Practicing With Professionalism - South Carolina Bar Association

Practicing With Professionalism - South Carolina Bar Association

Practicing With Professionalism - South Carolina Bar Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

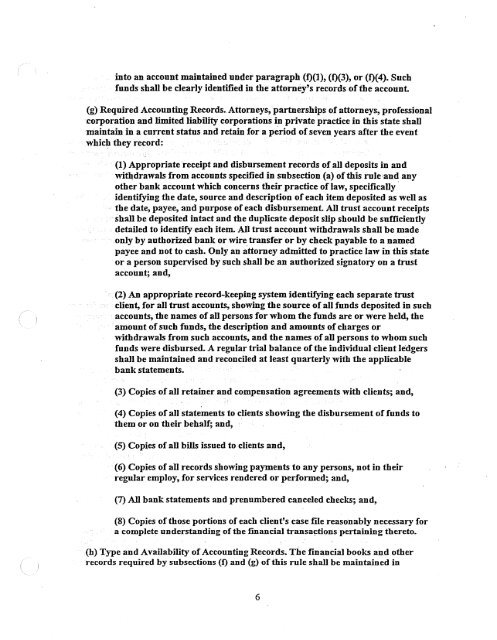

into an account maintained under paragraph (1)(1), (1)(3), or (1)(4). Such<br />

funds shall be clearly identified in the attorney's records ofthe account.<br />

(g) Required Accounting Records. Attorneys,partnerships of attorneys, professional<br />

corporation and limited liability corporations in private practice in this state shaU<br />

maintain in a current status and retain fora period ofseven years afterthe event<br />

whicJ:1 they record:<br />

(1) Appropriate receipt and disbursement records of an deposits in and<br />

wit~drawalsfrom accounts specified in subsection (a) ofthis rule and any<br />

other bank account which concerns their practice of law, specificaUy .<br />

identifying the date, source and description ofeach item deposited as wen as<br />

the date, payee, and purpose ofeach disbursement. An trust account receipts<br />

shall be deposited intact and the duplicate deposit slip should be sufficiently<br />

detailed to identify each item. All trust account withdrawals shaU be made<br />

only by authorized bank or wire. transferor by check payable to a named<br />

payee and not to cash. Only an attorney admitted to practice law in this state<br />

or a person supervised by such shaU be an authorized signatory on a trust<br />

account; and,<br />

(2) An appropriate record-keeping systemidentifying each separate trust<br />

client, for aU trust accounts, showing the source of all funds deposited in such<br />

accounts,the names of all persons for whomthe funds are or were held, the<br />

amount ofsuch funds, the description and amounts ofcharges or<br />

withdrawals from such accounts, and the names ofaU persons to whom such<br />

funds were disbursed. A regular trial balance ofthe individual client ledgers<br />

shall be maintained and reconciled at least quarterly with the applicable<br />

bank statements.<br />

(3) Copies ofaU retainer and compensation agreements with clients; and,<br />

(4) Copies ofall statements to clients showing the disbursement offunds to<br />

them or on their behalf; and,<br />

(5) Copies of aU bills issued to clients and,<br />

(6) Copies of all records showing payments to any persons, not in their<br />

regular employ, for services rendered or performed; and,<br />

(7) AU bank statements and prenumbered canceled checks; and,<br />

(8) Copies ofthose portions of each client's case file reasonably necessary for<br />

a complete understanding ofthe financial transactions pertaining thereto.<br />

(h) Type and Availability ofAccounting Records~The financial books and other<br />

records required by subsections (1) and (g) ofthis rule shall be maintained in<br />

6