2011 Annual Report - Carolina Farm Credit

2011 Annual Report - Carolina Farm Credit

2011 Annual Report - Carolina Farm Credit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Carolina</strong> <strong>Farm</strong> <strong>Credit</strong>, ACA<br />

<strong>Carolina</strong> <strong>Farm</strong> <strong>Credit</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

<br />

Loss – Assets are considered uncollectible.<br />

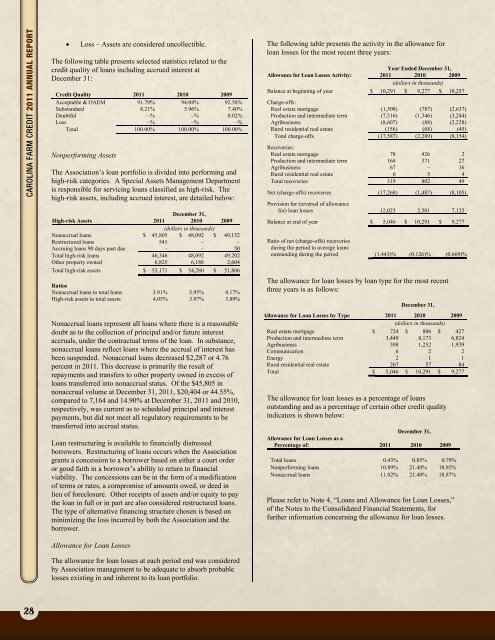

The following table presents selected statistics related to the<br />

credit quality of loans including accrued interest at<br />

December 31:<br />

<strong>Credit</strong> Quality <strong>2011</strong> 2010 2009<br />

Acceptable & OAEM 91.79% 94.04% 92.58%<br />

Substandard 8.21% 5.96% 7.40%<br />

Doubtful –% –% 0.02%<br />

Loss –% –% –%<br />

Total 100.00% 100.00% 100.00%<br />

Nonperforming Assets<br />

The Association’s loan portfolio is divided into performing and<br />

high-risk categories. A Special Assets Management Department<br />

is responsible for servicing loans classified as high-risk. The<br />

high-risk assets, including accrued interest, are detailed below:<br />

December 31,<br />

High-risk Assets <strong>2011</strong> 2010 2009<br />

(dollars in thousands)<br />

Nonaccrual loans $ 45,805 $ 48,092 $ 49,152<br />

Restructured loans 541 – –<br />

Accruing loans 90 days past due – – 50<br />

Total high-risk loans 46,346 48,092 49,202<br />

Other property owned 6,825 6,188 2,604<br />

Total high-risk assets $ 53,171 $ 54,280 $ 51,806<br />

Ratios<br />

Nonaccrual loans to total loans 3.91% 3.95% 4.17%<br />

High-risk assets to total assets 4.05% 3.97% 3.89%<br />

Nonaccrual loans represent all loans where there is a reasonable<br />

doubt as to the collection of principal and/or future interest<br />

accruals, under the contractual terms of the loan. In substance,<br />

nonaccrual loans reflect loans where the accrual of interest has<br />

been suspended. Nonaccrual loans decreased $2,287 or 4.76<br />

percent in <strong>2011</strong>. This decrease is primarily the result of<br />

repayments and transfers to other property owned in excess of<br />

loans transferred into nonaccrual status. Of the $45,805 in<br />

nonaccrual volume at December 31, <strong>2011</strong>, $20,404 or 44.55%,<br />

compared to 7,164 and 14.90% at December 31, <strong>2011</strong> and 2010,<br />

respectively, was current as to scheduled principal and interest<br />

payments, but did not meet all regulatory requirements to be<br />

transferred into accrual status.<br />

Loan restructuring is available to financially distressed<br />

borrowers. Restructuring of loans occurs when the Association<br />

grants a concession to a borrower based on either a court order<br />

or good faith in a borrower’s ability to return to financial<br />

viability. The concessions can be in the form of a modification<br />

of terms or rates, a compromise of amounts owed, or deed in<br />

lieu of foreclosure. Other receipts of assets and/or equity to pay<br />

the loan in full or in part are also considered restructured loans.<br />

The type of alternative financing structure chosen is based on<br />

minimizing the loss incurred by both the Association and the<br />

borrower.<br />

The following table presents the activity in the allowance for<br />

loan losses for the most recent three years:<br />

Year Ended December 31,<br />

Allowance for Loan Losses Activity: <strong>2011</strong> 2010 2009<br />

(dollars in thousands)<br />

Balance at beginning of year $ 10,291 $ 9,277 $ 10,257<br />

Charge-offs:<br />

Real estate mortgage (1,508) (787) (2,637)<br />

Production and intermediate term (7,316) (1,346) (3,244)<br />

Agribusiness (8,607) (88) (2,228)<br />

Rural residential real estate (156) (68) (45)<br />

Total charge-offs (17,587) (2,289) (8,154)<br />

Recoveries:<br />

Real estate mortgage 78 426 2<br />

Production and intermediate term 168 371 27<br />

Agribusiness 67 – 16<br />

Rural residential real estate 6 5 4<br />

Total recoveries 319 802 49<br />

Net (charge-offs) recoveries (17,268) (1,487) (8,105)<br />

Provision for (reversal of allowance<br />

for) loan losses 12,023 2,501 7,125<br />

Balance at end of year $ 5,046 $ 10,291 $ 9,277<br />

Ratio of net (charge-offs) recoveries<br />

during the period to average loans<br />

outstanding during the period (1.443)% (0.126)% (0.669)%<br />

The allowance for loan losses by loan type for the most recent<br />

three years is as follows:<br />

December 31,<br />

Allowance for Loan Losses by Type <strong>2011</strong> 2010 2009<br />

(dollars in thousands)<br />

Real estate mortgage $ 724 $ 806 $ 427<br />

Production and intermediate term 3,449 8,173 6,824<br />

Agribusiness 598 1,252 1,939<br />

Communication 6 2 2<br />

Energy 2 1 1<br />

Rural residential real estate 267 57 84<br />

Total $ 5,046 $ 10,291 $ 9,277<br />

The allowance for loan losses as a percentage of loans<br />

outstanding and as a percentage of certain other credit quality<br />

indicators is shown below:<br />

December 31,<br />

Allowance for Loan Losses as a<br />

Percentage of: <strong>2011</strong> 2010 2009<br />

Total loans 0.43% 0.85% 0.79%<br />

Nonperforming loans 10.89% 21.40% 18.85%<br />

Nonaccrual loans 11.02% 21.40% 18.87%<br />

Please refer to Note 4, “Loans and Allowance for Loan Losses,”<br />

of the Notes to the Consolidated Financial Statements, for<br />

further information concerning the allowance for loan losses.<br />

Allowance for Loan Losses<br />

The allowance for loan losses at each period end was considered<br />

by Association management to be adequate to absorb probable<br />

losses existing in and inherent to its loan portfolio.<br />

28<br />

10<br />

<strong>2011</strong> <strong>Annual</strong> <strong>Report</strong>