information brochure - Sullivan & Cromwell

information brochure - Sullivan & Cromwell

information brochure - Sullivan & Cromwell

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

S&C in Europe continued<br />

MERGERS & ACQUISITIONS / PRIVATE EQUITY<br />

• <strong>Sullivan</strong> & <strong>Cromwell</strong> is a leader in global mergers and acquisitions and has long dominated the<br />

M&A league tables. S&C ranks first by value among law firms over the last 10 years, having acted<br />

on approximately $3.96 trillion in announced transactions worldwide. We have acted on 3 of the<br />

top 5 largest announced deals in the five-year period 2008-2012. On each transaction, our lawyers<br />

bring the same level of professionalism, attention to detail, creativity and commercial sensitivity.<br />

• In Europe, we were ranked as the leading US firm in M&A over the five-year period<br />

2008–2012. High profile transactions of the last two years include advising Anheuser-Busch<br />

InBev (Belgium) on its $38.8 acquisition of Goose Island (US) (2011); Apollo Management<br />

(US) on its $1.3 billion acquisition, together with CVC Capital Partners (UK) of Brit Insurance<br />

(Netherlands) (2011); CGI (Canada) on its £2 billion takeover of Logica (UK) (2012); EDF<br />

(France) on the ¤1.4 billion acquisition of the shares it didn’t previously own in EDF Energies<br />

Nouvelles (France) (2011); Goldman Sachs, as financial adviser to Parmalat (Italy) on the $4.7<br />

billion acquisition by Groupe Lactalis (France) of the shares in Parmalat it didn’t already own<br />

(2011); ING (Netherlands) on the $9 billion sale of ING Direct USA’s online banking operations<br />

to Capital One Financial (US) (2012) and Silver Lake Partners (US) and other consortium<br />

members on the sale of Skype (Luxembourg) to Microsoft (US) (2011).<br />

• Nearly all of our lawyers in Europe are involved in M&A work, from public tender and exchange<br />

offers to private equity and other negotiated transactions, to corporate and structuring advice.<br />

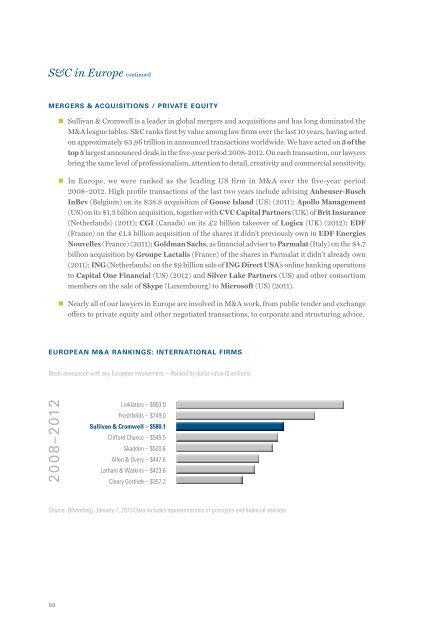

EUROPEAN M&A RANKINGS: INTERNATIONAL FIRMS<br />

Deals announced with any European involvement. – Ranked by dollar value ($ millions)<br />

2008–2012<br />

Linklaters – $903.0<br />

Freshfields – $749.0<br />

<strong>Sullivan</strong> & <strong>Cromwell</strong> – $580.1<br />

Clifford Chance – $549.5<br />

Skadden – $520.6<br />

Allen & Overy – $447.6<br />

Latham & Watkins – $423.6<br />

Cleary Gottlieb – $357.2<br />

Source: Bloomberg, January 7, 2013 Data includes representations of principals and financial advisers<br />

10