Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Both H&M and Inditex are enjoying success.<br />

For the year ended November 30, 2006,<br />

H&M’s sales rose 12% to 68.4 billion<br />

Swedish krona (US$9.17 billion). Sales at<br />

Inditex, which operates under eight banners,<br />

including Zara, Oysho, Pull and Bear, rose<br />

22% to €8.2 billion (US$10.4 billion) the<br />

year ended January 31, 2007. (Note: All currency<br />

conversions in this Survey are at average<br />

exchange rates for the period in question,<br />

except where noted.)<br />

US-based apparel retailers and manufacturers<br />

are wooing designers to produce merchandise<br />

at the low end. Discounter Target<br />

has featured lines by designers Isaac Mizrahi,<br />

Liz Lange, and Mossimo Giannulli. In April<br />

2007, Gap introduced Gap Design Editions,<br />

selecting three up-and-coming design labels<br />

to produce their versions of a woman’s iconic<br />

white shirt.<br />

Steve & Barry’s LLC, a clothing chain<br />

known for selling T-shirts, sweatshirts, jeans,<br />

and other basics — often for less than $10<br />

an item — signed actress Sarah Jessica<br />

Parker to help design a line of fashionable<br />

women’s clothing. Called Bitten, every piece<br />

in the collection will sell for $19.98 or less,<br />

according to press reports. Parker, known for<br />

her sense of style, said that she picked the<br />

chain because she grew up in a family of<br />

eight children that faced financial difficulties.<br />

The chain is hoping to build upon the success<br />

it has enjoyed with its $14.98 Starbury<br />

basketball sneakers, endorsed by New York<br />

Knicks basketball player Stephon Marbury,<br />

who wears them during games. Steve &<br />

Barry’s has since expanded its product line<br />

from 50 items to 200, including apparel and<br />

women’s athletic shoes.<br />

Offshore sourcing<br />

In the ongoing push to cut expenses, US<br />

apparel and footwear manufacturers increasingly<br />

have moved their production facilities<br />

to lower-cost regions outside the United<br />

States — notably Mexico, the Caribbean,<br />

Central America, Asia, and sub-Saharan<br />

Africa. Many manufacturers, though, have<br />

retained some facilities in the United States<br />

to manufacture products that require a fast<br />

turnaround time.<br />

Following the 1995 implementation of the<br />

North American Free Trade Agreement<br />

(NAFTA) and the subsequent lowering of<br />

tariffs, apparel manufacturing in Mexico and<br />

the Caribbean grew significantly. The proximity<br />

of these countries to the United States<br />

means that their facilities can offer significantly<br />

shorter shipping times compared with<br />

Asian manufacturers, while also providing<br />

low-cost production — factors that are especially<br />

important for basic goods.<br />

Legislation in the last several years has sustained<br />

the long-term shift to offshore sourcing.<br />

The Trade Act of 2002 was approved by<br />

the US Congress in July 2002 and signed into<br />

law by President George W. Bush. This legislation<br />

contains the Trade Promotion Authority,<br />

which grants the president the right to negotiate<br />

trade agreements and gives Congress the<br />

final authority to approve or disapprove those<br />

agreements. It also contains the Andean<br />

Trade Preference Act, which provides dutyfree<br />

access to most apparel, and virtually all<br />

footwear, from the Andean region of South<br />

America (Bolivia, Colombia, Ecuador, and<br />

Peru). The new legislation made certain<br />

retroactive modifications to the May 2000<br />

Caribbean Basin Trade Partnership Act and<br />

the African Growth and Opportunity Act<br />

(AGOA), both of which carry numerous<br />

breaks for footwear and apparel from countries<br />

in those regions.<br />

Standard & Poor’s believes that, while<br />

tariff and quota preferences for apparel and<br />

footwear produced in the Caribbean basin,<br />

the Andean region, and, to a lesser extent,<br />

sub-Saharan Africa have temporarily increased<br />

sourcing from these regions, the<br />

trend is not likely to last. Over time, we expect<br />

China’s share of apparel and global<br />

manufacturing to increase dramatically, facilitated<br />

by its entry into the World Trade Or-<br />

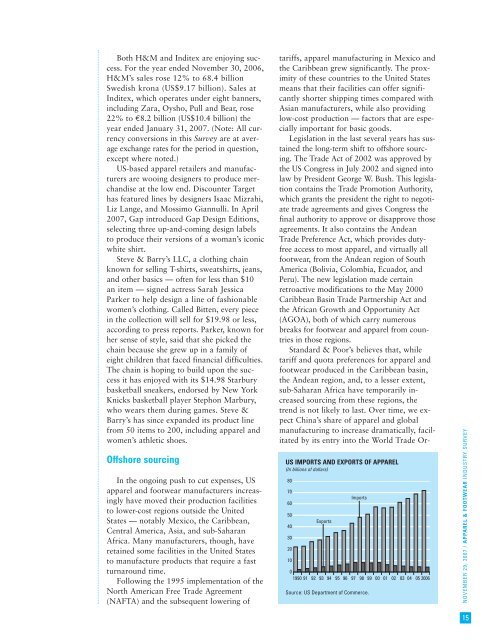

US IMPORTS AND EXPORTS OF APPAREL<br />

(In billions of dollars)<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

Exports<br />

Imports<br />

0<br />

1990 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 2006<br />

Source: US Department of Commerce.<br />

NOVEMBER 29, 2007 / APPAREL & FOOTWEAR INDUSTRY SURVEY<br />

15