Financial Statement - Food Empire Holdings Limited

Financial Statement - Food Empire Holdings Limited

Financial Statement - Food Empire Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Listed companies must provide the information required by Appendix 7.2 of the Listing Manual.<br />

Adequate disclosure should be given to explain any material extraordinary item either as a footnote<br />

of the material extraordinary item or in the "Review of the performance of the group".<br />

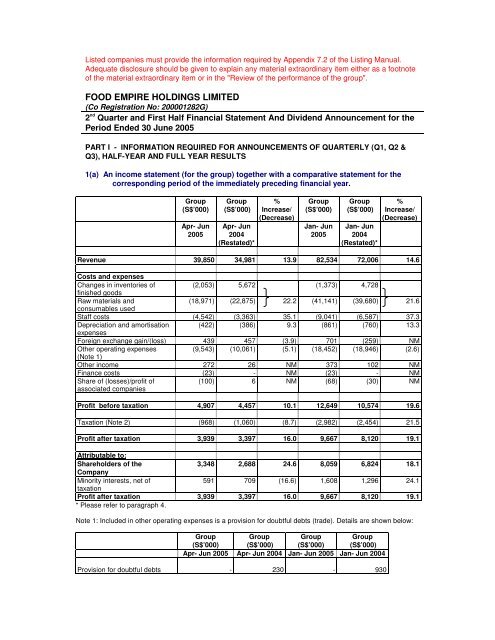

FOOD EMPIRE HOLDINGS LIMITED<br />

(Co Registration No: 200001282G)<br />

2 nd Quarter and First Half <strong>Financial</strong> <strong>Statement</strong> And Dividend Announcement for the<br />

Period Ended 30 June 2005<br />

PART I - INFORMATION REQUIRED FOR ANNOUNCEMENTS OF QUARTERLY (Q1, Q2 &<br />

Q3), HALF-YEAR AND FULL YEAR RESULTS<br />

1(a) An income statement (for the group) together with a comparative statement for the<br />

corresponding period of the immediately preceding financial year.<br />

Group<br />

(S$’000)<br />

Apr- Jun<br />

2005<br />

Group<br />

(S$’000)<br />

Apr- Jun<br />

2004<br />

(Restated)*<br />

%<br />

Increase/<br />

(Decrease)<br />

Group<br />

(S$’000)<br />

Jan- Jun<br />

2005<br />

Group<br />

(S$’000)<br />

Jan- Jun<br />

2004<br />

(Restated)*<br />

%<br />

Increase/<br />

(Decrease)<br />

Revenue 39,850 34,981 13.9 82,534 72,006 14.6<br />

Costs and expenses<br />

Changes in inventories of (2,053) 5,672 (1,373) 4,728<br />

finished goods<br />

Raw materials and<br />

(18,971) (22,875) 22.2 (41,141) (39,680) 21.6<br />

consumables used<br />

Staff costs (4,542) (3,363) 35.1 (9,041) (6,587) 37.3<br />

Depreciation and amortisation (422) (386) 9.3 (861) (760) 13.3<br />

expenses<br />

Foreign exchange gain/(loss) 439 457 (3.9) 701 (259) NM<br />

Other operating expenses (9,543) (10,061) (5.1) (18,452) (18,946) (2.6)<br />

(Note 1)<br />

Other income 272 26 NM 373 102 NM<br />

Finance costs (23) - NM (23) - NM<br />

Share of (losses)/profit of<br />

associated companies<br />

(100) 6 NM (68) (30) NM<br />

Profit before taxation 4,907 4,457 10.1 12,649 10,574 19.6<br />

Taxation (Note 2) (968) (1,060) (8.7) (2,982) (2,454) 21.5<br />

Profit after taxation 3,939 3,397 16.0 9,667 8,120 19.1<br />

Attributable to:<br />

Shareholders of the<br />

3,348 2,688 24.6 8,059 6,824 18.1<br />

Company<br />

Minority interests, net of<br />

591 709 (16.6) 1,608 1,296 24.1<br />

taxation<br />

Profit after taxation 3,939 3,397 16.0 9,667 8,120 19.1<br />

* Please refer to paragraph 4.<br />

Note 1: Included in other operating expenses is a provision for doubtful debts (trade). Details are shown below:<br />

Group<br />

(S$’000)<br />

Group<br />

(S$’000)<br />

Group<br />

(S$’000)<br />

Group<br />

(S$’000)<br />

Apr- Jun 2005 Apr- Jun 2004 Jan- Jun 2005 Jan- Jun 2004<br />

Provision for doubtful debts - 230 - 930

Note 2: Included in taxation for half year ended 30 June 2005 is an underprovision of S$338,000 (2004:S$nil) for<br />

the prior year.<br />

NM: Not meaningful.<br />

1(b)(i) A balance sheet (for the issuer and group), together with a comparative<br />

statement as at the end of the immediately preceding financial year.<br />

Group Group Company Company<br />

30/06/2005<br />

(S$'000)<br />

31/12/2004<br />

(Restated)<br />

(S$'000)<br />

30/06/2005<br />

(S$'000)<br />

31/12/2004<br />

(Restated)<br />

(S$'000)<br />

Assets Less Liabilities<br />

Non-Current Assets<br />

Fixed assets 14,450 13,369 - -<br />

Investments in subsidiary companies - - 12,519 12,519<br />

Investments in associated companies 1,427 1,272 979 979<br />

Deferred tax assets 948 1,385 - -<br />

Intangible assets 7,738 - - -<br />

24,563 16,026 13,498 13,498<br />

Current Assets<br />

Cash and bank balances 13,194 15,680 634 83<br />

Trade receivables 30,094 27,967 - -<br />

Prepayments,other deposits and other<br />

4,392 4,996 711 1,147<br />

receivables<br />

Amounts due from subsidiary companies<br />

(non-trade)<br />

- - 21,655 16,168<br />

Amounts due from associated companies (trade) 64 138 - -<br />

Amounts due from associated companies<br />

(non-trade)<br />

464 890 - 439<br />

Inventories 34,680 31,906 - -<br />

82,888 81,577 23,000 17,837<br />

Current Liabilities<br />

Trade payables and accruals (13,970) (19,555) (406) -<br />

Other payables (821) (414) (9) (314)<br />

Amount due to a related party (trade) - (1) - -<br />

Provision for taxation (4,380) (3,877) (9) (9)<br />

(19,171) (23,847) (424) (323)<br />

Net Current Assets 63,717 57,730 22,576 17,514<br />

Non-Current Liability<br />

Deferred tax liabilities (262) (249) - -<br />

(262) (249) - -<br />

Net Assets 88,018 73,507 36,074 31,012<br />

Equity<br />

Share capital 18,877 17,457 18,877 17,457<br />

Reserves 65,153 51,636 17,197 13,555<br />

84,030 69,093 36,074 31,012<br />

Minority interests 3,988 4,414 - -<br />

88,018 73,507 36,074 31,012

1(b)(ii)<br />

Aggregate amount of group’s borrowings and debt securities.<br />

Amount repayable in one year or less, or on demand<br />

As at 30/06/2005 As at 31/12/2004<br />

Secured Unsecured Secured Unsecured<br />

<br />

0 0 0 0<br />

Amount repayable after one year<br />

As at 30/06/2005 As at 31/12/2004<br />

Secured Unsecured Secured Unsecured<br />

<br />

0 0 0 0<br />

Details of any collateral<br />

NIL<br />

1(c) A cash flow statement (for the group), together with a comparative statement for<br />

the corresponding period of the immediately preceding financial year.<br />

Cash flows from operating activities:<br />

3 mths<br />

ended<br />

3 mths<br />

ended<br />

6 mths<br />

ended<br />

6 mths<br />

ended<br />

30 June<br />

2005<br />

30 June<br />

2004<br />

30 June<br />

2005<br />

30 June<br />

2004<br />

(Restated)<br />

(Restated)<br />

(S$'000) (S$'000) (S$'000) (S$'000)<br />

Profit from ordinary activities before taxation and minority<br />

4,907 4,457 12,649 10,574<br />

interests<br />

Adjustments for:<br />

Amortisation of goodwill - 5 - 10<br />

Depreciation of fixed assets 422 381 861 750<br />

Exchange realignment 1,082 801 1,355 360<br />

Loss/ (gain) on disposal of fixed assets 25 - 16 (9)<br />

Interest expense 23 - 23 -<br />

Interest income (25) (5) (45) (6)<br />

Share of losses/(gains) of associated companies 99 (6) 67 30<br />

Share-based payment expenses 145 57 276 63<br />

Operating income before reinvestment in working capital 6,678 5,690 15,202 11,772<br />

Increase in receivables (2,123) (3,677) (1,008) (3,640)<br />

Increase in inventories (1,914) (6,513) (2,774) (4,884)<br />

Increase/(decrease) in payables 21 5,148 (5,454) 3,896<br />

Cash generated from / (used in) from operations 2,662 648 5,966 7,144<br />

Income taxes paid (1,289) (790) (2,062) (1,457)<br />

Net cash generated from / (used in) from operating activities 1,373 (142) 3,904 5,687<br />

Cash flows from investing activities:<br />

Interest received 25 5 45 6<br />

Purchase of fixed assets (896) (258) (1,679) (419)<br />

Proceeds from sale of fixed assets 3 - 3 9

3 mths<br />

ended<br />

3 mths<br />

ended<br />

6 mths<br />

ended<br />

6 mths<br />

ended<br />

30 June<br />

2005<br />

30 June<br />

2004<br />

30 June<br />

2005<br />

30 June<br />

2004<br />

(Restated)<br />

(Restated)<br />

(S$'000) (S$'000) (S$'000) (S$'000)<br />

Loan to an associated company - (141) - (267)<br />

Investment in an associated company (162) (257) (162) (257)<br />

Net cash used in investing activities (1,030) (651) (1,793) (928)<br />

Cash flows from financing activities<br />

Dividends paid to minority shareholders of subsidiary companies (105) (944) (859) (1,351)<br />

Dividends paid to shareholders of the Company (4,225) (3,467) (4,225) (3,467)<br />

Interest expense (23) - (23) -<br />

Proceeds from issuance of shares 345 448 510 806<br />

Net cash used in financing activities (4,008) (3,963) (4,597) (4,012)<br />

Net (decrease)/ increase in cash and cash equivalents (3,665) (4,756) (2,486) 747<br />

Cash and cash equivalents at beginning of the period 16,859 17,328 15,680 11,825<br />

Cash and cash equivalents at end of the period 13,194 12,572 13,194 12,572<br />

1(d)(i)<br />

or (ii)<br />

A statement (for the issuer and group) showing either (i) all changes in equity<br />

changes in equity other than those arising from capitalisation issues and<br />

distributions to shareholders, together with a comparative statement for the<br />

corresponding period of the immediately preceding financial year.<br />

Share<br />

Capital<br />

Share<br />

Premium<br />

Foreign<br />

Currency<br />

Translation<br />

Reserve<br />

Other<br />

Reserve<br />

Revenue<br />

Reserve<br />

Total<br />

Minority<br />

Interests<br />

Total<br />

Equity<br />

(S$'000) (S$'000) (S$'000) (S$'000) (S$'000) (S$'000) (S$'000) (S$'000)<br />

The Group<br />

Balance as at<br />

01/01/2004<br />

- As previously 17,200 6,086 (202) - 33,918 57,002 3,277 60,279<br />

reported<br />

- Changes in<br />

- - - 14 (14) - - -<br />

accounting policies<br />

FRS 102<br />

- As restated 17,200 6,086 (202) 14 33,904 57,002 3,277 60,279<br />

Net profit for the<br />

- - - - 4,136 4,136 587 4,723<br />

period<br />

Dividends paid to a - - - - - - (407) (407)<br />

minority shareholder<br />

of a subsidiary<br />

company<br />

Movements during - - (485) 6 - (479) (29) (508)<br />

the period<br />

Issuance of ordinary 105 253 - - - 358 - 358<br />

shares<br />

Balance as at 17,305 6,339 (687) 20 38,040 61,017 3,428 64,445<br />

31/03/2004<br />

Net profit for the<br />

- - - - 2,688 2,688 709 3,397<br />

period<br />

Dividends paid to a<br />

minority shareholder<br />

of a subsidiary<br />

company<br />

- - - - - - (944) (944)

Dividends paid to<br />

shareholders of the<br />

Company<br />

Movements during<br />

the period<br />

Issuance of ordinary<br />

shares<br />

Balance as at<br />

30/06/2004<br />

Share<br />

Capital<br />

Share<br />

Premium<br />

Foreign<br />

Currency<br />

Translation<br />

Reserve<br />

Other<br />

Reserve<br />

Revenue<br />

Reserve<br />

Total<br />

Minority<br />

Interests<br />

Total<br />

Equity<br />

(S$'000) (S$'000) (S$'000) (S$'000) (S$'000) (S$'000) (S$'000) (S$'000)<br />

- - - - (3,467) (3,467) - (3,467)<br />

- - 794 58 - 852 52 904<br />

132 316 - - - 448 - 448<br />

17,437 6,655 107 78 37,261 61,538 3,245 64,783<br />

Balance as at<br />

01/01/2005<br />

- As previously 17,457 6,703 (529) - 45,698 69,329 4,414 73,743<br />

reported<br />

- Changes in<br />

- - (1,016) 346 434 (236) - (236)<br />

accounting policies<br />

FRS 21 & 102<br />

- As restated 17,457 6,703 (1,545) 346 46,132 69,093 4,414 73,507<br />

Net profit for the<br />

- - - - 4,711 4,711 1,017 5,728<br />

period<br />

Dividends paid to a<br />

- - - - - - (754) (754)<br />

minority shareholder<br />

of a subsidiary<br />

company<br />

Movements during<br />

- - 293 131 - 424 17 441<br />

the period<br />

Issuance of ordinary 49 116 - - - 165 - 165<br />

shares<br />

Balance as at 17,506 6,819 (1,252) 477 50,843 74,393 4,694 79,087<br />

31/03/2005<br />

Net profit for the<br />

- - - - 3,348 3,348 591 3,939<br />

period<br />

Dividends paid to a<br />

- - - - - - (105) (105)<br />

minority shareholder<br />

of a subsidiary<br />

company<br />

Dividends paid to<br />

- - - - (4,225) (4,225) - (4,225)<br />

shareholders of the<br />

Company<br />

Movements during<br />

- - 1,387 145 - 1,532 - 1,532<br />

the period<br />

Acquisition of<br />

- - - - - - (1,192) (1,192)<br />

shares from minority<br />

shareholder of a<br />

subsidiary company<br />

Issuance of ordinary 1,371 7,611 - - - 8,982 - 8,982<br />

shares<br />

Balance as at<br />

30/06/2005<br />

18,877 14,430 135 622 49,966 84,030 3,988 88,018

Share<br />

Capital<br />

Share<br />

Premium<br />

Foreign<br />

Currency<br />

Translation<br />

Reserve<br />

Other<br />

Reserve<br />

Revenue<br />

Reserve<br />

Total<br />

(S$'000) (S$'000) (S$'000) (S$'000) (S$'000) (S$'000)<br />

The Company<br />

Balance as at<br />

01/01/2004<br />

- As previously 17,200 6,086 - - 8,433 31,719<br />

reported<br />

- Changes in<br />

- - - 14 (14) -<br />

accounting policies<br />

FRS 102<br />

- As restated 17,200 6,086 - 14 8,419 31,719<br />

Net (loss) for the<br />

- - - - (21) (21)<br />

period<br />

Movements during - - - 6 - 6<br />

the period<br />

Issuance of<br />

105 253 - - - 358<br />

ordinary shares<br />

Balance as at 17,305 6,339 - 20 8,398 32,062<br />

31/03/2004<br />

Net (loss) for the<br />

- - - - (47) (47)<br />

period<br />

Movements during - - - 58 - 58<br />

the period<br />

Issuance of<br />

132 316 - - - 448<br />

ordinary shares<br />

Dividends paid to<br />

- - - - (3,467) (3,467)<br />

shareholders of<br />

the Company<br />

Balance as at<br />

30/06/2004<br />

17,437 6,655 - 78 4,884 29,054<br />

Balance as at<br />

01/01/2005<br />

- As previously 17,457 6,703 - - 6,852 31,012<br />

reported<br />

- Changes in<br />

- - - 346 (346) -<br />

accounting policies<br />

FRS 102<br />

- As restated 17,457 6,703 - 346 6,506 31,012<br />

Net (loss) for the<br />

- - - - (279) (279)<br />

period<br />

Movements during - - - 131 - 131<br />

the period<br />

Issuance of<br />

49 116 - - - 165<br />

ordinary shares<br />

Balance as at 17,506 6,819 - 477 6,227 31,029<br />

31/03/2005<br />

Net profit for the<br />

- - - - 143 143<br />

period<br />

Movements during - - - 145 - 145<br />

the period<br />

Issuance of<br />

1,371 7,611 - - - 8,982<br />

ordinary shares<br />

Dividends paid to<br />

- - - - (4,225) (4,225)<br />

shareholders of<br />

the Company<br />

Balance as at<br />

30/06/2005<br />

18,877 14,430 - 622 2,145 36,074

1(d)(ii) Details of any changes in the company's share capital arising from rights issue,<br />

bonus issue, share buy-backs, exercise of share options or warrants, conversion of<br />

other issues of equity securities, issue of shares for cash or as consideration for<br />

acquisition or for any other purpose since the end of the previous period reported<br />

on. State also the number of shares that may be issued on conversion of all the<br />

outstanding convertibles as at the end of the current financial period reported on<br />

and as at the end of the corresponding period of the immediately preceding<br />

financial year.<br />

The issued and paid-up capital of the Company increased from S$17,505,500 as at 31<br />

March 2005 to S$18,877,250 as at 30 June 2005. The increase was due to 2,035,000 new<br />

ordinary shares of S$0.05 each alloted and issued pursuant to the exercise of options<br />

granted under the <strong>Food</strong> <strong>Empire</strong> Share Option Scheme (the “Option Scheme”). In addition,<br />

25,400,000 new ordinary shares of S$0.05 each alloted and issued pursuant to the Sales &<br />

Purchase agreement entered with Sudeep Nair and Bestgate Investments Ltd and<br />

completed on 30 June 2005.<br />

Balance as at No of options No of options No of options Balance as at Exercise Price Exercise Period<br />

01-Apr-05 granted during lapsed during the exercised during the 30-Jun-05 per share<br />

the period period<br />

period<br />

$<br />

2002 Options 8,450,000 - (105,000) (2,035,000) 6,310,000 0.17 14 March 2004 to 13 March 2012<br />

2002 Options 800,000 - - - 800,000 0.17 14 March 2004 to 13 March 2007<br />

2003 Options 500,000 - - - 500,000 0.27 04 June 2005 to 13 March 2012<br />

2004 Options 400,000 - - - 400,000 0.275 25 May 2006 to 24 May 2009<br />

2004 Options 12,525,000 - (800,000) 11,725,000 0.275 25 May 2006 to 24 May 2014<br />

22,675,000 - (905,000) (2,035,000) 19,735,000<br />

As at 30 June 2005, options to subscribe for a total of 19,735,000 ordinary shares were<br />

outstanding under the Option Scheme . As at 30 June 2004, there were unexercised<br />

options for 25,650,000 of unissued ordinary shares of the Company under the Option<br />

Scheme.<br />

2. Whether the figures have been audited or reviewed and in accordance with which<br />

auditing standard or practice.<br />

The figures are unaudited and were not reviewed by the auditors.<br />

3. Where the figures have been audited or reviewed, the auditors’ report (including any<br />

qualifications or emphasis of a matter).<br />

Not applicable.<br />

4. Whether the same accounting policies and methods of computation as in the issuer’s<br />

most recently audited annual financial statements have been applied.<br />

The Group has applied the same accounting policies and methods of computation in the<br />

financial statements for the current financial period compared with the audited financial<br />

statements as at 31 December 2004 except for the adoption of the following new <strong>Financial</strong><br />

Reporting Standards (“FRS”) that are mandatory for the financial years beginning on or after 1<br />

January 2005:<br />

FRS 21:<br />

FRS 102:<br />

The Effects of Changes in Foreign Exchange Rates<br />

Share-based payment<br />

The impact of the changes in accounting policies is as follows:

1. FRS 21<br />

The adoption of FRS 21 has impact on the following:-<br />

a) Net Profit for the Group for Half Year ended 30 June 2004 was decreased by S$221,000.<br />

b) There was no impact on the revenue reserve of the Group as at 1 January 2004 as the<br />

Management is of the opinion that it is impractical to determine the effects of the change<br />

in accounting policy prior to 1 January 2004. Hence, the change in accounting policy is<br />

applied as at 1 January 2004.<br />

There is no impact at the Company level as the changes affected a subsidiary of the Group.<br />

2. FRS 102<br />

By adopting FRS 102, the Group and Company adjusted downwards the opening revenue<br />

reserve as at 1 January 2004 by S$14,000.<br />

Net Profit for the Group and the Company for Half Year ended 30 June 2004 was reduced by<br />

S$64,000.<br />

3. Effects of FRS 21 and FRS102 on Earnings Per Share(EPS)<br />

The effect of FRS 21 and FRS 102 on the Group’s basic and diluted EPS for Second Quarter<br />

ended 30 June 2004 is as follows:<br />

Basic EPS<br />

Diluted EPS<br />

Decrease of 0.14 cents<br />

Decrease of 0.13 cents<br />

The effect of FRS 21 and FRS 102 on the Group’s basic and diluted EPS for First Half ended<br />

30 June 2004 is as follows:<br />

Basic EPS<br />

Diluted EPS<br />

Decrease of 0.08 cents<br />

Decrease of 0.06 cents<br />

Apart from the above, the various revisions in FRS, applicable from 1 January 2005, are<br />

currently being assessed to ensure there are no material impact on the Group’s results.<br />

5. If there are any changes in the accounting policies and methods of computation,<br />

including any required by an accounting standard, what has changed, as well as the<br />

reasons for, and the effect of, the change.<br />

Please refer to paragraph 4.<br />

6. Earnings per ordinary share of the group for the current financial period reported on<br />

and the corresponding period of the immediately preceding financial year, after<br />

deducting any provision for preference dividends.<br />

Group Group Group Group<br />

3 months<br />

ended<br />

30/06/2005<br />

3 months<br />

ended<br />

30/06/2004<br />

(Restated)<br />

6 months<br />

ended<br />

30/06/2005<br />

6 months<br />

ended<br />

30/06/2004<br />

(Restated)<br />

Earnings per share<br />

(i) Based on existing issued share capital<br />

0.95 0.77 2.30 1.97<br />

(cents)<br />

(ii) On a fully diluted basis (cents) 0.95 0.76 2.27 1.95

Weighted average number of shares table<br />

3 mths<br />

ended<br />

3 mths<br />

ended<br />

6 mths<br />

ended<br />

6 mths<br />

ended<br />

30/06/2005 30/06/2004 30/06/2005 30/06/2004<br />

Weighted average number of shares<br />

for calculation of basic EPS 351,358,554 347,649,451 350,799,212 345,973,517<br />

Weighted average number of shares<br />

for calculation of diluted EPS 354,064,391 351,638,891 355,506,046 350,251,330<br />

7. Net asset value (for the issuer and group) per ordinary share based on issued share<br />

capital of the issuer at the end of the:-<br />

(a) current financial period reported on; and<br />

(b) immediately preceding financial year.<br />

Group Group Company Company<br />

30/06/2005 31/12/2004 30/06/2005 31/12/2004<br />

(Restated)<br />

(Restated)<br />

Net asset value per ordinary share (cents) 22.26 19.79 9.55 8.88<br />

8. A review of the performance of the group, to the extent necessary for a reasonable<br />

understanding of the group’s business. It must include a discussion of the<br />

following:-<br />

(a) any significant factors that affected the turnover, costs, and earnings of the<br />

group for the current financial period reported on, including (where applicable)<br />

seasonal or cyclical factors; and<br />

(b) any material factors that affected the cash flow, working capital, assets or<br />

liabilities of the group during the current financial period reported on.<br />

In Q2 2005, the Group continued to deliver double-digit growth in Revenue and Net Profit<br />

Attributable to Shareholders. Improvement was led by business expansion in key markets of Russia<br />

and Eastern Europe & Central Asia. Growth was broad-based for both beverage and non-beverage<br />

products.<br />

Revenue<br />

Geographical Analysis<br />

2Q05 2Q04 Chg 1H05 1H04 Chg<br />

$’000 $’000 $’000 $’000<br />

Russia 24,521 21,129 +16.1% 53,992 43,356 +24.5%<br />

Eastern Europe & Central Asia 13,085 11,112 +17.8% 22,962 23,340 -1.6%<br />

Others 2,244 2,740 -18.1% 5,580 5,310 +5.1%<br />

Total 39,850 34,981 +13.9% 82,534 72,006 +14.6%<br />

Stronger sales in key market segments of Russia and Eastern Europe & Central Asia contributed to the<br />

increase in Group Revenue. Russia remains as the top contributor to Group Revenue at 61.5%,<br />

followed by Eastern Europe & Central Asia at 32.8%. Sales from Other Markets made up the balance.<br />

Revenue from Russia rose 16.1% or S$3.4 million to S$24.5 million, and Eastern Europe & Central<br />

Asia increased by 17.8% to S$13.1 million in Q2 2005. This growth was due to successful distribution<br />

network expansion and ongoing promotion of the Group’s strong product brand name.<br />

Sales from the Ukraine market improved owing to the strong MacCoffee brand name built up over the<br />

years. Revenue from other Commonwealth of Independent States had also grown significantly.<br />

Revenue from Other markets fell S$0.5 million to S$2.2 million in Q2 2005 due to lower sales from the<br />

Middle East and USA markets.

For the first six months of 2005, Group Revenue was lifted 14.6% due to strong demand of the Group’s<br />

flagship products such as MacCoffee 3-in-1 which continued to perform well in Russia and other<br />

markets.<br />

Product Analysis<br />

2Q05 2Q04 Chg 1H05 1H04 Chg<br />

$’000 $’000 $’000 $’000<br />

Beverages 36,046 31,868 +13.1% 76,190 65,738 +15.9%<br />

Non-Beverages 3,804 3,113 +22.2% 6,344 6,268 +1.2%<br />

Total 39,850 34,981 +13.9% 82,534 72,006 +14.6%<br />

The Beverage product segment contributed to 90.5% of the Group Revenue compared to 91.1% in the<br />

corresponding quarter of the previous year. Beverage sales rose 13.1% to S$36.0 million led by higher<br />

sales from coffee-based products. Revenue from Non-beverage products grew 22.2% to S$3.8 million<br />

in Q2 2005 lifted by higher demand for snack food and confectionery food products.<br />

Net Profit<br />

Profit Before Tax improved by 10.1% to S$4.9 million in the second quarter of 2005. The increase in<br />

profit was driven largely by higher sales while the costs of major raw materials had increased.<br />

Raw Materials and Consumables Used increased by 22.2% or S$3.8 million to S$21.0 million in Q2<br />

2005 due to rising prices of coffee powder, sugar and packaging materials which were significantly<br />

higher compared to Q2 2004.<br />

Staff costs increased S$1.2 million or 35.1% to S$4.5 million due mainly to business expansions and<br />

employee share option expensing that started in this financial year.<br />

Other operating expenses fell 5.1% to S$9.5 million despite higher business activities. This is<br />

attributable to lower advertising and promotional expenses in the second quarter of 2005, while<br />

overseas office expenditure increased.<br />

Net Profit attributable to Shareholders grew 24.6% from S$2.7 million in Q2 2004 to S$3.3 million.<br />

For the six-month period ended 30 June 2005, Group Profit attributable to Shareholders rose 18.1% to<br />

S$8.1 million due mainly to the increase in turnover despite the rising raw material costs.<br />

Balance Sheet & Cash Flow<br />

Fixed Assets increased by S$1.1 million to S$14.5 million compared to year end 2004 due mainly to the<br />

roll-out of factory in Vietnam.<br />

On 30 June 2005, the Group completed its acquisition of 13% in Future Enterprises (Russia) Pte Ltd<br />

and FER (HK) <strong>Limited</strong>, which resulted in intangible assets of S$7.7 million.<br />

Cash and bank balances fell S$2.5 million from S$15.7 million as at 31 December 2004 to S$13.2<br />

million as at 30 June 2005 partly due to payment of dividends of S$5.1 million to shareholders. The<br />

Group continued to maintain its debt-free status.<br />

9. Where a forecast, or a prospect statement, has been previously disclosed to<br />

shareholders, any variance between it and the actual results.<br />

Not applicable.

10. A commentary at the date of the announcement of the significant trends and competitive<br />

conditions of the industry in which the group operates and any known factors or events<br />

that may affect the group in the next reporting period and the next 12 months.<br />

The Group will continue to invest in brand building and distribution network expansion to improve its<br />

market share.<br />

For the rest of FY2005, market conditions are expected to remain competitive. Foreign currency<br />

fluctuations as well as rising raw material costs will continue to be significant factors that would affect<br />

the Group’s performance. Despite challenging business conditions ahead, the Group is cautiously<br />

optimistic of its business prospects.<br />

11. Dividend<br />

(a) Current <strong>Financial</strong> Period Reported On<br />

Any dividend declared for the current financial period reported on?<br />

None<br />

(b) Corresponding Period of the Immediately Preceding <strong>Financial</strong> Year<br />

Any dividend declared for the corresponding period of the immediately preceding financial<br />

year? None<br />

(c) Date payable<br />

Not applicable.<br />

(d) Books closure date<br />

Not applicable.<br />

12. If no dividend has been declared/recommended, a statement to that effect.<br />

Not applicable.<br />

PART II - ADDITIONAL INFORMATION REQUIRED FOR FULL YEAR ANNOUNCEMENT<br />

(This part is not applicable to Q1, Q2, Q3 or Half Year Results)<br />

13. Segmented revenue and results for business or geographical segments (of the group) in<br />

the form presented in the issuer’s most recently audited annual financial statements,<br />

with comparative information for the immediately preceding year.<br />

Not applicable<br />

14. In the review of performance, the factors leading to any material changes in<br />

contributions to turnover and earnings by the business or geographical segments.<br />

Not applicable.<br />

15. A breakdown of sales.<br />

Not applicable.

16. A breakdown of the total annual dividend (in dollar value) for the issuer’s latest<br />

full year and its previous full year.<br />

Total Annual Dividend (Refer to Para 16 of Appendix 7.2 for the required details)<br />

Latest Full Year (S$)<br />

FY2004<br />

Previous Full Year (S$)<br />

FY2003<br />

Ordinary - -<br />

Preference - -<br />

Total: - -<br />

BY ORDER OF THE BOARD<br />

Tan San-Ju<br />

Company Secretary<br />

11 August 2005