Financial Statement - Food Empire Holdings Limited

Financial Statement - Food Empire Holdings Limited

Financial Statement - Food Empire Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1. FRS 21<br />

The adoption of FRS 21 has impact on the following:-<br />

a) Net Profit for the Group for Half Year ended 30 June 2004 was decreased by S$221,000.<br />

b) There was no impact on the revenue reserve of the Group as at 1 January 2004 as the<br />

Management is of the opinion that it is impractical to determine the effects of the change<br />

in accounting policy prior to 1 January 2004. Hence, the change in accounting policy is<br />

applied as at 1 January 2004.<br />

There is no impact at the Company level as the changes affected a subsidiary of the Group.<br />

2. FRS 102<br />

By adopting FRS 102, the Group and Company adjusted downwards the opening revenue<br />

reserve as at 1 January 2004 by S$14,000.<br />

Net Profit for the Group and the Company for Half Year ended 30 June 2004 was reduced by<br />

S$64,000.<br />

3. Effects of FRS 21 and FRS102 on Earnings Per Share(EPS)<br />

The effect of FRS 21 and FRS 102 on the Group’s basic and diluted EPS for Second Quarter<br />

ended 30 June 2004 is as follows:<br />

Basic EPS<br />

Diluted EPS<br />

Decrease of 0.14 cents<br />

Decrease of 0.13 cents<br />

The effect of FRS 21 and FRS 102 on the Group’s basic and diluted EPS for First Half ended<br />

30 June 2004 is as follows:<br />

Basic EPS<br />

Diluted EPS<br />

Decrease of 0.08 cents<br />

Decrease of 0.06 cents<br />

Apart from the above, the various revisions in FRS, applicable from 1 January 2005, are<br />

currently being assessed to ensure there are no material impact on the Group’s results.<br />

5. If there are any changes in the accounting policies and methods of computation,<br />

including any required by an accounting standard, what has changed, as well as the<br />

reasons for, and the effect of, the change.<br />

Please refer to paragraph 4.<br />

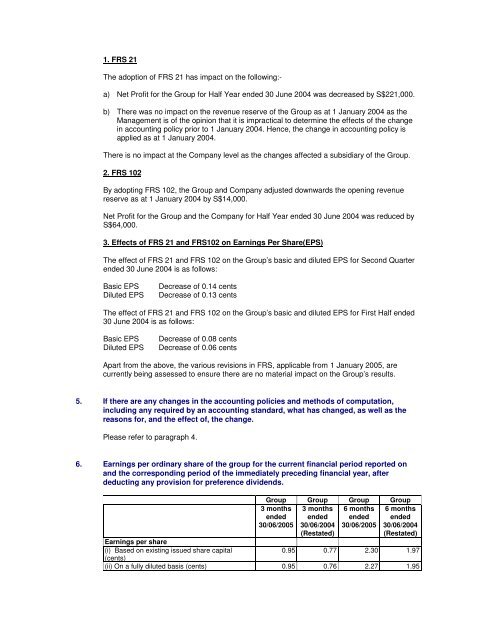

6. Earnings per ordinary share of the group for the current financial period reported on<br />

and the corresponding period of the immediately preceding financial year, after<br />

deducting any provision for preference dividends.<br />

Group Group Group Group<br />

3 months<br />

ended<br />

30/06/2005<br />

3 months<br />

ended<br />

30/06/2004<br />

(Restated)<br />

6 months<br />

ended<br />

30/06/2005<br />

6 months<br />

ended<br />

30/06/2004<br />

(Restated)<br />

Earnings per share<br />

(i) Based on existing issued share capital<br />

0.95 0.77 2.30 1.97<br />

(cents)<br />

(ii) On a fully diluted basis (cents) 0.95 0.76 2.27 1.95