undergraduate application and instructions - SUNY Institute of ...

undergraduate application and instructions - SUNY Institute of ...

undergraduate application and instructions - SUNY Institute of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COSTS AND FINANCIAL AID<br />

You can obtain general financial aid information, <strong>and</strong><br />

information about your own financial aid <strong>application</strong><br />

by calling Federal Financial Aid Application Status at<br />

1-800-433-3243 or New York State TAP <strong>and</strong> Loan<br />

Application Status at 1-888-697-4372.<br />

How Financial Aid Works<br />

Financial aid is available at all<br />

State University campuses to<br />

assist students who are unable<br />

to pay college costs.<br />

Eligibility for financial aid is<br />

based on the amount which you<br />

<strong>and</strong> your family are expected to<br />

contribute toward your college<br />

expenses. This amount is determined<br />

by analyzing your family’s<br />

financial circumstance, including<br />

such factors as income, assets,<br />

<strong>and</strong> number <strong>of</strong> dependents in<br />

college. Each State University college<br />

uses the federal calculation<br />

to determine your financial need<br />

<strong>and</strong> eligibility for assistance.<br />

State University campuses<br />

participate in a variety <strong>of</strong> state,<br />

federal, <strong>and</strong> private financial aid<br />

programs. Assistance is available<br />

for full-time <strong>and</strong> part-time students<br />

based on financial need <strong>and</strong> availability<br />

<strong>of</strong> funds. If eligible, you may<br />

be <strong>of</strong>fered aid for tuition <strong>and</strong> other<br />

college expenses from programs<br />

such as education loans, Federal<br />

Pell Grants, New York State Tuition<br />

Assistance Program (TAP), institutional<br />

grants <strong>and</strong> scholarships, <strong>and</strong><br />

others. Read this information on<br />

how to apply. You or your family<br />

may also qualify for certain tax<br />

benefits associated with college<br />

costs. You may wish to get<br />

pr<strong>of</strong>essional tax advice.<br />

Tuition, Fees <strong>and</strong> Other Costs<br />

Costs vary depending on the<br />

college, its location, full-time or<br />

part-time enrollment, program <strong>of</strong><br />

study, housing accommodations,<br />

personal expenses, <strong>and</strong> other<br />

individual factors.<br />

State University colleges have<br />

higher tuition rates for students<br />

who are not New York State residents<br />

(see chart below). Contact<br />

the Office for Student Accounts at<br />

your college choices for details<br />

about residency requirements.<br />

Technology colleges charge a<br />

reduced non-resident tuition rate<br />

<strong>of</strong> $5,000 per year for the associate<br />

degree <strong>and</strong> the st<strong>and</strong>ard nonresident<br />

rate <strong>of</strong> $8,300 for the<br />

bachelor degree.<br />

Community college tuition<br />

ranges from $2,200-$2,600.<br />

The sample budgets below can<br />

be used to estimate costs for<br />

the 2003-2004 academic year.<br />

Students who enroll in a community<br />

college not in their home county,<br />

must provide the college with a<br />

certificate <strong>of</strong> county residency to<br />

benefit from the lower, in-district<br />

tuition rate.<br />

For students taking fewer than<br />

12 semester hours (part-time<br />

study), New York State resident<br />

tuition is $137 per credit hour for<br />

baccalaureate degree programs<br />

<strong>and</strong> $128 per credit hour for<br />

associate degree programs.<br />

Most State University campuses<br />

have time-payment plans to<br />

enable you to pay in monthly<br />

installments. Campus business<br />

<strong>of</strong>fices can provide you with information<br />

on payment options.<br />

How New Students<br />

Apply for Financial Aid<br />

1. Read each college’s catalog<br />

<strong>and</strong> financial aid literature <strong>and</strong><br />

contact the college financial aid<br />

<strong>of</strong>fice if you have specific questions.<br />

This is the best source <strong>of</strong><br />

financial aid information.<br />

2. Apply for financial aid:<br />

• Check with the college to see<br />

which forms to use. All students<br />

must complete the Free Application<br />

for Federal Student Aid<br />

(FAFSA).<br />

• If you have Internet access, you<br />

can file the FAFSA online at<br />

www.fafsa.ed.gov. FAFSA applicants<br />

who are New York State<br />

residents <strong>and</strong> who plan to attend<br />

a college in New York will automatically<br />

be sent an Express<br />

TAP <strong>application</strong>.<br />

• Complete the FAFSA after January<br />

1, 2003, even if you have not<br />

yet filed your 2002 tax returns.<br />

Use estimates if necessary.<br />

• If you are unable to file on the<br />

web, you can obtain the FAFSA<br />

<strong>application</strong> from your high school<br />

guidance <strong>of</strong>fice. Be sure to meet<br />

all deadlines.<br />

3. Investigate other sources <strong>of</strong> aid.<br />

Several free scholarship search<br />

services are available on the<br />

Internet.<br />

4. Keep a file <strong>of</strong> records <strong>and</strong><br />

copies <strong>of</strong> <strong>application</strong>s.<br />

How Transfer Students<br />

Apply for Financial Aid<br />

1. If you did not submit a FAFSA<br />

for the current academic year,<br />

you should follow the <strong>application</strong><br />

<strong>instructions</strong> for new students.<br />

2. If you did apply for financial aid<br />

this year, you will automatically<br />

receive a Renewal FAFSA<br />

from the U.S. Department <strong>of</strong><br />

Education for next year.<br />

3. You can complete the<br />

Renewal FAFSA on the web at<br />

www.fafsa.ed.gov. (You will<br />

need the “pin” number that<br />

was sent to you with the results<br />

<strong>of</strong> your <strong>application</strong>.) Or you can<br />

complete the paper Renewal<br />

FAFSA.<br />

4. To apply for financial aid at the<br />

college you are transferring to,<br />

use the college code for the<br />

new campus on the Renewal<br />

FAFSA. You can get the code<br />

from the college, or by calling<br />

1-800-4-FEDAID, or on the web<br />

at www.fafsa.ed.gov.<br />

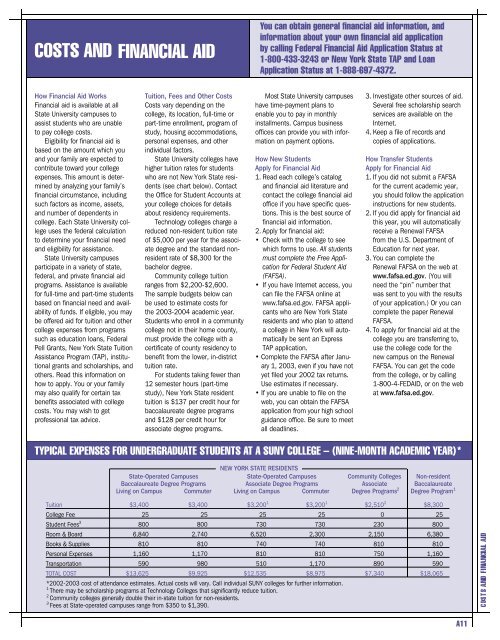

TYPICAL EXPENSES FOR UNDERGRADUATE STUDENTS AT A <strong>SUNY</strong> COLLEGE – (NINE-MONTH ACADEMIC YEAR)*<br />

NEW YORK STATE RESIDENTS<br />

State-Operated Campuses State-Operated Campuses Community Colleges Non-resident<br />

Baccalaureate Degree Programs Associate Degree Programs Associate Baccalaureate<br />

Living on Campus Commuter Living on Campus Commuter Degree Programs 2 Degree Program 1<br />

Tuition $3,400 $3,400 $3,200 1 $3,200 1 $2,510 2 $8,300<br />

College Fee 25 25 25 25 0 25<br />

Student Fees 3 800 800 730 730 230 800<br />

Room & Board 6,840 2,740 6,520 2,300 2,150 6,380<br />

Books & Supplies 810 810 740 740 810 810<br />

Personal Expenses 1,160 1,170 810 810 750 1,160<br />

Transportation 590 980 510 1,170 890 590<br />

TOTAL COST $13,625 $9,925 $12,535 $8,975 $7,340 $18,065<br />

*2002-2003 cost <strong>of</strong> attendance estimates. Actual costs will vary. Call individual <strong>SUNY</strong> colleges for further information.<br />

1<br />

There may be scholarship programs at Technology Colleges that significantly reduce tuition.<br />

2<br />

Community colleges generally double their in-state tuition for non-residents.<br />

3<br />

Fees at State-operated campuses range from $350 to $1,390.<br />

A11