Doing Business 2009 - Government of Grenada

Doing Business 2009 - Government of Grenada

Doing Business 2009 - Government of Grenada

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

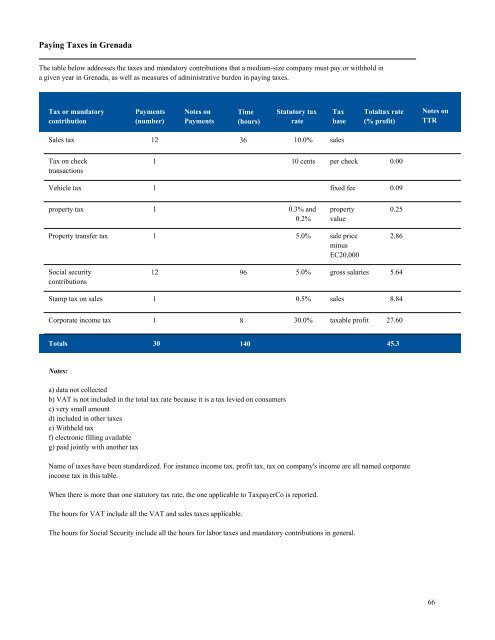

Paying Taxes in <strong>Grenada</strong><br />

The table below addresses the taxes and mandatory contributions that a medium-size company must pay or withhold in<br />

a given year in <strong>Grenada</strong>, as well as measures <strong>of</strong> administrative burden in paying taxes.<br />

Tax or mandatory<br />

contribution<br />

Payments<br />

(number)<br />

Notes on<br />

Payments<br />

Time<br />

(hours)<br />

Statutory tax<br />

rate<br />

Tax<br />

base<br />

Totaltax rate<br />

(% pr<strong>of</strong>it)<br />

Notes on<br />

TTR<br />

Sales tax<br />

12<br />

36<br />

10.0%<br />

sales<br />

Tax on check<br />

transactions<br />

1<br />

10 cents<br />

per check<br />

0.00<br />

Vehicle tax<br />

1<br />

fixed fee<br />

0.09<br />

property tax<br />

1<br />

0.3% and<br />

0.2%<br />

property<br />

value<br />

0.25<br />

Property transfer tax<br />

1<br />

5.0%<br />

sale price<br />

minus<br />

EC20,000<br />

2.86<br />

Social security<br />

contributions<br />

12<br />

96<br />

5.0%<br />

gross salaries<br />

5.64<br />

Stamp tax on sales<br />

1<br />

0.5%<br />

sales<br />

8.84<br />

Corporate income tax<br />

1<br />

8<br />

30.0%<br />

taxable pr<strong>of</strong>it<br />

27.60<br />

Totals 30 140 45.3<br />

Notes:<br />

a) data not collected<br />

b) VAT is not included in the total tax rate because it is a tax levied on consumers<br />

c) very small amount<br />

d) included in other taxes<br />

e) Withheld tax<br />

f) electronic filling available<br />

g) paid jointly with another tax<br />

Name <strong>of</strong> taxes have been standardized. For instance income tax, pr<strong>of</strong>it tax, tax on company's income are all named corporate<br />

income tax in this table.<br />

When there is more than one statutory tax rate, the one applicable to TaxpayerCo is reported.<br />

The hours for VAT include all the VAT and sales taxes applicable.<br />

The hours for Social Security include all the hours for labor taxes and mandatory contributions in general.<br />

66