Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

Annual Report 2011 - 2012 - United Breweries Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

March 31, <strong>2012</strong> stood at Rs.1,005.1 million, comprising of Equity Share Capital of Re.1 each aggregating to Rs.264.4<br />

million and Cumulative Redeemable Preference Shares of Rs.100 each aggregating to Rs.740.7 million.<br />

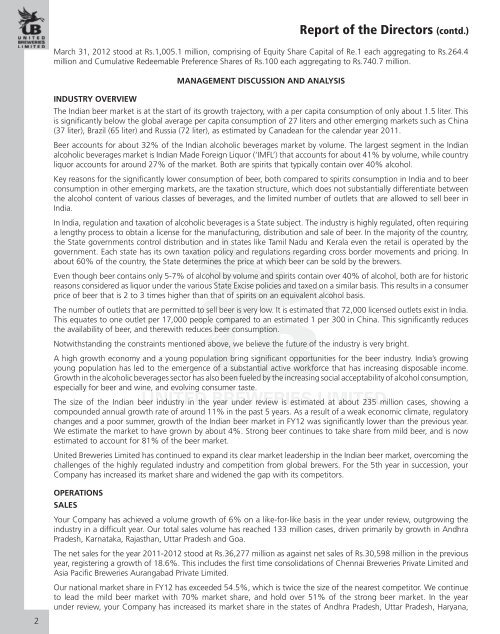

MANAGEMENT DISCUSSION AND ANALYSIS<br />

<strong>Report</strong> of the Directors (contd.)<br />

INDUSTRY OVERVIEW<br />

The Indian beer market is at the start of its growth trajectory, with a per capita consumption of only about 1.5 liter. This<br />

is significantly below the global average per capita consumption of 27 liters and other emerging markets such as China<br />

(37 liter), Brazil (65 liter) and Russia (72 liter), as estimated by Canadean for the calendar year <strong>2011</strong>.<br />

Beer accounts for about 32% of the Indian alcoholic beverages market by volume. The largest segment in the Indian<br />

alcoholic beverages market is Indian Made Foreign Liquor (‘IMFL’) that accounts for about 41% by volume, while country<br />

liquor accounts for around 27% of the market. Both are spirits that typically contain over 40% alcohol.<br />

Key reasons for the significantly lower consumption of beer, both compared to spirits consumption in India and to beer<br />

consumption in other emerging markets, are the taxation structure, which does not substantially differentiate between<br />

the alcohol content of various classes of beverages, and the limited number of outlets that are allowed to sell beer in<br />

India.<br />

In India, regulation and taxation of alcoholic beverages is a State subject. The industry is highly regulated, often requiring<br />

a lengthy process to obtain a license for the manufacturing, distribution and sale of beer. In the majority of the country,<br />

the State governments control distribution and in states like Tamil Nadu and Kerala even the retail is operated by the<br />

government. Each state has its own taxation policy and regulations regarding cross border movements and pricing. In<br />

about 60% of the country, the State determines the price at which beer can be sold by the brewers.<br />

Even though beer contains only 5-7% of alcohol by volume and spirits contain over 40% of alcohol, both are for historic<br />

reasons considered as liquor under the various State Excise policies and taxed on a similar basis. This results in a consumer<br />

price of beer that is 2 to 3 times higher than that of spirits on an equivalent alcohol basis.<br />

The number of outlets that are permitted to sell beer is very low. It is estimated that 72,000 licensed outlets exist in India.<br />

This equates to one outlet per 17,000 people compared to an estimated 1 per 300 in China. This significantly reduces<br />

the availability of beer, and therewith reduces beer consumption.<br />

Notwithstanding the constraints mentioned above, we believe the future of the industry is very bright.<br />

A high growth economy and a young population bring significant opportunities for the beer industry. India’s growing<br />

young population has led to the emergence of a substantial active workforce that has increasing disposable income.<br />

Growth in the alcoholic beverages sector has also been fueled by the increasing social acceptability of alcohol consumption,<br />

especially for beer and wine, and evolving consumer taste.<br />

The size of the Indian beer industry in the year under review is estimated at about 235 million cases, showing a<br />

compounded annual growth rate of around 11% in the past 5 years. As a result of a weak economic climate, regulatory<br />

changes and a poor summer, growth of the Indian beer market in FY12 was significantly lower than the previous year.<br />

We estimate the market to have grown by about 4%. Strong beer continues to take share from mild beer, and is now<br />

estimated to account for 81% of the beer market.<br />

<strong>United</strong> <strong>Breweries</strong> <strong>Limited</strong> has continued to expand its clear market leadership in the Indian beer market, overcoming the<br />

challenges of the highly regulated industry and competition from global brewers. For the 5th year in succession, your<br />

Company has increased its market share and widened the gap with its competitors.<br />

OPERATIONS<br />

SALES<br />

Your Company has achieved a volume growth of 6% on a like-for-like basis in the year under review, outgrowing the<br />

industry in a difficult year. Our total sales volume has reached 133 million cases, driven primarily by growth in Andhra<br />

Pradesh, Karnataka, Rajasthan, Uttar Pradesh and Goa.<br />

The net sales for the year <strong>2011</strong>-<strong>2012</strong> stood at Rs.36,277 million as against net sales of Rs.30,598 million in the previous<br />

year, registering a growth of 18.6%. This includes the first time consolidations of Chennai <strong>Breweries</strong> Private <strong>Limited</strong> and<br />

Asia Pacific <strong>Breweries</strong> Aurangabad Private <strong>Limited</strong>.<br />

Our national market share in FY12 has exceeded 54.5%, which is twice the size of the nearest competitor. We continue<br />

to lead the mild beer market with 70% market share, and hold over 51% of the strong beer market. In the year<br />

under review, your Company has increased its market share in the states of Andhra Pradesh, Uttar Pradesh, Haryana,<br />

2