Part 2: Statements 1-21 - McKnight Foundation

Part 2: Statements 1-21 - McKnight Foundation

Part 2: Statements 1-21 - McKnight Foundation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

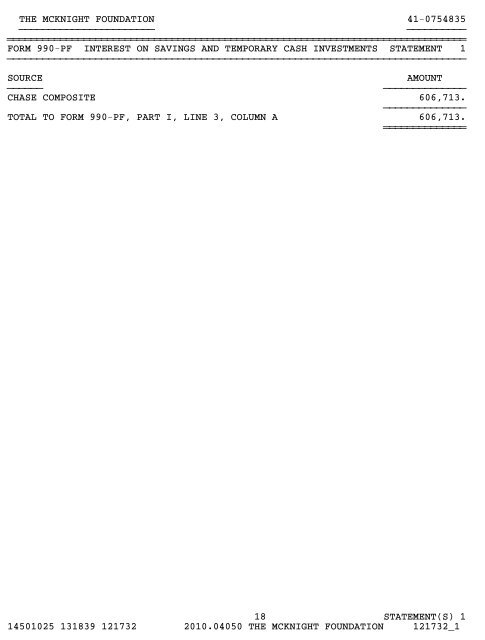

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF INTEREST ON SAVINGS AND TEMPORARY CASH INVESTMENTS STATEMENT 1<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

SOURCE<br />

AMOUNT<br />

}}}}}} }}}}}}}}}}}}}}<br />

CHASE COMPOSITE 606,713.<br />

}}}}}}}}}}}}}}<br />

TOTAL TO FORM 990-PF, PART I, LINE 3, COLUMN A<br />

606,713.<br />

~~~~~~~~~~~~~~<br />

18<br />

STATEMENT(S) 1<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION<br />

41-0754835<br />

12/31/2010<br />

PART I - DIVIDENDS AND INTEREST FROM SECURITIES STATEMENT 2<br />

REVENUE AND EXPENSES NET INVESTMENT<br />

DESCRIPTION PER BOOKS INCOME<br />

SCHEDULE K-1 INTEREST INCOME:<br />

Chase Composite 11,730,244 11,730,244<br />

Mellon Global Alpha #500-801 333,142 0<br />

Mellon VMB #500-789 77,236 0<br />

Mellon VMB II #500-791 76,934 0<br />

Commonfund Capital International <strong>Part</strong>ners V 0 79,061<br />

Commonfund Capital International <strong>Part</strong>ners VI 0 20,745<br />

Commonfund Capital Natural Resources <strong>Part</strong>ners VII 0 22,137<br />

Commonfund Capital Private Equity <strong>Part</strong>ners V 0 487,956<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VI 0 160,316<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VII 0 81,797<br />

Commonfund Capital Venture <strong>Part</strong>ners VI 0 25,456<br />

Commonfund Capital Venture <strong>Part</strong>ners VII 0 17,209<br />

Commonfund Capital Venture <strong>Part</strong>ners VIII 0 5,574<br />

Commonfund Capital Venture <strong>Part</strong>ners IX 0 5<br />

First State Investments 0 0<br />

Goldman Sachs Vintage Fund IV 0 327,057<br />

Harbourvest International Private Equity <strong>Part</strong>ners V 0 281,677<br />

Harbourvest International Private Equity <strong>Part</strong>ners VI 0 11,885<br />

Harbourvest <strong>Part</strong>ners VI- Buyout 0 68,127<br />

Harbourvest <strong>Part</strong>ners VI-Direct Fund 0 11,737<br />

Harbourvest <strong>Part</strong>ners VI-<strong>Part</strong>nership Fund 0 104,592<br />

Harbourvest <strong>Part</strong>ners VII-2005 Buyout 0 59,384<br />

Harbourvest <strong>Part</strong>ners VII-Buyout 0 24,999<br />

Harbourvest <strong>Part</strong>ners VII-Dover 0 7,878<br />

Harbourvest <strong>Part</strong>ners VII-Mezzanine and Distressed Debt Fund 0 282,382<br />

Harbourvest <strong>Part</strong>ners VII-Venture <strong>Part</strong>nership Fund 0 58,528<br />

Harbourvest <strong>Part</strong>ners VIII-Buyout Fund 0 85,562<br />

Harbourvest <strong>Part</strong>ners VIII-Venture Fund 0 27,809<br />

Mondrian Emerging Markets Equity Fund 0 532<br />

Oaktree Principal Fund V 0 102,313<br />

Pantheon Europe Fund V B LP 0 94,013<br />

Pantheon Europe Fund VI 0 17,634<br />

Pantheon Global Secondary Fund IV 0 481<br />

Pantheon USA Fund VII 0 95,041<br />

Pantheon USA Fund VIII 0 51,948<br />

Silchester International Investors 0 124<br />

State Street Bank & Trust Company SSGA 43,484 105<br />

Wellington Trust Company 0 1,605,892<br />

LESS: Interest Income Reported <strong>Part</strong> I (see statement 1) (606,713) (606,713)<br />

TOTAL INTEREST 11,654,327 15,343,487<br />

(PAGE 1 OF 2)

THE MCKNIGHT FOUNDATION<br />

41-0754835<br />

12/31/2010<br />

PART I - DIVIDENDS AND INTEREST FROM SECURITIES STATEMENT 2<br />

REVENUE AND EXPENSES NET INVESTMENT<br />

DESCRIPTION PER BOOKS INCOME<br />

SCHEDULE K-1 DIVIDEND INCOME:<br />

Commonfund Capital International <strong>Part</strong>ners V 0 83,991<br />

Commonfund Capital International <strong>Part</strong>ners VI 0 72,482<br />

Commonfund Capital Natural Resources <strong>Part</strong>ners VII 0 15,846<br />

Commonfund Capital Private Equity <strong>Part</strong>ners V 0 176,358<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VI 0 81,117<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VII 0 34,664<br />

Commonfund Capital Venture <strong>Part</strong>ners VI 0 13,181<br />

Commonfund Capital Venture <strong>Part</strong>ners VII 0 6,804<br />

Commonfund Capital Venture <strong>Part</strong>ners VIII 0 3,459<br />

Commonfund Capital Venture <strong>Part</strong>ners IX 0 0<br />

First State Investments 860,200 1,089,374<br />

Goldman Sachs Vintage Fund IV 0 243,072<br />

Harbourvest International Private Equity <strong>Part</strong>ners V 0 68,829<br />

Harbourvest International Private Equity <strong>Part</strong>ners VI 0 1,312<br />

Harbourvest <strong>Part</strong>ners VI- Buyout 0 487,165<br />

Harbourvest <strong>Part</strong>ners VI-Direct Fund 0 483<br />

Harbourvest <strong>Part</strong>ners VI-<strong>Part</strong>nership Fund 0 262,610<br />

Harbourvest <strong>Part</strong>ners VII-2005 Buyout 0 366,334<br />

Harbourvest <strong>Part</strong>ners VII-Buyout 0 183,748<br />

Harbourvest <strong>Part</strong>ners VII-Dover 0 5,270<br />

Harbourvest <strong>Part</strong>ners VII-Mezzanine and Distressed Debt Fund 0 44,611<br />

Harbourvest <strong>Part</strong>ners VII-Venture <strong>Part</strong>nership Fund 0 79,735<br />

Harbourvest <strong>Part</strong>ners VIII-Buyout Fund 0 191,135<br />

Harbourvest <strong>Part</strong>ners VIII-Venture Fund 0 28,727<br />

Mondrian Emerging Markets Equity Fund 4,099,541 4,708,470<br />

Oaktree Principal Fund V 0 10,829<br />

Pantheon Europe Fund V B LP 0 58,833<br />

Pantheon Europe Fund VI 0 13,977<br />

Pantheon Global Secondary Fund IV 0 0<br />

Pantheon USA Fund VII 0 90,235<br />

Pantheon USA Fund VIII 0 5,832<br />

Silchester International Investors 1,516,737 1,613,<strong>21</strong>7<br />

State Street Bank & Trust Company SSGA 814,527 824,767<br />

Wellington Trust Company 0 1,509,925<br />

SUB-TOTAL 7,291,005 12,376,392<br />

OTHER DIVIDENDS:<br />

Mellon Growth #502-527 945,519 0<br />

Mellon VMB #500-789 61,931 0<br />

Mellon VMB II #500-791 59,584 0<br />

Mellon Global Alpha #500-801 4,520,888 0<br />

Mellon Bank N.A. 1,553,944 7,629,179<br />

Chase Composite 6,176,733 0<br />

Plus: Accrued Dividends BOY 0 163,106<br />

Less: Accrued Dividends EOY 0 (200,026)<br />

SUB-TOTAL 13,318,599 7,592,259<br />

TOTAL DIVIDENDS 20,609,604 19,968,651<br />

TOTAL INTEREST AND DIVIDENDS 32,263,931 35,312,138<br />

(PAGE 2 OF 2)

THE MCKNIGHT FOUNDATION<br />

41-0754835<br />

12/31/2010<br />

PART I - GROSS RENTS STATEMENT 3<br />

REVENUE AND EXPENSES<br />

NET INVESTMENT<br />

DESCRIPTION PER BOOKS INCOME(LOSS)<br />

Commonfund Capital Natural Resources <strong>Part</strong>ners VII 0 6,874<br />

Commonfund Capital Private Equity <strong>Part</strong>ners V 0 658<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VI 0 45<br />

Commonfund Capital Venture <strong>Part</strong>ners VII 0 311<br />

Commonfund Capital Venture <strong>Part</strong>ners VII 0 (25)<br />

Goldman Sachs Vintage Fund IV 0 355<br />

Harbourvest International Private Equity <strong>Part</strong>ners V 0 (29)<br />

Harbourvest International Private Equity <strong>Part</strong>ners VI 0 (2)<br />

Harbourvest <strong>Part</strong>ners VI- Buyout 0 <strong>21</strong>5<br />

Harbourvest <strong>Part</strong>ners VI-<strong>Part</strong>nership Fund 0 (3,402)<br />

Harbourvest <strong>Part</strong>ners VII-2005 Buyout 0 (87)<br />

Harbourvest <strong>Part</strong>ners VII-Buyout 0 (1,682)<br />

Harbourvest <strong>Part</strong>ners VII-Dover 0 57<br />

Harbourvest <strong>Part</strong>ners VII-Mezzanine and Distressed Debt Fund 0 5<br />

Harbourvest <strong>Part</strong>ners VII-Venture <strong>Part</strong>nership Fund 0 16<br />

Harbourvest <strong>Part</strong>ners VIII-Buyout Fund 0 3<br />

Harbourvest <strong>Part</strong>ners VIII-Venture Fund 0 42<br />

Pantheon USA Fund VII 0 (70)<br />

Pantheon USA Fund VIII 0 (56)<br />

TOTAL 0 3,228

THE MCKNIGHT FOUNDATION<br />

41-0754835<br />

12/31/2010<br />

PART I - OTHER INCOME STATEMENT 4<br />

REVENUE AND EXPENSES NET INVESTMENT<br />

DESCRIPTION PER BOOKS INCOME<br />

ORDINARY INCOME FROM K-1'S:<br />

Commonfund Capital International <strong>Part</strong>ners V 0 0<br />

Commonfund Capital International <strong>Part</strong>ners VI 0 0<br />

Commonfund Capital Natural Resources <strong>Part</strong>ners VII 0 (119,593)<br />

Commonfund Capital Private Equity <strong>Part</strong>ners V 0 (2,669)<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VI 0 (26,995)<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VII 0 (35,278)<br />

Commonfund Capital Venture <strong>Part</strong>ners VI 0 3,<strong>21</strong>3<br />

Commonfund Capital Venture <strong>Part</strong>ners VII 0 (153,244)<br />

Commonfund Capital Venture <strong>Part</strong>ners VIII 0 (192)<br />

Commonfund Capital Venture <strong>Part</strong>ners IX 0 0<br />

First State Investments 0 0<br />

Goldman Sachs Vintage Fund IV 0 73,536<br />

Harbourvest International Private Equity <strong>Part</strong>ners V 0 (5,224)<br />

Harbourvest International Private Equity <strong>Part</strong>ners VI 0 (339)<br />

Harbourvest <strong>Part</strong>ners VI- Buyout 0 12,369<br />

Harbourvest <strong>Part</strong>ners VI-Direct Fund 0 0<br />

Harbourvest <strong>Part</strong>ners VI-<strong>Part</strong>nership Fund 0 (7,246)<br />

Harbourvest <strong>Part</strong>ners VII-2005 Buyout 0 (28,275)<br />

Harbourvest <strong>Part</strong>ners VII-Buyout 0 (8,891)<br />

Harbourvest <strong>Part</strong>ners VII-Dover 0 10,205<br />

Harbourvest <strong>Part</strong>ners VII-Mezzanine and Distressed Debt Fund 0 12,776<br />

Harbourvest <strong>Part</strong>ners VII-Venture <strong>Part</strong>nership Fund 0 (3,898)<br />

Harbourvest <strong>Part</strong>ners VIII-Buyout Fund 0 26,361<br />

Harbourvest <strong>Part</strong>ners VIII-Venture Fund 0 4,612<br />

Mondrian Emerging Markets Equity Fund 0 0<br />

Oaktree Principal Fund V 0 (4,896)<br />

Pantheon Europe Fund V B LP 0 (44,996)<br />

Pantheon Europe Fund VI 0 (23,006)<br />

Pantheon Global Secondary Fund IV 0 241<br />

Pantheon USA Fund VII 0 (26,440)<br />

Pantheon USA Fund VIII 0 (16,865)<br />

Silchester International Investors 0 0<br />

State Street Bank & Trust Company SSGA 0 0<br />

Wellington Trust Company 0 0<br />

SUB-TOTAL 0 (364,734)<br />

ROYALTY INCOME FROM K-1'S:<br />

Commonfund Capital International <strong>Part</strong>ners V 0 0<br />

Commonfund Capital International <strong>Part</strong>ners VI 0 0<br />

Commonfund Capital Natural Resources <strong>Part</strong>ners VII 0 33,248<br />

Commonfund Capital Private Equity <strong>Part</strong>ners V 0 606<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VI 0 6,290<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VII 0 6,808<br />

Commonfund Capital Venture <strong>Part</strong>ners VI 0 0<br />

Commonfund Capital Venture <strong>Part</strong>ners VII 0 0<br />

Commonfund Capital Venture <strong>Part</strong>ners VIII 0 0<br />

Commonfund Capital Venture <strong>Part</strong>ners IX 0 0<br />

First State Investments 0 0<br />

Goldman Sachs Vintage Fund IV 0 6<br />

Harbourvest International Private Equity <strong>Part</strong>ners V 0 0<br />

Harbourvest International Private Equity <strong>Part</strong>ners VI 0 0<br />

Harbourvest <strong>Part</strong>ners VI- Buyout 0 5,095<br />

Harbourvest <strong>Part</strong>ners VI-Direct Fund 0 0<br />

Harbourvest <strong>Part</strong>ners VI-<strong>Part</strong>nership Fund 0 (76)<br />

Harbourvest <strong>Part</strong>ners VII-2005 Buyout 0 <strong>21</strong>,822<br />

Harbourvest <strong>Part</strong>ners VII-Buyout 0 6,827<br />

Harbourvest <strong>Part</strong>ners VII-Dover 0 0<br />

Harbourvest <strong>Part</strong>ners VII-Mezzanine and Distressed Debt Fund 0 30<br />

Harbourvest <strong>Part</strong>ners VII-Venture <strong>Part</strong>nership Fund 0 2<br />

Harbourvest <strong>Part</strong>ners VIII-Buyout Fund 0 7,922<br />

Harbourvest <strong>Part</strong>ners VIII-Venture Fund 0 0<br />

Mondrian Emerging Markets Equity Fund 0 0<br />

Oaktree Principal Fund V 0 0<br />

Pantheon Europe Fund V B LP 0 0<br />

Pantheon Europe Fund VI 0 0<br />

Pantheon Global Secondary Fund IV 0 0<br />

Pantheon USA Fund VII 0 779<br />

Pantheon USA Fund VIII 0 381<br />

Silchester International Investors 0 0<br />

State Street Bank & Trust Company SSGA 0 0<br />

Wellington Trust Company 0 0<br />

(PAGE 1 OF 3)<br />

SUB-TOTAL 0 89,740

THE MCKNIGHT FOUNDATION<br />

41-0754835<br />

12/31/2010<br />

PART I - OTHER INCOME STATEMENT 4<br />

REVENUE AND EXPENSES NET INVESTMENT<br />

DESCRIPTION PER BOOKS INCOME<br />

ORDINARY PORTFOLIO INCOME FROM K-1'S:<br />

Commonfund Capital International <strong>Part</strong>ners V 0 (491,388)<br />

Commonfund Capital International <strong>Part</strong>ners VI 0 (199,441)<br />

Commonfund Capital Natural Resources <strong>Part</strong>ners VII 0 7,911<br />

Commonfund Capital Private Equity <strong>Part</strong>ners V 0 2,520<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VI 0 1,953<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VII 0 (33)<br />

Commonfund Capital Venture <strong>Part</strong>ners VI 0 322<br />

Commonfund Capital Venture <strong>Part</strong>ners VII 0 391<br />

Commonfund Capital Venture <strong>Part</strong>ners VIII 0 109<br />

Commonfund Capital Venture <strong>Part</strong>ners IX 0 0<br />

First State Investments 0 0<br />

Goldman Sachs Vintage Fund IV 0 29,337<br />

Harbourvest International Private Equity <strong>Part</strong>ners V 0 (63,539)<br />

Harbourvest International Private Equity <strong>Part</strong>ners VI 0 52<br />

Harbourvest <strong>Part</strong>ners VI- Buyout 0 2,855<br />

Harbourvest <strong>Part</strong>ners VI-Direct Fund 0 (28,425)<br />

Harbourvest <strong>Part</strong>ners VI-<strong>Part</strong>nership Fund 0 2,224<br />

Harbourvest <strong>Part</strong>ners VII-2005 Buyout 0 2,339<br />

Harbourvest <strong>Part</strong>ners VII-Buyout 0 2,698<br />

Harbourvest <strong>Part</strong>ners VII-Dover 0 (2,001)<br />

Harbourvest <strong>Part</strong>ners VII-Mezzanine and Distressed Debt Fund 0 (1,644)<br />

Harbourvest <strong>Part</strong>ners VII-Venture <strong>Part</strong>nership Fund 0 (38)<br />

Harbourvest <strong>Part</strong>ners VIII-Buyout Fund 0 (1,633)<br />

Harbourvest <strong>Part</strong>ners VIII-Venture Fund 0 (172)<br />

Mondrian Emerging Markets Equity Fund 0 0<br />

Oaktree Principal Fund V 0 1,430<br />

Pantheon Europe Fund V B LP 0 2,415<br />

Pantheon Europe Fund VI 0 1,096<br />

Pantheon Global Secondary Fund IV 0 (12)<br />

Pantheon USA Fund VII 0 249<br />

Pantheon USA Fund VIII 0 (1,442)<br />

Silchester International Investors 0 0<br />

State Street Bank & Trust Company SSGA 0 59,739<br />

Wellington Trust Company 0 3,697,778<br />

SUB-TOTAL 0 3,025,650<br />

OTHER INCOME FROM K-1'S:<br />

Commonfund Capital International <strong>Part</strong>ners V (142,780) (2,805)<br />

Commonfund Capital International <strong>Part</strong>ners VI (198,101) (397)<br />

Commonfund Capital Natural Resources <strong>Part</strong>ners VII (264,529) 366<br />

Commonfund Capital Private Equity <strong>Part</strong>ners V 302,173 31,027<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VI 70,792 31,613<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VII (380,518) 127,073<br />

Commonfund Capital Venture <strong>Part</strong>ners VI (228,035) 4,110<br />

Commonfund Capital Venture <strong>Part</strong>ners VII (389,195) 161<br />

Commonfund Capital Venture <strong>Part</strong>ners VIII (451,662) 7,270<br />

Commonfund Capital Venture <strong>Part</strong>ners IX (27,078) 0<br />

First State Investments 0 78,431<br />

Goldman Sachs Vintage Fund IV (90,665) 28,425<br />

Hancock Timber Fund (994,2<strong>21</strong>) 0<br />

Harbourvest International Private Equity <strong>Part</strong>ners V (17,936) 7,424<br />

Harbourvest International Private Equity <strong>Part</strong>ners VI (6,613) (167)<br />

Harbourvest <strong>Part</strong>ners VI- Buyout (1,946) 26,406<br />

Harbourvest <strong>Part</strong>ners VI-Direct Fund 558 0<br />

Harbourvest <strong>Part</strong>ners VI-<strong>Part</strong>nership Fund (1,556) 7,981<br />

Harbourvest <strong>Part</strong>ners VII-2005 Buyout (6,9<strong>21</strong>) 5,067<br />

Harbourvest <strong>Part</strong>ners VII-Buyout (1,373) 224<br />

Harbourvest <strong>Part</strong>ners VII-Dover (10,853) 4,168<br />

Harbourvest <strong>Part</strong>ners VII-Mezzanine and Distressed Debt Fund 8,309 11,128<br />

Harbourvest <strong>Part</strong>ners VII-Venture <strong>Part</strong>nership Fund (3,048) 2,895<br />

Harbourvest <strong>Part</strong>ners VIII-Buyout Fund 31,095 10,669<br />

Harbourvest <strong>Part</strong>ners VIII-Venture Fund (12,386) 8,586<br />

Mondrian Emerging Markets Equity Fund 0 97,511<br />

Oaktree Principal Fund V 72,163 0<br />

Pantheon Europe Fund V B LP 13,820 (20)<br />

Pantheon Europe Fund VI 10,205 (1,430)<br />

Pantheon Global Secondary Fund IV (9,838) 908<br />

Pantheon USA Fund VII (6,124) 20,925<br />

Pantheon USA Fund VIII (6,084))<br />

13,540<br />

Silchester International Investors 0 86,331<br />

Wellington Trust Company 0 2,817,444<br />

(PAGE 2 OF 3)<br />

SUB-TOTAL (2,742,347) 3,424,864

THE MCKNIGHT FOUNDATION<br />

41-0754835<br />

12/31/2010<br />

PART I - OTHER INCOME STATEMENT 4<br />

REVENUE AND EXPENSES NET INVESTMENT<br />

DESCRIPTION PER BOOKS INCOME<br />

ORDINARY MISCELLANEOUS INCOME:<br />

Adminstrative Fees - Neuroscience Fund 100,000 0<br />

Misc Refunds and Adjustments 1,571 114<br />

Investment adjustments (156,322) (156,322)<br />

Interest - Program Related Investment 366,840 366,840<br />

Plus: Acc Interest PRI at Beginning of Year 0 314,392<br />

Less: Acc Interest PRI at End of Year 0 (229,132)<br />

Less: UBI (Income) Loss 0 495,579<br />

SUB-TOTAL 312,089 791,471<br />

TOTAL OTHER INCOME (2,430,258) 6,966,991<br />

(PAGE 3 OF 3)

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF LEGAL FEES STATEMENT 5<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

(A) (B) (C) (D)<br />

EXPENSES NET INVEST- ADJUSTED CHARITABLE<br />

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES<br />

}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}<br />

ADMINISTRATIVE 10,824. 1<strong>21</strong>. 10,920.<br />

BOARD 8,027. 1,605. 6,422.<br />

PROGRAM 8,624. 0. 8,624.<br />

INVEST 8,119.<br />

8,119.<br />

0.<br />

}}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}<br />

TO FM 990-PF, PG 1, LN 16A<br />

35,594.<br />

9,845.<br />

25,966.<br />

~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~<br />

22<br />

STATEMENT(S) 5<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF ACCOUNTING FEES STATEMENT 6<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

(A) (B) (C) (D)<br />

EXPENSES NET INVEST- ADJUSTED CHARITABLE<br />

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES<br />

}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}<br />

AUDIT 67,083. 33,542. 33,542.<br />

TAX 18,229.<br />

9,115.<br />

33,274.<br />

}}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}<br />

TO FORM 990-PF, PG 1, LN 16B 85,312. 42,657.<br />

66,816.<br />

~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~<br />

23<br />

STATEMENT(S) 6<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF OTHER PROFESSIONAL FEES STATEMENT 7<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

(A) (B) (C) (D)<br />

EXPENSES NET INVEST- ADJUSTED CHARITABLE<br />

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES<br />

}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}<br />

GENERAL ADMINISTRATIVE 92,177. 1,032. 98,176.<br />

PORTFOLIO MANAGEMENT FEES 10,966,053. 5,444,167. 0.<br />

INVESTMENT CONSULTANT 143,033. 143,033. 0.<br />

PROPOSAL REVIEWS 139,590. 0. 148,166.<br />

PROGRAM SUPPORT 1,515,892. 0. 1,045,851.<br />

EVALUATION 442,956. 0. 416,225.<br />

PROGRAM COMMUNICATION 7,146. 0. 7,126.<br />

FOUNDATION COMMUNICATION 924. 0. 924.<br />

RECRUITING EXPENSE 18,318. 205. 18,015.<br />

COMPUTER TRAINING 1,279. 14. 1,265.<br />

PAYROLL SERVICE 7,102. 471. 6,631.<br />

TEMP HELP SERVICE 14,030. 157. 13,992.<br />

GUEST PARKING 1,939.<br />

22.<br />

1,993.<br />

}}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}<br />

TO FORM 990-PF, PG 1, LN 16C 13,350,439. 5,589,101.<br />

1,758,364.<br />

~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~<br />

24<br />

STATEMENT(S) 7<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF TAXES STATEMENT 8<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

(A) (B) (C) (D)<br />

EXPENSES NET INVEST- ADJUSTED CHARITABLE<br />

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES<br />

}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}<br />

EXCISE TAX EXPENSE -2,356,925. 0. 0.<br />

INCOME TAXES -<strong>21</strong>1. 0. 0.<br />

PARTNERSHIP INVESTMENT<br />

FOREIGN TAXES PAID 0.<br />

}}}}}}}}}}}}<br />

TO FORM 990-PF, PG 1, LN 18<br />

1,036,234.<br />

}}}}}}}}}}}} }}}}}}}}}}}}<br />

0.<br />

}}}}}}}}}}}<br />

-2,357,136. 1,036,234.<br />

0.<br />

~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~<br />

25<br />

STATEMENT(S) 8<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF OTHER EXPENSES STATEMENT 9<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

(A) (B) (C) (D)<br />

EXPENSES NET INVEST- ADJUSTED CHARITABLE<br />

DESCRIPTION PER BOOKS MENT INCOME NET INCOME PURPOSES<br />

}}}}}}}}}}} }}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}<br />

OFFICE/COMP/ARTWORK SUPPLIES 57,638. 646. 67,400.<br />

REPAIRS AND MAINTENANCE 81,300. 911. 80,825.<br />

POSTAGE AND DELIVERY 6,767. 76. 6,201.<br />

DUES AND MEMBERSHIPS 32,882. 368. 32,504.<br />

SUBSCRIPTIONS 3,412. 38. 3,858.<br />

INSURANCE 63,587. 712. 71,296.<br />

LOSS ON PRI 728,397. 0. 0.<br />

MISC-GENERAL 4,015. 45. 3,970.<br />

PARTNERSHIP INVESTMENT<br />

EXPENSES-SEE STMT 9A 0.<br />

}}}}}}}}}}}<br />

TO FORM 990-PF, PG 1, LN 23<br />

14,540,994.<br />

}}}}}}}}}}}} }}}}}}}}}}}}<br />

0.<br />

}}}}}}}}}}}<br />

977,998. 14,543,790.<br />

266,054.<br />

~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~<br />

26<br />

STATEMENT(S) 9<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION<br />

41-0754835<br />

12/31/2010<br />

OTHER EXPENSES FROM K-1'S<br />

Sec 179 CHAR. INVEST. ROYALTY SEC. 59(e)(2) PORTFOLIO OTHER<br />

PARTNERSHIP DEDUCTION CONTRIB. INT. EXP DEDUCTION EXPENDITURES DEDUCTIONS DEDUCTIONS TOTALS<br />

Commonfund Capital International <strong>Part</strong>ners V - - 296 - - 450,953 - 451,249<br />

Commonfund Capital International <strong>Part</strong>ners VI - - 672 - - 350,723 - 351,395<br />

Commonfund Capital Natural Resources <strong>Part</strong>ners VII 308 200 7,842 7,637 83,662 317,675 680 418,004<br />

Commonfund Capital Private Equity <strong>Part</strong>ners V 743 402 396,426 - 1,066 404,799 2,076 805,512<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VI 9 462 65,843 <strong>21</strong>5 - 519,964 17,864 604,357<br />

Commonfund Capital Private Equity <strong>Part</strong>ners VII - 61 6,386 281 - 715,199 7,125 729,052<br />

Commonfund Capital Venture <strong>Part</strong>ners VI 98 20 635 - - 387,444 - 388,197<br />

Commonfund Capital Venture <strong>Part</strong>ners VII - 29 1,679 - 448 645,406 - 647,562<br />

Commonfund Capital Venture <strong>Part</strong>ners VIII 19 43 1,117 - - 605,083 - 606,262<br />

Commonfund Capital Venture <strong>Part</strong>ners IX - - - - - 14,627 - 14,627<br />

First State Investments - - 35 - - 79,801 - 79,836<br />

Goldman Sachs Vintage Fund IV 160 733 69,404 - 200 722,342 11,037 803,876<br />

Harbourvest International Private Equity <strong>Part</strong>ners V - 34 35,002 - 7,101 886,042 1,006 929,185<br />

Harbourvest International Private Equity <strong>Part</strong>ners VI - 2 5,116 - - 154,452 30 159,600<br />

Harbourvest <strong>Part</strong>ners VI- Buyout - 234 18,209 - - 165,798 275 184,516<br />

Harbourvest <strong>Part</strong>ners VI-Direct Fund - - - - - 48,319 - 48,319<br />

Harbourvest <strong>Part</strong>ners VI-<strong>Part</strong>nership Fund 25 17 34,023 - 1,385 323,557 446 359,453<br />

Harbourvest <strong>Part</strong>ners VII-2005 Buyout 16 715 32,191 - (11,940) 403,559 12,928 437,469<br />

Harbourvest <strong>Part</strong>ners VII-Buyout 9 <strong>21</strong>5 5,498 - 2,<strong>21</strong>7 192,410 2,678 203,027<br />

Harbourvest <strong>Part</strong>ners VII-Dover 8 7 3,747 - - 59,255 8,642 71,659<br />

Harbourvest <strong>Part</strong>ners VII-Mezzanine and Distressed Debt Fund 301 101 8,791 - 256 103,337 2,437 115,223<br />

Harbourvest <strong>Part</strong>ners VII-Venture <strong>Part</strong>nership Fund 61 60 39,304 - 1,049 286,506 2,735 329,715<br />

Habourvest <strong>Part</strong>ners VIII-Buyout Fund 107 402 29,629 - 347 551,178 42,607 624,270<br />

Harbourvest <strong>Part</strong>ners VIII-Venture Fund 47 230 15,062 - 2 543,374 516 559,231<br />

Mondrian Emerging Markets Equity Fund - - - - - 120,872 - 120,872<br />

Oaktree Principal Fund V - 10 5 - 468 237,550 - 238,033<br />

Pantheon Europe Fund V B LP - - 4,654 - - 392,465 - 397,119<br />

Pantheon Europe Fund VI - - 1,451 - - 268,408 - 269,859<br />

Pantheon Global Secondary Fund IV - 12 - - - 62,152 - 62,164<br />

Pantheon USA Fund VII - 710 10,127 2 25,027 432,475 7,166 475,507<br />

Pantheon USA Fund VIII - 125 2,602 - 9,719 296,376 556 309,378<br />

Silchester International Investors - - - - - - - -<br />

State Street Bank & Trust Company SSGA - - - - - 17,915 - 17,915<br />

Wellington Trust Company - - 1,663 - - 2,726,888 - 2,728,551<br />

- -<br />

- -<br />

TOTALS FROM PARTNERSHIPS 1,911 4,824 797,409 8,135 1<strong>21</strong>,007 13,486,904 120,804 14,540,994<br />

STATEMENT 9A

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF DEPRECIATION OF ASSETS NOT HELD FOR INVESTMENT STATEMENT 10<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

COST OR ACCUMULATED FAIR MARKET<br />

DESCRIPTION OTHER BASIS DEPRECIATION BOOK VALUE VALUE<br />

}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}} }}}}}}}}}}}}<br />

FURNITURE & FIXTURES 620,393. 367,833. 252,560. 252,560.<br />

OFFICE EQUIPMENT 18,116. 12,577. 5,539. 5,539.<br />

OFFICE ARTWORK 139,076. 0. 139,076. 139,076.<br />

COMPUTER - HARDWARE 367,123. 2<strong>21</strong>,010. 146,113. 146,113.<br />

COMPUTER - SOFTWARE 344,468. 282,725. 61,743. 61,743.<br />

LEASEHOLD IMPROVEMENTS<br />

TO 990-PF, PART II, LN 14<br />

3,900,<strong>21</strong>6.<br />

}}}}}}}}}}}}<br />

5,389,392.<br />

2,798,665.<br />

}}}}}}}}}}}}<br />

3,682,810.<br />

1,101,551.<br />

}}}}}}}}}}}}<br />

1,706,582.<br />

1,101,551.<br />

}}}}}}}}}}}}<br />

1,706,582.<br />

~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~ ~~~~~~~~~~~~<br />

27<br />

STATEMENT(S) 10<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF U.S. AND STATE/CITY GOVERNMENT OBLIGATIONS STATEMENT 11<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

U.S. OTHER<br />

FAIR MARKET<br />

DESCRIPTION GOV’T GOV’T BOOK VALUE VALUE<br />

}}}}}}}}}}} }}}}} }}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}<br />

JP MORGAN CHASE COMPOSITE - SEE<br />

X<br />

STMT 11A<br />

88,300,456. 88,300,456.<br />

}}}}}}}}}}}}}} }}}}}}}}}}}}}}<br />

TOTAL U.S. GOVERNMENT OBLIGATIONS 88,300,456. 88,300,456.<br />

}}}}}}}}}}}}}} }}}}}}}}}}}}}}<br />

TOTAL STATE AND MUNICIPAL GOVERNMENT OBLIGATIONS<br />

}}}}}}}}}}}}}} }}}}}}}}}}}}}}<br />

TOTAL TO FORM 990-PF, PART II, LINE 10A 88,300,456. 88,300,456.<br />

~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~<br />

28<br />

STATEMENT(S) 11<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF CORPORATE STOCK STATEMENT 12<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

FAIR MARKET<br />

DESCRIPTION BOOK VALUE VALUE<br />

}}}}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}<br />

JP MORGAN CHASE COMPOSITE - SEE STMT 11A 383,894,381. 383,894,381.<br />

MELLON CAPITAL GLOBAL ALPHA - SEE STMT 11B 202,784,711. 202,784,711.<br />

MELLON CAPITAL GROWTH - SEE STMT 12A 34,<strong>21</strong>6,435. 34,<strong>21</strong>6,435.<br />

MELLON CAPITAL VMB I - SEE STMT 12B 3,777,519. 3,777,519.<br />

MELLON CAPITAL VMB II - SEE STMT 12C 3,581,323. 3,581,323.<br />

SILCHESTER - SEE STMT 12D 53,858,111. 53,858,111.<br />

MONDRIAN - SEE STMT 12E 120,047,294. 120,047,294.<br />

FIRST STATE - SEE STMT 12F 62,638,868. 62,638,868.<br />

WELLINGTON CTF - SEE STMT 11C<br />

TOTAL TO FORM 990-PF, PART II, LINE 10B<br />

143,141,848.<br />

}}}}}}}}}}}}}}<br />

1007940490.<br />

143,141,848.<br />

}}}}}}}}}}}}}}<br />

1007940490.<br />

~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~<br />

29<br />

STATEMENT(S) 12<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF CORPORATE BONDS STATEMENT 13<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

FAIR MARKET<br />

DESCRIPTION BOOK VALUE VALUE<br />

}}}}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}<br />

JP MORGAN CHASE COMPOSITE - SEE STMT 11A 115,316,345. 115,316,345.<br />

MELLON CAPITAL VMB I - SEE STMT 12B 2,031,654. 2,031,654.<br />

MELLON CAPITAL VMB II - SEE STMT 12C 1,982,908. 1,982,908.<br />

WELLINGTON CTF - SEE STMT 11C<br />

TOTAL TO FORM 990-PF, PART II, LINE 10C<br />

5,958,558.<br />

}}}}}}}}}}}}}}<br />

125,289,465.<br />

5,958,558.<br />

}}}}}}}}}}}}}}<br />

125,289,465.<br />

~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~<br />

30<br />

STATEMENT(S) 13<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

THE MCKNIGHT FOUNDATION 41-0754835<br />

}}}}}}}}}}}}}}}}}}}}}}} }}}}}}}}}}<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

FORM 990-PF OTHER INVESTMENTS STATEMENT 14<br />

}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}}<br />

VALUATION<br />

FAIR MARKET<br />

DESCRIPTION METHOD BOOK VALUE VALUE<br />

}}}}}}}}}}} }}}}}}}}} }}}}}}}}}}}}}} }}}}}}}}}}}}}}<br />

CHASE COMPOSITE FMV 68,356,306. 68,356,306.<br />

WELLINGTON MULTI-ASSET FMV 53,200,371. 53,200,371.<br />

COMMONFUND PEP V FMV <strong>21</strong>,570,300. <strong>21</strong>,570,300.<br />

COMMONFUND VP VI FMV 15,926,052. 15,926,052.<br />

COMMONFUND IP V FMV 22,160,771. 22,160,771.<br />

COMMONFUND PEP VI FMV 18,472,186. 18,472,186.<br />

COMMONFUND VP VII FMV 20,380,401. 20,380,401.<br />

COMMONFUND PEP VII FMV 15,420,932. 15,420,932.<br />

COMMONFUND IP VI FMV 8,570,360. 8,570,360.<br />

COMMONFUND NR VII FMV 9,047,652. 9,047,652.<br />

COMMONFUND VP VIII FMV 10,220,805. 10,220,805.<br />

COMMONFUND VP IX FMV 354,011. 354,011.<br />

PANTHEON USA FUND VII FMV 9,636,896. 9,636,896.<br />

PANTHEON USA FUND VIII FMV 4,722,860. 4,722,860.<br />

PANTHEON GLOBAL SECONDARY FUND IV FMV 1,511,987. 1,511,987.<br />

PANTHEON EUROPE FUND V "B" FMV 11,833,173. 11,833,173.<br />

PANTHEON EUROPE FUND VI "B" FMV 7,447,919. 7,447,919.<br />

GOLDMAN SACHS VINTAGE IV FMV 20,756,541. 20,756,541.<br />

HARBOURVEST VI PARTNERSHIP FMV 10,671,628. 10,671,628.<br />

HARBOURVEST VI BUYOUT FMV 8,051,703. 8,051,703.<br />

HARBOURVEST VI DIRECT FMV 2,980,929. 2,980,929.<br />

HARBOURVEST VII BUYOUT FMV 7,852,341. 7,852,341.<br />

HARBOURVEST VII MEZZANINE FMV 3,890,187. 3,890,187.<br />

HARBOURVEST VII VENTURE FMV 8,864,447. 8,864,447.<br />

HARBOURVEST VII 2005 BUYOUT FMV 16,088,687. 16,088,687.<br />

HARBOURVEST VII DOVER STREET FMV 2,888,292. 2,888,292.<br />

HARBOURVEST VIII VENTURE FMV 12,715,959. 12,715,959.<br />

HARBOURVEST VIII BUYOUT FMV 16,492,759. 16,492,759.<br />

HARBOURVEST HIPEP V FMV 23,748,583. 23,748,583.<br />

HARBOURVEST HIPEP VI FMV 371,034. 371,034.<br />

HANCOCK FMV 34,046,641. 34,046,641.<br />

OAKTREE PRINCIPAL FUND V FMV 4,412,768. 4,412,768.<br />

INVESTMENT COLLATERAL-STMT 14A<br />

TOTAL TO FORM 990-PF, PART II, LINE 13<br />

FMV 41,225,850.<br />

}}}}}}}}}}}}}}<br />

513,891,331.<br />

41,225,850.<br />

}}}}}}}}}}}}}}<br />

513,891,331.<br />

~~~~~~~~~~~~~~ ~~~~~~~~~~~~~~<br />

31<br />

STATEMENT(S) 14<br />

14501025 131839 1<strong>21</strong>732 2010.04050 THE MCKNIGHT FOUNDATION 1<strong>21</strong>732_1

Daily Security Collateral Detail<br />

Page 1 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Borrower Name: Barclays Borrower ID: 008038G<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 3128H3L74 FMAC 04.500 FGPC E95750 G MAT: 04/01/2018 CPN: 4.5000 Agency-MBS US 39,334.51 8,066.96 7,989.44<br />

PB 3128JRVQ6 FMAC FMAR 847823 G MAT: 10/01/2037 CPN: 5.9490 Agency-MBS US 34,162.28 11,674.88 11,623.63<br />

PB 3128K5FF4 FMAC 06.000 FGPC A44666 G MAT: 04/01/2036 CPN: 6.0000 Agency-MBS US 68,929.54 23,496.95 23,357.61<br />

PB 3128KSUB6 FMAC 06.000 FGPC A62378 G MAT: 06/01/2037 CPN: 6.0000 Agency-MBS US 41,046.81 17,493.77 17,430.00<br />

PB 3128LXNR7 05.500 FGPC G02200 G MAT: 06/01/36 CPN: 5.500000 Agency-MBS US 44,728.46 17,905.95 17,851.68<br />

PB 3128M4W33 FMAC 06.000 FGPC G03066 G MAT: 05/01/2037 CPN: 6.0000 Agency-MBS US 39,466.29 19,643.08 19,261.58<br />

PB 3128M7EW2 FMAC 05.000 FGPC G05249 G MAT: 01/01/2039 CPN: 5.0000 Agency-MBS US 32,450.06 18,8<strong>21</strong>.73 18,896.87<br />

PB 3128MB6W2 FMAC 05.500 FGPC G13385 G MAT: 11/01/2023 CPN: 5.5000 Agency-MBS US 51,547.36 24,415.24 24,311.62<br />

PB 3128MCHQ1 FMAC 05.000 FGPC G13639 G MAT: 12/01/2020 CPN: 5.0000 Agency-MBS US 39,733.79 26,083.42 25,727.46<br />

PB 3128MUA96 FMAC 06.500 FGPC H01832 G MAT: 10/01/2037 CPN: 6.5000 Agency-MBS US 30,996.86 14,160.85 14,108.11<br />

PB 3128NHC50 FMAC FMAR 1J0992 G MAT: 04/01/2038 CPN: 4.4410 Agency-MBS US 2,080.39 1,589.45 1,584.17<br />

PB 3128P7PY3 FMAC 04.000 FGPC C91339 G MAT: 10/01/2030 CPN: 4.0000 Agency-MBS US 22,617.90 22,689.59 22,742.88<br />

PB 3128PQQV6 FMAC 04.000 FGPC J11368 G MAT: 01/01/2025 CPN: 4.0000 Agency-MBS US <strong>21</strong>,925.72 19,589.26 19,503.01<br />

PB 3128PTJ55 FMAC 03.500 FGPC J13884 G MAT: 12/01/2025 CPN: 3.5000 Agency-MBS US 207,471.38 208,814.48 207,900.73<br />

PB 3128Q2FQ1 FMAC FMAR 1L0175 G MAT: 08/01/2035 CPN: 5.2270 Agency-MBS US 27,389.82 9,433.71 9,376.08<br />

PB 3128QGAC6 FMAC FMAR 1N0003 G MAT: 04/01/2035 CPN: 2.1140 Agency-MBS US 60,920.17 23,267.09 23,229.37<br />

PB 3128QGAD4 FMAC FMAR 1N0004 G MAT: 04/01/2035 CPN: 2.1690 Agency-MBS US 57,014.75 <strong>21</strong>,557.96 <strong>21</strong>,5<strong>21</strong>.98<br />

PB 3128QLQ95 FMAC FMAR 1H2580 G MAT: 09/01/2035 CPN: 2.6320 Agency-MBS US 91,886.93 43,530.81 43,443.32<br />

PB 3128QLSR3 FMAC FMAR 1H2628 G MAT: 07/01/2036 CPN: 6.1410 Agency-MBS US 32,888.58 13,620.95 13,539.50<br />

PB 3128QS7J9 FMAC FMAR 1G2697 G MAT: 02/01/2038 CPN: 5.4340 Agency-MBS US <strong>21</strong>,984.75 9,349.29 9,313.80<br />

PB 3128QSM94 FMAC FMAR 1G<strong>21</strong>84 G MAT: 10/01/2037 CPN: 6.2240 Agency-MBS US <strong>21</strong>,925.72 11,348.35 11,297.08<br />

PB 3128S4UT2 FMAC FMAR 1Q0594 G MAT: 09/01/2038 CPN: 5.2440 Agency-MBS US 43,851.44 25,318.02 25,220.62<br />

PB 3128S5G40 FMAC FMAR 1Q1119 G MAT: 07/01/2040 CPN: 4.3230 Agency-MBS US 11,<strong>21</strong>6.17 11,395.41 11,358.00<br />

PB 3128S5GZ1 FMAC FMAR 1Q1116 G MAT: 04/01/2038 CPN: 5.6130 Agency-MBS US 15,208.78 15,919.51 15,854.<strong>21</strong><br />

PB 31292H4K7 FMAC 06.000 FGPC C01726 G MAT: 12/01/2033 CPN: 6.0000 Agency-MBS US 37,273.72 9,294.67 9,137.44<br />

PB 31292K4W4 FMAC 04.500 FGPC C03537 G MAT: 08/01/2040 CPN: 4.5000 Agency-MBS US <strong>21</strong>,925.72 <strong>21</strong>,752.86 <strong>21</strong>,655.25<br />

PB 31292LAN5 FMAC 04.000 FGPC C03613 G MAT: 11/01/2040 CPN: 4.0000 Agency-MBS US 109,628.59 108,407.38 108,425.46<br />

PB 312932SA5 FMAC 05.000 FGPC A85913 G MAT: 05/01/2039 CPN: 5.0000 Agency-MBS US 22,759.89 15,598.64 15,662.40<br />

PB 312943NE9 FMAC 04.000 FGPC A94889 G MAT: 11/01/2040 CPN: 4.0000 Agency-MBS US 82,556.11 81,733.28 81,746.92<br />

PB 312943QU0 FMAC 04.000 FGPC A94967 G MAT: 11/01/2040 CPN: 4.0000 Agency-MBS US 96,168.80 95,031.63 95,047.48<br />

Market Information (including without limitation, indicative market values such as prices and accrued income, either stated or derived, and public credit ratings from NRSROs) furnished in this report has been obtained from sources (including<br />

third party vendors, and tri-party agents that may hold securities collateral for securities lending transactions) which J.P. Morgan believes to be reliable and is furnished for the exclusive use of the customer to whom this statement is<br />

addressed.J.P. Morgan MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF ACCURACY OR COMPLETENESS OR THAT ANY QUOTED VALUES NECESSARILY REFLECT THE<br />

PROCEEDS WHICH MAY BE RECEIVED ON THE SALE OF A SECURITY.<br />

Copyright JPMorgan Chase & Co. 2011. Copyright J.P. Morgan Europe Limited 2011. All rights reserved.<br />

D-036-947-<strong>21</strong>0 <strong>21</strong>-Jan-2011 19:12:28

Daily Security Collateral Detail<br />

Page 2 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 312944PJ4 FMAC 04.000 FGPC A95825 G MAT: 12/01/2040 CPN: 4.0000 Agency-MBS US 314,915.06 312,275.87 312,327.95<br />

PB 312944PM7 FMAC 04.500 FGPC A95828 G MAT: 12/01/2040 CPN: 4.5000 Agency-MBS US 88,078.13 90,268.01 90,136.95<br />

PB 312944TB7 FMAC 04.000 FGPC A95946 G MAT: 01/01/2041 CPN: 4.0000 Agency-MBS US 59,355.59 58,858.15 58,867.97<br />

PB 312944TT8 FMAC 04.500 FGPC A95962 G MAT: 12/01/2040 CPN: 4.5000 Agency-MBS US 53,235.44 54,559.04 54,479.82<br />

PB 312944VP3 FMAC 04.000 FGPC A96022 G MAT: 01/01/2041 CPN: 4.0000 Agency-MBS US 76,318.52 75,678.92 75,691.54<br />

PB 312944Y47 FMAC 04.500 FGPC A96131 G MAT: 01/01/2041 CPN: 4.5000 Agency-MBS US 79,110.25 81,077.17 80,959.46<br />

PB 31300LJK2 FMAC FMAR 848366 G MAT: 07/01/2038 CPN: 5.0810 Agency-MBS US 16,020.04 16,230.25 16,169.28<br />

PB 31300LJR7 FMAC FMAR 848372 G MAT: 09/01/2036 CPN: 5.0440 Agency-MBS US 12,653.46 12,736.05 12,658.54<br />

PB 3132GAD<strong>21</strong> FMAC 04.500 FGPC U60371 G MAT: 01/01/2041 CPN: 4.5000 Agency-MBS US 137,828.67 141,858.50 142,006.25<br />

PB 31371LDG1 FNMA FNMS 05.000 CL254903 MAT: 09/01/2033 CPN: 5.0000 Agency-MBS US 14,906.76 5,693.70 5,691.76<br />

PB 3137A0PR0 FMAC FGRM 3694AG 11/15/27 MAT: 11/15/2027 CPN: 3.5000 Agency-MBS US 39,111.92 37,273.18 37,370.72<br />

PB 3137A0RP2 FGRA 3692FA 07/15/40 MAT: 07/15/40 CPN: 1.260310 Agency-MBS US 15,944.38 14,201.14 14,201.68<br />

PB 3137A1DD2 FMAC FGRM 03707A 07/15/25 MAT: 07/15/2025 CPN: 2.0000 Agency-MBS US 52,6<strong>21</strong>.72 43,706.68 43,713.42<br />

PB 3137A1DG5 FMAC FGRM 3707AK 11/15/23 MAT: 11/15/2023 CPN: 2.0000 Agency-MBS US 42,796.59 35,599.31 35,583.48<br />

PB 3137A1EK5 FMAC FGRM 3707HA 12/15/23 MAT: 12/15/2023 CPN: 2.0000 Agency-MBS US 68,605.45 62,196.87 62,<strong>21</strong>9.67<br />

PB 3137A1EZ2 FMAC FGRM 3707LA 03/15/24 MAT: 03/15/2024 CPN: 2.0000 Agency-MBS US 130,741.72 117,052.80 117,1<strong>21</strong>.75<br />

PB 3137A1U92 FMAC FGRM 3725KA 11/15/38 MAT: 11/15/2038 CPN: 2.0000 Agency-MBS US 81,933.24 75,975.26 76,512.60<br />

PB 3137A1UC5 FMAC FGRM 3725LA 01/15/40 MAT: 01/15/2040 CPN: 2.0000 Agency-MBS US 102,776.80 94,840.24 94,850.74<br />

PB 3137A3H69 FMAC FGRM 3751HA 11/15/24 MAT: 11/15/2024 CPN: 3.5000 Agency-MBS US 12,755.98 12,828.88 12,830.15<br />

PB 3137A4HH3 FMAC FGRM 3772HC 10/15/18 MAT: 10/15/2018 CPN: 3.0000 Agency-MBS US 73,042.75 75,045.29 74,984.49<br />

PB 31385XN29 FNMA FNMS 05.000 CI555809 MAT: 10/01/2018 CPN: 5.0000 Agency-MBS US 40,518.73 9,604.91 9,491.00<br />

PB 3138A2BQ1 FNMA FNMS 04.000 CLAH0946 MAT: 12/01/2040 CPN: 4.0000 Agency-MBS US 193,155.96 191,959.04 191,931.30<br />

PB 3138A2CD9 FNMA FNMS 03.500 CIAH0967 MAT: 12/01/2025 CPN: 3.5000 Agency-MBS US 51,334.31 51,746.82 51,520.75<br />

PB 3138A2CW7 FNMA FNMS 04.000 CLAH0984 MAT: 12/01/2040 CPN: 4.0000 Agency-MBS US 65,788.79 65,381.32 65,371.67<br />

PB 3138A2WW5 FNMA FNMS 04.000 CLAH1560 MAT: 01/01/2041 CPN: 4.0000 Agency-MBS US 123,096.00 122,333.58 122,315.54<br />

PB 3138A36X0 FNMA FNMS 04.000 CLAH2685 MAT: 01/01/2041 CPN: 4.0000 Agency-MBS US 143,026.04 142,140.18 142,119.<strong>21</strong><br />

PB 3138A3T23 FNMA FNMS 04.000 CLAH2368 MAT: 01/01/2041 CPN: 4.0000 Agency-MBS US 2,154.89 2,141.54 2,141.23<br />

PB 3138A3UE5 FNMA FNMS 04.000 CLAH2380 MAT: 01/01/2041 CPN: 4.0000 Agency-MBS US 87,857.90 87,313.74 87,300.86<br />

PB 3138A3VY0 FNMA FNMS 03.500 CIAH2430 MAT: 01/01/2026 CPN: 3.5000 Agency-MBS US 44,060.96 44,415.02 44,220.98<br />

PB 3138A4A54 FNMA FNMS 04.500 CLAH2727 MAT: 01/01/2041 CPN: 4.5000 Agency-MBS US 77,185.39 79,<strong>21</strong>3.05 79,110.20<br />

PB 31393CEA7 FNMA FNRM CL034WX R03F034 MAT: 10/25/2029 CPN: 4.0000 Agency-MBS US 71,156.85 19,957.24 20,203.29<br />

Market Information (including without limitation, indicative market values such as prices and accrued income, either stated or derived, and public credit ratings from NRSROs) furnished in this report has been obtained from sources (including<br />

third party vendors, and tri-party agents that may hold securities collateral for securities lending transactions) which J.P. Morgan believes to be reliable and is furnished for the exclusive use of the customer to whom this statement is<br />

addressed.J.P. Morgan MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF ACCURACY OR COMPLETENESS OR THAT ANY QUOTED VALUES NECESSARILY REFLECT THE<br />

PROCEEDS WHICH MAY BE RECEIVED ON THE SALE OF A SECURITY.<br />

Copyright JPMorgan Chase & Co. 2011. Copyright J.P. Morgan Europe Limited 2011. All rights reserved.<br />

D-036-947-<strong>21</strong>0 <strong>21</strong>-Jan-2011 19:12:28

Daily Security Collateral Detail<br />

Page 3 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 31396WY75 FNMA FNRM CL076EA R07F076 MAT: 07/25/2035 CPN: 6.0000 Agency-MBS US 83,317.73 20,484.20 20,699.47<br />

PB 31397H2V9 FMAC FGRM 3315HE 06/15/35 MAT: 06/15/2035 CPN: 6.0000 Agency-MBS US 36,628.57 9,945.55 10,059.53<br />

PB 31397RDP8 FMAC FGRM 3420AD 11/15/37 MAT: 11/15/2037 CPN: 5.5000 Agency-MBS US 32,888.58 9,137.96 9,233.71<br />

PB 31397THS4 FMAC FGRA 03453F 05/15/38 MAT: 05/15/2038 CPN: 1.1530 Agency-MBS US 71,837.84 28,630.02 28,690.28<br />

PB 31398JH48 FMAC FGRM 03560A 08/15/24 MAT: 08/15/2024 CPN: 4.5000 Agency-MBS US 43,851.44 31,616.43 31,813.08<br />

PB 31398KK66 FMAC FGRM 3591BD 03/15/37 MAT: 03/15/2037 CPN: 4.0000 Agency-MBS US 15,348.00 11,603.25 11,674.73<br />

PB 31398NJ39 FNMA FNRM CL110KA R10F110 MAT: 10/25/2025 CPN: 2.0000 Agency-MBS US 85,510.30 74,063.67 74,100.40<br />

PB 31398NK60 FNMA FNRM CL110BA R10F110 MAT: 10/25/2025 CPN: 2.0000 Agency-MBS US 61,880.52 55,9<strong>21</strong>.08 55,896.57<br />

PB 31398SEN9 FNMA FNRM CL125KA R10F125 MAT: 11/25/2025 CPN: 2.0000 Agency-MBS US 62,969.76 58,948.24 58,920.72<br />

PB 31398SZN6 FNMA FNRM RC141G R10F141 MAT: 05/25/2030 CPN: 3.5000 Agency-MBS US 15,272.43 15,004.69 15,446.58<br />

PB 31398TXY2 FNMA FNRM RC090ME R10F090 MAT: 04/25/2028 CPN: 3.5000 Agency-MBS US 13,067.73 12,057.71 12,066.80<br />

PB 31398WR89 FMAC FGRA 3632BF 02/15/40 MAT: 02/15/2040 CPN: 1.5030 Agency-MBS US 23,679.78 24,166.16 24,186.82<br />

PB 31401JM62 FNMA FNMS 05.500 CL709681 MAT: 06/01/2033 CPN: 5.5000 Agency-MBS US 43,851.44 16,141.27 15,930.09<br />

PB 31403DJ34 FNMA FNMS 05.500 CL745582 MAT: 06/01/2036 CPN: 5.5000 Agency-MBS US 24,366.28 9,937.77 9,914.83<br />

PB 31410KTT1 FNMA FNAR XX.XXX LB889862 MAT: 08/01/2038 CPN: 5.0260 Agency-MBS US 35,081.15 22,094.20 22,027.89<br />

PB 31410KTV6 FNMA FNAR XX.XXX LB889864 MAT: 09/01/2038 CPN: 5.0990 Agency-MBS US 43,851.44 20,881.54 20,815.75<br />

PB 31411NP50 FNMA FNAR XX.XXX LB912244 MAT: 02/01/2037 CPN: 5.3020 Agency-MBS US 2,168.60 883.57 880.08<br />

PB 31411SQN9 FNMA FNMS 06.000 NP914061 MAT: 03/01/2037 CPN: 6.0000 Agency-MBS US 25,754.78 11,115.39 10,788.09<br />

PB 31412BNP3 FNMA FNMS 05.000 CL920298 MAT: 04/01/2036 CPN: 5.0000 Agency-MBS US 54,989.70 29,984.51 29,974.31<br />

PB 31412HT74 FNMA FNMS 04.500 BI925874 MAT: 06/01/2020 CPN: 4.5000 Agency-MBS US 30,713.55 18,180.78 18,161.97<br />

PB 31412P4F5 FNMA FNMS 05.000 CT931522 MAT: 07/01/2029 CPN: 5.0000 Agency-MBS US 14,148.34 11,458.38 11,452.73<br />

PB 31412QCA5 FNMA FNMS 04.500 CI931665 MAT: 07/01/2024 CPN: 4.5000 Agency-MBS US <strong>21</strong>,925.72 16,692.23 16,684.99<br />

PB 31412QGW3 FNMA FNMS 04.500 CL931813 MAT: 08/01/2039 CPN: 4.5000 Agency-MBS US 9,647.32 9,420.76 9,397.08<br />

PB 31412RLV7 FNMA FNMS 03.500 CI932840 MAT: 12/01/2025 CPN: 3.5000 Agency-MBS US 84,314.86 84,641.99 84,272.23<br />

PB 31413LJW0 FNMA FNMS 06.500 NP948577 MAT: 08/01/2037 CPN: 6.5000 Agency-MBS US <strong>21</strong>,925.72 10,873.81 10,831.89<br />

PB 31413WFW0 FNMA FNAR XX.XXX MB957481 MAT: 01/01/2023 CPN: 4.4510 Agency-MBS US <strong>21</strong>,925.72 16,735.42 16,679.67<br />

PB 31414PKP3 FNMA FNMS 05.000 CL972002 MAT: 02/01/2038 CPN: 5.0000 Agency-MBS US 36,838.25 23,036.69 23,129.17<br />

PB 31414SFQ1 FNMA FNAR XX.XXX LB974575 MAT: 04/01/2038 CPN: 4.3450 Agency-MBS US 18,358.53 12,757.12 12,715.75<br />

PB 31416BKR8 FNMA FNAR XX.XXX LB995004 MAT: 10/01/2038 CPN: 5.2980 Agency-MBS US 43,851.44 23,279.01 23,187.86<br />

PB 31416CDP8 FNMA FNMS 05.500 CL995710 MAT: 03/01/2039 CPN: 5.5000 Agency-MBS US 23,367.28 14,757.59 14,747.09<br />

PB 31416CH58 FNMA FNMS 05.500 CL995852 MAT: 06/01/2039 CPN: 5.5000 Agency-MBS US 27,707.14 24,745.71 24,731.70<br />

Market Information (including without limitation, indicative market values such as prices and accrued income, either stated or derived, and public credit ratings from NRSROs) furnished in this report has been obtained from sources (including<br />

third party vendors, and tri-party agents that may hold securities collateral for securities lending transactions) which J.P. Morgan believes to be reliable and is furnished for the exclusive use of the customer to whom this statement is<br />

addressed.J.P. Morgan MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF ACCURACY OR COMPLETENESS OR THAT ANY QUOTED VALUES NECESSARILY REFLECT THE<br />

PROCEEDS WHICH MAY BE RECEIVED ON THE SALE OF A SECURITY.<br />

Copyright JPMorgan Chase & Co. 2011. Copyright J.P. Morgan Europe Limited 2011. All rights reserved.<br />

D-036-947-<strong>21</strong>0 <strong>21</strong>-Jan-2011 19:12:28

Daily Security Collateral Detail<br />

Page 4 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 31416CJX5 FNMA FNMS 04.000 CI995878 MAT: 06/01/2024 CPN: 4.0000 Agency-MBS US 34,864.08 27,426.74 27,322.88<br />

PB 31416W6P2 FNMA FNMS 03.500 CIAB1777 MAT: 11/01/2025 CPN: 3.5000 Agency-MBS US 66,0<strong>21</strong>.49 65,985.01 65,696.74<br />

PB 31416XE48 FNMA FNMS 04.000 CLAB1954 MAT: 12/01/2040 CPN: 4.0000 Agency-MBS US 135,564.70 134,478.24 134,458.41<br />

PB 31417JKN9 FNMA FNMS 05.500 CLAC0300 MAT: 01/01/2034 CPN: 5.5000 Agency-MBS US 29,233.50 20,667.04 20,535.76<br />

PB 31417MKZ5 FNMA FNAR XX.XXX LBAC3011 MAT: 10/01/2039 CPN: 3.8020 Agency-MBS US 15,352.99 13,557.76 13,518.89<br />

PB 31417SYS3 FNMA FNMS 05.000 CKAC6120 MAT: 11/01/2039 CPN: 5.0000 Agency-MBS US 1,389.84 788.71 788.31<br />

PB 31417VN66 FNMA FNMS 04.500 CLAC8512 MAT: 12/01/2039 CPN: 4.5000 Agency-MBS US 17,722.30 15,866.02 15,843.01<br />

PB 31417VPQ0 FNMA FNMS 05.000 CKAC8530 MAT: 12/01/2039 CPN: 5.0000 Agency-MBS US 17,766.41 13,700.90 13,905.42<br />

PB 31417WSR3 FNMA FNMS 04.500 CLAC9527 MAT: 01/01/2040 CPN: 4.5000 Agency-MBS US 179,062.28 162,486.88 162,251.24<br />

PB 31417YVG9 FNMA FNMS 04.000 CLMA0614 MAT: 12/01/2040 CPN: 4.0000 Agency-MBS US 79,389.69 78,897.74 78,886.33<br />

PB 31418M3K6 FNMA FNAR XX.XXX LBAD0801 MAT: 06/01/2035 CPN: 2.6610 Agency-MBS US 17,770.61 14,177.40 14,148.66<br />

PB 31418MBV3 FNMA FNMS 05.500 CLAD0051 MAT: 01/01/2039 CPN: 5.5000 Agency-MBS US 25,433.83 20,418.93 20,271.63<br />

PB 31418MLC4 FNMA FNAR XX.XXX GAAD0322 MAT: 05/01/2037 CPN: 3.0280 Agency-MBS US 11,700.44 9,532.61 9,511.01<br />

PB 31418NZX1 FNMA FNMS 05.000 CKAD1657 MAT: 03/01/2040 CPN: 5.0000 Agency-MBS US <strong>21</strong>,925.72 15,755.36 15,747.50<br />

PB 31418QP49 FNMA FNMS 04.000 CIAD3142 MAT: 05/01/2025 CPN: 4.0000 Agency-MBS US 17,413.67 17,143.36 16,934.59<br />

PB 31418R6M8 FNMA FNAR XX.XXX LBAD4475 MAT: 05/01/2040 CPN: 3.6070 Agency-MBS US 22,085.69 15,754.61 15,711.40<br />

PB 31418RHD6 FNMA FNMS 04.000 CIAD3827 MAT: 04/01/2025 CPN: 4.0000 Agency-MBS US 18,302.26 17,789.32 17,615.08<br />

PB 31418U4C5 FNMA FNAR XX.XXX LBAD7118 MAT: 08/01/2040 CPN: 3.5790 Agency-MBS US 10,532.33 10,554.74 10,525.57<br />

PB 31418XXK9 FNMA FNAR XX.XXX LBAD9681 MAT: 08/01/2040 CPN: 3.6950 Agency-MBS US 10,980.10 10,748.63 10,864.93<br />

PB 31419AC88 FNMA FNAR XX.XXX WSAE0094 MAT: 08/01/2035 CPN: 2.4150 Agency-MBS US 35,042.51 31,200.04 31,141.89<br />

PB 31419BVX0 FNMA FNMS 03.500 CIAE1529 MAT: 10/01/2025 CPN: 3.5000 Agency-MBS US 14,470.97 14,368.09 14,305.32<br />

PB 31419CBW2 FNMA FNAR XX.XXX LBAE1852 MAT: 08/01/2040 CPN: 3.3050 Agency-MBS US 18,840.52 18,336.51 18,509.62<br />

PB 31419EUG2 FNMA FNMS 04.000 CTAE4182 MAT: 10/01/2030 CPN: 4.0000 Agency-MBS US 22,078.07 22,147.27 22,195.80<br />

PB 31419EZE2 FNMA FNMS 04.000 CTAE4340 MAT: 10/01/2030 CPN: 4.0000 Agency-MBS US 12,394.99 12,354.14 12,764.43<br />

PB 31419HWH1 FNMA FNMS 04.000 CLAE6947 MAT: 11/01/2040 CPN: 4.0000 Agency-MBS US 26,025.05 25,825.62 25,8<strong>21</strong>.81<br />

PB 31419KGY5 FNMA FNMS 04.000 CLAE8314 MAT: 11/01/2040 CPN: 4.0000 Agency-MBS US 22,798.55 22,612.88 22,609.54<br />

PB 36202ET25 GNMA GNII SF 004169 M MAT: 06/20/2038 CPN: 5.5000 Agency-MBS US 35,519.66 20,442.39 20,373.79<br />

PB 36202FCJ3 GNMA GNII JM 004573 M MAT: 11/20/2039 CPN: 5.0000 Agency-MBS US 4,152.62 2,922.35 2,9<strong>21</strong>.19<br />

PB 36202FGD2 GNMA GNII SF 004696 M MAT: 05/20/2040 CPN: 4.5000 Agency-MBS US 87,502.03 88,197.01 88,022.33<br />

PB 3620AAT81 GNMA GNMI SF 724275 X MAT: 09/15/2039 CPN: 5.0000 Agency-MBS US 13,155.43 11,095.37 11,142.10<br />

PB 3620AQ6A6 GNMA GNMI SF 737165 X MAT: 04/15/2025 CPN: 4.5000 Agency-MBS US 9,725.37 9,750.88 9,732.27<br />

Market Information (including without limitation, indicative market values such as prices and accrued income, either stated or derived, and public credit ratings from NRSROs) furnished in this report has been obtained from sources (including<br />

third party vendors, and tri-party agents that may hold securities collateral for securities lending transactions) which J.P. Morgan believes to be reliable and is furnished for the exclusive use of the customer to whom this statement is<br />

addressed.J.P. Morgan MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF ACCURACY OR COMPLETENESS OR THAT ANY QUOTED VALUES NECESSARILY REFLECT THE<br />

PROCEEDS WHICH MAY BE RECEIVED ON THE SALE OF A SECURITY.<br />

Copyright JPMorgan Chase & Co. 2011. Copyright J.P. Morgan Europe Limited 2011. All rights reserved.<br />

D-036-947-<strong>21</strong>0 <strong>21</strong>-Jan-2011 19:12:28

Daily Security Collateral Detail<br />

Page 5 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 36241KUH9 GNMA GNMI SP 782384 X MAT: 11/15/2034 CPN: 5.0000 Agency-MBS US <strong>21</strong>,925.72 15,918.85 15,912.72<br />

PB 36241LFD3 GNMA GNII SP 782864 M MAT: 09/20/2039 CPN: 6.0000 Agency-MBS US 20,682.70 11,405.74 11,343.41<br />

PB 36241LGB6 GNMA GNMI SP 782894 X MAT: 11/15/2039 CPN: 5.5000 Agency-MBS US 14,206.97 13,370.43 13,342.20<br />

PB 36241LHV1 GNMA GNII SP 782944 M MAT: 02/20/2040 CPN: 5.5000 Agency-MBS US 19,294.63 17,258.51 17,283.51<br />

PB 36241LPN0 GNMA GNMI SP 783129 X MAT: 10/15/2040 CPN: 4.0000 Agency-MBS US 11,265.00 11,279.68 11,263.01<br />

PB 36296Q5V7 GNMA GNMI SF 698460 X MAT: 08/15/2039 CPN: 4.5000 Agency-MBS US 10,419.10 9,270.88 9,253.81<br />

PB 36297F4U3 GNMA GNMI SF 711035 X MAT: 12/15/2039 CPN: 5.0000 Agency-MBS US 22,934.30 23,488.20 23,587.14<br />

PB 36297FRQ7 GNMA GNMI SF 710695 X MAT: 07/15/2039 CPN: 5.5000 Agency-MBS US 11,086.13 10,901.18 10,878.46<br />

PB 36297FYZ9 GNMA GNMI SF 710928 X MAT: 10/15/2039 CPN: 5.0000 Agency-MBS US 11,780.66 11,780.40 11,830.02<br />

PB 38373W7N2 GNMA GNRA 2008-025 FB MAT: 03/20/2038 CPN: 0.8606 Agency-MBS US 43,851.44 12,277.54 12,277.84<br />

PB 38376TE73 GNMA GNRA 2010-011 FC MAT: 01/16/2040 CPN: 0.9706 Agency-MBS US 43,851.44 34,024.36 34,015.77<br />

PB 38376TSC7 GNMA GNRA 2010-006 FG MAT: 01/16/2040 CPN: 0.8606 Agency-MBS US 43,851.44 33,249.12 33,276.28<br />

PB 38376TXD9 GNMA GNRA 2010-001 FA MAT: 01/16/2040 CPN: 1.0106 Agency-MBS US 83,317.73 55,104.32 55,290.28<br />

PB 38376YC25 GNMA GNRA 2010-047 BF MAT: 04/20/2040 CPN: 0.7606 Agency-MBS US 85,718.40 79,244.91 79,519.82<br />

PB 38376YC90 GNMA GNRA 2010-047 FL MAT: 04/20/2040 CPN: 1.1006 Agency-MBS US 33,290.18 30,809.84 30,876.09<br />

PB 38377J4G5 GNMA GNRM 2010-113 EA MAT: 10/20/2035 CPN: 2.0000 Agency-MBS US <strong>21</strong>,925.72 <strong>21</strong>,458.23 <strong>21</strong>,479.45<br />

PB 38377JPM9 GNMA GNRM 2010-098 A MAT: 07/20/2035 CPN: 2.2500 Agency-MBS US <strong>21</strong>,925.72 <strong>21</strong>,6<strong>21</strong>.17 <strong>21</strong>,651.86<br />

Total For Barclays 6,489,764.45 5,271,809.54 5,268,492.90<br />

Borrower Name: CANTOR Borrower ID: 005253G<br />

PB 3128JNCS2 FMAC FMAR 1B2880 G MAT: 05/01/2035 CPN: 2.7770 Agency-MBS US 11,625.98 2,503.67 2,385.69<br />

PB 3128JP3J7 FMAC FMAR 1B4500 G MAT: 11/01/2039 CPN: 3.7560 Agency-MBS US 6,019.99 4,881.78 4,858.53<br />

PB 3128JQCK2 FMAC FMAR 1B4673 G MAT: 04/01/2040 CPN: 3.6930 Agency-MBS US 7,441.90 5,604.25 5,529.89<br />

PB 3128JQEN4 FMAC FMAR 1B4740 G MAT: 05/01/2040 CPN: 3.4410 Agency-MBS US 5,651.04 5,337.52 5,323.43<br />

PB 3128JQFG8 FMAC FMAR 1B4766 G MAT: 06/01/2040 CPN: 3.5530 Agency-MBS US 6,194.67 5,490.19 5,519.81<br />

PB 3128JRNC6 FMAC FMAR 847587 G MAT: 07/01/2032 CPN: 2.7920 Agency-MBS US 8,231.<strong>21</strong> 2,507.79 2,502.48<br />

PB 3128LU4F0 FMAC FMAR 1J0822 G MAT: 01/01/2038 CPN: 5.7650 Agency-MBS US 6,994.10 3,512.22 3,497.44<br />

PB 3128LULQ7 FMAC FMAR 1J0335 G MAT: 03/01/2037 CPN: 5.8130 Agency-MBS US 8,136.50 3,275.89 3,261.97<br />

PB 3128LUZH2 FMAC FMAR 1J0744 G MAT: 12/01/2037 CPN: 5.9500 Agency-MBS US 8,032.92 3,624.81 3,609.07<br />

PB 3128QEAF4 FMAC FMAR 1M0006 G MAT: 05/01/2035 CPN: 2.8540 Agency-MBS US <strong>21</strong>,084.88 6,427.12 6,387.29<br />

PB 3128QJJN7 FMAC FMAR 1G1169 G MAT: 09/01/2036 CPN: 6.0480 Agency-MBS US 11,3<strong>21</strong>.<strong>21</strong> 3,979.81 3,962.29<br />

PB 3128QJYE0 FMAC FMAR 1G1609 G MAT: 03/01/2037 CPN: 5.5090 Agency-MBS US 8,095.50 3,820.47 3,651.52<br />

Market Information (including without limitation, indicative market values such as prices and accrued income, either stated or derived, and public credit ratings from NRSROs) furnished in this report has been obtained from sources (including<br />

third party vendors, and tri-party agents that may hold securities collateral for securities lending transactions) which J.P. Morgan believes to be reliable and is furnished for the exclusive use of the customer to whom this statement is<br />

addressed.J.P. Morgan MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF ACCURACY OR COMPLETENESS OR THAT ANY QUOTED VALUES NECESSARILY REFLECT THE<br />

PROCEEDS WHICH MAY BE RECEIVED ON THE SALE OF A SECURITY.<br />

Copyright JPMorgan Chase & Co. 2011. Copyright J.P. Morgan Europe Limited 2011. All rights reserved.<br />

D-036-947-<strong>21</strong>0 <strong>21</strong>-Jan-2011 19:12:28

Daily Security Collateral Detail<br />

Page 6 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 3128QSKD7 FMAC FMAR 1G2092 G MAT: 07/01/2037 CPN: 6.0100 Agency-MBS US 23,051.25 9,445.71 9,426.63<br />

PB 3128QSN77 FMAC FMAR 1G2<strong>21</strong>4 G MAT: 09/01/2037 CPN: 6.0580 Agency-MBS US 13,018.00 5,519.84 5,495.50<br />

PB 3128S43C9 FMAC FMAR 1Q0795 G MAT: 06/01/2037 CPN: 5.7230 Agency-MBS US 6,882.54 3,543.84 3,528.82<br />

PB 3128S44C8 FMAC FMAR 1Q0819 G MAT: 06/01/2037 CPN: 5.4030 Agency-MBS US 14,602.39 8,268.95 8,235.79<br />

PB 3128S4CD7 FMAC FMAR 1Q0068 G MAT: 04/01/2036 CPN: 2.6430 Agency-MBS US 7,116.66 3,579.12 3,571.90<br />

PB 3128S4CR6 FMAC FMAR 1Q0080 G MAT: 01/01/2036 CPN: 3.1200 Agency-MBS US 9,102.30 3,658.33 3,649.61<br />

PB 3128S4D20 FMAC FMAR 1Q01<strong>21</strong> G MAT: 10/01/2036 CPN: 6.0230 Agency-MBS US 11,623.42 3,480.42 3,256.13<br />

PB 3128S4LK1 FMAC FMAR 1Q0330 G MAT: 10/01/2037 CPN: 3.7100 Agency-MBS US 11,363.69 4,069.00 3,956.84<br />

PB 3128S5B45 FMAC FMAR 1Q0959 G MAT: 09/01/2037 CPN: 5.8130 Agency-MBS US 9,813.16 7,795.19 7,790.61<br />

PB 31300LBF1 FMAC FMAR 848138 G MAT: 07/01/2038 CPN: 3.1490 Agency-MBS US 8,926.78 7,838.55 7,819.97<br />

PB 31349UB64 FMAC FMAR 782761 G MAT: 10/01/2036 CPN: 5.7600 Agency-MBS US 28,998.10 6,079.41 6,042.11<br />

PB 31349UBU1 FMAC FMAR 782751 G MAT: 10/01/2036 CPN: 5.7170 Agency-MBS US 30,391.01 10,977.71 10,955.97<br />

PB 31381JR38 FNMA FNAR XX.XXX AM462306 MAT: 04/01/2037 CPN: 5.6960 Agency-MBS US 5,040.03 3,935.22 3,919.09<br />

PB 31381JSD5 FNMA FNAR XX.XXX MB462316 MAT: 04/01/2020 CPN: 4.2320 Agency-MBS US 5,755.62 3,719.96 3,708.01<br />

PB 31402CYC0 FNMA FNAR XX.XXX LB725307 MAT: 01/01/2034 CPN: 2.5580 Agency-MBS US 15,871.19 3,823.26 3,772.15<br />

PB 31405UQ93 FNMA FNAR XX.XXX LB799780 MAT: 11/01/2034 CPN: 2.3180 Agency-MBS US 15,775.39 3,551.61 3,454.59<br />

PB 31407BZM4 FNMA FNAR XX.XXX WS826148 MAT: 07/01/2035 CPN: 2.1110 Agency-MBS US 24,409.67 3,388.38 3,382.56<br />

PB 31407CNG8 FNMA FNAR XX.XXX LB826691 MAT: 08/01/2035 CPN: 2.5550 Agency-MBS US 11,623.70 3,813.54 3,806.05<br />

PB 31407EKA0 FNMA FNAR XX.XXX LB828389 MAT: 07/01/2035 CPN: 4.9650 Agency-MBS US 11,578.62 4,279.74 4,139.77<br />

PB 31407THP8 FNMA FNAR XX.XXX LB840038 MAT: 08/01/2035 CPN: 3.5690 Agency-MBS US 24,814.11 3,554.98 3,545.55<br />

PB 31409SKX7 FNMA FNAR XX.XXX WD877010 MAT: 03/01/2035 CPN: 2.8270 Agency-MBS US 9,948.72 3,081.51 3,074.92<br />

PB 31409UWQ4 FNMA FNAR XX.XXX LB879155 MAT: 01/01/2036 CPN: 5.2630 Agency-MBS US 46,297.82 11,376.88 11,282.06<br />

PB 31409VKF9 FNMA FNAR XX.XXX LB879694 MAT: 12/01/2037 CPN: 5.6920 Agency-MBS US 8,049.20 3,<strong>21</strong>0.07 3,196.57<br />

PB 31410GM75 FNMA FNAR XX.XXX LB888782 MAT: 03/01/2036 CPN: 3.1050 Agency-MBS US 15,719.42 5,776.63 5,763.02<br />

PB 31410GQE6 FNMA FNAR XX.XXX LB888853 MAT: 05/01/2035 CPN: 2.6320 Agency-MBS US 9,066.27 3,485.28 3,478.29<br />

PB 31410KRK2 FNMA FNAR XX.XXX S1889790 MAT: 11/01/2037 CPN: 3.2370 Agency-MBS US 11,525.10 4,158.54 4,148.31<br />

PB 31410LBW1 FNMA FNMS 05.500 CI890253 MAT: 10/01/20<strong>21</strong> CPN: 5.5000 Agency-MBS US 17,928.34 18,929.93 18,803.68<br />

PB 31413FYQ9 FNMA FNMS 06.500 NP944519 MAT: 07/01/2037 CPN: 6.5000 Agency-MBS US 10,518.86 3,372.04 3,062.08<br />

PB 31413YHQ7 FNMA FNAR XX.XXX LB959339 MAT: 11/01/2037 CPN: 5.6770 Agency-MBS US 9,329.84 3,783.02 3,767.17<br />

PB 31413YWU1 FNMA FNAR XX.XXX LB959759 MAT: 11/01/2037 CPN: 5.7560 Agency-MBS US 10,861.02 4,002.47 3,985.47<br />

PB 31414TB75 FNMA FNAR XX.XXX LB975362 MAT: 06/01/2038 CPN: 4.9480 Agency-MBS US 8,850.<strong>21</strong> 6,287.31 6,269.41<br />

Market Information (including without limitation, indicative market values such as prices and accrued income, either stated or derived, and public credit ratings from NRSROs) furnished in this report has been obtained from sources (including<br />

third party vendors, and tri-party agents that may hold securities collateral for securities lending transactions) which J.P. Morgan believes to be reliable and is furnished for the exclusive use of the customer to whom this statement is<br />

addressed.J.P. Morgan MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF ACCURACY OR COMPLETENESS OR THAT ANY QUOTED VALUES NECESSARILY REFLECT THE<br />

PROCEEDS WHICH MAY BE RECEIVED ON THE SALE OF A SECURITY.<br />

Copyright JPMorgan Chase & Co. 2011. Copyright J.P. Morgan Europe Limited 2011. All rights reserved.<br />

D-036-947-<strong>21</strong>0 <strong>21</strong>-Jan-2011 19:12:28

Daily Security Collateral Detail<br />

Page 7 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 31415BHB8 FNMA FNAR XX.XXX LB981826 MAT: 06/01/2038 CPN: 5.<strong>21</strong>10 Agency-MBS US 5,185.23 3,274.08 3,261.82<br />

PB 31415MZX6 FNMA FNAR XX.XXX LB984658 MAT: 07/01/2038 CPN: 4.9000 Agency-MBS US 6,964.27 4,626.30 4,610.65<br />

PB 31415P5A2 FNMA FNAR XX.XXX WS985641 MAT: 06/01/2038 CPN: 4.8180 Agency-MBS US 9,028.16 3,761.50 3,748.02<br />

PB 31416CMC7 FNMA FNAR XX.XXX LB995955 MAT: 07/01/2035 CPN: 2.7040 Agency-MBS US 5,823.41 4,255.31 4,246.51<br />

PB 31416PWF0 FNMA FNAR XX.XXX LBAA6045 MAT: 05/01/2039 CPN: 4.3830 Agency-MBS US 10,465.08 7,891.53 7,865.62<br />

PB 31417KZ42 FNMA FNAR XX.XXX LBAC1662 MAT: 09/01/2039 CPN: 4.0920 Agency-MBS US 11,628.26 5,994.33 5,975.89<br />

PB 31417L4B8 FNMA FNAR XX.XXX LBAC2617 MAT: 10/01/2039 CPN: 3.8840 Agency-MBS US 5,822.73 3,489.18 3,478.95<br />

PB 31417LZQ1 FNMA FNAR XX.XXX LBAC2550 MAT: 09/01/2039 CPN: 4.1030 Agency-MBS US 17,206.66 10,454.29 10,463.20<br />

PB 31417NC74 FNMA FNAR XX.XXX LBAC3693 MAT: 10/01/2039 CPN: 3.8710 Agency-MBS US 9,315.70 6,064.81 6,047.05<br />

PB 31417NN23 FNMA FNAR XX.XXX LBAC4008 MAT: 10/01/2039 CPN: 3.7890 Agency-MBS US 10,693.54 6,724.87 6,705.65<br />

PB 31417NNV9 FNMA FNAR XX.XXX LBAC4003 MAT: 10/01/2039 CPN: 3.8720 Agency-MBS US 6,975.38 5,887.72 5,870.53<br />

PB 31417Q2C7 FNMA FNAR XX.XXX LBAC5270 MAT: 11/01/2039 CPN: 3.8880 Agency-MBS US 10,854.64 6,818.03 6,798.02<br />

PB 31417Q2M5 FNMA FNAR XX.XXX LBAC5279 MAT: 11/01/2039 CPN: 3.8530 Agency-MBS US 5,091.93 4,583.44 4,570.12<br />

PB 31417S4U1 FNMA FNAR XX.XXX LBAC6234 MAT: 11/01/2039 CPN: 3.8400 Agency-MBS US 10,693.54 6,991.36 6,971.06<br />

PB 31417S6Y1 FNMA FNAR XX.XXX LBAC6286 MAT: 12/01/2039 CPN: 3.9040 Agency-MBS US 7,088.52 4,944.63 4,930.05<br />

PB 31417YU47 FNMA FNMS 03.500 CTMA0602 MAT: 12/01/2030 CPN: 3.5000 Agency-MBS US 34,305.16 33,341.02 33,473.82<br />

PB 31418MR46 FNMA FNAR XX.XXX LBAD0506 MAT: 01/01/2037 CPN: 2.2000 Agency-MBS US 7,649.74 6,007.62 5,997.44<br />

PB 31418SM30 FNMA FNAR XX.XXX LBAD4877 MAT: 06/01/2040 CPN: 3.6510 Agency-MBS US 3,440.53 3,299.20 3,290.02<br />

PB 31418UV27 FNMA FNMS 04.500 CTAD6932 MAT: 06/01/2030 CPN: 4.5000 Agency-MBS US 13,1<strong>21</strong>.95 13,227.10 13,244.72<br />

PB 31419ACF2 FNMA FNAR XX.XXX LBAE0069 MAT: 06/01/2038 CPN: 5.6760 Agency-MBS US 8,706.22 6,905.50 6,876.87<br />

PB 31419ASL2 FNMA FNMS 06.000 NPAE0522 MAT: 05/01/2038 CPN: 6.0000 Agency-MBS US 16,872.89 17,055.55 17,055.55<br />

PB 31419ASY4 FNMA FNAR XX.XXX LBAE0534 MAT: 10/01/2040 CPN: 3.6060 Agency-MBS US 581.54 591.96 601.47<br />

Total For CANTOR 774,197.43 388,941.23 386,861.07<br />

Borrower Name: CIBC Borrower ID: 000208G<br />

PB 3128KRVJ0 06.000 FGPC A61517 G MAT: 10/01/36 CPN: 6.000000 Agency-MBS US 299,616.58 143,242.14 142,007.26<br />

PB 3128KRVT8 06.000 FGPC A61526 G MAT: 10/01/36 CPN: 6.000000 Agency-MBS US 187,727.16 91,804.34 91,099.71<br />

PB 3128KVT39 06.500 FGPC A65070 G MAT: 09/01/37 CPN: 6.500000 Agency-MBS US 340,343.05 157,177.25 156,480.20<br />

PB 3128KXHK0 06.500 FGPC A66534 G MAT: 10/01/37 CPN: 6.500000 Agency-MBS US <strong>21</strong>7,445.00 123,579.89 122,141.05<br />

PB 3128M6DG0 06.000 FGPC G04303 G MAT: 04/01/38 CPN: 6.000000 Agency-MBS US 96,832.59 50,052.51 49,877.66<br />

PB 312940E<strong>21</strong> 05.500 FGPC A91953 G MAT: 04/01/40 CPN: 5.500000 Agency-MBS US 162,929.11 169,239.27 169,144.81<br />

PB 912828BR0 4 1/4 NOTE E 13 MAT: 11/15/13 CPN: 4.250000 Aaa T Notes US 589.10 646.82 648.08<br />

Market Information (including without limitation, indicative market values such as prices and accrued income, either stated or derived, and public credit ratings from NRSROs) furnished in this report has been obtained from sources (including<br />

third party vendors, and tri-party agents that may hold securities collateral for securities lending transactions) which J.P. Morgan believes to be reliable and is furnished for the exclusive use of the customer to whom this statement is<br />

addressed.J.P. Morgan MAKES NO WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING ANY WARRANTY OF ACCURACY OR COMPLETENESS OR THAT ANY QUOTED VALUES NECESSARILY REFLECT THE<br />

PROCEEDS WHICH MAY BE RECEIVED ON THE SALE OF A SECURITY.<br />

Copyright JPMorgan Chase & Co. 2011. Copyright J.P. Morgan Europe Limited 2011. All rights reserved.<br />

D-036-947-<strong>21</strong>0 <strong>21</strong>-Jan-2011 19:12:28

Daily Security Collateral Detail<br />

Page 8 of 169<br />

Securities Lending<br />

Client Name: MCKNIGHT FOUNDATION<br />

Base Currency: USD<br />

Loan Product Security ID Security Description<br />

Summary<br />

As of: 31-Dec-2010<br />

Moody's<br />

LT Rating<br />

Asset Type<br />

Country<br />

of Risk<br />

Quantity<br />

Daily Security Collateral Detail<br />

End of Day<br />

Start of Day<br />

Collateral Market Value Collateral Market Value<br />

PB 912828GA2 4 1/2 NOTE Q 11 MAT: 11/30/11 CPN: 4.500000 Aaa T Notes US 13,864.36 14,445.59 14,449.05<br />

PB 912828JT8 US TREAS NTS 2% 30/NOV/2013 INTR: 2.0 MATD: 11/30/13 Aaa T Notes US 176.73 181.96 182.28<br />

PB 912828NY2 0 3/4 NOTE AC 13 MAT: 09/15/13 CPN: 0.750000 Aaa T Notes US 1,178.19 1,175.24 1,177.01<br />

PB 912828PF1 1 7/8 NOTE R 17 MAT: 10/31/17 CPN: 1.875000 Aaa T Notes US 16,789.22 15,955.52 16,031.65<br />

Total For CIBC 1,337,491.10 767,500.53 763,238.77<br />

Borrower Name: CITIGROUP Borrower ID: 000274G<br />

PB 31288UTY7 FMAC FMAR 845067 G MAT: 01/01/2022 CPN: 3.7850 Agency-MBS US 8,528.49 51.94 51.79<br />

PB 3128HDLG2 FMAC FMAR 846627 G MAT: 10/01/2028 CPN: 2.6050 Agency-MBS US 2,550.67 74.87 74.72<br />

PB 3128HDX79 FMAC FMAR 847002 G MAT: 01/01/2032 CPN: 2.6370 Agency-MBS US 3,280.19 75.27 75.11<br />

PB 3128HDXE4 FMAC FMAR 846977 G MAT: 01/01/2032 CPN: 2.6250 Agency-MBS US 16,400.95 80.15 79.99<br />

PB 3128JLRY7 FMAC FMAR 1B1502 G MAT: 02/01/2034 CPN: 3.1650 Agency-MBS US 1,312.08 142.92 142.57<br />

PB 3128QGMN9 FMAC FMAR 1N0365 G MAT: 02/01/2037 CPN: 6.1770 Agency-MBS US 1,049.66 110.10 109.60<br />

PB 312904N27 FMAC FGRM 01030F 12/15/20 MAT: 12/15/2020 CPN: 9.0000 Aaa Agency-MBS US 5,773.13 77.68 77.12<br />

PB 31295KKN3 FMAC FMAR 786601 G MAT: 01/01/2029 CPN: 2.9100 Agency-MBS US 5,306.69 91.66 91.45<br />

PB 31295N6X1 FMAC FMAR 789886 G MAT: 11/01/2032 CPN: 2.9740 Agency-MBS US 3,280.19 111.46 111.20<br />

PB 31336SHM3 FMAC FMAR 1B0636 G MAT: 12/01/2032 CPN: 3.0840 Agency-MBS US 2,492.94 59.36 59.22<br />

PB 31336SRX8 FMAC FMAR 1B0902 G MAT: 05/01/2033 CPN: 2.6530 Agency-MBS US 4,329.85 106.65 106.44<br />

PB 31342ADG1 FMAC FMAR 780103 G MAT: 12/01/2032 CPN: 2.5980 Agency-MBS US 3,280.19 93.61 93.42<br />

PB 31349UDH8 FMAC FMAR 782804 G MAT: 11/01/2034 CPN: 2.6760 Agency-MBS US 328.02 90.30 90.12<br />

PB 31359EWF4 30461FNRM CL203PL RT93203 MAT: 10/25/2023 CPN: 6.5000 Aaa Agency-MBS US 328.02 162.40 161.98<br />

PB 31372VA63 FNMA FNAR XX.XXX W2283629 MAT: 05/01/2024 CPN: 2.6250 Agency-MBS US 4,814.07 129.65 129.39<br />

PB 31374FV48 FNMA FNAR XX.XXX YY313035 MAT: 06/01/2016 CPN: 7.5190 Agency-MBS US 7<strong>21</strong>.64 102.66 102.12<br />

PB 31375XBU2 FNMA FNAR XX.XXX WN347551 MAT: 10/01/2026 CPN: 2.3750 Agency-MBS US 3,284.34 55.59 55.49<br />

PB 31381NLQ4 FNMA FNAR XX.XXX HY465735 MAT: 09/01/2020 CPN: 3.8500 Agency-MBS US 164.01 162.29 162.63<br />

PB 31384VWW8 FNMA FNAR XX.XXX WS535361 MAT: 05/01/2026 CPN: 2.5430 Agency-MBS US 2,260.00 142.37 142.10<br />

PB 31385HSD5 FNMA FNAR XX.XXX WS545116 MAT: 05/01/2031 CPN: 2.8270 Agency-MBS US 8,095.47 125.62 125.35<br />

PB 31385JHV3 FNMA FNAR XX.XXX WS545744 MAT: 06/01/2032 CPN: 2.6080 Agency-MBS US 3,559.12 77.64 77.49<br />

PB 31385JN61 FNMA FNAR XX.XXX WS545913 MAT: 10/01/2025 CPN: 2.3490 Agency-MBS US 427.08 59.91 57.27<br />

PB 31385WXE4 FNMA FNAR XX.XXX WS555177 MAT: 01/01/2033 CPN: 2.4330 Agency-MBS US 1,382.76 100.63 100.44<br />

PB 31386CXW7 FNMA FNAR XX.XXX WS559693 MAT: 06/01/2028 CPN: 2.6790 Agency-MBS US 3,280.19 127.74 127.48<br />

PB 31387UQ87 FNMA FNAR XX.XXX WS594579 MAT: 08/01/2030 CPN: 2.5400 Agency-MBS US 4,609.87 64.93 64.80<br />