Malcolm Baldrige National Quality Award - American Society for ...

Malcolm Baldrige National Quality Award - American Society for ...

Malcolm Baldrige National Quality Award - American Society for ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

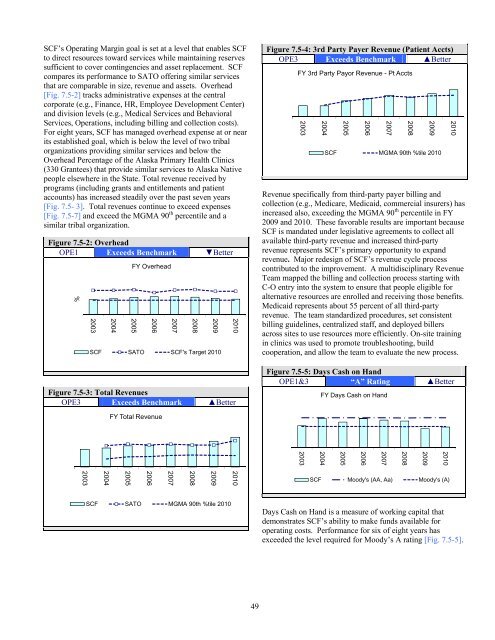

SCF’s Operating Margin goal is set at a level that enables SCF<br />

to direct resources toward services while maintaining reserves<br />

sufficient to cover contingencies and asset replacement. SCF<br />

compares its per<strong>for</strong>mance to SATO offering similar services<br />

that are comparable in size, revenue and assets. Overhead<br />

[Fig. 7.5-2] tracks administrative expenses at the central<br />

corporate (e.g., Finance, HR, Employee Development Center)<br />

and division levels (e.g., Medical Services and Behavioral<br />

Services, Operations, including billing and collection costs).<br />

For eight years, SCF has managed overhead expense at or near<br />

its established goal, which is below the level of two tribal<br />

organizations providing similar services and below the<br />

Overhead Percentage of the Alaska Primary Health Clinics<br />

(330 Grantees) that provide similar services to Alaska Native<br />

people elsewhere in the State. Total revenue received by<br />

programs (including grants and entitlements and patient<br />

accounts) has increased steadily over the past seven years<br />

[Fig. 7.5- 3]. Total revenues continue to exceed expenses<br />

[Fig. 7.5-7] and exceed the MGMA 90 th percentile and a<br />

similar tribal organization.<br />

Figure 7.5-2: Overhead<br />

OPE1 Exceeds Benchmark ▼Better<br />

%<br />

2003<br />

2004<br />

FY Overhead<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

SCF SATO SCF's Target 2010<br />

Figure 7.5-3: Total Revenues<br />

OPE3 Exceeds Benchmark ▲Better<br />

2010<br />

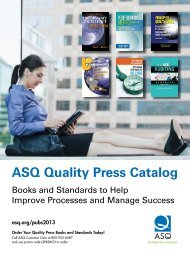

Figure 7.5-4: 3rd Party Payer Revenue (Patient Accts)<br />

OPE3 Exceeds Benchmark ▲Better<br />

FY 3rd Party Payor Revenue - Pt Accts<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

SCF MGMA 90th %tile 2010<br />

Revenue specifically from third-party payer billing and<br />

collection (e.g., Medicare, Medicaid, commercial insurers) has<br />

increased also, exceeding the MGMA 90 th percentile in FY<br />

2009 and 2010. These favorable results are important because<br />

SCF is mandated under legislative agreements to collect all<br />

available third-party revenue and increased third-party<br />

revenue represents SCF’s primary opportunity to expand<br />

revenue. Major redesign of SCF’s revenue cycle process<br />

contributed to the improvement. A multidisciplinary Revenue<br />

Team mapped the billing and collection process starting with<br />

C-O entry into the system to ensure that people eligible <strong>for</strong><br />

alternative resources are enrolled and receiving those benefits.<br />

Medicaid represents about 55 percent of all third-party<br />

revenue. The team standardized procedures, set consistent<br />

billing guidelines, centralized staff, and deployed billers<br />

across sites to use resources more efficiently. On-site training<br />

in clinics was used to promote troubleshooting, build<br />

cooperation, and allow the team to evaluate the new process.<br />

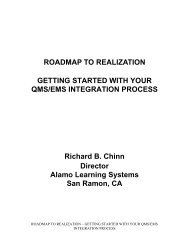

Figure 7.5-5: Days Cash on Hand<br />

OPE1&3 “A” Rating ▲Better<br />

FY Days Cash on Hand<br />

2010<br />

FY Total Revenue<br />

2010<br />

2009<br />

2008<br />

2007<br />

2006<br />

2005<br />

2004<br />

2003<br />

2003<br />

2004<br />

2005<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

SCF Moody's (AA, Aa) Moody's (A)<br />

SCF SATO MGMA 90th %tile 2010<br />

Days Cash on Hand is a measure of working capital that<br />

demonstrates SCF’s ability to make funds available <strong>for</strong><br />

operating costs. Per<strong>for</strong>mance <strong>for</strong> six of eight years has<br />

exceeded the level required <strong>for</strong> Moody’s A rating [Fig. 7.5-5].<br />

49