Exempt Organization Business Income Tax Return 990-T - McKnight ...

Exempt Organization Business Income Tax Return 990-T - McKnight ...

Exempt Organization Business Income Tax Return 990-T - McKnight ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TF LMXX1002.1<br />

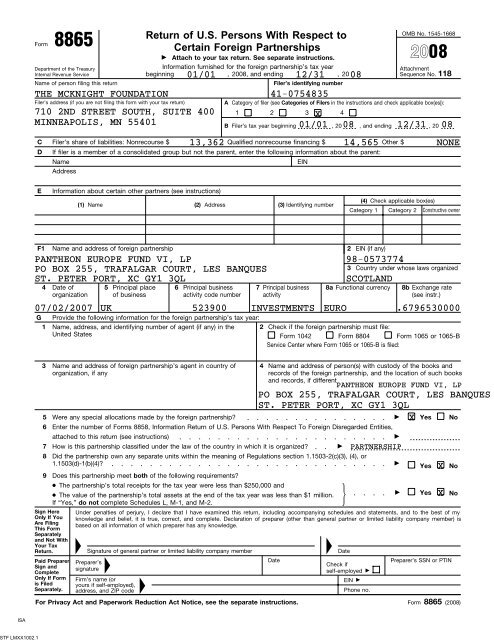

Form<br />

8865<br />

Department of the Treasury<br />

Internal Revenue Service<br />

Name of person filing this return<br />

Filer’s address (if you are not filing this form with your tax return)<br />

<strong>Return</strong> of U.S. Persons With Respect to<br />

Certain Foreign Partnerships<br />

Attach to your tax return. See separate instructions.<br />

Information furnished for the foreign partnership’s tax year<br />

beginning , 2008, and ending , 20<br />

Filer’s identifying number<br />

01/01 12/31 08<br />

THE MCKNIGHT FOUNDATION 41-0754835<br />

710 2ND STREET SOUTH, SUITE 400<br />

MINNEAPOLIS, MN 55401<br />

OMB No. 1545-1668<br />

A Category of filer (see Categories of Filers in the instructions and check applicable box(es)):<br />

1 2 3 4<br />

B Filer’s tax year beginning ,20 , and ending ,20<br />

C Filer’s share of liabilities: Nonrecourse $ Qualified nonrecourse financing $ Other $<br />

D If filer is a member of a consolidated group but not the parent, enter the following information about the parent:<br />

Name<br />

EIN<br />

Address<br />

2008<br />

Attachment<br />

Sequence No. 118<br />

X<br />

01/01 08 12/31 08<br />

13,362 14,565 NONE<br />

E<br />

Information about certain other partners (see instructions)<br />

(1) Name<br />

(2) Address<br />

(3) Identifying number<br />

(4) Check applicable box(es)<br />

Category 1 Category 2 Constructive owner<br />

F1<br />

4<br />

G<br />

1<br />

Name and address of foreign partnership<br />

PANTHEON EUROPE FUND VI, LP<br />

PO BOX 255, TRAFALGAR COURT, LES BANQUES<br />

ST. PETER PORT, XC GY1 3QL<br />

Date of<br />

organization<br />

5<br />

Principal place<br />

of business<br />

6<br />

Principal business<br />

activity code number<br />

7 Principal business<br />

activity<br />

2 EIN (if any)<br />

98-0573774<br />

3<br />

Country under whose laws organized<br />

SCOTLAND<br />

8a Functional currency<br />

8b Exchange rate<br />

(see instr.)<br />

07/02/2007 UK 523900 INVESTMENTS EURO .6796530000<br />

Provide the following information for the foreign partnership’s tax year:<br />

Name, address, and identifying number of agent (if any) in the 2 Check if the foreign partnership must file:<br />

United States<br />

Form 1042 Form 8804 Form 1065 or 1065-B<br />

Service Center where Form 1065 or 1065-B is filed:<br />

3<br />

Name and address of foreign partnership’s agent in country of<br />

organization, if any<br />

4<br />

Name and address of person(s) with custody of the books and<br />

records of the foreign partnership, and the location of such books<br />

and records, if different<br />

5 Were any special allocations made by the foreign partnership?<br />

Yes No<br />

6 Enter the number of Forms 8858, Information <strong>Return</strong> of U.S. Persons With Respect To Foreign Disregarded Entities,<br />

attached to this return (see instructions)<br />

7 How is this partnership classified under the law of the country in which it is organized?<br />

PARTNERSHIP<br />

8 Did the partnership own any separate units within the meaning of Regulations section 1.1503-2(c)(3), (4), or<br />

1.1503(d)-1(b)(4)?<br />

Yes X No<br />

9 Does this partnership meet both of the following requirements?<br />

The partnership’s total receipts for the tax year were less than $250,000 and<br />

The value of the partnership’s total assets at the end of the tax year was less than $1 million.<br />

Yes X No<br />

If “Yes,” do not complete Schedules L, M-1, and M-2.<br />

Sign Here<br />

Only If You<br />

Are Filing<br />

This Form<br />

Separately<br />

and Not With<br />

Your <strong>Tax</strong><br />

<strong>Return</strong>.<br />

Paid Preparer<br />

Sign and<br />

Complete<br />

Only If Form<br />

is Filed<br />

Separately.<br />

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my<br />

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than general partner or limited liability company member) is<br />

based on all information of which preparer has any knowledge.<br />

Signature of general partner or limited liability company member<br />

Preparer’s<br />

signature<br />

Firm’s name (or<br />

yours if self-employed),<br />

address, and ZIP code<br />

PANTHEON EUROPE FUND VI, LP<br />

PO BOX 255, TRAFALGAR COURT, LES BANQUES<br />

ST. PETER PORT, XC GY1 3QL<br />

For Privacy Act and Paperwork Reduction Act Notice, see the separate instructions. Form 8865 (2008)<br />

Date<br />

Date<br />

Check if<br />

self-employed<br />

EIN<br />

Phone no.<br />

X<br />

Preparer’s SSN or PTIN<br />

ISA