2011 Annual Report - Carolina Farm Credit

2011 Annual Report - Carolina Farm Credit

2011 Annual Report - Carolina Farm Credit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Carolina</strong> <strong>Farm</strong> <strong>Credit</strong>, ACA<br />

<strong>Carolina</strong> <strong>Farm</strong> <strong>Credit</strong> <strong>2011</strong> <strong>Annual</strong> <strong>Report</strong><br />

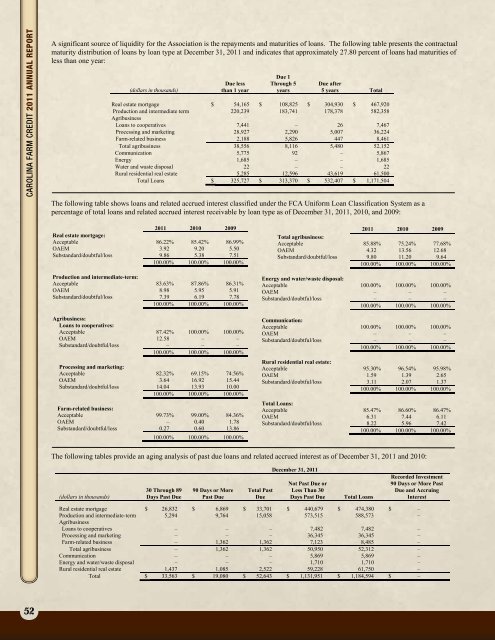

A significant source of liquidity for the Association is the repayments and maturities of loans. The following table presents the contractual<br />

maturity distribution of loans by loan type at December 31, <strong>2011</strong> and indicates that approximately 27.80 percent of loans had maturities of<br />

less than one year:<br />

(dollars in thousands)<br />

Due less<br />

than 1 year<br />

Due 1<br />

Through 5<br />

years<br />

Due after<br />

5 years Total<br />

Real estate mortgage $ 54,165 $ 108,825 $ 304,930 $ 467,920<br />

Production and intermediate term 220,239 183,741 178,378 582,358<br />

Agribusiness<br />

Loans to cooperatives 7,441 – 26 7,467<br />

Processing and marketing 28,927 2,290 5,007 36,224<br />

<strong>Farm</strong>-related business 2,188 5,826 447 8,461<br />

Total agribusiness 38,556 8,116 5,480 52,152<br />

Communication 5,775 92 – 5,867<br />

Energy 1,685 – – 1,685<br />

Water and waste disposal 22 – – 22<br />

Rural residential real estate 5,285 12,596 43,619 61,500<br />

Total Loans $ 325,727 $ 313,370 $ 532,407 $ 1,171,504<br />

The following table shows loans and related accrued interest classified under the FCA Uniform Loan Classification System as a<br />

percentage of total loans and related accrued interest receivable by loan type as of December 31, <strong>2011</strong>, 2010, and 2009:<br />

<strong>2011</strong> 2010 2009<br />

Real estate mortgage:<br />

Acceptable 86.22% 85.42% 86.99%<br />

OAEM 3.92 9.20 5.50<br />

Substandard/doubtful/loss 9.86 5.38 7.51<br />

100.00% 100.00% 100.00%<br />

Production and intermediate-term:<br />

Acceptable 83.63% 87.86% 86.31%<br />

OAEM 8.98 5.95 5.91<br />

Substandard/doubtful/loss 7.39 6.19 7.78<br />

100.00% 100.00% 100.00%<br />

Agribusiness:<br />

Loans to cooperatives:<br />

Acceptable 87.42% 100.00% 100.00%<br />

OAEM 12.58 – –<br />

Substandard/doubtful/loss – – –<br />

100.00% 100.00% 100.00%<br />

Processing and marketing:<br />

Acceptable 82.32% 69.15% 74.56%<br />

OAEM 3.64 16.92 15.44<br />

Substandard/doubtful/loss 14.04 13.93 10.00<br />

100.00% 100.00% 100.00%<br />

<strong>Farm</strong>-related business:<br />

Acceptable 99.73% 99.00% 84.36%<br />

OAEM – 0.40 1.78<br />

Substandard/doubtful/loss 0.27 0.60 13.86<br />

100.00% 100.00% 100.00%<br />

<strong>2011</strong> 2010 2009<br />

Total agribusiness:<br />

Acceptable 85.88% 75.24% 77.68%<br />

OAEM 4.32 13.56 12.68<br />

Substandard/doubtful/loss 9.80 11.20 9.64<br />

100.00% 100.00% 100.00%<br />

Energy and water/waste disposal:<br />

Acceptable 100.00% 100.00% 100.00%<br />

OAEM – – –<br />

Substandard/doubtful/loss – – –<br />

100.00% 100.00% 100.00%<br />

Communication:<br />

Acceptable 100.00% 100.00% 100.00%<br />

OAEM – – –<br />

Substandard/doubtful/loss – – –<br />

100.00% 100.00% 100.00%<br />

Rural residential real estate:<br />

Acceptable 95.30% 96.54% 95.98%<br />

OAEM 1.59 1.39 2.65<br />

Substandard/doubtful/loss 3.11 2.07 1.37<br />

100.00% 100.00% 100.00%<br />

Total Loans:<br />

Acceptable 85.47% 86.60% 86.47%<br />

OAEM 6.31 7.44 6.11<br />

Substandard/doubtful/loss 8.22 5.96 7.42<br />

100.00% 100.00% 100.00%<br />

The following tables provide an aging analysis of past due loans and related accrued interest as of December 31, <strong>2011</strong> and 2010:<br />

(dollars in thousands)<br />

30 Through 89<br />

Days Past Due<br />

90 Days or More<br />

Past Due<br />

Total Past<br />

Due<br />

December 31, <strong>2011</strong><br />

Not Past Due or<br />

Less Than 30<br />

Days Past Due<br />

Total Loans<br />

Recorded Investment<br />

90 Days or More Past<br />

Due and Accruing<br />

Interest<br />

Real estate mortgage $ 26,832 $ 6,869 $ 33,701 $ 440,679 $ 474,380 $ –<br />

Production and intermediate-term 5,294 9,764 15,058 573,515 588,573 –<br />

Agribusiness<br />

Loans to cooperatives – – – 7,482 7,482 –<br />

Processing and marketing – – – 36,345 36,345 –<br />

<strong>Farm</strong>-related business – 1,362 1,362 7,123 8,485 –<br />

Total agribusiness – 1,362 1,362 50,950 52,312 –<br />

Communication – – – 5,869 5,869 –<br />

Energy and water/waste disposal – – – 1,710 1,710 –<br />

Rural residential real estate 1,437 1,085 2,522 59,228 61,750 –<br />

Total $ 33,563 $ 19,080 $ 52,643 $ 1,131,951 $ 1,184,594 $ –<br />

52<br />

34<br />

<strong>2011</strong> <strong>Annual</strong> <strong>Report</strong>