SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

SETTING UP A HEDGE FUND â PART TWO - BarclayHedge

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

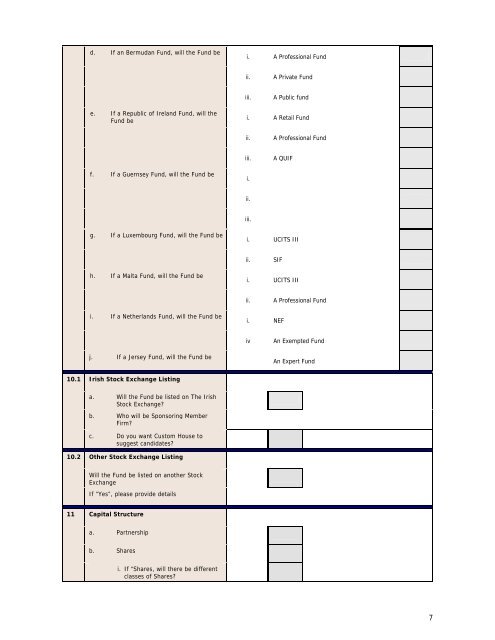

d. If an Bermudan Fund, will the Fund be<br />

i. A Professional Fund<br />

ii.<br />

A Private Fund<br />

iii.<br />

A Public fund<br />

e. If a Republic of Ireland Fund, will the<br />

Fund be<br />

i. A Retail Fund<br />

ii.<br />

A Professional Fund<br />

iii.<br />

A QUIF<br />

f. If a Guernsey Fund, will the Fund be<br />

i.<br />

ii.<br />

iii.<br />

g. If a Luxembourg Fund, will the Fund be<br />

i. UCITS III<br />

ii.<br />

SIF<br />

h. If a Malta Fund, will the Fund be<br />

i. UCITS III<br />

ii.<br />

A Professional Fund<br />

i. If a Netherlands Fund, will the Fund be<br />

i. NEF<br />

iv<br />

An Exempted Fund<br />

j. If a Jersey Fund, will the Fund be<br />

An Expert Fund<br />

10.1 Irish Stock Exchange Listing<br />

a. Will the Fund be listed on The Irish<br />

Stock Exchange?<br />

b. Who will be Sponsoring Member<br />

Firm?<br />

c. Do you want Custom House to<br />

suggest candidates?<br />

10.2 Other Stock Exchange Listing<br />

Will the Fund be listed on another Stock<br />

Exchange<br />

If “Yes”, please provide details<br />

11 Capital Structure<br />

a. Partnership<br />

b. Shares<br />

i. If “Shares, will there be different<br />

classes of Shares?<br />

7

![Definitions & Concepts... [PDF] - Cycles Research Institute](https://img.yumpu.com/26387731/1/190x245/definitions-concepts-pdf-cycles-research-institute.jpg?quality=85)