The economic impact of the 2011 Formula 1 ... - Tourism Victoria

The economic impact of the 2011 Formula 1 ... - Tourism Victoria

The economic impact of the 2011 Formula 1 ... - Tourism Victoria

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

►<br />

Surveys designed and administered by Ernst & Young:<br />

►<br />

►<br />

►<br />

►<br />

►<br />

An internet survey <strong>of</strong> competing teams from support events at <strong>the</strong> Grand Prix.<br />

An internet survey <strong>of</strong> international media (supplementing <strong>the</strong> responses from <strong>the</strong><br />

Newspoll fieldwork).<br />

An email survey <strong>of</strong> organisations, including FIA, FOM, V8SCA and CAMS (sent by<br />

AGPC).<br />

Face-to-face and email surveys <strong>of</strong> <strong>the</strong> <strong>Formula</strong> 1 and V8 Supercars teams.<br />

An internet survey, email survey and telephone interviews <strong>of</strong> corporate buyers.<br />

►<br />

O<strong>the</strong>r data:<br />

►<br />

Number and origin <strong>of</strong> CAMS <strong>of</strong>ficials at <strong>the</strong> Grand Prix (provided by CAMS).<br />

3.1.4 <strong>The</strong> extent <strong>of</strong> representative samples<br />

In determining <strong>the</strong> sample sizes from which market research is to be obtained for <strong>economic</strong><br />

<strong>impact</strong> assessments <strong>of</strong> major events, Ernst & Young utilises <strong>the</strong> industry accepted range <strong>of</strong><br />

95% confidence level and 5% confidence interval, and 90% confidence level and 10%<br />

confidence interval 7 . At a minimum, this range is sought for <strong>the</strong> first level <strong>of</strong> questions<br />

asked to a particular category <strong>of</strong> visitor or attendee (i.e. origin question for spectators),<br />

with <strong>the</strong> aim to <strong>the</strong>n achieve it for <strong>the</strong> second level <strong>of</strong> questions (i.e. whe<strong>the</strong>r <strong>the</strong> interstate<br />

or overseas spectator is a specific or extended stay visitor to <strong>the</strong> State). It should be noted<br />

that circumstances can occur beyond <strong>the</strong> control <strong>of</strong> Ernst & Young that result in this range<br />

not being achieved. For example an event where <strong>the</strong>re is a very small number <strong>of</strong><br />

international visitors, necessitating a proportionally high number <strong>of</strong> responses from such<br />

visitors.<br />

It should be noted that <strong>the</strong> questionnaire utilised to collect market research from attendees<br />

at an event <strong>of</strong>ten has a number <strong>of</strong> filtered questions within it that can result in a lessening<br />

<strong>of</strong> <strong>the</strong> confidence levels and intervals to levels below <strong>the</strong> above-mentioned range, especially<br />

in relation to certain sub-groups <strong>of</strong> visitor (i.e. corporate patrons and extended stay<br />

spectators in general).<br />

For <strong>the</strong> reasons outlined above, and to achieve representative samples where possible,<br />

Ernst & Young has merged <strong>the</strong> responses <strong>of</strong> interstate specific and extended stay visitors<br />

and international specific and extended stay visitors. Fur<strong>the</strong>r, we have aggregated all<br />

spectator data into one category (instead <strong>of</strong> separating corporate patrons and o<strong>the</strong>r<br />

ticketed spectators). Not taking this action would have resulted in non representative<br />

samples <strong>of</strong> extended stay interstate and international spectators to <strong>the</strong> Grand Prix, and non<br />

representative samples <strong>of</strong> corporate patrons. <strong>The</strong> process <strong>of</strong> ‘aggregation’ limits <strong>the</strong> <strong>impact</strong><br />

<strong>of</strong> outliers in small samples significantly skewing final outcomes for average days stay and<br />

average daily expenditure, that when extrapolated over <strong>the</strong> wider populations, can result in<br />

materially different outcomes.<br />

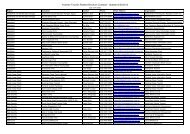

For information purposes, based on an industry accepted range <strong>of</strong> 95% confidence level and<br />

5% confidence interval, and 90% confidence level and 10% confidence interval 8 , <strong>the</strong> success<br />

<strong>of</strong> <strong>the</strong> surveying in falling within or above this range for each type <strong>of</strong> attendee is set out in<br />

Table 8 over <strong>the</strong> page:<br />

7<br />

Partnerships <strong>Victoria</strong>, Public Sector Comparative: Appendix E: Statistical probability techniques and sample<br />

distributions – “It is not possible to obtain an estimate <strong>of</strong> probability that is 100% correct. An appropriate trade-<strong>of</strong>f<br />

between ma<strong>the</strong>matical accuracy and meaningful estimate <strong>the</strong>refore needs to be made. Generally, a confidence<br />

interval <strong>of</strong> 90% or 95% is considered statistically robust.”<br />

8<br />

Ibid.<br />

<strong>Tourism</strong> <strong>Victoria</strong><br />

<strong>The</strong> <strong>economic</strong> <strong>impact</strong> <strong>of</strong> <strong>the</strong> <strong>2011</strong> <strong>Formula</strong> 1 Australian Grand Prix Ernst & Young ÷ 11