SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

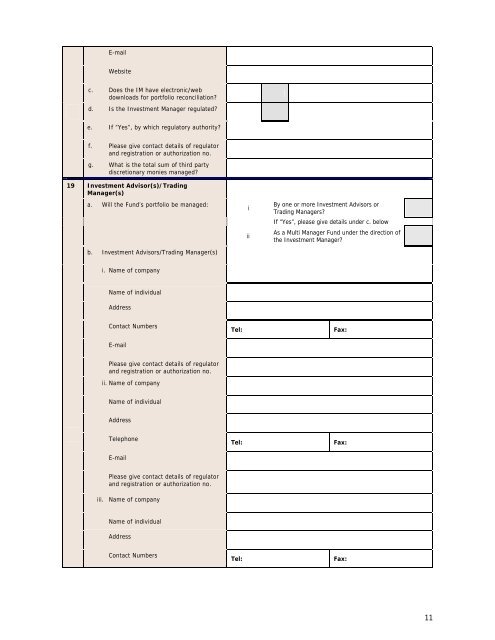

E-mail<br />

Website<br />

c. Does the IM have electronic/web<br />

downloads for portfolio reconciliation?<br />

d. Is the Investment Manager regulated?<br />

e. If “Yes”, by which regulatory authority?<br />

f. Please give contact details of regulator<br />

and registration or authorization no.<br />

g. What is the total sum of third party<br />

discretionary monies managed?<br />

19 Investment Advisor(s)/Trading<br />

Manager(s)<br />

a. Will the Fund’s portfolio be managed:<br />

b. Investment Advisors/Trading Manager(s)<br />

i<br />

ii<br />

By one or more Investment Advisors or<br />

Trading Managers?<br />

If “Yes”, please give details under c. below<br />

As a Multi Manager Fund under the direction of<br />

the Investment Manager?<br />

i. Name of company<br />

Name of individual<br />

Address<br />

Contact Numbers<br />

E-mail<br />

Tel:<br />

Fax:<br />

Please give contact details of regulator<br />

and registration or authorization no.<br />

ii. Name of company<br />

Name of individual<br />

Address<br />

Telephone<br />

E-mail<br />

Tel:<br />

Fax:<br />

Please give contact details of regulator<br />

and registration or authorization no.<br />

iii. Name of company<br />

Name of individual<br />

Address<br />

Contact Numbers<br />

Tel:<br />

Fax:<br />

11

![Definitions & Concepts... [PDF] - Cycles Research Institute](https://img.yumpu.com/26387731/1/190x245/definitions-concepts-pdf-cycles-research-institute.jpg?quality=85)