Financial Statement - Food Empire Holdings Limited

Financial Statement - Food Empire Holdings Limited

Financial Statement - Food Empire Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

For the first six months of 2005, Group Revenue was lifted 14.6% due to strong demand of the Group’s<br />

flagship products such as MacCoffee 3-in-1 which continued to perform well in Russia and other<br />

markets.<br />

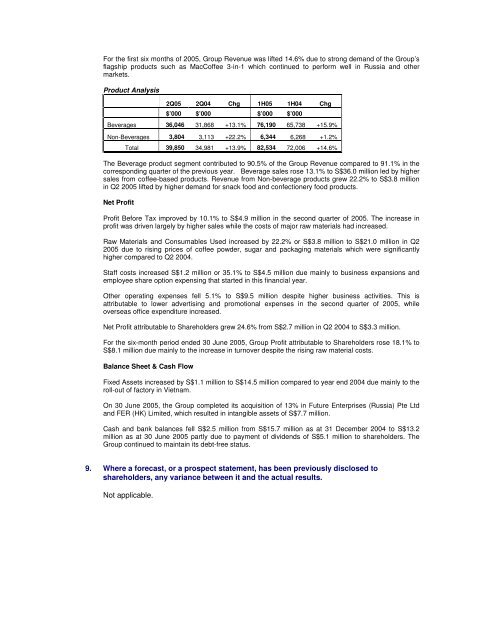

Product Analysis<br />

2Q05 2Q04 Chg 1H05 1H04 Chg<br />

$’000 $’000 $’000 $’000<br />

Beverages 36,046 31,868 +13.1% 76,190 65,738 +15.9%<br />

Non-Beverages 3,804 3,113 +22.2% 6,344 6,268 +1.2%<br />

Total 39,850 34,981 +13.9% 82,534 72,006 +14.6%<br />

The Beverage product segment contributed to 90.5% of the Group Revenue compared to 91.1% in the<br />

corresponding quarter of the previous year. Beverage sales rose 13.1% to S$36.0 million led by higher<br />

sales from coffee-based products. Revenue from Non-beverage products grew 22.2% to S$3.8 million<br />

in Q2 2005 lifted by higher demand for snack food and confectionery food products.<br />

Net Profit<br />

Profit Before Tax improved by 10.1% to S$4.9 million in the second quarter of 2005. The increase in<br />

profit was driven largely by higher sales while the costs of major raw materials had increased.<br />

Raw Materials and Consumables Used increased by 22.2% or S$3.8 million to S$21.0 million in Q2<br />

2005 due to rising prices of coffee powder, sugar and packaging materials which were significantly<br />

higher compared to Q2 2004.<br />

Staff costs increased S$1.2 million or 35.1% to S$4.5 million due mainly to business expansions and<br />

employee share option expensing that started in this financial year.<br />

Other operating expenses fell 5.1% to S$9.5 million despite higher business activities. This is<br />

attributable to lower advertising and promotional expenses in the second quarter of 2005, while<br />

overseas office expenditure increased.<br />

Net Profit attributable to Shareholders grew 24.6% from S$2.7 million in Q2 2004 to S$3.3 million.<br />

For the six-month period ended 30 June 2005, Group Profit attributable to Shareholders rose 18.1% to<br />

S$8.1 million due mainly to the increase in turnover despite the rising raw material costs.<br />

Balance Sheet & Cash Flow<br />

Fixed Assets increased by S$1.1 million to S$14.5 million compared to year end 2004 due mainly to the<br />

roll-out of factory in Vietnam.<br />

On 30 June 2005, the Group completed its acquisition of 13% in Future Enterprises (Russia) Pte Ltd<br />

and FER (HK) <strong>Limited</strong>, which resulted in intangible assets of S$7.7 million.<br />

Cash and bank balances fell S$2.5 million from S$15.7 million as at 31 December 2004 to S$13.2<br />

million as at 30 June 2005 partly due to payment of dividends of S$5.1 million to shareholders. The<br />

Group continued to maintain its debt-free status.<br />

9. Where a forecast, or a prospect statement, has been previously disclosed to<br />

shareholders, any variance between it and the actual results.<br />

Not applicable.