Legal Guide for Foreign Investors in Brazil - Apex-Brasil

Legal Guide for Foreign Investors in Brazil - Apex-Brasil

Legal Guide for Foreign Investors in Brazil - Apex-Brasil

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Legal</strong> <strong>Guide</strong> <strong>for</strong> <strong>Foreign</strong> <strong>Investors</strong> <strong>in</strong> <strong>Brazil</strong><br />

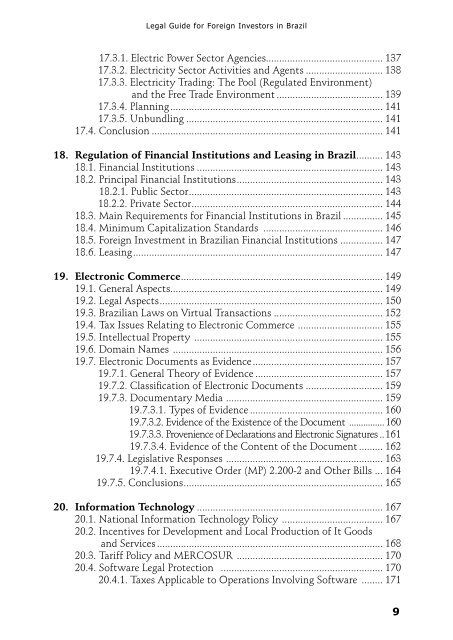

17.3.1. Electric Power Sector Agencies............................................ 137<br />

17.3.2. Electricity Sector Activities and Agents.............................. 138<br />

17.3.3. Electricity Trad<strong>in</strong>g: The Pool (Regulated Environment)<br />

and the Free Trade Environment......................................... 139<br />

17.3.4. Plann<strong>in</strong>g................................................................................. 141<br />

17.3.5. Unbundl<strong>in</strong>g........................................................................... 141<br />

17.4. Conclusion........................................................................................ 141<br />

18. Regulation of F<strong>in</strong>ancial Institutions and Leas<strong>in</strong>g <strong>in</strong> <strong>Brazil</strong>.......... 143<br />

18.1. F<strong>in</strong>ancial Institutions....................................................................... 143<br />

18.2. Pr<strong>in</strong>cipal F<strong>in</strong>ancial Institutions....................................................... 143<br />

18.2.1. Public Sector......................................................................... 143<br />

18.2.2. Private Sector........................................................................ 144<br />

18.3. Ma<strong>in</strong> Requirements <strong>for</strong> F<strong>in</strong>ancial Institutions <strong>in</strong> <strong>Brazil</strong>................ 145<br />

18.4. M<strong>in</strong>imum Capitalization Standards .............................................. 146<br />

18.5. <strong>Foreign</strong> Investment <strong>in</strong> <strong>Brazil</strong>ian F<strong>in</strong>ancial Institutions ................ 147<br />

18.6. Leas<strong>in</strong>g.............................................................................................. 147<br />

19. Electronic Commerce............................................................................ 149<br />

19.1. General Aspects................................................................................ 149<br />

19.2. <strong>Legal</strong> Aspects.................................................................................... 150<br />

19.3. <strong>Brazil</strong>ian Laws on Virtual Transactions ......................................... 152<br />

19.4. Tax Issues Relat<strong>in</strong>g to Electronic Commerce ................................ 155<br />

19.5. Intellectual Property ........................................................................ 155<br />

19.6. Doma<strong>in</strong> Names ................................................................................ 156<br />

19.7. Electronic Documents as Evidence.................................................. 157<br />

19.7.1. General Theory of Evidence................................................. 157<br />

19.7.2. Classification of Electronic Documents ............................. 159<br />

19.7.3. Documentary Media ........................................................... 159<br />

19.7.3.1. Types of Evidence................................................... 160<br />

19.7.3.2. Evidence of the Existence of the Document ................160<br />

19.7.3.3. Provenience of Declarations and Electronic Signatures...161<br />

19.7.3.4. Evidence of the Content of the Document.......... 162<br />

19.7.4. Legislative Responses ........................................................... 163<br />

19.7.4.1. Executive Order (MP) 2.200-2 and Other Bills ... 164<br />

19.7.5. Conclusions........................................................................... 165<br />

20. In<strong>for</strong>mation Technology....................................................................... 167<br />

20.1. National In<strong>for</strong>mation Technology Policy ....................................... 167<br />

20.2. Incentives <strong>for</strong> Development and Local Production of It Goods<br />

and Services...................................................................................... 168<br />

20.3. Tariff Policy and MERCOSUR ........................................................ 170<br />

20.4. Software <strong>Legal</strong> Protection .............................................................. 170<br />

20.4.1. Taxes Applicable to Operations Involv<strong>in</strong>g Software ......... 171