S T A Y I N G A H E A D O F T H E G A M E - Singapore Press Holdings

S T A Y I N G A H E A D O F T H E G A M E - Singapore Press Holdings

S T A Y I N G A H E A D O F T H E G A M E - Singapore Press Holdings

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE FINANCIAL STATEMENTS (CONT’D)<br />

AUGUST 31, 2004<br />

NOTES TO THE FINANCIAL STATEMENTS (CONT’D)<br />

AUGUST 31, 2004<br />

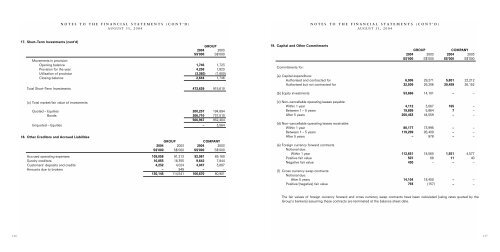

17. Short–Term Investments (cont’d)<br />

GROUP<br />

2004 2003<br />

S$’000 S$’000<br />

Movements in provision<br />

Opening balance 1,746 1,723<br />

Provision for the year 4,258 1,823<br />

Utilisation of provision (3,360) (1,800)<br />

Closing balance 2,644 1,746<br />

Total Short–Term Investments 473,639 915,610<br />

(c) Total market/fair value of investments<br />

Quoted – Equities 200,257 194,894<br />

Bonds 306,710 737,510<br />

506,967 932,404<br />

Unquoted – Equities – 3,564<br />

18. Other Creditors and Accrued Liabilities<br />

GROUP<br />

COMPANY<br />

2004 2003 2004 2003<br />

S$’000 S$’000 S$’000 S$’000<br />

Accrued operating expenses 109,058 91,213 92,981 69,160<br />

Sundry creditors 16,855 18,355 9,642 7,844<br />

Customers' deposits and credits 4,232 4,024 4,047 3,897<br />

Amounts due to brokers – 949 – –<br />

130,145 114,541 106,670 80,901<br />

19. Capital and Other Commitments<br />

Commitments for:<br />

GROUP<br />

COMPANY<br />

2004 2003 2004 2003<br />

S$’000 S$’000 S$’000 S$’000<br />

(a) Capital expenditure:<br />

Authorised and contracted for 6,906 29,271 5,801 22,212<br />

Authorised but not contracted for 32,509 26,206 20,459 26,152<br />

(b) Equity investments 53,666 14,101 – –<br />

(c) Non–cancellable operating leases payable:<br />

Within 1 year 4,112 3,067 165 –<br />

Between 1 – 5 years 19,899 5,864 7 –<br />

After 5 years 200,463 44,559 – –<br />

(d) Non–cancellable operating leases receivable:<br />

Within 1 year 80,177 73,995 – –<br />

Between 1 – 5 years 119,299 95,409 – –<br />

After 5 years – 978 – –<br />

(e) Foreign currency forward contracts<br />

Notional due:<br />

Within 1 year 112,651 18,560 1,551 4,577<br />

Positive fair value 507 68 11 40<br />

Negative fair value 430 – – –<br />

(f) Cross currency swap contracts<br />

Notional due:<br />

After 5 years 14,104 18,400 – –<br />

Positive/(negative) fair value 793 (157) – –<br />

The fair values of foreign currency forward and cross currency swap contracts have been calculated (using rates quoted by the<br />

Group's bankers) assuming these contracts are terminated at the balance sheet date.<br />

126<br />

127