information brochure - Sullivan & Cromwell

information brochure - Sullivan & Cromwell

information brochure - Sullivan & Cromwell

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

S&C in Europe continued<br />

CAPITAL MARKETS/SECURITIES<br />

• S&C is a leading law firm in international securities offerings and financings on both<br />

a worldwide and European basis. The Firm regularly advises on the most complex<br />

and highest profile European securities transactions. These have included, most<br />

recently, very large equity offerings by LEG Immobilien, Deutsche Wohnen and Sky<br />

Deutschland (Germany); Anheuser-Busch InBev (Belgium); Barclays (UK); Unipol<br />

(Italy); Mail.ru Group (Russia); and billion-dollar debt offerings Daimler, KfW and<br />

Rentenbank (Germany); Anglo American, BP, Diageo, Standard Chartered and<br />

JaguarLandRover (UK); Banque PSA, CEB, EDF and Total (France); European<br />

Investment Bank (Luxembourg); Statoil (Norway); and Philips (Netherlands),<br />

among others.<br />

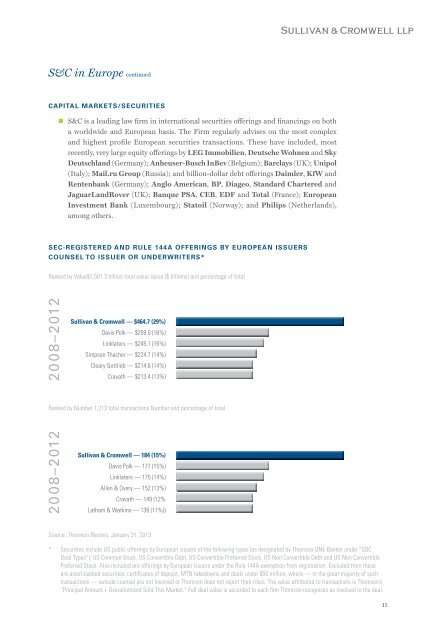

SEC-REGISTERED AND RULE 144A OFFERINGS BY EUROPEAN ISSUERS<br />

COUNSEL TO ISSUER OR UNDERWRITERS*<br />

Ranked by Value$1,581.3 billion total value Value ($ billions) and percentage of total<br />

2008–2012<br />

<strong>Sullivan</strong> & <strong>Cromwell</strong> — $464.7 (29%)<br />

Davis Polk — $259.0 (16%)<br />

Linklaters — $245.1 (16%)<br />

Simpson Thacher — $224.7 (14%)<br />

Cleary Gottlieb — $214.6 (14%)<br />

Cravath — $213.4 (13%)<br />

Ranked by Number 1,213 total transactions Number and percentage of total<br />

2008–2012<br />

<strong>Sullivan</strong> & <strong>Cromwell</strong> — 184 (15%)<br />

Davis Polk — 177 (15%)<br />

Linklaters — 175 (14%)<br />

Allen & Overy — 152 (13%)<br />

Cravath — 149 (12%<br />

Latham & Watkins — 139 (11%))<br />

Source: Thomson Reuters, January 31, 2013<br />

* Securities include US public offerings by European issuers of the following types (as designated by Thomson ONE Banker under “SDC<br />

Deal Types”): US Common Stock, US Convertible Debt, US Convertible Preferred Stock, US Non Convertible Debt and US Non Convertible<br />

Preferred Stock. Also included are offerings by European issuers under the Rule 144A exemption from registration. Excluded from these<br />

are asset-backed securities, certificates of deposit, MTN takedowns and deals under $50 million, where — in the great majority of such<br />

transactions — outside counsel are not involved or Thomson does not report their roles. The value attributed to transactions is Thomson’s<br />

“Principal Amount + Overallotment Sold This Market.” Full deal value is accorded to each firm Thomson recognises as involved in the deal.<br />

11