Part 2: Statements 1-21 - McKnight Foundation

Part 2: Statements 1-21 - McKnight Foundation

Part 2: Statements 1-21 - McKnight Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

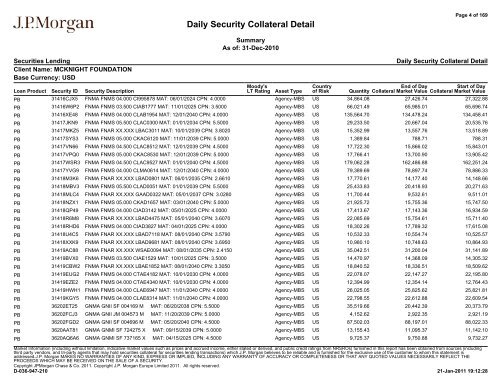

Daily Security Collateral Detail<br />

Page 4 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 31416CJX5 FNMA FNMS 04.000 CI995878 MAT: 06/01/2024 CPN: 4.0000 Agency-MBS US 34,864.08 27,426.74 27,322.88<br />

PB 31416W6P2 FNMA FNMS 03.500 CIAB1777 MAT: 11/01/2025 CPN: 3.5000 Agency-MBS US 66,0<strong>21</strong>.49 65,985.01 65,696.74<br />

PB 31416XE48 FNMA FNMS 04.000 CLAB1954 MAT: 12/01/2040 CPN: 4.0000 Agency-MBS US 135,564.70 134,478.24 134,458.41<br />

PB 31417JKN9 FNMA FNMS 05.500 CLAC0300 MAT: 01/01/2034 CPN: 5.5000 Agency-MBS US 29,233.50 20,667.04 20,535.76<br />

PB 31417MKZ5 FNMA FNAR XX.XXX LBAC3011 MAT: 10/01/2039 CPN: 3.8020 Agency-MBS US 15,352.99 13,557.76 13,518.89<br />

PB 31417SYS3 FNMA FNMS 05.000 CKAC6120 MAT: 11/01/2039 CPN: 5.0000 Agency-MBS US 1,389.84 788.71 788.31<br />

PB 31417VN66 FNMA FNMS 04.500 CLAC8512 MAT: 12/01/2039 CPN: 4.5000 Agency-MBS US 17,722.30 15,866.02 15,843.01<br />

PB 31417VPQ0 FNMA FNMS 05.000 CKAC8530 MAT: 12/01/2039 CPN: 5.0000 Agency-MBS US 17,766.41 13,700.90 13,905.42<br />

PB 31417WSR3 FNMA FNMS 04.500 CLAC9527 MAT: 01/01/2040 CPN: 4.5000 Agency-MBS US 179,062.28 162,486.88 162,251.24<br />

PB 31417YVG9 FNMA FNMS 04.000 CLMA0614 MAT: 12/01/2040 CPN: 4.0000 Agency-MBS US 79,389.69 78,897.74 78,886.33<br />

PB 31418M3K6 FNMA FNAR XX.XXX LBAD0801 MAT: 06/01/2035 CPN: 2.6610 Agency-MBS US 17,770.61 14,177.40 14,148.66<br />

PB 31418MBV3 FNMA FNMS 05.500 CLAD0051 MAT: 01/01/2039 CPN: 5.5000 Agency-MBS US 25,433.83 20,418.93 20,271.63<br />

PB 31418MLC4 FNMA FNAR XX.XXX GAAD0322 MAT: 05/01/2037 CPN: 3.0280 Agency-MBS US 11,700.44 9,532.61 9,511.01<br />

PB 31418NZX1 FNMA FNMS 05.000 CKAD1657 MAT: 03/01/2040 CPN: 5.0000 Agency-MBS US <strong>21</strong>,925.72 15,755.36 15,747.50<br />

PB 31418QP49 FNMA FNMS 04.000 CIAD3142 MAT: 05/01/2025 CPN: 4.0000 Agency-MBS US 17,413.67 17,143.36 16,934.59<br />

PB 31418R6M8 FNMA FNAR XX.XXX LBAD4475 MAT: 05/01/2040 CPN: 3.6070 Agency-MBS US 22,085.69 15,754.61 15,711.40<br />

PB 31418RHD6 FNMA FNMS 04.000 CIAD3827 MAT: 04/01/2025 CPN: 4.0000 Agency-MBS US 18,302.26 17,789.32 17,615.08<br />

PB 31418U4C5 FNMA FNAR XX.XXX LBAD7118 MAT: 08/01/2040 CPN: 3.5790 Agency-MBS US 10,532.33 10,554.74 10,525.57<br />

PB 31418XXK9 FNMA FNAR XX.XXX LBAD9681 MAT: 08/01/2040 CPN: 3.6950 Agency-MBS US 10,980.10 10,748.63 10,864.93<br />

PB 31419AC88 FNMA FNAR XX.XXX WSAE0094 MAT: 08/01/2035 CPN: 2.4150 Agency-MBS US 35,042.51 31,200.04 31,141.89<br />

PB 31419BVX0 FNMA FNMS 03.500 CIAE1529 MAT: 10/01/2025 CPN: 3.5000 Agency-MBS US 14,470.97 14,368.09 14,305.32<br />

PB 31419CBW2 FNMA FNAR XX.XXX LBAE1852 MAT: 08/01/2040 CPN: 3.3050 Agency-MBS US 18,840.52 18,336.51 18,509.62<br />

PB 31419EUG2 FNMA FNMS 04.000 CTAE4182 MAT: 10/01/2030 CPN: 4.0000 Agency-MBS US 22,078.07 22,147.27 22,195.80<br />

PB 31419EZE2 FNMA FNMS 04.000 CTAE4340 MAT: 10/01/2030 CPN: 4.0000 Agency-MBS US 12,394.99 12,354.14 12,764.43<br />

PB 31419HWH1 FNMA FNMS 04.000 CLAE6947 MAT: 11/01/2040 CPN: 4.0000 Agency-MBS US 26,025.05 25,825.62 25,8<strong>21</strong>.81<br />

PB 31419KGY5 FNMA FNMS 04.000 CLAE8314 MAT: 11/01/2040 CPN: 4.0000 Agency-MBS US 22,798.55 22,612.88 22,609.54<br />

PB 36202ET25 GNMA GNII SF 004169 M MAT: 06/20/2038 CPN: 5.5000 Agency-MBS US 35,519.66 20,442.39 20,373.79<br />

PB 36202FCJ3 GNMA GNII JM 004573 M MAT: 11/20/2039 CPN: 5.0000 Agency-MBS US 4,152.62 2,922.35 2,9<strong>21</strong>.19<br />

PB 36202FGD2 GNMA GNII SF 004696 M MAT: 05/20/2040 CPN: 4.5000 Agency-MBS US 87,502.03 88,197.01 88,022.33<br />

PB 3620AAT81 GNMA GNMI SF 724275 X MAT: 09/15/2039 CPN: 5.0000 Agency-MBS US 13,155.43 11,095.37 11,142.10<br />

PB 3620AQ6A6 GNMA GNMI SF 737165 X MAT: 04/15/2025 CPN: 4.5000 Agency-MBS US 9,725.37 9,750.88 9,732.27<br />

Market Information (including without limitation, indicative market values such as prices and accrued income, either stated or derived, and public credit ratings from NRSROs) furnished in this report has been obtained from sources (including<br />

third party vendors, and tri-party agents that may hold securities collateral for securities lending transactions) which J.P. Morgan believes to be reliable and is furnished for the exclusive use of the customer to whom this statement is<br />

addressed.J.P. Morgan MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF ACCURACY OR COMPLETENESS OR THAT ANY QUOTED VALUES NECESSARILY REFLECT THE<br />

PROCEEDS WHICH MAY BE RECEIVED ON THE SALE OF A SECURITY.<br />

Copyright JPMorgan Chase & Co. 2011. Copyright J.P. Morgan Europe Limited 2011. All rights reserved.<br />

D-036-947-<strong>21</strong>0 <strong>21</strong>-Jan-2011 19:12:28