Exempt Organization Business Income Tax Return 990-T - McKnight ...

Exempt Organization Business Income Tax Return 990-T - McKnight ...

Exempt Organization Business Income Tax Return 990-T - McKnight ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

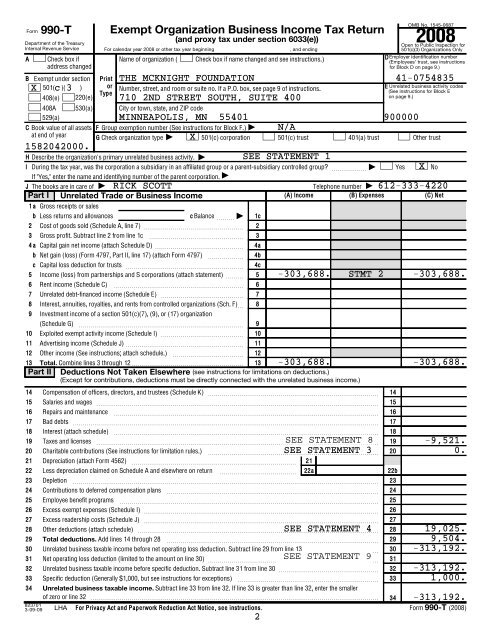

2008<br />

OMB No. 1545-0687<br />

Form<br />

<strong>990</strong>-T <strong>Exempt</strong> <strong>Organization</strong> <strong>Business</strong> <strong>Income</strong> <strong>Tax</strong> <strong>Return</strong><br />

Department of the Treasury<br />

(and proxy tax under section 6033(e))<br />

Open to Public Inspection for<br />

Internal Revenue Service<br />

For calendar year 2008 or other tax year beginning<br />

, and ending<br />

501(c)(3) <strong>Organization</strong>s Only<br />

DEmployer identification number<br />

A Check box if<br />

Name of organization ( Check box if name changed and see instructions.) (Employees’ trust, see instructions<br />

address changed<br />

for Block D on page 9.)<br />

B <strong>Exempt</strong> under section Print THE MCKNIGHT FOUNDATION 41-0754835<br />

X 501( c )( 3 ) or<br />

E Unrelated business activity codes<br />

Number, street, and room or suite no. If a P.O. box, see page 9 of instructions. (See instructions for Block E<br />

Type<br />

408(e) 220(e) 710 2ND STREET SOUTH, SUITE 400<br />

on page 9.)<br />

408A 530(a) City or town, state, and ZIP code<br />

529(a)<br />

MINNEAPOLIS, MN 55401 900000<br />

C Book value of all assets F Group exemption number (See instructions for Block F.) | N/A<br />

at end of year G Check organization type | X 501(c) corporation 501(c) trust 401(a) trust Other trust<br />

1582042000.<br />

H Describe the organization’s primary unrelated business activity. | SEE STATEMENT 1<br />

I During the tax year, was the corporation a subsidiary in an affiliated group or a parent-subsidiary controlled group? ~~~~~~ | Yes X No<br />

If "Yes," enter the name and identifying number of the parent corporation. |<br />

J The books are in care of | RICK SCOTT Telephone number | 612-333-4220<br />

Part I Unrelated Trade or <strong>Business</strong> <strong>Income</strong><br />

(A) <strong>Income</strong><br />

(B) Expenses<br />

(C) Net<br />

1 a Gross receipts or sales<br />

2<br />

3<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

b<br />

b<br />

c<br />

Less returns and allowances c Balance ~~~ | 1c<br />

Cost of goods sold (Schedule A, line 7) ~~~~~~~~~~~~~~~~~<br />

Gross profit. Subtract line 2 from line 1c<br />

~~~~~~~~~~~~~~~~<br />

4 a Capital gain net income (attach Schedule D) ~~~~~~~~~~~~~~~<br />

Net gain (loss) (Form 4797, Part II, line 17) (attach Form 4797) ~~~~~~<br />

Capital loss deduction for trusts ~~~~~~~~~~~~~~~~~~~~<br />

<strong>Income</strong> (loss) from partnerships and S corporations (attach statement) ~~~<br />

Rent income (Schedule C)<br />

~~~~~~~~~~~~~~~~~~~~~~<br />

Unrelated debt-financed income (Schedule E) ~~~~~~~~~~~~~~<br />

Interest, annuities, royalties, and rents from controlled organizations (Sch. F)~<br />

Investment income of a section 501(c)(7), (9), or (17) organization<br />

(Schedule G)<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Exploited exempt activity income (Schedule I) ~~~~~~~~~~~~~~<br />

Advertising income (Schedule J) ~~~~~~~~~~~~~~~~~~~~<br />

12 Other income (See instructions; attach schedule.) ~~~~~~~~~~~~ 12<br />

13 Total. Combine lines 3 through 12 13 -303,688. -303,688.<br />

Part II Deductions Not Taken Elsewhere (see instructions for limitations on deductions.)<br />

(Except for contributions, deductions must be directly connected with the unrelated business income.)<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

Compensation of officers, directors, and trustees (Schedule K) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 14<br />

Salaries and wages ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Repairs and maintenance<br />

Bad debts ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Interest (attach schedule)<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

<strong>Tax</strong>es and licenses ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Charitable contributions (See instructions for limitation rules.) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

SEE STATEMENT 3<br />

Depreciation (attach Form 4562)<br />

Less depreciation claimed on Schedule A and elsewhere on return<br />

Depletion<br />

Contributions to deferred compensation plans<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 21<br />

2<br />

3<br />

4a<br />

4b<br />

4c<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

~~~~~~~~~~~~~ 22a<br />

22b<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Employee benefit programs ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Excess exempt expenses (Schedule I) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Excess readership costs (Schedule J) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Other deductions (attach schedule) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

SEE STATEMENT 4<br />

Total deductions. Add lines 14 through 28 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Unrelated business taxable income before net operating loss deduction. Subtract line 29 from line 13 ~~~~~~~~~~~~<br />

Net operating loss deduction (limited to the amount on line 30) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Unrelated business taxable income before specific deduction. Subtract line 31 from line 30 ~~~~~~~~~~~~~~~~~<br />

Specific deduction (Generally $1,000, but see instructions for exceptions)<br />

-303,688. STMT 2 -303,688.<br />

~~~~~~~~~~~~~~~~~~~~~~~~<br />

34 Unrelated business taxable income. Subtract line 33 from line 32. If line 33 is greater than line 32, enter the smaller<br />

of zero or line 32 34 -313,192.<br />

823701<br />

3-09-09 LHA For Privacy Act and Paperwork Reduction Act Notice, see instructions.<br />

2<br />

Form <strong>990</strong>-T (2008)<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

-9,521.<br />

0.<br />

19,025.<br />

9,504.<br />

-313,192.<br />

-313,192.<br />

1,000.

THE MCKNIGHT FOUNDATION 41-0754835<br />

Part III <strong>Tax</strong> Computation<br />

35 <strong>Organization</strong>s <strong>Tax</strong>able as Corporations. See instructions for tax computation.<br />

Form <strong>990</strong>-T (2008)<br />

36<br />

37<br />

38<br />

Controlled group members (sections 1561 and 1563) check here |<br />

See instructions and:<br />

a Enter your share of the $50,000, $25,000, and $9,925,000 taxable income brackets (in that order):<br />

b Enter organization’s share of: (1) Additional 5% tax (not more than $11,750) $<br />

c<br />

(1) $ (2) $ (3) $<br />

(2) Additional 3% tax (not more than $100,000) ~~~~~~~~~~~~~ $<br />

<strong>Income</strong> tax on the amount on line 34 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |<br />

Trusts <strong>Tax</strong>able at Trust Rates. See instructions for tax computation. <strong>Income</strong> tax on the amount on line 34 from:<br />

<strong>Tax</strong> rate schedule or Schedule D (Form 1041) ~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Proxy tax. See instructions ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Alternative minimum tax<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

39 Total. Add lines 37 and 38 to line 35c or 36, whichever applies <br />

Part IV <strong>Tax</strong> and Payments<br />

40a<br />

Foreign tax credit (corporations attach Form 1118; trusts attach Form 1116) ~~~~~~~~ 40a<br />

41<br />

42<br />

b Other credits (see instructions)<br />

c<br />

d Credit for prior year minimum tax (attach Form 8801 or 8827) ~~~~~~~~~~~~~~<br />

e<br />

~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

General business credit. Attach Form 3800 ~~~~~~~~~~~~~~~~~~~~~~<br />

Total credits. Add lines 40a through 40d ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Subtract line 40e from line 39 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Other taxes. Check if from: Form 4255 Form 8611 Form 8697 Form 8866 Other (attach schedule)<br />

43 Total tax. Add lines 41 and 42 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 43<br />

44 a Payments: A 2007 overpayment credited to 2008 ~~~~~~~~~~~~~~~~~~~ 44a 262,235.<br />

b 2008 estimated tax payments ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 44b 100,000.<br />

c <strong>Tax</strong> deposited with Form 8868 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 44c<br />

d Foreign organizations: <strong>Tax</strong> paid or withheld at source (see instructions) ~~~~~~~~~~ 44d<br />

8.<br />

e Backup withholding (see instructions) ~~~~~~~~~~~~~~~~~~~~~~~~ 44e<br />

f Other credits and payments:<br />

Form 2439<br />

45<br />

46<br />

Form 4136 Other<br />

Total |<br />

Total payments. Add lines 44a through 44f ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 45<br />

Estimated tax penalty (see instructions). Check if Form 2220 is attached | ~~~~~~~~~~~~~~~~~~~<br />

47<br />

48<br />

<strong>Tax</strong> due. If line 45 is less than the total of lines 43 and 46, enter amount owed ~~~~~~~~~~~~~~~~~~~<br />

Overpayment. If line 45 is larger than the total of lines 43 and 46, enter amount overpaid ~~~~~~~~~~~~~~<br />

|<br />

|<br />

47<br />

48 362,243.<br />

49 Enter the amount of line 48 you want: Credited to 2009 estimated tax | 200,000. Refunded | 49 162,243.<br />

Part V Statements Regarding Certain Activities and Other Information (See instructions on page 18)<br />

1 At any time during the 2008 calendar year, did the organization have an interest in or a signature or other authority over a financial account<br />

Yes No<br />

(bank, securities, or other) in a foreign country? If YES, the organization may have to file Form TD F 90-22.1, Report of Foreign Bank and<br />

X<br />

Financial Accounts. If YES, enter the name of the foreign country here |<br />

2 During the tax year, did the organization receive a distribution from, or was it the grantor of, or transferor to, a foreign trust?<br />

If YES, see page 5 of the instructions for other forms the organization may have to file. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

3 Enter the amount of tax-exempt interest received or accrued during the tax year | $<br />

0.<br />

X<br />

Schedule A - Cost of Goods Sold. Enter method of inventory valuation |<br />

N/A<br />

1<br />

2<br />

3<br />

4 a<br />

b<br />

Inventory at beginning of year ~~~ 1<br />

Purchases<br />

~~~~~~~~~~~ 2<br />

7 Cost of goods sold. Subtract line 6<br />

Cost of labor~~~~~~~~~~~ 3<br />

from line 5. Enter here and in Part I, line 2 ~~~~<br />

Additional section 263A costs ~~~ 4a<br />

8 Do the rules of section 263A (with respect to<br />

Other costs (attach schedule) ~~~<br />

4b<br />

6<br />

40b<br />

40c<br />

40d<br />

44f<br />

Inventory at end of year ~~~~~~~~~~~~ 6<br />

property produced or acquired for resale) apply to<br />

5 Total. Add lines 1 through 4b 5 the organization? <br />

Sign<br />

Here<br />

Paid<br />

Preparer’s<br />

Use Only<br />

823711 03-09-09<br />

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true,<br />

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.<br />

= =<br />

Preparer’s<br />

signature =<br />

|<br />

|<br />

35c<br />

36<br />

37<br />

38<br />

39<br />

40e<br />

41<br />

42<br />

46<br />

7<br />

Yes<br />

May the IRS discuss this return with<br />

the preparer shown below (see<br />

Signature of officer Date Title instructions)? Yes No<br />

Date<br />

Check if<br />

Preparer’s SSN or PTIN<br />

self-employed<br />

P00092677<br />

RSM MCGLADREY, INC. EIN 41-1944416<br />

Firm’s name (or<br />

yours if selfemployed),<br />

address, and<br />

ZIP code<br />

=<br />

801 NICOLLET MALL, SUITE 1100<br />

Phone no.<br />

MINNEAPOLIS, MN 55402 612-573-8750<br />

3<br />

X<br />

Page 2<br />

0.<br />

0.<br />

0.<br />

0.<br />

362,243.<br />

No<br />

X<br />

Form <strong>990</strong>-T (2008)

Form<br />

8868<br />

(Rev. April 2008)<br />

Department of the Treasury<br />

Internal Revenue Service<br />

Application for Extension of Time To File an<br />

<strong>Exempt</strong> <strong>Organization</strong> <strong>Return</strong><br />

File a separate application for each return.<br />

OMB No. 1545-1709<br />

If you are filing for an Automatic 3-Month Extension, complete only Part I and check this box<br />

If you are filing for an Additional (Not Automatic) 3-Month Extension, complete only Part II (on page 2 of this form).<br />

Do not complete Part II unless you have already been granted an automatic 3-month extension on a previously filed Form 8868.<br />

Part I Automatic 3-Month Extension of Time. Only submit original (no copies needed).<br />

A corporation required to file Form <strong>990</strong>-T and requesting an automatic 6-month extension—check this box and complete<br />

Part I only<br />

X<br />

All other corporations (including 1120-C filers), partnerships, REMICs, and trusts must use Form 7004 to request an extension of<br />

time to file income tax returns.<br />

Electronic Filing ( e-file). Generally, you can electronically file Form 8868 if you want a 3-month automatic extension of time to file<br />

one of the returns noted below (6 months for a corporation required to file Form <strong>990</strong>-T). However, you cannot file Form 8868<br />

electronically if (1) you want the additional (not automatic) 3-month extension or (2) you file Forms <strong>990</strong>-BL, 6069, or 8870, group<br />

returns, or a composite or consolidated Form <strong>990</strong>-T. Instead, you must submit the fully completed and signed page 2 (Part II) of Form<br />

8868. For more details on the electronic filing of this form, visit www.irs.gov/efile and click on e-file for Charities & Nonprofits.<br />

Type or Name of <strong>Exempt</strong> <strong>Organization</strong><br />

Employer identification number<br />

print THE MCKNIGHT FOUNDATION 41-0754835<br />

File by the Number, street, and room or suite no. If a P.O. box, see instructions.<br />

due date for<br />

filing your 710 2ND STREET SOUTH, SUITE 400<br />

return. See<br />

instructions. City, town or post office, state, and ZIP code. For a foreign address, see instructions.<br />

MINNEAPOLIS, MN 55401<br />

Check type of return to be filed (file a separate application for each return):<br />

Form <strong>990</strong><br />

x Form <strong>990</strong>-T (corporation)<br />

Form 4720<br />

Form <strong>990</strong>-BL<br />

Form <strong>990</strong>-T (sec. 401(a) or 408(a) trust)<br />

Form 5227<br />

Form <strong>990</strong>-EZ<br />

Form <strong>990</strong>-T (trust other than above)<br />

Form 6069<br />

Form <strong>990</strong>-PF Form 1041-A<br />

Form 8870<br />

The books are in the care of<br />

RICK SCOTT<br />

Telephone No. 612-333-4220<br />

FAX No.<br />

If the organization does not have an office or place of business in the United States, check this box<br />

If this is for a Group <strong>Return</strong>, enter the organization’s four digit Group <strong>Exempt</strong>ion Number (GEN)<br />

. If this is<br />

for the whole group, check this box . ..... . If it is for part of the group, check this box . ..... and attach<br />

a list with the names and EINs of all members the extension will cover.<br />

1<br />

I request an automatic 3-month (6 months for a corporation required to file Form <strong>990</strong>-T) extension of time<br />

until NOVEMBER 16 , 20 09 , to file the exempt organization return for the organization named above. The extension is<br />

for the organization’s return for:<br />

X calendar year 2008<br />

or<br />

tax year beginning<br />

, 20 , and ending , 20 .<br />

2 If this tax year is for less than 12 months, check reason: Initial return Final return Change in accounting period<br />

3a If this application is for Form <strong>990</strong>-BL, <strong>990</strong>-PF, <strong>990</strong>-T, 4720, or 6069, enter the tentative tax,<br />

less any nonrefundable credits. See instructions. 3a $ 362,235<br />

b If this application is for Form <strong>990</strong>-PF or <strong>990</strong>-T, enter any refundable credits and estimated tax<br />

payments made. Include any prior year overpayment allowed as a credit.<br />

c Balance Due. Subtract line 3b from line 3a. Include your payment with this form, or, if required,<br />

deposit with FTD coupon or, if required, by using EFTPS (Electronic Federal <strong>Tax</strong> Payment<br />

System). See instructions.<br />

3b<br />

3c<br />

$<br />

$<br />

362,365<br />

0.00<br />

Caution. If you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EO<br />

for payment instructions.<br />

For Privacy Act and Paperwork Reduction Act Notice, see Instructions. Form 8868 (Rev. 4-2008)<br />

ISA<br />

STF XVWZ1001.1

THE MCKNIGHT FOUNDATION 41-0754835<br />

Schedule C - Rent <strong>Income</strong> (From Real Property and Personal Property Leased With Real Property)(see instr. on pg 19)<br />

Form <strong>990</strong>-T (2008) Page 3<br />

1 Description of property<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

(1)<br />

(2)<br />

(3)<br />

(a) From personal property (if the percentage of<br />

rent for personal property is more than<br />

10% but not more than 50%)<br />

2 Rent received or accrued<br />

(b) From real and personal property (if the percentage<br />

of rent for personal property exceeds 50% or if<br />

the rent is based on profit or income)<br />

3(a) Deductions directly connected with the income in<br />

columns 2(a) and 2(b) (attach schedule)<br />

(4)<br />

Total<br />

0. Total<br />

0.<br />

(c) Total income. Add totals of columns 2(a) and 2(b). Enter<br />

(b) Total deductions.<br />

here and on page 1, Part I, line 6, column (A) | 0.<br />

Enter here and on page 1,<br />

Part I, line 6, column (B) |<br />

0.<br />

Schedule E - Unrelated Debt-Financed <strong>Income</strong> (See instructions on page 19)<br />

3 Deductions directly connected with or allocable<br />

2 Gross income from<br />

to debt-financed property<br />

1 Description of debt-financed property<br />

or allocable to debtfinanced<br />

property<br />

(a) Straight line depreciation (b) Other deductions<br />

(attach schedule)<br />

(attach schedule)<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

4 Amount of average acquisition<br />

5 Average adjusted basis<br />

6 Column 4 divided<br />

7 Gross income<br />

8Allocable deductions<br />

debt on or allocable to debt-financed<br />

of or allocable to<br />

by column 5<br />

reportable (column<br />

(column 6 x total of columns<br />

property (attach schedule)<br />

debt-financed property<br />

2 x column 6)<br />

3(a) and 3(b))<br />

(attach schedule)<br />

%<br />

%<br />

%<br />

%<br />

Enter here and on page 1,<br />

Part I, line 7, column (A).<br />

Enter here and on page 1,<br />

Part I, line 7, column (B).<br />

Totals ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |<br />

0. 0.<br />

Total dividends-received deductions included in column 8 |<br />

0.<br />

Schedule F - Interest, Annuities, Royalties, and Rents From Controlled <strong>Organization</strong>s (See instructions on page 20)<br />

<strong>Exempt</strong> Controlled <strong>Organization</strong>s<br />

1 Name of controlled organization<br />

2 3 4 5 Part of column 4 that is 6 Deductions directly<br />

Employer identification Net unrelated income Total of specified included in the controlling connected with income<br />

number<br />

(loss) (see instructions) payments made organization’s gross income in column 5<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

Nonexempt Controlled <strong>Organization</strong>s<br />

7 <strong>Tax</strong>able <strong>Income</strong> 8 Net unrelated income (loss) 9 Total of specified payments 10 Part of column 9 that is included 11 Deductions directly connected<br />

(see instructions) made<br />

in the controlling organization’s<br />

with income in column 10<br />

gross income<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

Totals J<br />

823721 03-09-09<br />

4<br />

Add columns 5 and 10.<br />

Enter here and on page 1, Part I,<br />

line 8, column (A).<br />

Add columns 6 and 11.<br />

Enter here and on page 1, Part I,<br />

line 8, column (B).<br />

0. 0.<br />

Form <strong>990</strong>-T (2008)

Form <strong>990</strong>-T (2008) Page 4<br />

Schedule G - Investment <strong>Income</strong> of a Section 501(c)(7), (9), or (17) <strong>Organization</strong><br />

(see instructions on page 21)<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

1 Description of income<br />

2 Amount of income<br />

Enter here and on page 1,<br />

Part I, line 9, column (A).<br />

3 Deductions<br />

Total deductions<br />

directly connected 4 Set-asides 5<br />

and set-asides<br />

(attach schedule)<br />

(attach schedule)<br />

(col. 3 plus col. 4)<br />

Enter here and on page 1,<br />

Part I, line 9, column (B).<br />

Totals 0. 0.<br />

9<br />

Schedule I - Exploited <strong>Exempt</strong> Activity <strong>Income</strong>, Other Than Advertising <strong>Income</strong><br />

(see instructions on page 21)<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

1 Description of<br />

exploited activity<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

2 Gross<br />

unrelated business<br />

income from<br />

trade or business<br />

Enter here and on<br />

page 1, Part I,<br />

line 10, col. (A).<br />

3 Expenses<br />

directly connected<br />

with production<br />

of unrelated<br />

business income<br />

Enter here and on<br />

page 1, Part I,<br />

line 10, col. (B).<br />

4 Net income (loss)<br />

from unrelated trade or<br />

business (column 2<br />

minus column 3). If a<br />

gain, compute cols. 5<br />

through 7.<br />

Totals<br />

9<br />

Schedule J - Advertising <strong>Income</strong> (see instructions on page 21)<br />

Part I <strong>Income</strong> From Periodicals Reported on a Consolidated Basis<br />

5 Gross income<br />

from activity that<br />

is not unrelated<br />

business income<br />

6 Expenses<br />

attributable to<br />

column 5<br />

7 Excess exempt<br />

expenses (column<br />

6 minus column 5,<br />

but not more than<br />

column 4).<br />

Enter here and<br />

on page 1,<br />

Part II, line 26.<br />

0. 0. 0.<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

1 Name of periodical<br />

2 Gross<br />

advertising<br />

income<br />

3 Direct<br />

advertising costs<br />

4 Advertising gain<br />

or (loss) (col. 2 minus<br />

col. 3). If a gain, compute<br />

cols. 5 through 7.<br />

5 Circulation<br />

income<br />

6 Readership<br />

costs<br />

7 Excess readership<br />

costs (column 6 minus<br />

column 5, but not more<br />

than column 4).<br />

Totals (carry to Part II, line (5)) 0. 0. 0.<br />

9<br />

Part II <strong>Income</strong> From Periodicals Reported on a Separate Basis (For each periodical listed in Part II, fill in<br />

columns 2 through 7 on a line-by-line basis.)<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

1 Name of periodical<br />

(5) Totals from Part I<br />

2 Gross<br />

advertising<br />

income<br />

Enter here and on<br />

page 1, Part I,<br />

line 11, col. (A).<br />

3 Direct<br />

advertising costs<br />

Enter here and on<br />

page 1, Part I,<br />

line 11, col. (B).<br />

4 Advertising gain<br />

or (loss) (col. 2 minus<br />

col. 3). If a gain, compute<br />

cols. 5 through 7.<br />

5 Circulation<br />

income<br />

6 Readership<br />

costs<br />

7 Excess readership<br />

costs (column 6 minus<br />

column 5, but not more<br />

than column 4).<br />

0. 0. 0.<br />

Enter here and<br />

on page 1,<br />

Part II, line 27.<br />

Totals, Part II (lines 1-5) 0. 0. 0.<br />

9<br />

Schedule K - Compensation of Officers, Directors, and Trustees (see instructions on page 22)<br />

3 Percent of<br />

4 Compensation attributable<br />

time devoted to<br />

1 Name 2 Title<br />

to unrelated business<br />

business<br />

%<br />

Total. Enter here and on page 1, Part II, line 14 <br />

9<br />

823731<br />

03-09-09<br />

5<br />

%<br />

%<br />

%<br />

0.<br />

Form <strong>990</strong>-T (2008)

Capital Gains and Losses OMB No. 1545-0123<br />

| Attach to Form 1120, 1120-C, 1120-F, 1120-FSC, 1120-H, 1120-IC-DISC, 1120-L, 1120-ND,<br />

SCHEDULE D<br />

(Form 1120)<br />

Department of the Treasury<br />

1120-PC, 1120-POL, 1120-REIT, 1120-RIC, 1120-SF, or certain Forms <strong>990</strong>-T.<br />

Internal Revenue Service<br />

| See separate instructions.<br />

2008<br />

Name<br />

1<br />

Part I Short-Term Capital Gains and Losses - Assets Held One Year or Less<br />

(a) Description of property<br />

(Example: 100 shares of Z Co.)<br />

(b) Date acquired<br />

(mo., day, yr.)<br />

(c) Date sold<br />

(mo., day, yr.)<br />

(d) Sales price<br />

(see instructions)<br />

(e) Cost or other basis<br />

(see instructions)<br />

Employer identification number<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

(f) Gain or (loss)<br />

(Subtract (e) from (d))<br />

SEE STATEMENT 5 31,934. 1,355,984. -1,324,050.<br />

2 Short-term capital gain from installment sales from Form 6252, line 26 or 37 ~~~~~~~~~~~~~~~~~~~~~ 2<br />

3 Short-term gain or (loss) from like-kind exchanges from Form 8824 ~~~~~~~~~~~~~~~~~~~~~~~~ 3<br />

4 Unused capital loss carryover (attach computation) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ 4 ( )<br />

5 Net short-term capital gain or (loss). Combine lines 1 through 4 5 -1,324,050.<br />

Part II Long-Term Capital Gains and Losses - Assets Held More Than One Year<br />

6<br />

SEE STATEMENT 6 411,041. 15. 411,026.<br />

7<br />

8<br />

9<br />

10<br />

Enter gain from Form 4797, line 7 or 9 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Long-term capital gain from installment sales from Form 6252, line 26 or 37 ~~~~~~~~~~~~~~~~~~~~~<br />

Long-term gain or (loss) from like-kind exchanges from Form 8824 ~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Capital gain distributions (see instructions) ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

11 Net long-term capital gain or (loss). Combine lines 6 through 10 <br />

Part III Summary of Parts I and II<br />

12 Enter excess of net short-term capital gain (line 5) over net long-term capital loss (line 11) ~~~~~~~~~~~~~~~<br />

13 Net capital gain. Enter excess of net long-term capital gain (line 11) over net short-term capital loss (line 5) ~~~~~~~~<br />

14 Add lines 12 and 13. Enter here and on Form 1120, page 1, line 8, or the proper line on other returns. If the corporation has<br />

qualified timber gain, also complete Part IV ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Note. If losses exceed gains, see Capital losses in the instructions.<br />

Part IV Alternative <strong>Tax</strong> for Corporations with Qualified Timber Gains. Complete Part IV only if the corporation has qualified<br />

timber gain under section 1201(b). Skip this part if you are filing Form 1120-RIC. See instructions.<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

Enter qualified timber gain (as defined in section 1201(b)(2)) ~~~~~~~~~~~<br />

Enter taxable income from Form 1120, page 1, line 30, or the applicable line of your tax return ~~~~<br />

Enter the smallest of: (a) the amount on line 15; (b) the amount on line 16; or (c) the amount on Part III, line 13 ~~~~~~<br />

Multiply line 17 by 15% ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Subtract line 13 from line 16. If zero or less, enter -0- ~~~~~~~~~~~~~~~<br />

Enter the tax on line 19, figured using the <strong>Tax</strong> Rate Schedule (or applicable tax rate) appropriate for the return with which<br />

Schedule D (Form 1120) is being filed ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Add lines 17 and 19 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Subtract line 21 from line 16. If zero or less, enter -0-<br />

~~~~~~~~~~~~~~~<br />

Multiply line 22 by 35% ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Add lines 18, 20, and 23 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Enter the tax on line 16, figured using the <strong>Tax</strong> Rate Schedule (or applicable tax rate) appropriate for the return<br />

with which Schedule D (Form 1120) is being filed ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~<br />

Enter the smaller of line 24 or line 25. Also enter this amount on Form 1120, Schedule J, line 2, or the applicable line of your tax return <br />

JWA For Paperwork Reduction Act Notice, see the Instructions for Form 1120. Schedule D (Form 1120) (2008)<br />

821051<br />

12-31-08<br />

9<br />

15<br />

16<br />

17<br />

19<br />

21<br />

22<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

18<br />

20<br />

23<br />

24<br />

25<br />

26<br />

411,026.<br />

0.

STF VCTZ1002.1<br />

Form 4626<br />

Department of the Treasury<br />

Internal Revenue Service<br />

Name<br />

Alternative Minimum <strong>Tax</strong>—Corporations<br />

See separate instructions.<br />

Attach to the corporation’s tax return.<br />

OMB No. 1545-0175<br />

2008<br />

Employer identification number<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

Part I Alternative Minimum <strong>Tax</strong> Computation<br />

Note: See the instructions to find out if the corporation is a small corporation exempt from the<br />

alternative minimum tax (AMT) under section 55(e).<br />

1 <strong>Tax</strong>able income or (loss) before net operating loss deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 (313,192)<br />

2 Adjustments and preferences:<br />

a Depreciation of post-1986 property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2a 13,952<br />

b Amortization of certified pollution control facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2b<br />

c Amortization of mining exploration and development costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2c<br />

d Amortization of circulation expenditures (personal holding companies only) . . . . . . . . . . . . . . . . . . . . . . 2d<br />

e Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2e (1,265)<br />

f Long-term contracts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2f<br />

g Merchant marine capital construction funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2g<br />

h Section 833(b) deduction (Blue Cross, Blue Shield, and similar type organizations only) . . . . . . . . . . . . 2h<br />

i <strong>Tax</strong> shelter farm activities (personal service corporations only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2i<br />

j Passive activities (closely held corporations and personal service corporations only) . . . . . . . . . . . . . . . 2j<br />

k Loss limitations . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2k<br />

l Depletion . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2l<br />

m <strong>Tax</strong>-exempt interest income from specified private activity bonds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2m<br />

n Intangible drilling costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2n<br />

o Other adjustments and preferences . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2o<br />

30<br />

3 Pre-adjustment alternative minimum taxable income (AMTI). Combine lines 1 through 2o . . . . . . . . . . . 3 (300,475)<br />

4 Adjusted current earnings (ACE) adjustment:<br />

a ACE from line 10 of the ACE worksheet in the instructions . . . . . . . . . . . . . . . . . . . 4a (300,475)<br />

b Subtract line 3 from line 4a. If line 3 exceeds line 4a, enter the difference as a<br />

negative amount (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4b<br />

0<br />

c Multiply line 4b by 75% (.75). Enter the result as a positive amount . . . . . . . . . . . . 4c<br />

0<br />

d Enter the excess, if any, of the corporation’s total increases in AMTI from prior<br />

year ACE adjustments over its total reductions in AMTI from prior year ACE<br />

adjustments (see instructions). Note: You must enter an amount on line 4d<br />

(even if line 4b is positive) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4d<br />

e ACE adjustment.<br />

If line 4b is zero or more, enter the amount from line 4c . . . . . . . . . 4e<br />

If line 4b is less than zero, enter the smaller of line 4c or line 4d as a negative amount<br />

5 Combine lines 3 and 4e. If zero or less, stop here; the corporation does not owe any AMT . . . . . . . . . . . 5<br />

6 Alternative tax net operating loss deduction (see instructions) . SEE . . . . . STATEMENT . . . . . . . . . . . . . . . 11 . . . . . . . . . . . . 6<br />

7 Alternative minimum taxable income. Subtract line 6 from line 5. If the corporation held a residual<br />

interest in a REMIC, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7<br />

8 <strong>Exempt</strong>ion phase-out (if line 7 is $310,000 or more, skip lines 8a and 8b and enter -0- on line 8c):<br />

a Subtract $150,000 from line 7 (if completing this line for a member of a<br />

controlled group, see instructions). If zero or less, enter -0- . . . . . . . . . . . . . . . . . . 8a<br />

0<br />

b Multiply line 8a by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8b<br />

c <strong>Exempt</strong>ion. Subtract line 8b from $40,000 (if completing this line for a member of a controlled group,<br />

see instructions). If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8c<br />

9 Subtract line 8c from line 7. If zero or less, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9<br />

10 If the corporation had qualified timber gain, complete Part II and enter the amount from line 24 here.<br />

Otherwise, multiply line 9 by 20% (.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10<br />

11 Alternative minimum tax foreign tax credit (AMTFTC) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . 11<br />

12 Tentative minimum tax. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12<br />

13 Regular tax liability before applying all credits except the foreign tax credit . . . . . . . . . . . . . . . . . . . . . . . 13<br />

14 Alternative minimum tax. Subtract line 13 from line 12. If zero or less, enter -0-. Enter here and on<br />

Form 1120, Schedule J, line 3, or the appropriate line of the corporation’s income tax return . . . . . . . . . 14<br />

0<br />

(300,475)<br />

0<br />

0<br />

For Paperwork Reduction Act Notice, see the instructions. Form 4626 (2008)<br />

ISA

STF VCTZ1002.2<br />

Form 4626 (2008) Page 2<br />

Part II Alternative <strong>Tax</strong> for Corporations with Qualified Timber Gain. Complete Part II only if the corporation had<br />

qualified timber gain under section 1201(b). See instructions.<br />

15 Enter qualified timber gain from Schedule D (Form 1120), line 15, as refigured for the AMT, if<br />

necessary. If you are filing Form 1120-RIC, see instructions for the amount to enter . . . . . . . . . . . . . . . . 15<br />

16 Enter the amount from Schedule D (Form 1120), line 13, as refigured for the AMT, if necessary . . . . . . . 16<br />

17 Enter the amount from Part I, line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17<br />

18 Enter the smallest of the amount on line 15, line 16, or line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18<br />

19 Multiply line 18 by 15% (.15) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19<br />

20 Subtract line 18 from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20<br />

21 Multiply line 20 by 20% (.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21<br />

22 Enter the total of line 19 and line 21 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22<br />

23 Multiply line 17 by 20% (.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23<br />

24 Enter the smaller of line 22 or line 23 here and on Part I, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24<br />

Form 4626 (2008)

TF JPQJ1002.1<br />

Form 1118<br />

(Rev. June 2009)<br />

Department of the Treasury<br />

Internal Revenue Service<br />

Name of corporation<br />

Foreign <strong>Tax</strong> Credit—Corporations<br />

Attach to the corporation’s tax return.<br />

See separate instructions.<br />

For calendar year 20 08 , or other tax year beginning , 20 , and ending , 20<br />

OMB No. 1545-0122<br />

Employer identification number<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

Use a separate Form 1118 for each applicable category of income listed below. See Categories of <strong>Income</strong> on page 1 of instructions. Also, see Specific Instructions on page 5.<br />

Check only one box on each form.<br />

x<br />

Passive Category <strong>Income</strong><br />

General Category <strong>Income</strong><br />

Section 901(j) <strong>Income</strong>: Name of Sanctioned Country<br />

<strong>Income</strong> Re-sourced by Treaty: Name of Country<br />

Schedule A<br />

<strong>Income</strong> or (Loss) Before Adjustments (Report all amounts in U.S. dollars. See page 5 of instructions.)<br />

1. Foreign Country or<br />

U.S. Possession (Enter<br />

two-letter code from<br />

list beginning on page<br />

2. Deemed Dividends (see instructions)<br />

3. Other Dividends<br />

11 of instructions. Use<br />

4. Interest<br />

a separate line for<br />

each.) *<br />

(a) Exclude gross-up (b) Gross-up (sec. 78) (a) Exclude gross-up (b) Gross-up (sec. 78)<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

Totals (add lines A through F)<br />

* For section 863(b) income, NOLs, income from RICs, and high-taxed income, use a single line (see Schedule A on page 5 of the instructions).<br />

Gross <strong>Income</strong> or (Loss) From Sources Outside the United States (INCLUDE Foreign Branch Gross <strong>Income</strong> here and on Schedule F)<br />

5. Gross Rents,<br />

Royalties, and<br />

License Fees<br />

6. Gross <strong>Income</strong><br />

From Performance<br />

of Services<br />

Deductions (INCLUDE Foreign Branch Deductions here and on Schedule F)<br />

9. Definitely Allocable Deductions<br />

10. Apportioned Share<br />

Rental, Royalty, and Licensing Expenses<br />

of Deductions Not<br />

(c) Expenses<br />

(e) Total Definitely<br />

(d) Other<br />

Definitely Allocable<br />

Related to Gross<br />

Allocable<br />

11. Net Operating<br />

(a) Depreciation,<br />

Definitely<br />

(enter amount from<br />

(b) Other<br />

<strong>Income</strong> From<br />

Deductions (add<br />

Loss Deduction<br />

Depletion, and<br />

Allocable<br />

applicable line of<br />

Expenses<br />

Performance of<br />

columns 9(a)<br />

Amortization<br />

Deductions<br />

Schedule H, Part II,<br />

Services<br />

through 9(d))<br />

column (d))<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

7. Other (attach<br />

schedule)<br />

12. Total<br />

Deductions (add<br />

columns 9(e)<br />

through 11)<br />

8. Total (add columns<br />

2(a) through 7)<br />

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00<br />

13. Total <strong>Income</strong> or<br />

(Loss) Before<br />

Adjustments (subtract<br />

column 12 from<br />

column 8)<br />

Totals 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00<br />

For Paperwork Reduction Act Notice, see separate instructions. Form 1118 (Rev. 06-2009)<br />

ISA

TF JPQJ1002.2<br />

Form 1118 (Rev. 06-2009) Page 2<br />

Schedule B Foreign <strong>Tax</strong> Credit (Report all foreign tax amounts in U.S. dollars.)<br />

Part I—Foreign <strong>Tax</strong>es Paid, Accrued, and Deemed Paid (see page 6 of instructions)<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

1. Credit is Claimed<br />

for <strong>Tax</strong>es:<br />

x<br />

Paid<br />

Date Paid<br />

Accrued<br />

Date Accrued<br />

Totals (add lines A through F)<br />

2. Foreign <strong>Tax</strong>es Paid or Accrued (attach schedule showing amounts in foreign currency and conversion rate(s) used)<br />

<strong>Tax</strong> Withheld at Source on:<br />

(a) Dividends<br />

(b) Interest<br />

(c) Rents, Royalties,<br />

and License Fees<br />

Other Foreign <strong>Tax</strong>es Paid or Accrued on:<br />

(d) Section<br />

863(b) <strong>Income</strong><br />

(e) Foreign<br />

Branch <strong>Income</strong><br />

(f) Services <strong>Income</strong><br />

SEE STATEMENT 13 1,490 1,490.00<br />

(g) Other<br />

3. <strong>Tax</strong> Deemed Paid<br />

(from Schedule C—<br />

(h) Total Foreign <strong>Tax</strong>es Part I, column 10,<br />

Paid or Accrued (add Part II, column 8(b),<br />

columns 2(a) through 2(g)) and Part III, column 8)<br />

0.00 1,490.00 0.00 0.00 0.00 0.00 0.00 1,490.00 0.00<br />

Part II—Separate Foreign <strong>Tax</strong> Credit (Complete a separate Part II for each applicable category of income.)<br />

1 Total foreign taxes paid or accrued (total from Part I, column 2(h)) . . . . . . . . . . . . . . . . . . . . . . . 1,490.00<br />

2 Total taxes deemed paid (total from Part I, column 3) . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

0.00<br />

3 Reductions of taxes paid, accrued, or deemed paid (enter total from Schedule G) . . . . . . . . . . . . . . . . . . ( 0.00 )<br />

4 <strong>Tax</strong>es reclassified under high-tax kickout . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

5 Total carryover of foreign taxes (attach schedule showing computation in detail—see page 6 of the instructions) . . . . . . . .<br />

6 Total foreign taxes (combine lines 1 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

7 Enter the amount from the applicable column of Schedule J, Part I, line 11 (see page 6 of instructions). If Schedule J is not required to be completed,<br />

enter the result from the “Totals” line of column 13 of the applicable Schedule A . . . . . . . . . . . . . . . . . . . . . . . .<br />

8a Total taxable income from all sources (enter taxable income from the corporation’s tax return) . . . . . . . . . . . . . .<br />

b Adjustments to line 8a (see page 6 of instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

c Subtract line 8b from line 8a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

9 Divide line 7 by line 8c. Enter the resulting fraction as a decimal (see instructions). If line 7 is greater than line 8c, enter 1 . . . . . . . . . . .<br />

10 Total U.S. income tax against which credit is allowed (regular tax liability (see section 26(b)) minus American Samoa economic development credit) . .<br />

11 Credit limitation (multiply line 9 by line 10) (see page 6 of instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

12 Separate foreign tax credit (enter the smaller of line 6 or line 11 here and on the appropriate line of Part III) . . . . . . . . . . . . . . .<br />

1,490.00<br />

0.00<br />

Part III—Summary of Separate Credits (Enter amounts from Part II, line 12 for each applicable category of income. Do not include taxes paid to sanctioned countries.)<br />

1 Credit for taxes on passive category income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,490<br />

2 Credit for taxes on general category income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

3 Credit for taxes on income re-sourced by treaty (combine all such credits on this line) . . . . . . . . . . . . . . . .<br />

4 Total (add lines 1 through 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,490.00<br />

5 Reduction in credit for international boycott operations (see page 6 of instructions) . . . . . . . . . . . . . . . . . . . . . . .<br />

6 Total foreign tax credit (subtract line 5 from line 4). Enter here and on the appropriate line of the corporation’s tax return . . . . . . . . . . 1,490.00<br />

0.00<br />

0.0<br />

Form 1118 (Rev. 06-2009)

TF JPQJ1002.1<br />

Form 1118<br />

(Rev. June 2009)<br />

Department of the Treasury<br />

Internal Revenue Service<br />

Name of corporation<br />

ALTERNATIVE MINIMUM TAX<br />

Foreign <strong>Tax</strong> Credit—Corporations<br />

Attach to the corporation’s tax return.<br />

See separate instructions.<br />

For calendar year 20 08 , or other tax year beginning , 20 , and ending , 20<br />

OMB No. 1545-0122<br />

Employer identification number<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

Use a separate Form 1118 for each applicable category of income listed below. See Categories of <strong>Income</strong> on page 1 of instructions. Also, see Specific Instructions on page 5.<br />

Check only one box on each form.<br />

X<br />

Passive Category <strong>Income</strong><br />

General Category <strong>Income</strong><br />

Section 901(j) <strong>Income</strong>: Name of Sanctioned Country<br />

<strong>Income</strong> Re-sourced by Treaty: Name of Country<br />

Schedule A<br />

<strong>Income</strong> or (Loss) Before Adjustments (Report all amounts in U.S. dollars. See page 5 of instructions.)<br />

1. Foreign Country or<br />

U.S. Possession (Enter<br />

two-letter code from<br />

list beginning on page<br />

2. Deemed Dividends (see instructions)<br />

3. Other Dividends<br />

11 of instructions. Use<br />

4. Interest<br />

a separate line for<br />

each.) *<br />

(a) Exclude gross-up (b) Gross-up (sec. 78) (a) Exclude gross-up (b) Gross-up (sec. 78)<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

Totals (add lines A through F)<br />

* For section 863(b) income, NOLs, income from RICs, and high-taxed income, use a single line (see Schedule A on page 5 of the instructions).<br />

Gross <strong>Income</strong> or (Loss) From Sources Outside the United States (INCLUDE Foreign Branch Gross <strong>Income</strong> here and on Schedule F)<br />

5. Gross Rents,<br />

Royalties, and<br />

License Fees<br />

6. Gross <strong>Income</strong><br />

From Performance<br />

of Services<br />

Deductions (INCLUDE Foreign Branch Deductions here and on Schedule F)<br />

9. Definitely Allocable Deductions<br />

10. Apportioned Share<br />

Rental, Royalty, and Licensing Expenses<br />

of Deductions Not<br />

(c) Expenses<br />

(e) Total Definitely<br />

(d) Other<br />

Definitely Allocable<br />

Related to Gross<br />

Allocable<br />

11. Net Operating<br />

(a) Depreciation,<br />

Definitely<br />

(enter amount from<br />

(b) Other<br />

<strong>Income</strong> From<br />

Deductions (add<br />

Loss Deduction<br />

Depletion, and<br />

Allocable<br />

applicable line of<br />

Expenses<br />

Performance of<br />

columns 9(a)<br />

Amortization<br />

Deductions<br />

Schedule H, Part II,<br />

Services<br />

through 9(d))<br />

column (d))<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

7. Other (attach<br />

schedule)<br />

12. Total<br />

Deductions (add<br />

columns 9(e)<br />

through 11)<br />

8. Total (add columns<br />

2(a) through 7)<br />

0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00<br />

13. Total <strong>Income</strong> or<br />

(Loss) Before<br />

Adjustments (subtract<br />

column 12 from<br />

column 8)<br />

Totals 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00<br />

For Paperwork Reduction Act Notice, see separate instructions. Form 1118 (Rev. 06-2009)<br />

ISA

TF JPQJ1002.2<br />

Form 1118 (Rev. 06-2009) Page 2<br />

Schedule B Foreign <strong>Tax</strong> Credit (Report all foreign tax amounts in U.S. dollars.)<br />

Part I—Foreign <strong>Tax</strong>es Paid, Accrued, and Deemed Paid (see page 6 of instructions)<br />

A<br />

B<br />

C<br />

D<br />

E<br />

F<br />

1. Credit is Claimed<br />

for <strong>Tax</strong>es:<br />

X<br />

Paid<br />

Date Paid<br />

Accrued<br />

Date Accrued<br />

Totals (add lines A through F)<br />

2. Foreign <strong>Tax</strong>es Paid or Accrued (attach schedule showing amounts in foreign currency and conversion rate(s) used)<br />

<strong>Tax</strong> Withheld at Source on:<br />

(a) Dividends<br />

ALTERNATIVE MINIMUM TAX<br />

(b) Interest<br />

(c) Rents, Royalties,<br />

and License Fees<br />

Other Foreign <strong>Tax</strong>es Paid or Accrued on:<br />

(d) Section<br />

863(b) <strong>Income</strong><br />

(e) Foreign<br />

Branch <strong>Income</strong><br />

(f) Services <strong>Income</strong><br />

SEE STATEMENT 14 1,490 1,490.00<br />

(g) Other<br />

3. <strong>Tax</strong> Deemed Paid<br />

(from Schedule C—<br />

(h) Total Foreign <strong>Tax</strong>es Part I, column 10,<br />

Paid or Accrued (add Part II, column 8(b),<br />

columns 2(a) through 2(g)) and Part III, column 8)<br />

0.00 1,490.00 0.00 0.00 0.00 0.00 0.00 1,490.00 0.00<br />

Part II—Separate Foreign <strong>Tax</strong> Credit (Complete a separate Part II for each applicable category of income.)<br />

1 Total foreign taxes paid or accrued (total from Part I, column 2(h)) . . . . . . . . . . . . . . . . . . . . . . . 1,490.00<br />

2 Total taxes deemed paid (total from Part I, column 3) . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

0.00<br />

3 Reductions of taxes paid, accrued, or deemed paid (enter total from Schedule G) . . . . . . . . . . . . . . . . . . ( 0.00 )<br />

4 <strong>Tax</strong>es reclassified under high-tax kickout . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

5 Total carryover of foreign taxes (attach schedule showing computation in detail—see page 6 of the instructions) . . . . . . . .<br />

6 Total foreign taxes (combine lines 1 through 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

7 Enter the amount from the applicable column of Schedule J, Part I, line 11 (see page 6 of instructions). If Schedule J is not required to be completed,<br />

enter the result from the “Totals” line of column 13 of the applicable Schedule A . . . . . . . . . . . . . . . . . . . . . . . .<br />

8a Total taxable income from all sources (enter taxable income from the corporation’s tax return) . . . . . . . . . . . . . .<br />

b Adjustments to line 8a (see page 6 of instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

c Subtract line 8b from line 8a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

9 Divide line 7 by line 8c. Enter the resulting fraction as a decimal (see instructions). If line 7 is greater than line 8c, enter 1 . . . . . . . . . . .<br />

10 Total U.S. income tax against which credit is allowed (regular tax liability (see section 26(b)) minus American Samoa economic development credit) . .<br />

11 Credit limitation (multiply line 9 by line 10) (see page 6 of instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

12 Separate foreign tax credit (enter the smaller of line 6 or line 11 here and on the appropriate line of Part III) . . . . . . . . . . . . . . .<br />

1,490.00<br />

0.00<br />

Part III—Summary of Separate Credits (Enter amounts from Part II, line 12 for each applicable category of income. Do not include taxes paid to sanctioned countries.)<br />

1 Credit for taxes on passive category income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,490<br />

2 Credit for taxes on general category income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

3 Credit for taxes on income re-sourced by treaty (combine all such credits on this line) . . . . . . . . . . . . . . . .<br />

4 Total (add lines 1 through 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,490.00<br />

5 Reduction in credit for international boycott operations (see page 6 of instructions) . . . . . . . . . . . . . . . . . . . . . . .<br />

6 Total foreign tax credit (subtract line 5 from line 4). Enter here and on the appropriate line of the corporation’s tax return . . . . . . . . . . 1,490.00<br />

0.00<br />

0.0<br />

Form 1118 (Rev. 06-2009)

TF WVPB1002.1<br />

General <strong>Business</strong> Credit<br />

Form 3800<br />

See separate instructions.<br />

Department of the Treasury<br />

Attach to your tax return.<br />

Internal Revenue Service (99)<br />

Name(s) shown on return<br />

OMB No. 1545–0895<br />

2008<br />

Attachment<br />

Sequence No. 22<br />

Identifying number<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

Part I Current Year Credit<br />

Important: You may not be required to complete and file a separate credit form (shown in parentheses below) to claim the<br />

credit. For details, see the instructions.<br />

1a Investment credit (Form 3468, Part II only) (attach Form 3468)<br />

b Welfare-to-work credit (Form 8861)<br />

c Credit for increasing research activities (Form 6765)<br />

d Low-income housing credit (Form 8586, Part I only) (enter EIN if claiming this credit from a<br />

pass-through entity: )<br />

e Disabled access credit (Form 8826) (do not enter more than $5,000)<br />

f Renewable electricity production credit (Form 8835, Part I only)<br />

g Indian employment credit (Form 8845)<br />

h Orphan drug credit (Form 8820)<br />

i New markets credit (Form 8874) (enter EIN if claiming this credit from a pass-through entity:<br />

)<br />

j Credit for small employer pension plan startup costs (Form 8881) (do not enter more than $500)<br />

k Credit for employer-provided child care facilities and services (Form 8882) (enter EIN if claiming<br />

this credit from a pass-through entity: )<br />

l Biodiesel and renewable diesel fuels credit (attach Form 8864)<br />

m Low sulfur diesel fuel production credit (Form 8896)<br />

n Distilled spirits credit (Form 8906)<br />

o Nonconventional source fuel credit (Form 8907)<br />

p Energy efficient home credit (Form 8908)<br />

q Energy efficient appliance credit (Form 8909)<br />

r Alternative motor vehicle credit (Form 8910) (enter EIN if claiming this credit from a pass-through<br />

entity: )<br />

s Alternative fuel vehicle refueling property credit (Form 8911)<br />

t Credits for affected Midwestern disaster area employers (Form 5884-A)<br />

u Mine rescue team training credit (Form 8923)<br />

v Agricultural chemicals security credit (Form 8931)<br />

w Credit for employer differential wage payments (Form 8932)<br />

x Carbon dioxide sequestration credit (Form 8933)<br />

y Credit for contributions to selected community development corporations (Form 8847)<br />

z General credits from an electing large partnership (Schedule K-1 (Form 1065-B))<br />

1a<br />

1b<br />

1c<br />

1d<br />

1e<br />

1f<br />

1g<br />

1h<br />

1i<br />

1j<br />

1k<br />

1l<br />

1m<br />

1n<br />

1o<br />

1p<br />

1q<br />

1r<br />

1s<br />

1t<br />

1u<br />

1v<br />

1w<br />

1x<br />

1y<br />

1z<br />

12<br />

2<br />

Add lines 1a through 1z<br />

2<br />

12<br />

3<br />

Passive activity credits included on line 2 (see instructions)<br />

3<br />

4<br />

Subtract line 3 from line 2<br />

4<br />

12<br />

5<br />

Passive activity credits allowed for 2008 (see instructions)<br />

5<br />

6<br />

Carryforward of general business credit to 2008. See instructions for the schedule to attach<br />

6<br />

7<br />

Carryback of general business credit from 2009 (see instructions)<br />

7<br />

8 Current year credit. Add lines 4 through 7<br />

8<br />

12<br />

For Paperwork Reduction Act Notice, see separate instructions. Form 3800 (2008)<br />

ISA

TF WVPB1002.2<br />

Form 3800 (2008)<br />

Page 2<br />

Part II<br />

Allowable Credit<br />

9<br />

Regular tax before credits:<br />

Individuals. Enter the amount from Form 1040, line 44 or Form 1040NR, line 41<br />

Corporations. Enter the amount from Form 1120, Schedule J, line 2; or the<br />

applicable line of your return<br />

Estates and trusts. Enter the sum of the amounts from Form 1041, Schedule G,<br />

lines 1a and 1b, or the amount from the applicable line of your return<br />

9<br />

0<br />

10<br />

Alternative minimum tax:<br />

Individuals. Enter the amount from Form 6251, line 36<br />

Corporations. Enter the amount from Form 4626, line 14<br />

Estates and trusts. Enter the amount from Schedule I (Form 1041), line 56<br />

10<br />

0<br />

11<br />

Add lines 9 and 10<br />

11<br />

0<br />

12a Foreign tax credit<br />

b Personal credits from Form 1040, lines 48 through 54 (or Form<br />

1040NR, lines 45 through 49)<br />

c Credit from Form 8834<br />

d Non-business alternative motor vehicle credit (Form 8910, line 18)<br />

e Non-business alternative fuel vehicle refueling property credit<br />

(Form 8911, line 19)<br />

f Add lines 12a through 12e<br />

12a<br />

12b<br />

12c<br />

12d<br />

12e<br />

12f<br />

0<br />

13<br />

Net income tax. Subtract line 12f from line 11. If zero, skip lines 14 through 17 and enter -0- on line 18a<br />

13<br />

0<br />

14<br />

Net regular tax. Subtract line 12f from line 9. If zero or less, enter -0-<br />

14<br />

15<br />

Enter 25% (.25) of the excess, if any, of line 14 over $25,000 (see<br />

instructions)<br />

15<br />

16<br />

Tentative minimum tax:<br />

Individuals. Enter the amount from Form 6251, line 34<br />

Corporations. Enter the amount from Form 4626, line 12<br />

Estates and trusts. Enter the amount from Schedule I<br />

(Form 1041), line 54<br />

16<br />

0<br />

17<br />

Enter the greater of line 15 or line 16<br />

17<br />

18a<br />

b<br />

c<br />

Subtract line 17 from line 13. If zero or less, enter -0-<br />

For a corporation electing to accelerate the research credit, enter the bonus depreciation amount<br />

attributable to the research credit. (see instructions)<br />

Add lines 18a and 18b<br />

18a<br />

18b<br />

18c<br />

0<br />

0<br />

0<br />

19a<br />

Enter the smaller of line 8 or line 18c<br />

Individuals, estates, and trusts: See the instructions for line 19a if claiming the research credit.<br />

C corporations: See the line 19a instructions if there has been an ownership change, acquisition,<br />

or reorganization.<br />

19a<br />

0<br />

b<br />

c<br />

Enter the smaller of line 8 or line 18a. If you made an entry on line 18b, go to line 19c; otherwise,<br />

skip line 19c<br />

Subtract line 19b from line 19a. This is the refundable amount for a corporation electing to<br />

accelerate the research credit. Include this amount on line 32g of Form 1120 (or the applicable<br />

line of your return)<br />

19b<br />

19c<br />

Form 3800 (2008)

TF WVPB1002.3<br />

Form 3800 (2008)<br />

Page 3<br />

Part II Allowable Credit (Continued)<br />

Note. If you are not filing Form 8844, skip lines 20 through 24 and enter -0- on line 25.<br />

20 Multiply line 16 by 75%<br />

20<br />

21<br />

Enter the greater of line 15 or line 20<br />

21<br />

22<br />

Subtract line 21 from line 13. If zero or less, enter -0-<br />

22<br />

0<br />

23<br />

Subtract line 19b from line 22. If zero or less, enter -0-<br />

23<br />

0<br />

24<br />

Enter the amount from Form 8844, line 10 or line 12<br />

24<br />

25<br />

Empowerment zone and renewal community employment credit allowed. Enter the smaller of<br />

line 23 or line 24<br />

25<br />

26<br />

Subtract line 15 from line 13. If zero or less, enter -0-<br />

26<br />

0<br />

27<br />

Add lines 19b and 25<br />

27<br />

28<br />

Subtract line 27 from line 26. If zero or less, enter -0-<br />

28<br />

0<br />

29a<br />

b<br />

c<br />

d<br />

e<br />

f<br />

g<br />

Enter the investment credit from Form 3468, Part III, line 18 (attach<br />

Form 3468)<br />

29a<br />

Enter the work opportunity credit from Form 5884, line 10 or<br />

line 12<br />

29b<br />

Enter the alcohol and cellulosic biofuel fuels credit from Form 6478,<br />

line 15 or line 17<br />

29c<br />

Enter the low-income housing credit from Form 8586, Part II, line 18 or<br />

line 20<br />

29d<br />

Enter the renewable electricity, refined coal, and Indian coal<br />

production credit from Form 8835, Part II, line 36 or line 38<br />

29e<br />

Enter the credit for employer social security and Medicare taxes<br />

paid on certain employee tips from Form 8846, line 12<br />

29f<br />

Enter the qualified railroad track maintenance credit from Form<br />

8900, line 12 29g<br />

52<br />

30<br />

Add lines 29a through 29g<br />

30<br />

52<br />

31<br />

Enter the smaller of line 28 or line 30<br />

31<br />

0<br />

32<br />

Credit allowed for the current year. Add lines 27 and 31.<br />

Report the amount from line 32 (if smaller than the sum of lines 8, 24, and 30, see instructions)<br />

as indicated below or on the applicable line of your return: SEE STATEMENT 12<br />

Individuals. Form 1040, line 54 or Form 1040NR, line 49<br />

Corporations. Form 1120, Schedule J, line 5c<br />

Estates and trusts. Form 1041, Schedule G, line 2c<br />

32<br />

0<br />

Form 3800 (2008)

TF XPBL1002.1<br />

Form<br />

5884<br />

(Rev. May 2009)<br />

Department of the Treasury<br />

Internal Revenue Service<br />

Name(s) shown on return<br />

Work Opportunity Credit<br />

Attach to your tax return.<br />

Identifying number<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

1 Enter on the applicable line below the total qualified first- or second-year wages paid or incurred<br />

during the tax year, and multiply by the percentage shown, for services of employees who are<br />

certified (if required) as members of a targeted group.<br />

OMB No. 1545-0219<br />

2008<br />

Attachment<br />

Sequence No. 77<br />

a<br />

b<br />

c<br />

Qualified first-year wages of employees who worked for you<br />

at least 120 hours but fewer than 400 hours . . . . . $ 25% (.25) 1a<br />

Qualified first-year wages of employees who worked for you<br />

at least 400 hours . . . . . . . . . . . . . . $ 40% (.40) 1b<br />

Qualified second-year wages of employees certified as<br />

long-term family assistance recipients . . . . . . . $ 50% (.50) 1c<br />

2 Add lines 1a, 1b, and 1c. See instructions for the adjustment you must make to salaries and wages 2<br />

3 Work opportunity credit from partnerships, S corporations, cooperatives, estates, and trusts . 3<br />

4 Add lines 2 and 3. Partnerships and S corporations, report this amount on Schedule K; all<br />

others, go to line 5 . . . . . . . . . . . . . . . . . . . . . . . . . 4<br />

5 Work opportunity credit included on line 4 from passive activities (see instructions) . . . . 5<br />

6 Subtract line 5 from line 4 . . . . . . . . . . . . . . . . . . . . . . . 6<br />

0<br />

52<br />

52<br />

0<br />

52<br />

7 Work opportunity credit allowed for 2008 from a passive activity (see instructions) . . . . . 7<br />

8 Carryforward of any work opportunity credit that originated in a tax year that began after 2006<br />

and carryforward from 2007 of the New York Liberty Zone business employee credit . . . . 8<br />

9 Carryback of the work opportunity credit from 2009 (see instructions) . . . . . . . . . 9<br />

10 Add lines 6 through 9. Cooperatives, estates, and trusts, continue on to line 11. All others, report<br />

this amount on Form 3800, line 29b . . . . . . . . . . . . . . . . . . . . 10<br />

52<br />

11 Amount allocated to patrons of the cooperative or beneficiaries of the estate or trust (see<br />

instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11<br />

12 Cooperatives, estates, and trusts, subtract line 11 from line 10. Report this amount on Form<br />

3800, line 29b . . . . . . . . . . . . . . . . . . . . . . . . . . . 12<br />

General Instructions<br />

Section references are to the Internal Revenue Code unless<br />

otherwise noted.<br />

What’s New<br />

The period for hiring a Hurricane Katrina employee is<br />

extended from a 2- to a 4-year period beginning on August 28,<br />

2005.<br />

Food stamp recipients are now referred to as Supplemental<br />

Nutrition Assistance Program (SNAP) recipients.<br />

The tax liability limit is no longer figured on this form; instead,<br />

it must be figured on Form 3800, General <strong>Business</strong> Credit.<br />

The American Recovery and Reinvestment Act of 2009 added<br />

two targeted groups for certain unemployed veterans and<br />

disconnected youth who begin work after 2008 and before<br />

2011.<br />

Purpose of Form<br />

Use Form 5884 to claim the work opportunity credit for qualified<br />

first- or second-year wages you paid to or incurred for targeted<br />

group employees during the tax year. Your business does not<br />

have to be located in an empowerment zone, renewal<br />

community, or rural renewal county to qualify for this credit.<br />

You can claim or elect not to claim the work opportunity<br />

credit any time within 3 years from the due date of your return<br />

on either your original return or an amended return.<br />

For Paperwork Reduction Act Notice, see instructions. Form 5884 (2008) (Rev. 5-2009)<br />

ISA

TF NVWN1002.1<br />

Form<br />

6765<br />

Department of the Treasury<br />

Internal Revenue Service<br />

Name(s) shown on return<br />

Credit for Increasing Research Activities<br />

Attach to your tax return.<br />

OMB No. 1545-0619<br />

2008<br />

Attachment<br />

Sequence No. 81<br />

Identifying number<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

Section A—Regular Credit. Skip this section and go to Section B or C if you are electing or previously elected (and are not revoking)<br />

the alternative incremental credit or the alternative simplified credit, respectively.<br />

1 Certain amounts paid or incurred to energy consortia (see instructions)<br />

1<br />

2 Basic research payments to qualified organizations (see instructions) 2<br />

3 Qualified organization base period amount<br />

3<br />

4 Subtract line 3 from line 2. If zero or less, enter -0-<br />

4<br />

5 Wages for qualified services (do not include wages used in figuring<br />

the work opportunity credit)<br />

5<br />

6 Cost of supplies<br />

6<br />

7 Rental or lease costs of computers (see instructions)<br />

7<br />

8 Enter the applicable percentage of contract research expenses (see<br />

instructions)<br />

8<br />

9 Total qualified research expenses. Add lines 5 through 8<br />

9<br />

10 Enter fixed-base percentage, but not more than 16% (see instructions) 10<br />

%<br />

11 Enter average annual gross receipts (see instructions)<br />

11<br />

12 Multiply line 11 by the percentage on line 10<br />

12<br />

13 Subtract line 12 from line 9. If zero or less, enter -0-<br />

13<br />

14 Multiply line 9 by 50% (.50)<br />

14<br />

15 Enter the smaller of line 13 or line 14<br />

15<br />

16 Add lines 1, 4, and 15<br />

16<br />

17 Are you electing the reduced credit under section 280C? Yes No<br />

If “Yes,” multiply line 16 by 13% (.13). If “No,” multiply line 16 by 20% (.20) and see the instructions<br />

for the schedule that must be attached. Members of controlled groups or businesses under<br />

common control: see instructions for the schedule that must be attached<br />

17<br />

Section B—Alternative Incremental Credit. Skip this section if you are completing Section A or C.<br />

18 Certain amounts paid or incurred to energy consortia (see the line 1 instructions)<br />

18<br />

19 Basic research payments to qualified organizations (see the line 2<br />

20<br />

instructions)<br />

Qualified organization base period amount (see the line 3 instructions)<br />

19<br />

20<br />

21<br />

22<br />

Subtract line 20 from line 19. If zero or less, enter -0-<br />

Add lines 18 and 21<br />

21<br />

22<br />

23<br />

24<br />

Multiply line 22 by 20% (.20)<br />

Wages for qualified services (do not include wages used in figuring<br />

23<br />

the work opportunity credit)<br />

24<br />

25 Cost of supplies<br />

25<br />

26<br />

27<br />

Rental or lease costs of computers (see the line 7 instructions)<br />

Enter the applicable percentage of contract research expenses (see<br />

the line 8 instructions)<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

Total qualified research expenses. Add lines 24 through 27<br />

Enter average annual gross receipts (see the line 11 instructions)<br />

Multiply line 29 by 1% (.01)<br />