download - French Chamber of Commerce and Industry in Hong Kong

download - French Chamber of Commerce and Industry in Hong Kong

download - French Chamber of Commerce and Industry in Hong Kong

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consumer Br<strong>and</strong>s & Retail<br />

Global luxury goods – Equity<br />

March 2013<br />

abc<br />

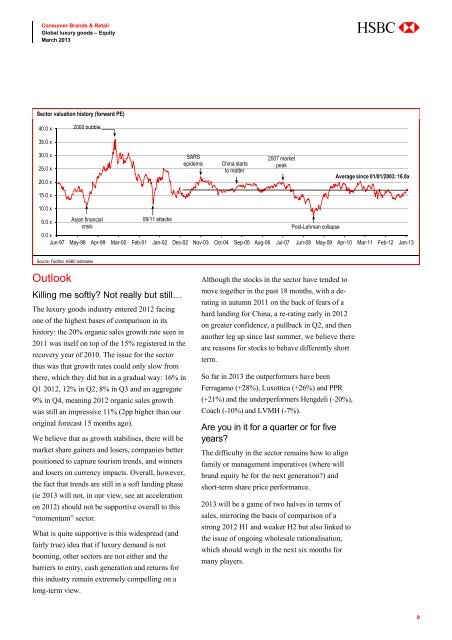

Sector valuation history (forward PE)<br />

40.0 x<br />

2000 bubble<br />

35.0 x<br />

30.0 x<br />

25.0 x<br />

20.0 x<br />

SARS<br />

epidemic<br />

Ch<strong>in</strong>a starts<br />

to matter<br />

2007 market<br />

peak<br />

Average s<strong>in</strong>ce 01/01/2003: 16.8x<br />

15.0 x<br />

10.0 x<br />

5.0 x<br />

Asian f<strong>in</strong>ancial<br />

09/11 attacks<br />

crisis<br />

Post-Lehman collapse<br />

0.0 x<br />

Jun-97 May-98 Apr-99 Mar-00 Feb-01 Jan-02 Dec-02 Nov-03 Oct-04 Sep-05 Aug-06 Jul-07 Jun-08 May-09 Apr-10 Mar-11 Feb-12 Jan-13<br />

Source: FactSet, HSBC estimates<br />

Outlook<br />

Kill<strong>in</strong>g me s<strong>of</strong>tly? Not really but still…<br />

The luxury goods <strong>in</strong>dustry entered 2012 fac<strong>in</strong>g<br />

one <strong>of</strong> the highest bases <strong>of</strong> comparison <strong>in</strong> its<br />

history: the 20% organic sales growth rate seen <strong>in</strong><br />

2011 was itself on top <strong>of</strong> the 15% registered <strong>in</strong> the<br />

recovery year <strong>of</strong> 2010. The issue for the sector<br />

thus was that growth rates could only slow from<br />

there, which they did but <strong>in</strong> a gradual way: 16% <strong>in</strong><br />

Q1 2012, 12% <strong>in</strong> Q2, 8% <strong>in</strong> Q3 <strong>and</strong> an aggregate<br />

9% <strong>in</strong> Q4, mean<strong>in</strong>g 2012 organic sales growth<br />

was still an impressive 11% (2pp higher than our<br />

orig<strong>in</strong>al forecast 15 months ago).<br />

We believe that as growth stabilises, there will be<br />

market share ga<strong>in</strong>ers <strong>and</strong> losers, companies better<br />

positioned to capture tourism trends, <strong>and</strong> w<strong>in</strong>ners<br />

<strong>and</strong> losers on currency impacts. Overall, however,<br />

the fact that trends are still <strong>in</strong> a s<strong>of</strong>t l<strong>and</strong><strong>in</strong>g phase<br />

(ie 2013 will not, <strong>in</strong> our view, see an acceleration<br />

on 2012) should not be supportive overall to this<br />

“momentum” sector.<br />

What is quite supportive is this widespread (<strong>and</strong><br />

fairly true) idea that if luxury dem<strong>and</strong> is not<br />

boom<strong>in</strong>g, other sectors are not either <strong>and</strong> the<br />

barriers to entry, cash generation <strong>and</strong> returns for<br />

this <strong>in</strong>dustry rema<strong>in</strong> extremely compell<strong>in</strong>g on a<br />

long-term view.<br />

Although the stocks <strong>in</strong> the sector have tended to<br />

move together <strong>in</strong> the past 18 months, with a derat<strong>in</strong>g<br />

<strong>in</strong> autumn 2011 on the back <strong>of</strong> fears <strong>of</strong> a<br />

hard l<strong>and</strong><strong>in</strong>g for Ch<strong>in</strong>a, a re-rat<strong>in</strong>g early <strong>in</strong> 2012<br />

on greater confidence, a pullback <strong>in</strong> Q2, <strong>and</strong> then<br />

another leg up s<strong>in</strong>ce last summer, we believe there<br />

are reasons for stocks to behave differently short<br />

term.<br />

So far <strong>in</strong> 2013 the outperformers have been<br />

Ferragamo (+28%), Luxottica (+26%) <strong>and</strong> PPR<br />

(+21%) <strong>and</strong> the underperformers Hengdeli (-20%),<br />

Coach (-10%) <strong>and</strong> LVMH (-7%).<br />

Are you <strong>in</strong> it for a quarter or for five<br />

years?<br />

The difficulty <strong>in</strong> the sector rema<strong>in</strong>s how to align<br />

family or management imperatives (where will<br />

br<strong>and</strong> equity be for the next generation?) <strong>and</strong><br />

short-term share price performance.<br />

2013 will be a game <strong>of</strong> two halves <strong>in</strong> terms <strong>of</strong><br />

sales, mirror<strong>in</strong>g the basis <strong>of</strong> comparison <strong>of</strong> a<br />

strong 2012 H1 <strong>and</strong> weaker H2 but also l<strong>in</strong>ked to<br />

the issue <strong>of</strong> ongo<strong>in</strong>g wholesale rationalisation,<br />

which should weigh <strong>in</strong> the next six months for<br />

many players.<br />

9