PDF : 3518KB - Alpine

PDF : 3518KB - Alpine

PDF : 3518KB - Alpine

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

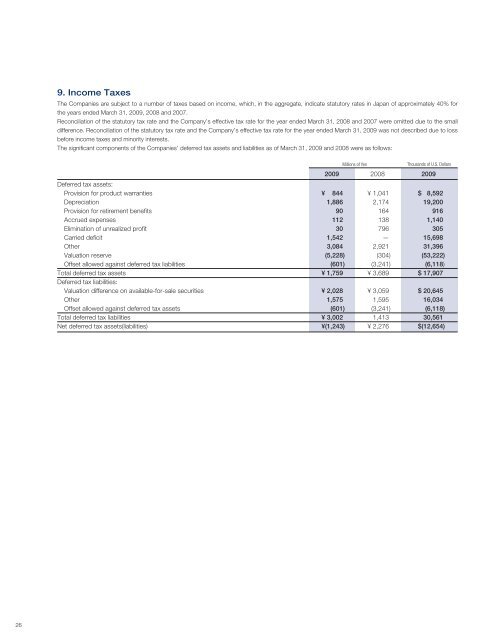

9. Income Taxes<br />

The Companies are subject to a number of taxes based on income, which, in the aggregate, indicate statutory rates in Japan of approximately 40% for<br />

the years ended March 31, 2009, 2008 and 2007.<br />

Reconciliation of the statutory tax rate and the Company’s effective tax rate for the year ended March 31, 2008 and 2007 were omitted due to the small<br />

difference. Reconciliation of the statutory tax rate and the Company’s effective tax rate for the year ended March 31, 2009 was not described due to loss<br />

before income taxes and minority interests.<br />

The significant components of the Companies’ deferred tax assets and liabilities as of March 31, 2009 and 2008 were as follows:<br />

Millions of Yen<br />

Thousands of U.S. Dollars<br />

2009 2008 2009<br />

Deferred tax assets:<br />

Provision for product warranties ¥ 844 ¥ 1,041 $ 8,592<br />

Depreciation 1,886 2,174 19,200<br />

Provision for retirement benefits 90 164 916<br />

Accrued expenses 112 138 1,140<br />

Elimination of unrealized profit 30 796 305<br />

Carried deficit 1,542 — 15,698<br />

Other 3,084 2,921 31,396<br />

Valuation reserve (5,228) (304) (53,222)<br />

Offset allowed against deferred tax liabilities (601) (3,241) (6,118)<br />

Total deferred tax assets ¥ 1,759 ¥ 3,689 $ 17,907<br />

Deferred tax liabilities:<br />

Valuation difference on available-for-sale securities ¥ 2,028 ¥ 3,059 $ 20,645<br />

Other 1,575 1,595 16,034<br />

Offset allowed against deferred tax assets (601) (3,241) (6,118)<br />

Total deferred tax liabilities ¥ 3,002 1,413 30,561<br />

Net deferred tax assets(liabilities) ¥(1,243) ¥ 2,276 $(12,654)<br />

26