Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOVEMBER 29, 2007 / APPAREL & FOOTWEAR INDUSTRY SURVEY<br />

12<br />

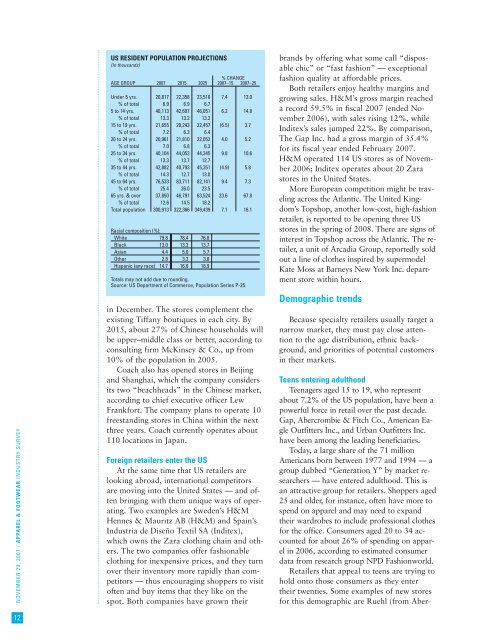

US RESIDENT POPULATION PROJECTIONS<br />

(In thousands)<br />

% CHANGE<br />

AGE GROUP 2007 2015 2025 2007–15 2007–25<br />

Under 5 yrs. 20,817 22,358 23,518 7.4 13.0<br />

% of total 6.9 6.9 6.7<br />

5 to 14 yrs. 40,113 42,607 46,051 6.2 14.8<br />

% of total 13.3 13.2 13.2<br />

15 to 19 yrs. 21,655 20,243 22,457 (6.5) 3.7<br />

% of total 7.2 6.3 6.4<br />

20 to 24 yrs. 20,961 21,810 22,052 4.0 5.2<br />

% of total 7.0 6.8 6.3<br />

25 to 34 yrs. 40,104 44,053 44,345 9.8 10.6<br />

% of total 13.3 13.7 12.7<br />

35 to 44 yrs. 42,882 40,793 45,351 (4.9) 5.8<br />

% of total 14.3 12.7 13.0<br />

45 to 64 yrs. 76,533 83,711 82,141 9.4 7.3<br />

% of total 25.4 26.0 23.5<br />

65 yrs. & over 37,850 46,791 63,524 23.6 67.8<br />

% of total 12.6 14.5 18.2<br />

Total population 300,913 322,366 349,439 7.1 16.1<br />

Racial composition (%):<br />

White 79.8 78.4 76.8<br />

Black 13.0 13.3 13.7<br />

Asian 4.4 5.0 5.7<br />

Other 2.8 3.3 3.8<br />

Hispanic (any race) 14.7 16.6 18.9<br />

Totals may not add due to rounding.<br />

Source: US Department of Commerce, Population Series P-25.<br />

in December. The stores complement the<br />

existing Tiffany boutiques in each city. By<br />

2015, about 27% of Chinese households will<br />

be upper–middle class or better, according to<br />

consulting firm McKinsey & Co., up from<br />

10% of the population in 2005.<br />

Coach also has opened stores in Beijing<br />

and Shanghai, which the company considers<br />

its two “beachheads” in the Chinese market,<br />

according to chief executive officer Lew<br />

Frankfort. The company plans to operate 10<br />

freestanding stores in China within the next<br />

three years. Coach currently operates about<br />

110 locations in Japan.<br />

Foreign retailers enter the US<br />

At the same time that US retailers are<br />

looking abroad, international competitors<br />

are moving into the United States — and often<br />

bringing with them unique ways of operating.<br />

Two examples are Sweden’s H&M<br />

Hennes & Mauritz AB (H&M) and Spain’s<br />

Industria de Diseño Textil SA (Inditex),<br />

which owns the Zara clothing chain and others.<br />

The two companies offer fashionable<br />

clothing for inexpensive prices, and they turn<br />

over their inventory more rapidly than competitors<br />

— thus encouraging shoppers to visit<br />

often and buy items that they like on the<br />

spot. Both companies have grown their<br />

brands by offering what some call “disposable<br />

chic” or “fast fashion” — exceptional<br />

fashion quality at affordable prices.<br />

Both retailers enjoy healthy margins and<br />

growing sales. H&M’s gross margin reached<br />

a record 59.5% in fiscal 2007 (ended November<br />

2006), with sales rising 12%, while<br />

Inditex’s sales jumped 22%. By comparison,<br />

The Gap Inc. had a gross margin of 35.4%<br />

for its fiscal year ended February 2007.<br />

H&M operated 114 US stores as of November<br />

2006; Inditex operates about 20 Zara<br />

stores in the United States.<br />

More European competition might be traveling<br />

across the Atlantic. The United Kingdom’s<br />

Topshop, another low-cost, high-fashion<br />

retailer, is reported to be opening three US<br />

stores in the spring of 2008. There are signs of<br />

interest in Topshop across the Atlantic. The retailer,<br />

a unit of Arcadia Group, reportedly sold<br />

out a line of clothes inspired by supermodel<br />

Kate Moss at Barneys New York Inc. department<br />

store within hours.<br />

Demographic trends<br />

Because specialty retailers usually target a<br />

narrow market, they must pay close attention<br />

to the age distribution, ethnic background,<br />

and priorities of potential customers<br />

in their markets.<br />

Teens entering adulthood<br />

Teenagers aged 15 to 19, who represent<br />

about 7.2% of the US population, have been a<br />

powerful force in retail over the past decade.<br />

Gap, Abercrombie & Fitch Co., American Eagle<br />

Outfitters Inc., and Urban Outfitters Inc.<br />

have been among the leading beneficiaries.<br />

Today, a large share of the 71 million<br />

Americans born between 1977 and 1994 — a<br />

group dubbed “Generation Y” by market researchers<br />

— have entered adulthood. This is<br />

an attractive group for retailers. Shoppers aged<br />

25 and older, for instance, often have more to<br />

spend on apparel and may need to expand<br />

their wardrobes to include professional clothes<br />

for the office. Consumers aged 20 to 34 accounted<br />

for about 26% of spending on apparel<br />

in 2006, according to estimated consumer<br />

data from research group NPD Fashionworld.<br />

Retailers that appeal to teens are trying to<br />

hold onto those consumers as they enter<br />

their twenties. Some examples of new stores<br />

for this demographic are Ruehl (from Aber-