Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

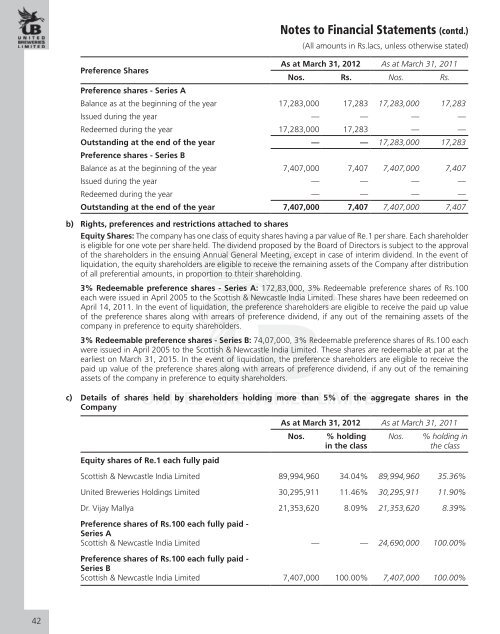

Preference Shares<br />

Notes to Financial Statements (contd.)<br />

(All amounts in Rs.lacs, unless otherwise stated)<br />

As at March 31, <strong>2012</strong> As at March 31, <strong>2011</strong><br />

Nos. Rs. Nos. Rs.<br />

Preference shares - Series A<br />

Balance as at the beginning of the year 17,283,000 17,283 17,283,000 17,283<br />

Issued during the year — — — —<br />

Redeemed during the year 17,283,000 17,283 — —<br />

Outstanding at the end of the year — — 17,283,000 17,283<br />

Preference shares - Series B<br />

Balance as at the beginning of the year 7,407,000 7,407 7,407,000 7,407<br />

Issued during the year — — — —<br />

Redeemed during the year — — — —<br />

Outstanding at the end of the year 7,407,000 7,407 7,407,000 7,407<br />

b) Rights, preferences and restrictions attached to shares<br />

Equity Shares: The company has one class of equity shares having a par value of Re.1 per share. Each shareholder<br />

is eligible for one vote per share held. The dividend proposed by the Board of Directors is subject to the approval<br />

of the shareholders in the ensuing <strong>Annual</strong> General Meeting, except in case of interim dividend. In the event of<br />

liquidation, the equity shareholders are eligible to receive the remaining assets of the Company after distribution<br />

of all preferential amounts, in proportion to thteir shareholding.<br />

3% Redeemable preference shares - Series A: 172,83,000, 3% Redeemable preference shares of Rs.100<br />

each were issued in April 2005 to the Scottish & Newcastle India <strong>Limited</strong>. These shares have been redeemed on<br />

April 14, <strong>2011</strong>. In the event of liquidation, the preference shareholders are eligible to receive the paid up value<br />

of the preference shares along with arrears of preference dividend, if any out of the remaining assets of the<br />

company in preference to equity shareholders.<br />

3% Redeemable preference shares - Series B: 74,07,000, 3% Redeemable preference shares of Rs.100 each<br />

were issued in April 2005 to the Scottish & Newcastle India <strong>Limited</strong>. These shares are redeemable at par at the<br />

earliest on March 31, 2015. In the event of liquidation, the preference shareholders are eligible to receive the<br />

paid up value of the preference shares along with arrears of preference dividend, if any out of the remaining<br />

assets of the company in preference to equity shareholders.<br />

c) Details of shares held by shareholders holding more than 5% of the aggregate shares in the<br />

Company<br />

As at March 31, <strong>2012</strong> As at March 31, <strong>2011</strong><br />

Nos.<br />

% holding<br />

in the class<br />

Nos.<br />

% holding in<br />

the class<br />

Equity shares of Re.1 each fully paid<br />

Scottish & Newcastle India <strong>Limited</strong> 89,994,960 34.04% 89,994,960 35.36%<br />

<strong>United</strong> <strong>Breweries</strong> Holdings <strong>Limited</strong> 30,295,911 11.46% 30,295,911 11.90%<br />

Dr. Vijay Mallya 21,353,620 8.09% 21,353,620 8.39%<br />

Preference shares of Rs.100 each fully paid -<br />

Series A<br />

Scottish & Newcastle India <strong>Limited</strong> — — 24,690,000 100.00%<br />

Preference shares of Rs.100 each fully paid -<br />

Series B<br />

Scottish & Newcastle India <strong>Limited</strong> 7,407,000 100.00% 7,407,000 100.00%<br />

42