />

d. Records showing the names of those to whom money was<br />

disbursed.<br />

3. You Must Do a Trial Balance No Less Than Quarterly of Each Client<br />

Ledger<br />

4. RULE l.l5(f)(3)-(7) - KEEP RECORDS FOR SEVEN YEARS<br />

a. You must keep retainer agreements or contingent fee<br />

agreements, statements to clients, bills to clients, payments to<br />

experts, reporters, etc., bank statements, and pre-numbered<br />

cancelled checks and copies of client's files to understand the<br />

financial transactions.<br />

<strong>Professionalism</strong> CLE (2004)