SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

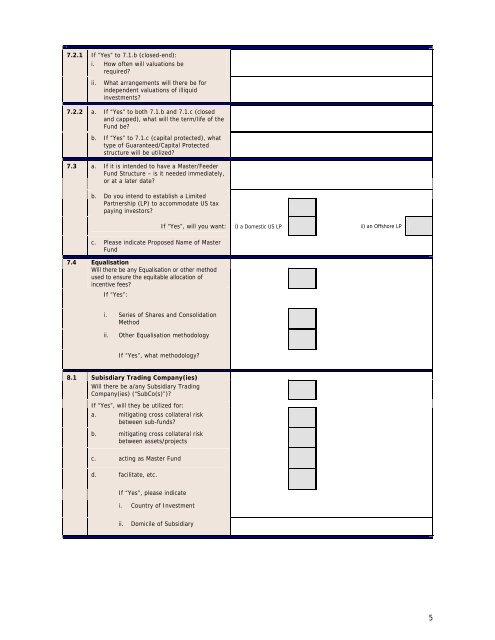

7.2.1 If “Yes” to 7.1.b (closed-end):<br />

i. How often will valuations be<br />

required?<br />

ii.<br />

What arrangements will there be for<br />

independent valuations of illiquid<br />

investments?<br />

7.2.2 a. If “Yes” to both 7.1.b and 7.1.c (closed<br />

and capped), what will the term/life of the<br />

Fund be?<br />

b. If “Yes” to 7.1.c (capital protected), what<br />

type of Guaranteed/Capital Protected<br />

structure will be utilized?<br />

7.3 a. If it is intended to have a Master/Feeder<br />

Fund Structure – is it needed immediately,<br />

or at a later date?<br />

b. Do you intend to establish a Limited<br />

Partnership (LP) to accommodate US tax<br />

paying investors?<br />

If “Yes”, will you want: i) a Domestic US LP ii) an Offshore LP<br />

c. Please indicate Proposed Name of Master<br />

Fund<br />

7.4 Equalisation<br />

Will there be any Equalisation or other method<br />

used to ensure the equitable allocation of<br />

incentive fees?<br />

If “Yes”:<br />

i. Series of Shares and Consolidation<br />

Method<br />

ii.<br />

Other Equalisation methodology<br />

If “Yes”, what methodology?<br />

8.1 Subisdiary Trading Company(ies)<br />

Will there be a/any Subsidiary Trading<br />

Company(ies) (“SubCo(s)”)?<br />

If “Yes”, will they be utilized for:<br />

a. mitigating cross collateral risk<br />

between sub-funds?<br />

b. mitigating cross collateral risk<br />

between assets/projects<br />

c. acting as Master Fund<br />

d. facilitate, etc.<br />

If “Yes”, please indicate<br />

i. Country of Investment<br />

ii.<br />

Domicile of Subsidiary<br />

5

![Definitions & Concepts... [PDF] - Cycles Research Institute](https://img.yumpu.com/26387731/1/190x245/definitions-concepts-pdf-cycles-research-institute.jpg?quality=85)